🧵

1/ There's a lot of hunger for information about TSMC, what they do, and how the business operates.

So I put together

Ten Charts That Tell The TSMC Tale

bloomberg.com/opinion/articl…

1/ There's a lot of hunger for information about TSMC, what they do, and how the business operates.

So I put together

Ten Charts That Tell The TSMC Tale

bloomberg.com/opinion/articl…

2/

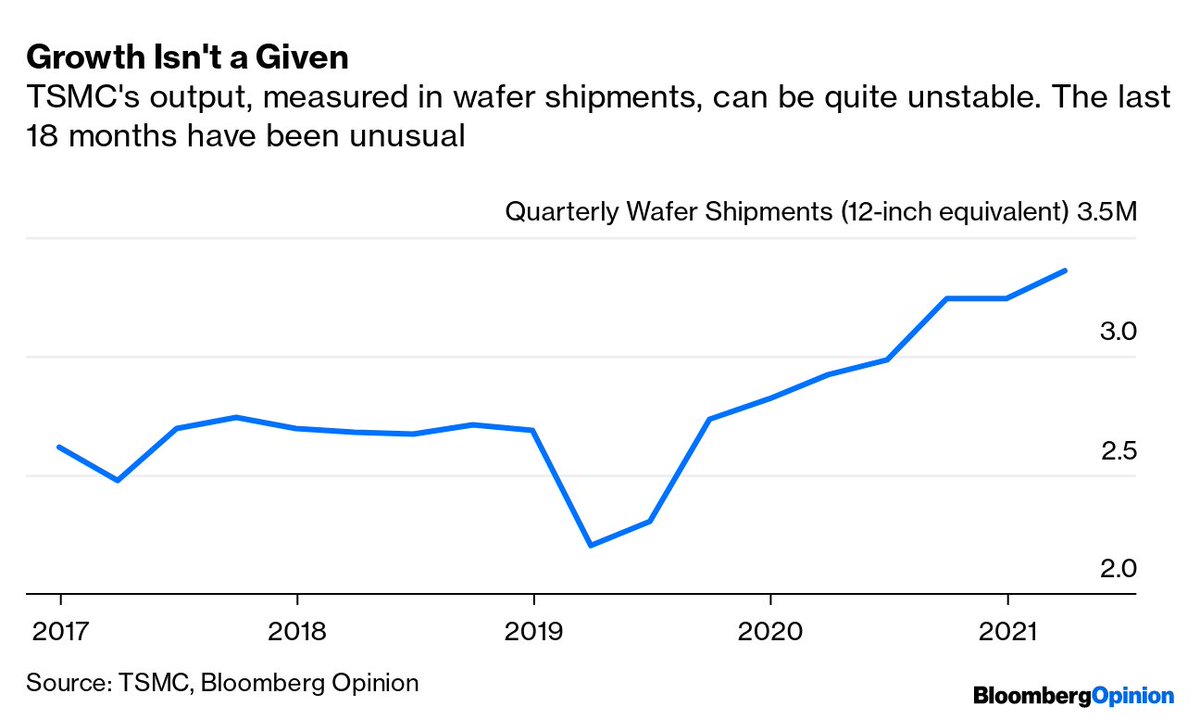

We often think of TSMC output always rising. Certainly revenue *usually* rises, but actual shipments often stagnates or even declines

We often think of TSMC output always rising. Certainly revenue *usually* rises, but actual shipments often stagnates or even declines

