Primer on How Investors can build an AI Portfolio to capture the $13T Opportunity from Artificial Intelligence by 2030.

Mega Thread //

• A Framework for evaluating AI Companies

• Top Companies that will continue to dominate

• First Principles basics on AI

Let's Review⬇️🧵

Mega Thread //

• A Framework for evaluating AI Companies

• Top Companies that will continue to dominate

• First Principles basics on AI

Let's Review⬇️🧵

* Disclaimer: Not advice

1/Some context - This is a follow-up to a Twitter spaces with some brilliant folks:

Thread Outline:

• Foundational elements

• Debunking AI

• My framework for structuring an AI portfolio

• My Top Companies to watch

• Market Opportunity

• Summary

🔽

1/Some context - This is a follow-up to a Twitter spaces with some brilliant folks:

Thread Outline:

• Foundational elements

• Debunking AI

• My framework for structuring an AI portfolio

• My Top Companies to watch

• Market Opportunity

• Summary

🔽

2/ What's AI?

Debunking it - AI simply involves training a complex system with huge amounts of data using algorithms (instructions), then using that trained system to make predictions about new data it has never seen.

Below is a break-down of the types (ML & NLP are common)

Debunking it - AI simply involves training a complex system with huge amounts of data using algorithms (instructions), then using that trained system to make predictions about new data it has never seen.

Below is a break-down of the types (ML & NLP are common)

3/ Types of AI:

a) Weak AI: For tasks such as automation of repetitive tasks such as Virtual assistants, auto check-outs at McDonalds etc

b) General AI: For more complex brain-like tasks such as advanced robots, Adv deep-learning.

ML is still the common form in organizations.

a) Weak AI: For tasks such as automation of repetitive tasks such as Virtual assistants, auto check-outs at McDonalds etc

b) General AI: For more complex brain-like tasks such as advanced robots, Adv deep-learning.

ML is still the common form in organizations.

4/ Basics of building an AI machine learning model

Stages broken down into:

• Gathering Data

• Clean + Process Data

• Preparation + Formatting of data

• Train + Deploy model

• Visualize through Graphs to drive decisions.

This is a very 'basic' process whenever you hear AI

Stages broken down into:

• Gathering Data

• Clean + Process Data

• Preparation + Formatting of data

• Train + Deploy model

• Visualize through Graphs to drive decisions.

This is a very 'basic' process whenever you hear AI

5/ Why would almost all company benefit from AI?

or improve them? The key ways are:

• Improve decision-making within an organization

• Personalization and customized consumers products

• Automate tasks and drive down costs

The list below are more benefits based on a survey:

or improve them? The key ways are:

• Improve decision-making within an organization

• Personalization and customized consumers products

• Automate tasks and drive down costs

The list below are more benefits based on a survey:

6/ So as an Investor - I use this foundational conceptual framework for building an AI Investing Strategy.

Why? -

Every organization in the world that will adopt an AI strategy by 2030 will have to undergo this maturity model by 'paying' these tech companies along the curve.

Why? -

Every organization in the world that will adopt an AI strategy by 2030 will have to undergo this maturity model by 'paying' these tech companies along the curve.

7/ How do I build my portfolio to capture this opportunity? [my structural framework]

i) Horizontal AI Companies: They provide the back-bone & Infrastructure

ii) Cloud Enablers Companies: They are the SaaS enablers

iii) Vertical AI Companies: Provide consumer product with AI

i) Horizontal AI Companies: They provide the back-bone & Infrastructure

ii) Cloud Enablers Companies: They are the SaaS enablers

iii) Vertical AI Companies: Provide consumer product with AI

8/ Horizontal AI Companies (Slightly levered toward Hardware)

• Databases: $MDB $ESTC $ORCL $CLDR $SAP

• Storage/Transformation/Integration: $CLDR $SNOW $IBM $TDC

• Semi-Conductors: $NVDA $AMAT $NVDA $MU $AMD $TSM $KLIC $INTC $ON

[Many more private companies not listed]

• Databases: $MDB $ESTC $ORCL $CLDR $SAP

• Storage/Transformation/Integration: $CLDR $SNOW $IBM $TDC

• Semi-Conductors: $NVDA $AMAT $NVDA $MU $AMD $TSM $KLIC $INTC $ON

[Many more private companies not listed]

