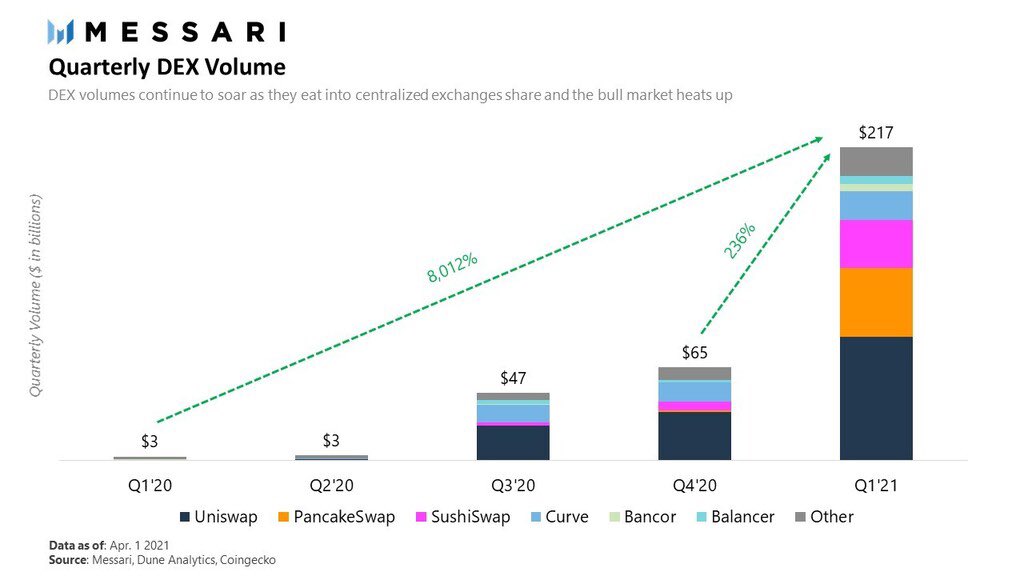

DEX volumes reached over $217 billion in Q1 2021.

This is up 236% from Q4 2020, and a whopping 8,012% from Q1 2020.

Uniswap continued to lead the way as volumes continue to rise in lockstep with asset prices.

A recap of the quarter below.

👇🏾

This is up 236% from Q4 2020, and a whopping 8,012% from Q1 2020.

Uniswap continued to lead the way as volumes continue to rise in lockstep with asset prices.

A recap of the quarter below.

👇🏾

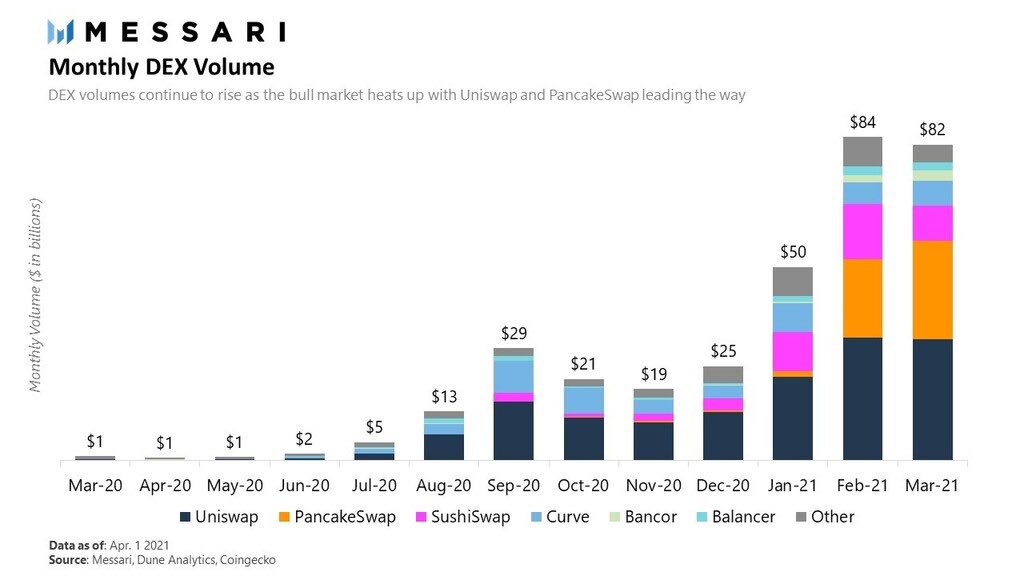

On a monthly basis DEX volumes reached a peak of $84 billion in February, once again led by Uniswap.