3/

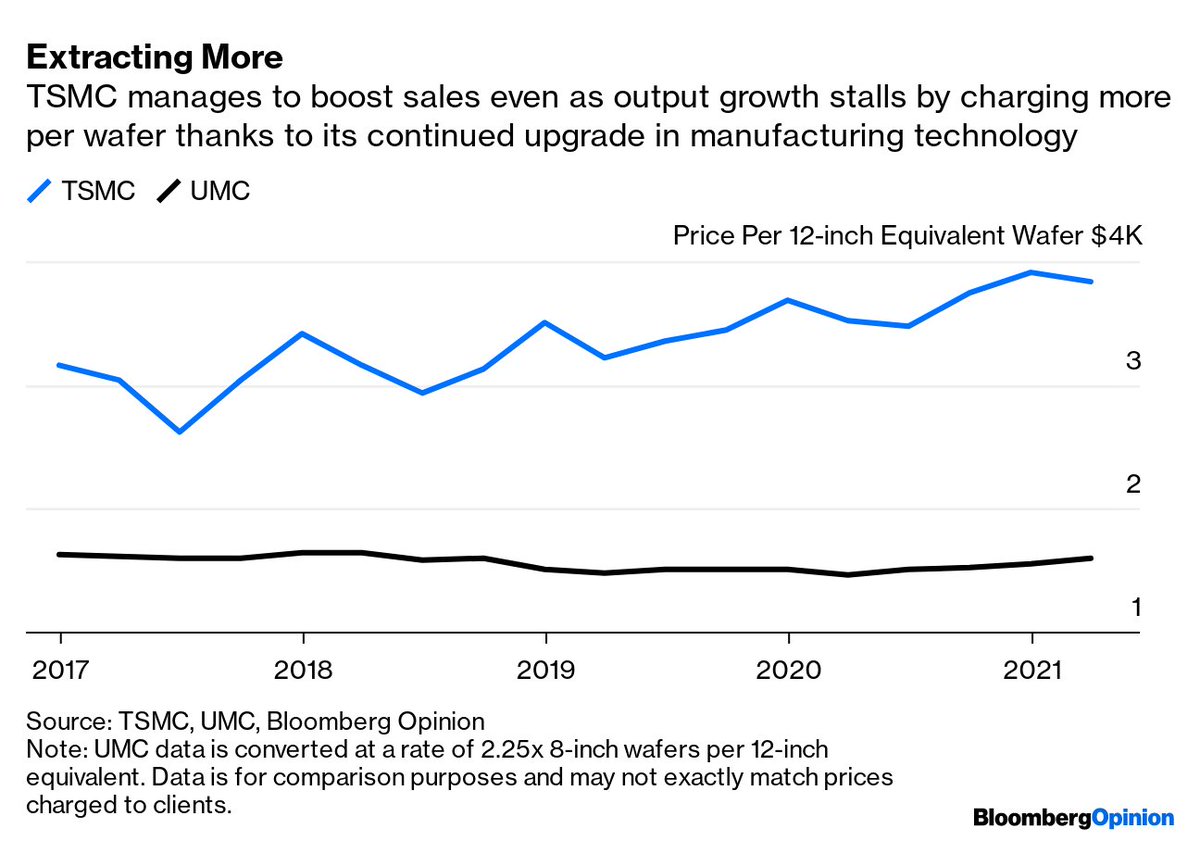

TSMC can boost revenue when output stalls by raising prices. This isn't as simple as it seems. Chip prices, like-for-like, fall over time. So to extract more money per wafer means always advancing technology.

Compare them to UMC and you'll see the difference.

TSMC can boost revenue when output stalls by raising prices. This isn't as simple as it seems. Chip prices, like-for-like, fall over time. So to extract more money per wafer means always advancing technology.

Compare them to UMC and you'll see the difference.

4/

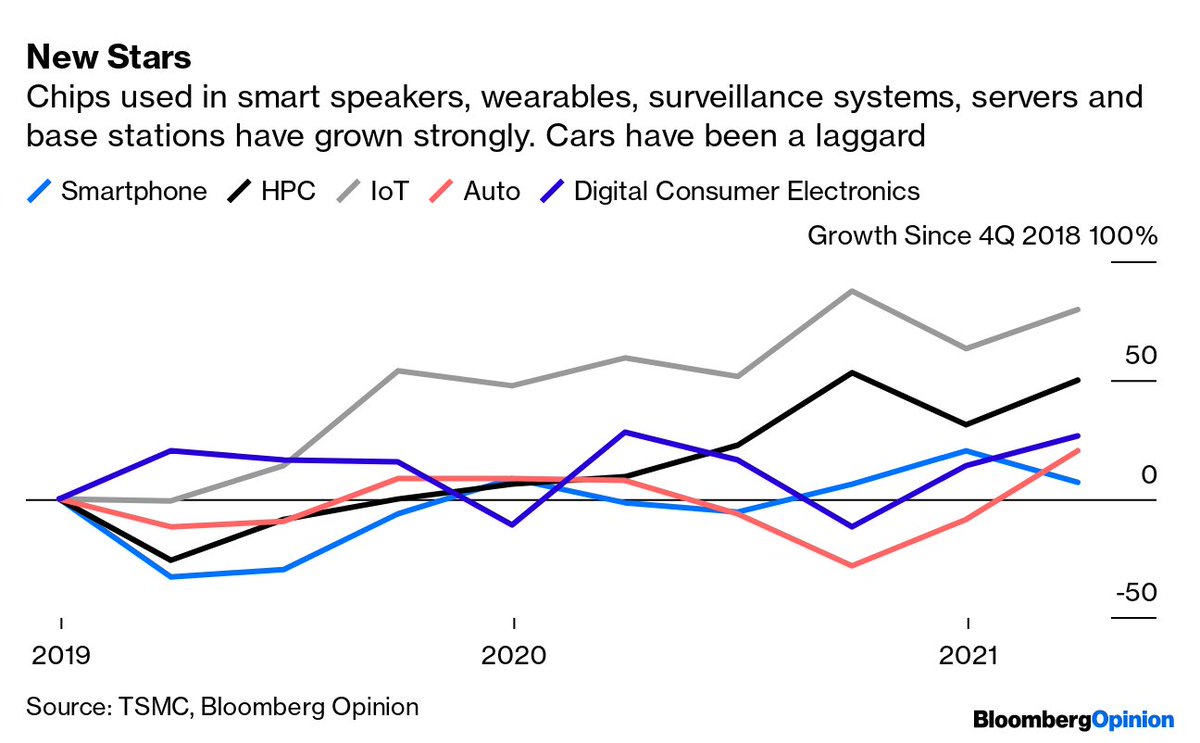

Despite bleatings by the auto industry, IoT and HPC have grown the most in the past two years. Cars have lagged.

Despite bleatings by the auto industry, IoT and HPC have grown the most in the past two years. Cars have lagged.