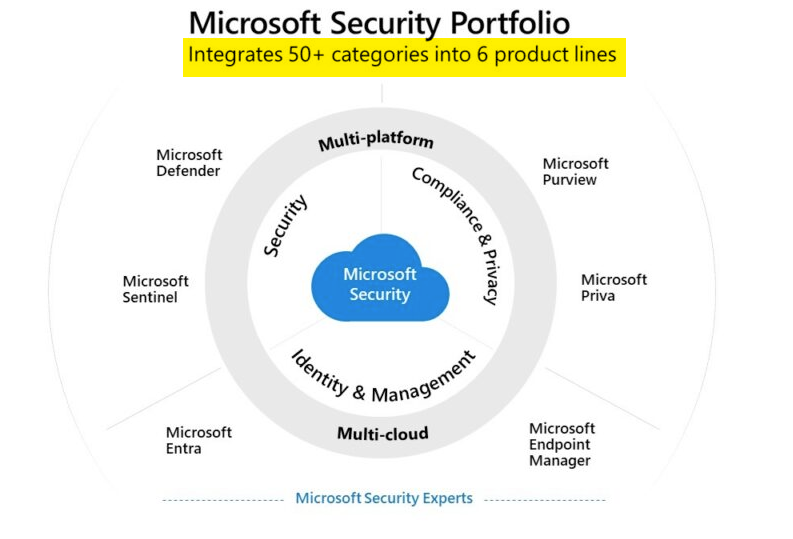

9/ Cloud AI Enablers Companies:

• Cloud Providers: $MSFT $GOOGL $AMZN $SAP

• Web performance/Edge: $NET $FSLY

• Security: $CRWD $ZS $PANW $FTNT

• Visualization: $SPLK $DOMO $MSTR

• Observational monitoring: $DDOG $DT $SUMO $PD

• Data Governance: $OKTA $SAIL

• Cloud Providers: $MSFT $GOOGL $AMZN $SAP

• Web performance/Edge: $NET $FSLY

• Security: $CRWD $ZS $PANW $FTNT

• Visualization: $SPLK $DOMO $MSTR

• Observational monitoring: $DDOG $DT $SUMO $PD

• Data Governance: $OKTA $SAIL

10/ Vertical AI Companies:

• Insurance: $LMND

• Consumer Lending: $UPST

• Fashion: $SFIX

• Autonomous driving: $TSLA FSD

• RPA: $PATH

• Communication/NLP: $TWLO

• Enterprise AI: $AI $APPN $PLTR

You've also got companies like $UBER $ABNB that embed, but not directly.

• Insurance: $LMND

• Consumer Lending: $UPST

• Fashion: $SFIX

• Autonomous driving: $TSLA FSD

• RPA: $PATH

• Communication/NLP: $TWLO

• Enterprise AI: $AI $APPN $PLTR

You've also got companies like $UBER $ABNB that embed, but not directly.

11/

5⃣ - My Top Picks: Companies that I believe could play a big role in the next decade:

My Criteria:

✅They provide the foundation (sticky)

✅Technological Optionality

✅Platform cuts across multiple verticals

✅Platform's ability to scale

✅TAM

🛑 Not looking at valuation

5⃣ - My Top Picks: Companies that I believe could play a big role in the next decade:

My Criteria:

✅They provide the foundation (sticky)

✅Technological Optionality

✅Platform cuts across multiple verticals

✅Platform's ability to scale

✅TAM

🛑 Not looking at valuation

1⃣ Databricks (Yet to IPO):

• They support most of the data pipeline.

• They have a Unified data Platform (foundation)

• They provide data exploration, data processing, model management and cloud storage

• They enable data processing from their combined Data lake + Warehouse

• They support most of the data pipeline.

• They have a Unified data Platform (foundation)

• They provide data exploration, data processing, model management and cloud storage

• They enable data processing from their combined Data lake + Warehouse

2⃣ Snowflake $SNOW

They provide:

• Cloud Storage,

• Database services

• Computational abilities

• Cloud Services through Data Marketplace- fosters data sharing & collaboration

• Snowflake gives everything an AI company needs in one package/solution (ridiculous!, I'll stop)

They provide:

• Cloud Storage,

• Database services

• Computational abilities

• Cloud Services through Data Marketplace- fosters data sharing & collaboration

• Snowflake gives everything an AI company needs in one package/solution (ridiculous!, I'll stop)

3⃣ Palantir: $PLTR

• Provide Gotham + Foundry

• Data Integration, AI modelling + Visualization

• They have all-in-one, full-stack analytics product (moat)

I've written multiple analysis:

i) A foundational piece:

ii) Below is a piece analyzing Foundry

investianalystnewsletter.substack.com/p/palantir-tec…

• Provide Gotham + Foundry

• Data Integration, AI modelling + Visualization

• They have all-in-one, full-stack analytics product (moat)

I've written multiple analysis:

i) A foundational piece:

ii) Below is a piece analyzing Foundry

investianalystnewsletter.substack.com/p/palantir-tec…

4⃣C3 AI $AI

• Ex Machina enables easy application of data science/AI to everyday business problems.

• Easy integration and allows developers to build enterprise AI without having to write lengthy code.

• UX data visualization

• Industry agnostic/ addresses multiple use-cases

• Ex Machina enables easy application of data science/AI to everyday business problems.

• Easy integration and allows developers to build enterprise AI without having to write lengthy code.