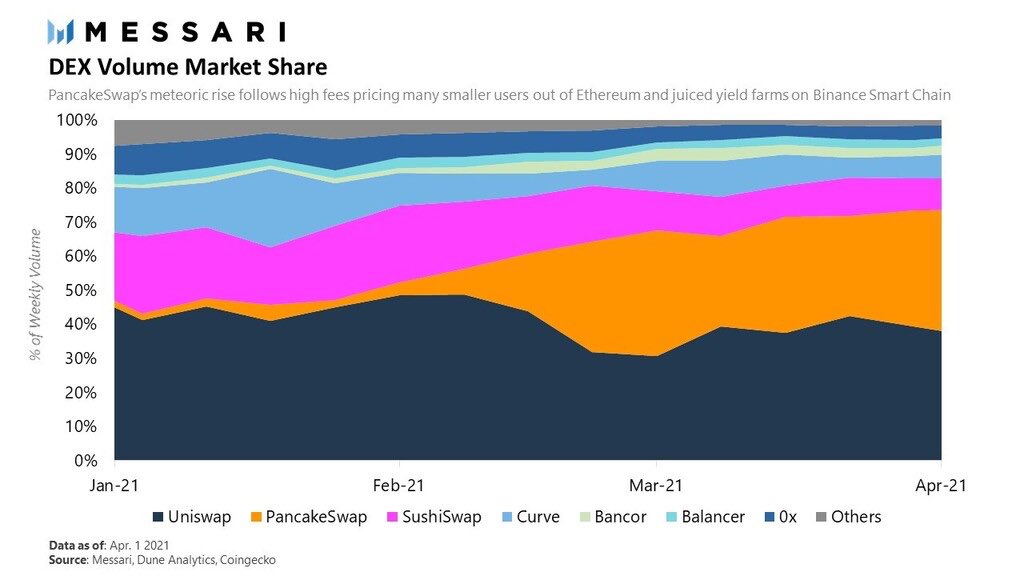

The biggest winner this quarter, and one of the more controversial DEXs, was PancakeSwap.

As BSC boomed in Q1, PancakeSwap grew its market share from to 37%.

The majority of the growth came from the middle of February onwards as Ethereum’s DeFi ecosystem fizzled out.

As BSC boomed in Q1, PancakeSwap grew its market share from to 37%.

The majority of the growth came from the middle of February onwards as Ethereum’s DeFi ecosystem fizzled out.

Now of course categorizing PancakeSwap as a DEX is generous given BSC’s centralization - in many ways it’s more like a CEX than a DEX.

So let’s zoom in on Ethereum to get a clearer picture of well... actual DeFi.

So let’s zoom in on Ethereum to get a clearer picture of well... actual DeFi.

https://twitter.com/wilsonwithiam/status/1381420702918664194

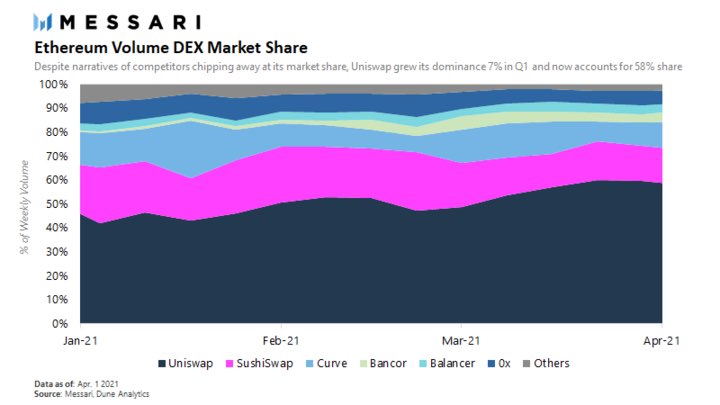

Despite narrative of competitors chipping away at its dominance Uniswap extended its lead in Q1.

It ended the quarter with just under a 60% share of the market.

It ended the quarter with just under a 60% share of the market.

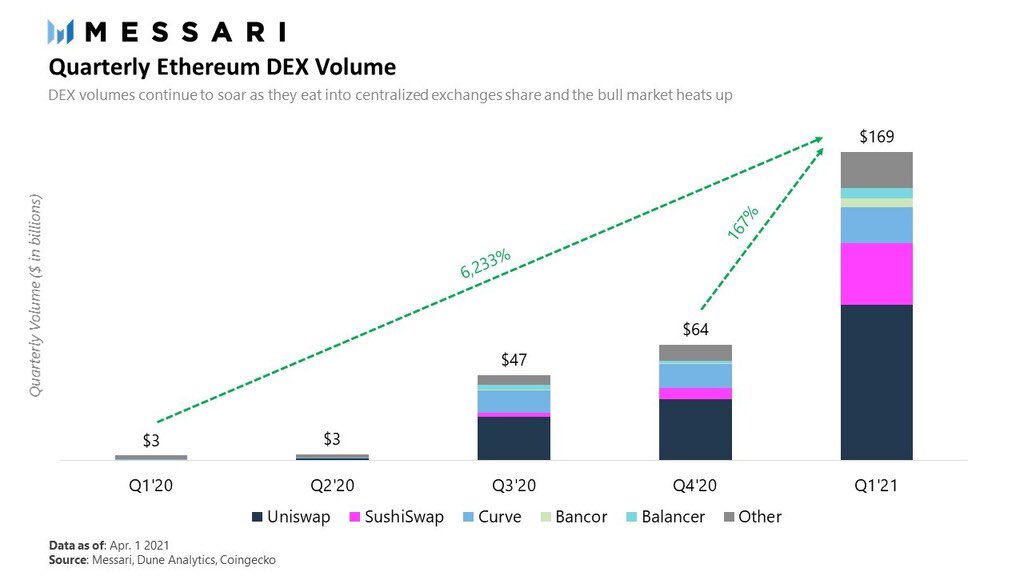

Quarterly DEX volumes on Ethereum tell a similar story to the lead tweet.

In Q1 volumes reached $169 billion - up 167% since last quarter and 6,233% YoY.

In Q1 volumes reached $169 billion - up 167% since last quarter and 6,233% YoY.

DeFi had an incredible start to the year.

In our Q1 DeFi report we walk you through sector by sector, in what was one of the most jam packed quarters in DeFi’s short history.

messari.io/article/q1-202…

In our Q1 DeFi report we walk you through sector by sector, in what was one of the most jam packed quarters in DeFi’s short history.

messari.io/article/q1-202…

Our DEX section of the piece features deep dives on PancakeSwap, SushiSwap, Bancor, THORChain, as well as overviews of next-gen AMMs for Uniswap, Sushi, and Balancer.

messari.io/article/q1-202…

messari.io/article/q1-202…

• • •

Missing some Tweet in this thread? You can try to

force a refresh