5/

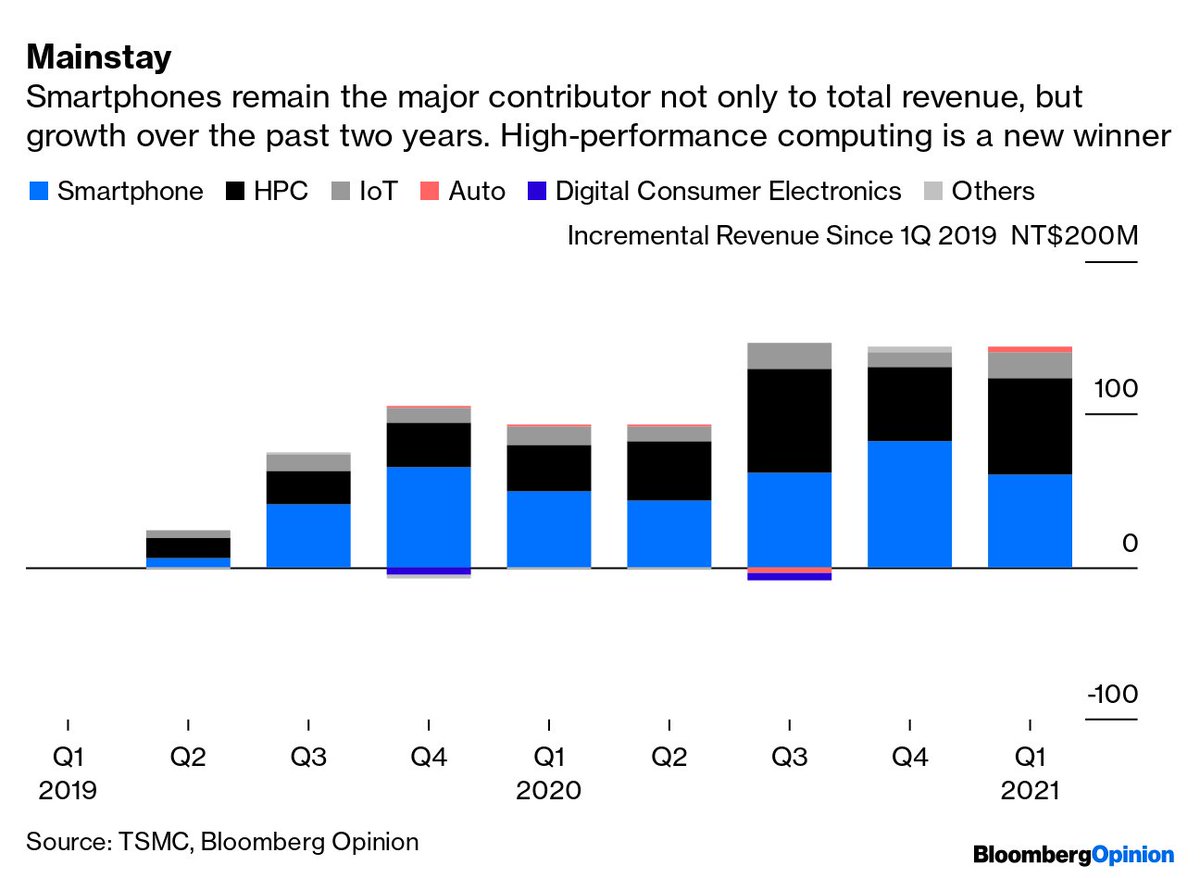

Smartphones remain the largest contributor to TSMC's revenue. But high-performance computing, which includes servers and base stations, were a huge contributor to incremental sales over the past two years.

Autos are barely a blip on the radar.

Smartphones remain the largest contributor to TSMC's revenue. But high-performance computing, which includes servers and base stations, were a huge contributor to incremental sales over the past two years.

Autos are barely a blip on the radar.

6/

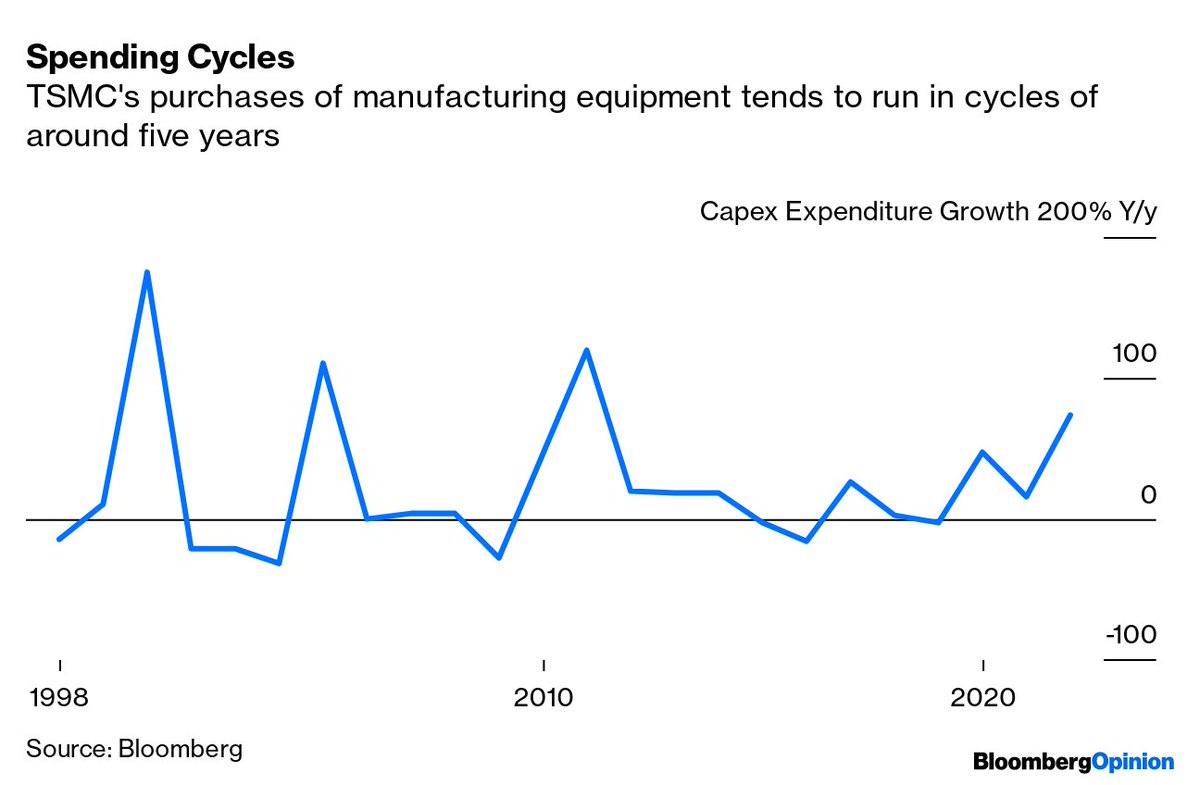

We're currently in the third year of what I predict will be a 5-6 year spending growth spurt.

This is normal. TSMC capex cycles tend to last around 5 years from trough to peak.

We're currently in the third year of what I predict will be a 5-6 year spending growth spurt.

This is normal. TSMC capex cycles tend to last around 5 years from trough to peak.

7/

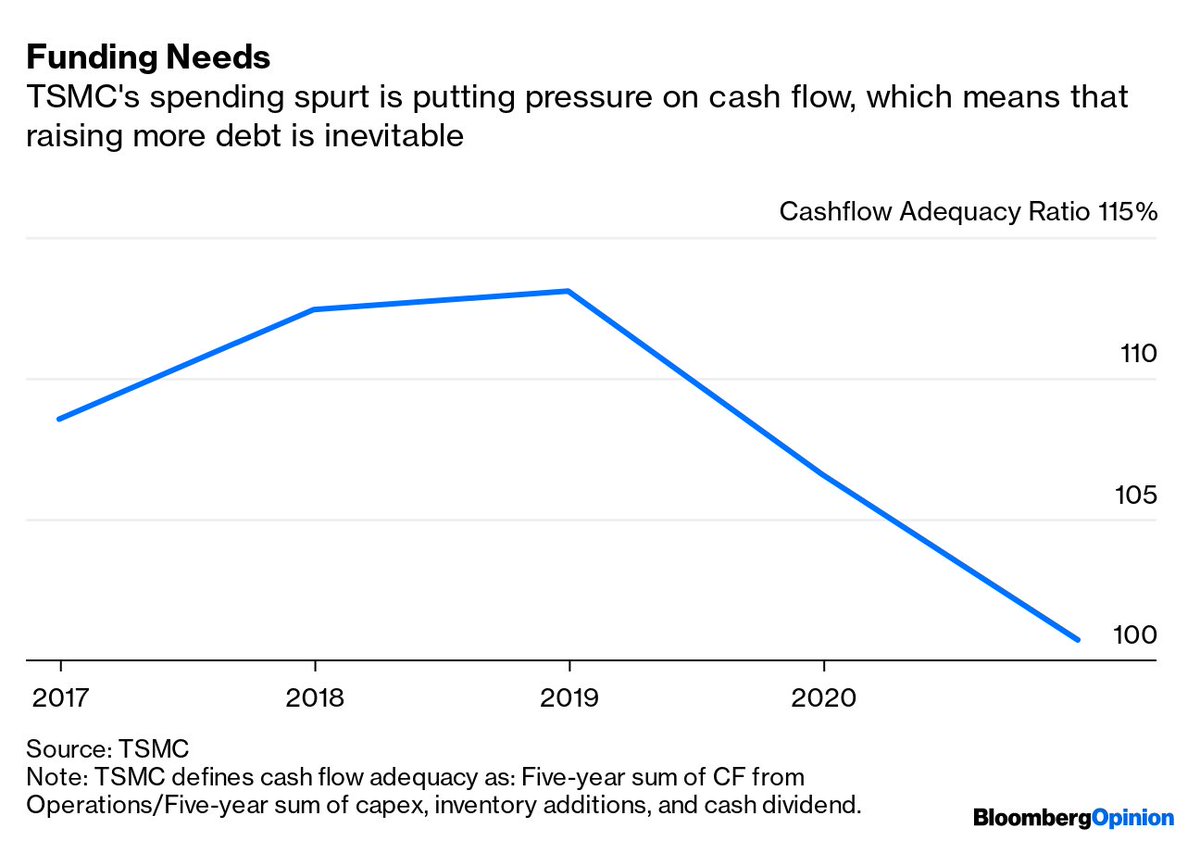

Yesterday I predicted this spending spurt would force TSMC to borrow money.

