Facebook employees:

"We have to prepare for the worst here." - VP, ad chief

"I think there is a real chance this is a very bad moment for us" - VP

"how long can we get away with the reach overestimation?"

"This is a lawsuit waiting to happen." /1

"We have to prepare for the worst here." - VP, ad chief

"I think there is a real chance this is a very bad moment for us" - VP

"how long can we get away with the reach overestimation?"

"This is a lawsuit waiting to happen." /1

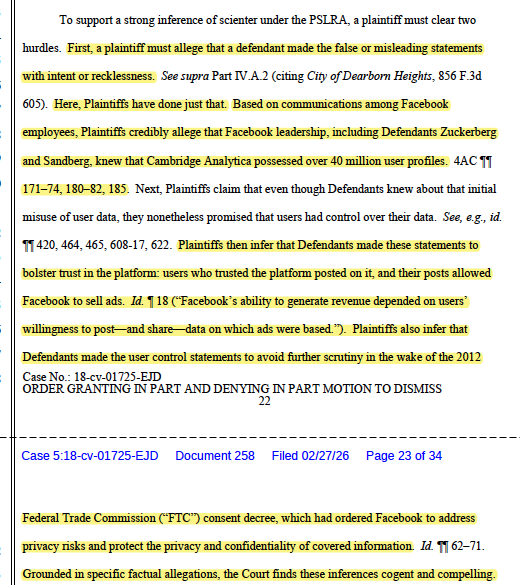

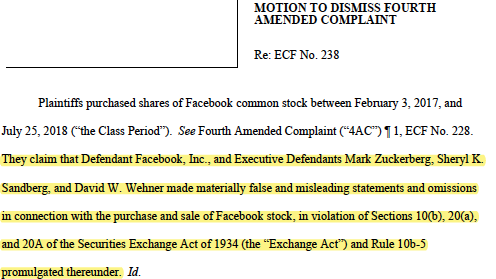

These are statements in "Highly Confidential - Attorneys' Eyes Only" evidence unsealed in a Facebook fraud case over weekend. In Feb, FB had framed the complaint to press as "cherry-picked" but we can now see full threads including Facebook COO, CFO, and half-dozen senior VPs. /2

Quick explainer (1 of 3): Measurement issues were an ongoing issue according to COO Sandberg to CFO Wehner. And an analyst had now noted Facebook's projected numbers in its advertising planning tools were even larger than actual people (using the US census). /2

Quick explainer (2 of 3): This was especially problematic in a moment when Facebook was rolling out a new marketing narrative that was "people-based" to get away from questions around fake accounts, fraud, bots and many of the existing concerns when buying from Facebook. /3

Quick explainer (3 of 3): My org, @DCNorg, had filed with court more than a year ago to unseal the evidence. We had prior experience with cover-ups by FB and found it easily in public's interest to see the full context of what were now fraud claims against the market leader. /4

This proved out. For example, exhibit 16 is an entire thread of top Facebook execs preparing for their Q3 2017 earnings call. In it, they discuss not informing their investors on the call, the real impact to market from discrepancies, and how to spin the issues publicly. /5

Facebook likes to claim these issues didn't impact billing of clients as they don't serve ads to these users.

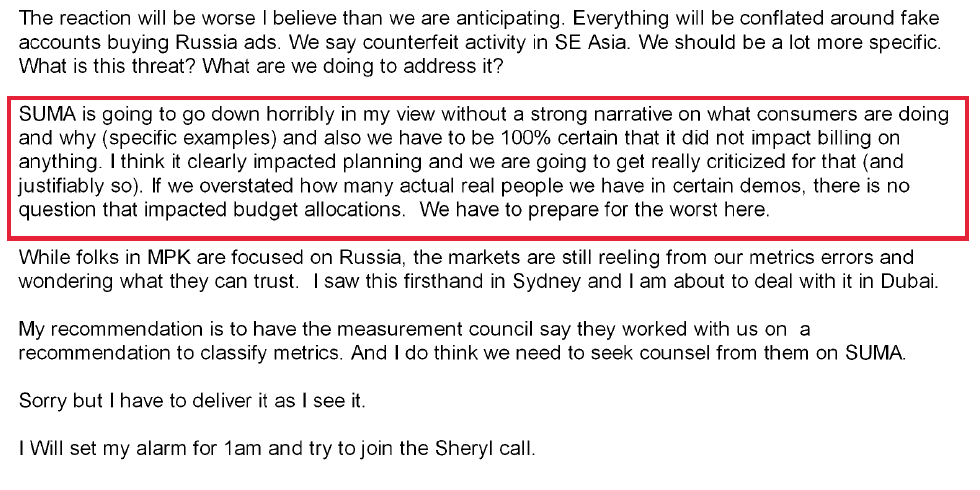

The red box is written by VP ad chief, Carolyn Everson, as she sounds red alarm. ("SUMA" is internal parlance for a single user with multiple accounts).

You be judge. /6

The red box is written by VP ad chief, Carolyn Everson, as she sounds red alarm. ("SUMA" is internal parlance for a single user with multiple accounts).

You be judge. /6

Remarkably, as execs scrambled ahead of earnings, CFO "Dave" meeting had decided they wouldn't include it in their prepared remarks. Their rationale being it was an advertising issue but not a business risk (despite involving the planning tool for 97% of their revenues). /7

Rob Goldman confirms the red alarm here (and throws in a side tidbit about Russia Today).

Again, the alarm is this would have impacted budgets and planning (ergo, everyone else in the market - publishers, advertisers, investors) and the two top ad execs are confirming it. /8

Again, the alarm is this would have impacted budgets and planning (ergo, everyone else in the market - publishers, advertisers, investors) and the two top ad execs are confirming it. /8

We also see their now-familiar PR strategy of using dominance to coach ad client advocates, propping up small business impact ("cover your melon!"). (note: XFN is their internal team for metrics-related issues - a key group for hacking growth and profits) /9

The key remaining redactions in email threads are addresses (irony considering Facebook's ongoing breach of 500+ million phone numbers and emails but I digress): Sandberg, COO

Everson, VP

Olivan, VP

Rose, VP

Goldman, VP

Fischer, VP

Vora, VP

Wehner, CFO

/10

Everson, VP

Olivan, VP

Rose, VP

Goldman, VP

Fischer, VP

Vora, VP

Wehner, CFO

/10

Here is what is now known as "exhibit 16" (one of 75) if you want to fully review with your own eyes. You can decide if it's cherry-picked or if these are mid-level employees.

Nope, it's another cover-up from putting growth ahead of integrity. /11 …d-40e9-822b-081bc894b6af.filesusr.com/ugd/372b91_40f…

Nope, it's another cover-up from putting growth ahead of integrity. /11 …d-40e9-822b-081bc894b6af.filesusr.com/ugd/372b91_40f…

Finally, here is my other thread from last night that took off and has other links as background. I decided to write a new thread hoping it would further clarify a few things. Cheers. /12

https://twitter.com/jason_kint/status/1386420566802923525?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh