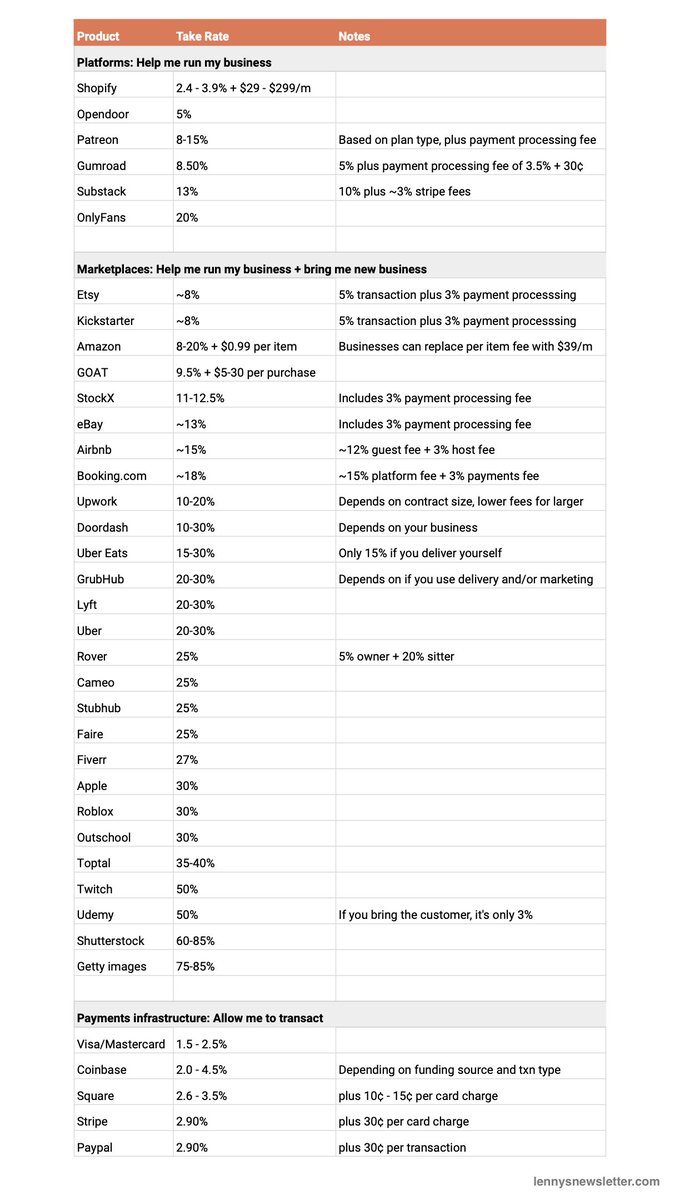

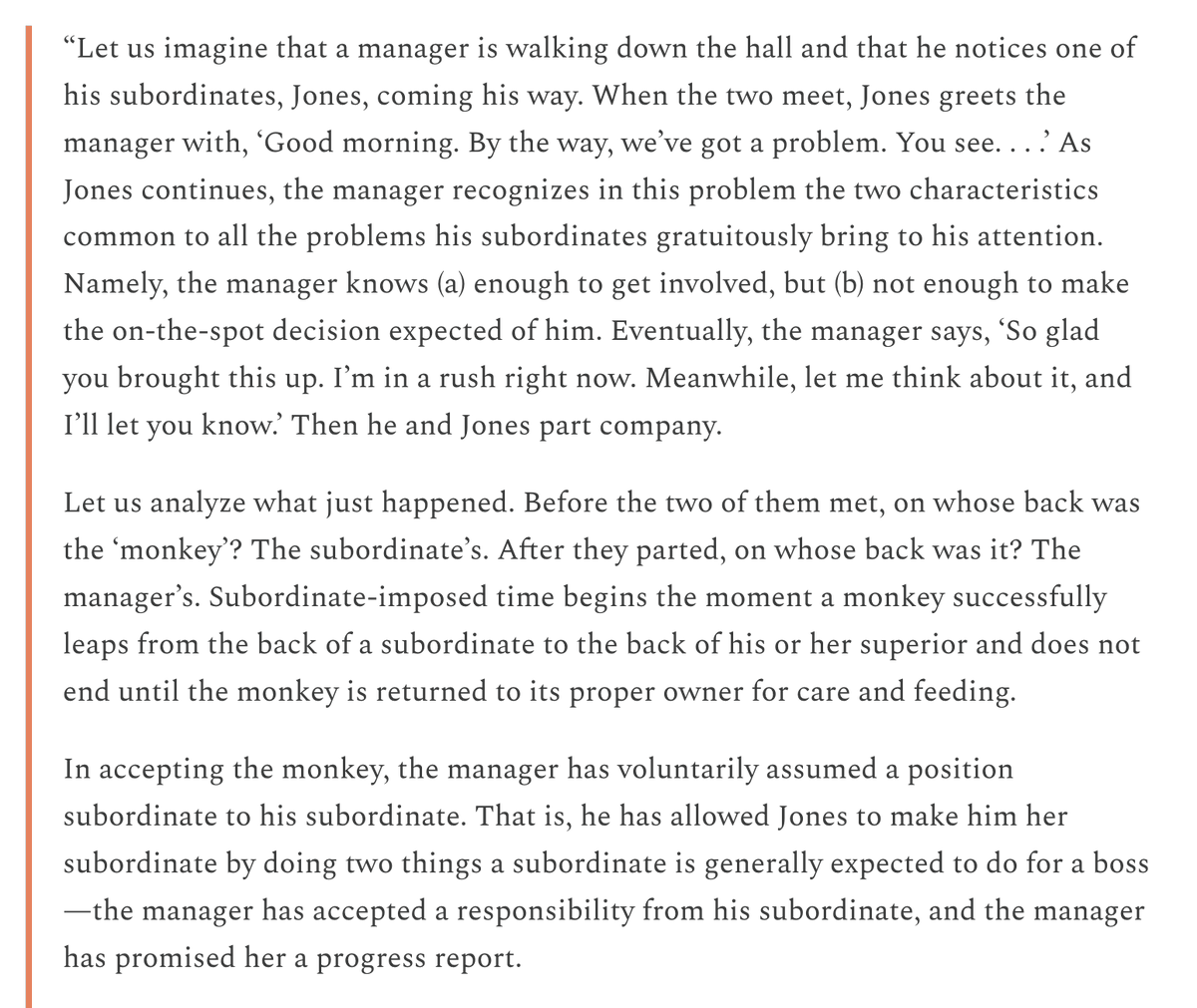

Takeaway #1: There is a relatively clear distinction between “platform” businesses taking 5-15% (which make it easier for you to run your business, e.g. @Patreon @SubstackInc), and Marketplaces taking 10-50% (which bring you new business as well, e.g. @DoorDash @BookCameo)

Takeaway #2: Differences in take rates are primarily driven by three factors: (1) whether you can drive new demand, (2) how much convenience you provide the seller, and (3) the level of competition in the market.

Take rate = Convenience + Demand - Competition

Take rate = Convenience + Demand - Competition

3/ For example:

Gumroad (8.50%): High convenience + Little demand gen - Medium competition

Substack (~13%): Very high convenience + Little demand gen - Medium competition

Twitch (50%): Very high convenience + Very high demand gen - Very low competition

Gumroad (8.50%): High convenience + Little demand gen - Medium competition

Substack (~13%): Very high convenience + Little demand gen - Medium competition

Twitch (50%): Very high convenience + Very high demand gen - Very low competition

4/ Surprises:

1. @OnlyFans (a platform that doesn’t bring any demand) is able to charge 20% (a rate normally reserved for marketplaces). This is because they solve a major pain point for their creators (e.g. accepting payment for sex work) and there isn’t much competition.

1. @OnlyFans (a platform that doesn’t bring any demand) is able to charge 20% (a rate normally reserved for marketplaces). This is because they solve a major pain point for their creators (e.g. accepting payment for sex work) and there isn’t much competition.

2. @Etsy's fees are at the low end of the spectrum for a marketplace (i.e. even lower than Substack, which doesn’t drive demand). This is probably because of heavy competition with Amazon.

3. @toptal is able to charge close to 40% as a labor marketplace. This is likely due to how much time and effort the platform saves both supply and demand.

4. @Twitch takes 50%. This likely speaks to the quality of the product and the significant network effects.

5. @Shutterstock and @GettyImages take up to 85%. This is likely due to how little work there is to get paid once you’ve uploaded your photos.

5. @Shutterstock and @GettyImages take up to 85%. This is likely due to how little work there is to get paid once you’ve uploaded your photos.

If you're looking for more, check out the full post which also includes:

✅ How to choose your take rate

✅ How to increase your take rate

✅ How to lower your take rate (and why)

lennysnewsletter.com/p/take-rates

✅ How to choose your take rate

✅ How to increase your take rate

✅ How to lower your take rate (and why)

lennysnewsletter.com/p/take-rates

• • •

Missing some Tweet in this thread? You can try to

force a refresh