Turns out, that prediction was more prescient than I'd expected: just today it launched a $3.5 billion USD bond offering in 5, 7 & 10yr terms. Expect more debt sales to come.

Yesterday I predicted this spending spurt would force TSMC to borrow money.

Turns out, that prediction was more prescient than I'd expected: just today it launched a $3.5 billion USD bond offering in 5, 7 & 10yr terms. Expect more debt sales to come.

8/

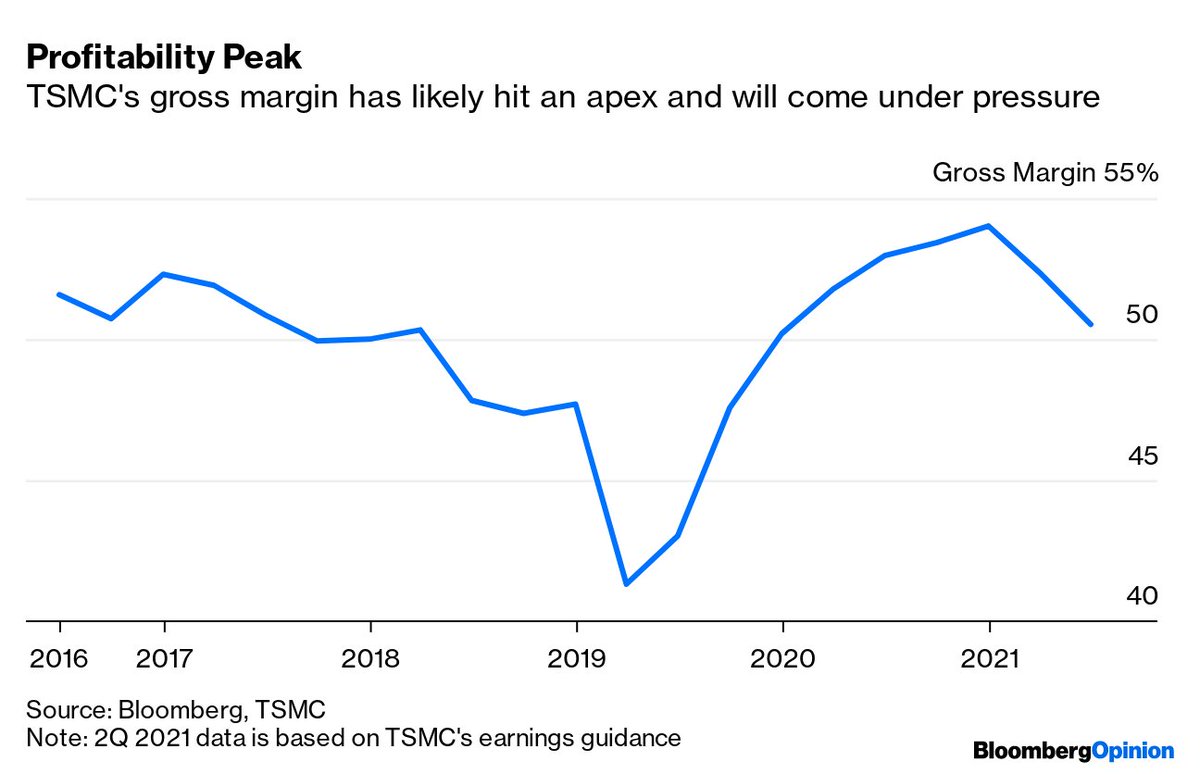

Since depreciation is a major component of costs, and more capex means higher depreciation, it's likely that TSMC's profitability (gross margins) has hit an apex.

That figure will probably trend up again, but for now it'll be under pressure due to the big jump in spending.

Since depreciation is a major component of costs, and more capex means higher depreciation, it's likely that TSMC's profitability (gross margins) has hit an apex.

That figure will probably trend up again, but for now it'll be under pressure due to the big jump in spending.