• UX data visualization

• Industry agnostic/ addresses multiple use-cases

5⃣ UI Path (vertical AI) - $PATH (IPO Soon)

• Enables robotics process automation

• Their software and AI monitors user activity to automate repetitive front and back-office tasks across an organization

• Leads to big cost savings

[I will be sharing a thread by end of April]

• Enables robotics process automation

• Their software and AI monitors user activity to automate repetitive front and back-office tasks across an organization

• Leads to big cost savings

[I will be sharing a thread by end of April]

17/ Future Investing opportunities to watch out for:

1. Advanced deep-learning to write software; GPT-3 AI understands language and can write emails, perform human tasks.

2. Deep-mind and Open AI's research

3. Advanced Robotics capabilities

4. Quantum computing

And many more!

1. Advanced deep-learning to write software; GPT-3 AI understands language and can write emails, perform human tasks.

2. Deep-mind and Open AI's research

3. Advanced Robotics capabilities

4. Quantum computing

And many more!

18/ Why should all this matter? -Market Opportunity.

Over the last decade, due to the digitization, the volume of Data has grown to 59ZT grown over 100x! The average teen has 800+ digital interactions

Data is the new gas that fuels AI-based product to make them better products!

Over the last decade, due to the digitization, the volume of Data has grown to 59ZT grown over 100x! The average teen has 800+ digital interactions

Data is the new gas that fuels AI-based product to make them better products!

19/ Market Opportunity (2): We're in early innings:

+ Over $13 - $15.7 Trillion will be contributed to the global economy by AI by 2030, according to PwC. Today, US Economy is $20T.

Ark forecast (c:@summerlinARK) over $30 Trillion will be added to MC's!

Think about the impact!

+ Over $13 - $15.7 Trillion will be contributed to the global economy by AI by 2030, according to PwC. Today, US Economy is $20T.

Ark forecast (c:@summerlinARK) over $30 Trillion will be added to MC's!

Think about the impact!

20/ Best Resources to growing/learning:

First, on Horizonal-like AI Companies Resources:

Chris puts great research on the Semi-conductor and hardware players leading $AI Race

• He has a four part series into breaking down Artificial Intelligence.

seifelcapital.substack.com

First, on Horizonal-like AI Companies Resources:

Chris puts great research on the Semi-conductor and hardware players leading $AI Race

• He has a four part series into breaking down Artificial Intelligence.

seifelcapital.substack.com

21/ Cloud AI-Enablers Resources:

• Muji puts together some great in-depth research exploring the technologies

• Some of the best the depth of $AYX $NET and $SNOW

hhhypergrowth.com

• Muji puts together some great in-depth research exploring the technologies

• Some of the best the depth of $AYX $NET and $SNOW

hhhypergrowth.com

22/ @jaminball is the person for both Vertical AI Companies/Cloud companies

• Analytics companies and SaaS metrics, earnings announcements, and highlight any significant news.

• SaaS metrics, earnings announcements, and highlight any significant news

cloudedjudgement.substack.com

• Analytics companies and SaaS metrics, earnings announcements, and highlight any significant news.

• SaaS metrics, earnings announcements, and highlight any significant news

cloudedjudgement.substack.com

23/ Occasionally, I put together in-depth research on a mix of both companies (cloud or mostly vertical companies like $UPST or recently $PLTR Foundry on my newsletter.

However, the guys listed above⬆️ and people like @publiccomps do a better job!

investianalystnewsletter.substack.com/p/optional-rea…

However, the guys listed above⬆️ and people like @publiccomps do a better job!

investianalystnewsletter.substack.com/p/optional-rea…

24/24 Summary ⬇️

✅AI/Analytics will make a big impact on society by 2030

✅Structure your portfolio strategically based on the technology's optionality and scalability.

✅This was only a primer, we could have discussed much more!

I hope this thread helps you develop a frame.

✅AI/Analytics will make a big impact on society by 2030

✅Structure your portfolio strategically based on the technology's optionality and scalability.

✅This was only a primer, we could have discussed much more!

I hope this thread helps you develop a frame.

25/ If you have questions, I'll be happy to answer sharing my experience, but the guys I listed above are experts.

Thanks for reading.

I'll like to hear from you -what industry group of companies are you excited about & believe has the biggest potential?

Feel free to comment.

Thanks for reading.

I'll like to hear from you -what industry group of companies are you excited about & believe has the biggest potential?

Feel free to comment.

I'll just cc some of the organizers/speakers from the Twitter Spaces:

@MaxTheComrade & @SeifelCapital @WOLF_Financial

@dhaval_kotecha @StockMarketNerd @fiducia_invest.

My bad, I forgot to tag/CC @hhhypergrowth when I mentioned Muji above!

@MaxTheComrade & @SeifelCapital @WOLF_Financial

@dhaval_kotecha @StockMarketNerd @fiducia_invest.

My bad, I forgot to tag/CC @hhhypergrowth when I mentioned Muji above!

• • •

Missing some Tweet in this thread? You can try to

force a refresh