9/

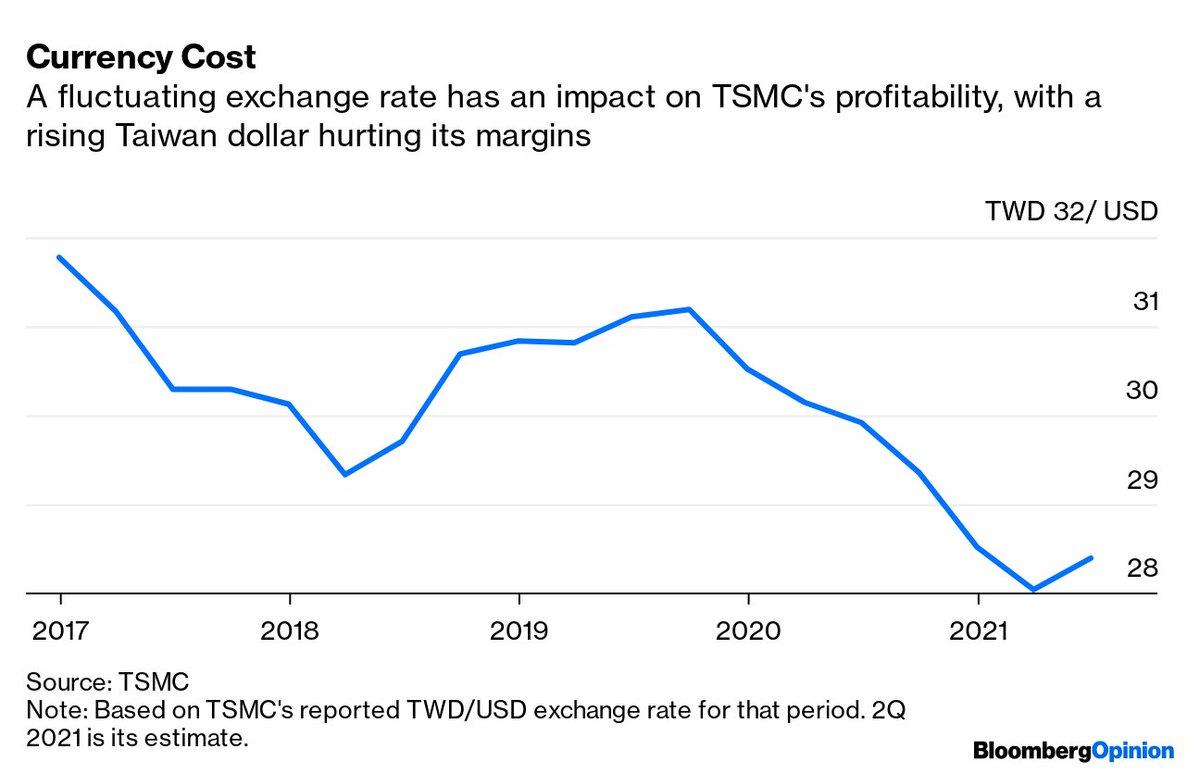

Looming large is the TWD.

Taiwan's currency appreciated strongly in recent years, with a 1% rise in the TWD hitting TSMC's gross margin by around 40bps.

As @samsonellis & @liviayap11 write, the U.S. may push for further appreciation of the TWD

bloomberg.com/news/articles/…

Looming large is the TWD.

Taiwan's currency appreciated strongly in recent years, with a 1% rise in the TWD hitting TSMC's gross margin by around 40bps.

As @samsonellis & @liviayap11 write, the U.S. may push for further appreciation of the TWD

bloomberg.com/news/articles/…

10/

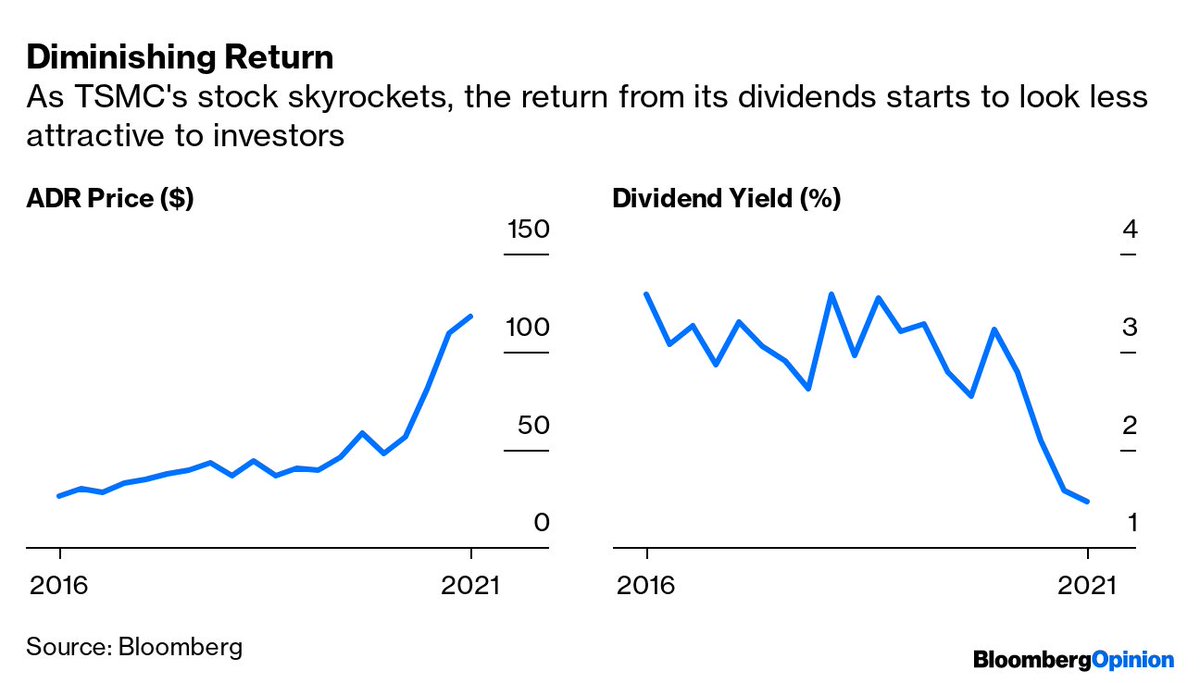

Despite its strong growth, TSMC has actually been seen as a good dividend play with solid yields.

But the rising share price has narrowed that yield to record lows.

Despite its strong growth, TSMC has actually been seen as a good dividend play with solid yields.

But the rising share price has narrowed that yield to record lows.

11/

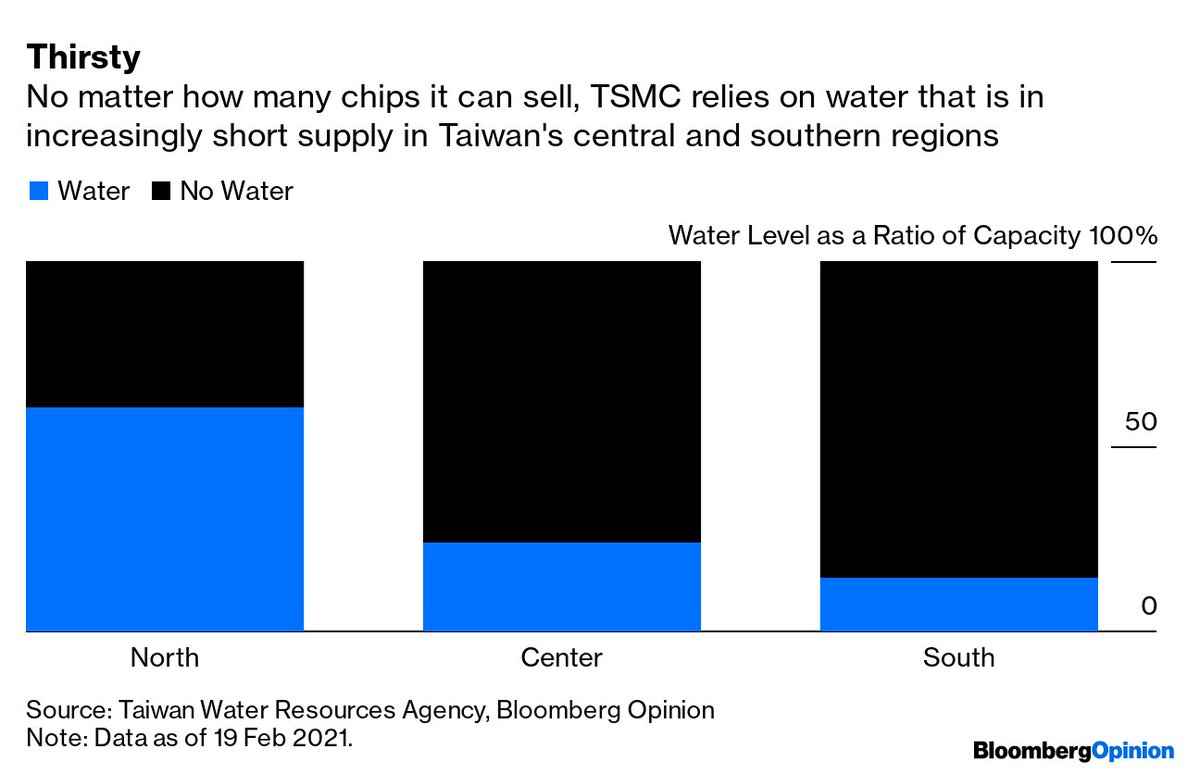

In February I wrote about Taiwan's drought and the risk to semiconductors. It bears repeating because the drought has worsened.

bloomberg.com/opinion/articl…

In fact, this chart tells you all that you need to know about the current water crisis.

In February I wrote about Taiwan's drought and the risk to semiconductors. It bears repeating because the drought has worsened.

bloomberg.com/opinion/articl…

In fact, this chart tells you all that you need to know about the current water crisis.

12/

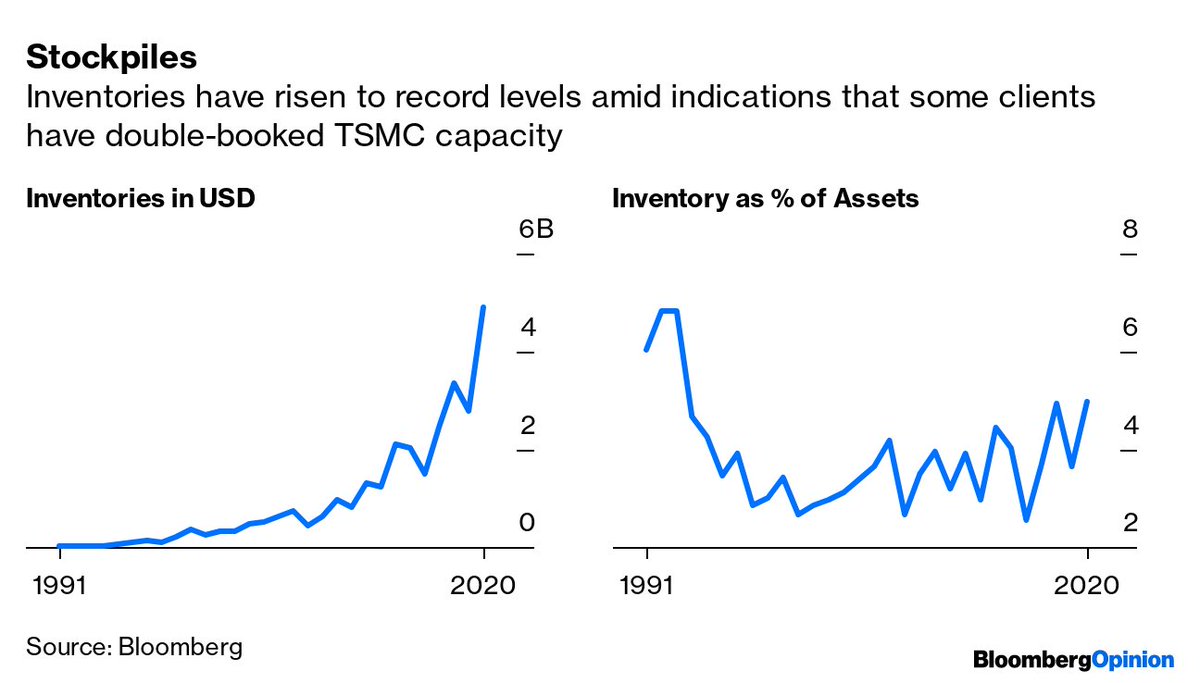

Now some bonus charts you haven't seen yet.

Inventory. Always keep an eye on inventory.

Although reports of chip shortages are well known, there's also word that some clients are double-booking (ordering more than they may need).

Inventories are now at historic highs.

Now some bonus charts you haven't seen yet.

Inventory. Always keep an eye on inventory.

Although reports of chip shortages are well known, there's also word that some clients are double-booking (ordering more than they may need).

Inventories are now at historic highs.

13/

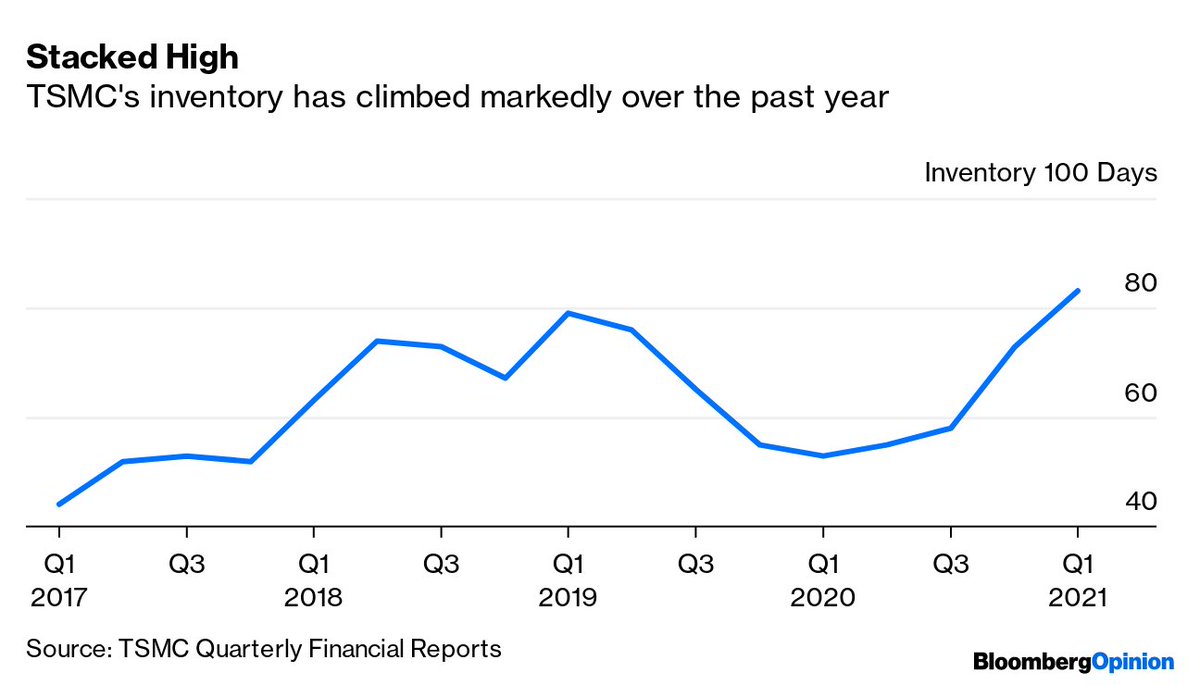

Rising inventories can be viewed in many ways.

But it's worth noting that TSMC's Days of Inventory, a common metric to measure stockpiles, has almost doubled over the past four years to near record levels.

Rising inventories can be viewed in many ways.

But it's worth noting that TSMC's Days of Inventory, a common metric to measure stockpiles, has almost doubled over the past four years to near record levels.

14/14

This ends my thread.

But let me leave you with a final thought: I actually think Intel's decision to stick with chip manufacturing is a good thing for TSMC.

I know that sounds counterintuitive, so you can read my arguments in this piece.

bloomberg.com/opinion/articl…

This ends my thread.

But let me leave you with a final thought: I actually think Intel's decision to stick with chip manufacturing is a good thing for TSMC.

I know that sounds counterintuitive, so you can read my arguments in this piece.

bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh