1/ $AMZN 1Q’21 Update

By now, it is no surprise that Amazon would post another Amazing quarter, but the growth/margin in international (+60%) and ads/other (+77%) still raised my eyebrows.

Let’s look at segment by segment and some highlights from the call.

By now, it is no surprise that Amazon would post another Amazing quarter, but the growth/margin in international (+60%) and ads/other (+77%) still raised my eyebrows.

Let’s look at segment by segment and some highlights from the call.

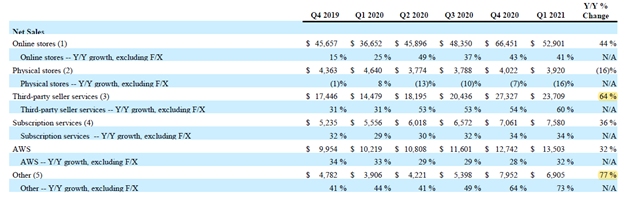

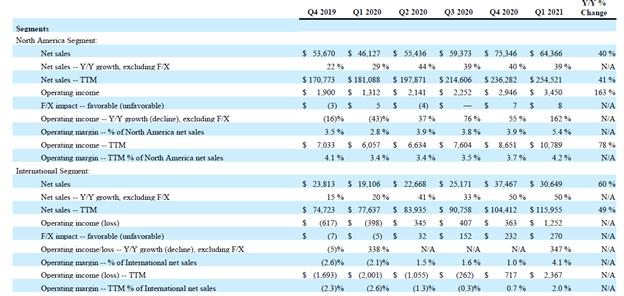

2/ But first here’s the breakdown of revenue by segment (both product and geography)

The real surprise was how international operating margin increased from -2.6% in 1Q’20 to +4.1% in 1Q’21. That’s +670 bps margin improvement vs NA’s +260 bps during the same time.

The real surprise was how international operating margin increased from -2.6% in 1Q’20 to +4.1% in 1Q’21. That’s +670 bps margin improvement vs NA’s +260 bps during the same time.

3/ One of my concerns was whether Amazon can mimic its success in NA to international markets as well.

Looking at the operating leverage and the pace of improvement, this looks much better than I anticipated.

Looking at the operating leverage and the pace of improvement, this looks much better than I anticipated.

4/ E-commerce (1P+3P)

+64% YoY 3P growth. This beast has no sign of slowdown.

“In the U.S., Same-Day Delivery in as fast as five hours is free on orders over $35 on over three million items in select cities”

+64% YoY 3P growth. This beast has no sign of slowdown.

“In the U.S., Same-Day Delivery in as fast as five hours is free on orders over $35 on over three million items in select cities”

5/ “Grocery has been a great revelation during the post-pandemic period here. I think people really value the ability to get home delivery. And we've seen the numbers go up considerably pre and post-pandemic”

Amazon Business: $25 Bn run-rate, ~50% sales from 3P.

Amazon Business: $25 Bn run-rate, ~50% sales from 3P.

6/ Prime

“175 million Prime members have streamed shows and movies in the past year, and streaming hours are up more than 70% year over year”

Total Prime members now ~200 mn

So every 7 out of 8 Prime members watched video. Video is a great customer acquisition tool for Prime

“175 million Prime members have streamed shows and movies in the past year, and streaming hours are up more than 70% year over year”

Total Prime members now ~200 mn

So every 7 out of 8 Prime members watched video. Video is a great customer acquisition tool for Prime

7/ AWS

no deceleration in topline with increasing margins.

One and half years ago, I remember people were really concerned about AWS margin sustainability with competition from Azure and GCP heating up.

AWS backlog $52.9 Bn, +55% YoY

no deceleration in topline with increasing margins.

One and half years ago, I remember people were really concerned about AWS margin sustainability with competition from Azure and GCP heating up.

AWS backlog $52.9 Bn, +55% YoY

8/ Every time I look at AWS/Azure/GCP numbers, it reminds me of this:

“for all practical purposes, I believe AWS is market-size unconstrained”.

If you haven’t read Bezos pitch on AWS, these four paragraphs will be a treat for you. Again, this was in Bezos letter in *2014*.

“for all practical purposes, I believe AWS is market-size unconstrained”.

If you haven’t read Bezos pitch on AWS, these four paragraphs will be a treat for you. Again, this was in Bezos letter in *2014*.

9/ Other

“Hours watched on Twitch nearly doubled year-over-year in the first quarter, and we now average more than 35 million daily visitors.”

~80% other revenue is ads. What’s driving the eye-popping growth? Traffic and relevance of the ads.

“Hours watched on Twitch nearly doubled year-over-year in the first quarter, and we now average more than 35 million daily visitors.”

~80% other revenue is ads. What’s driving the eye-popping growth? Traffic and relevance of the ads.

10/ Outlook: 2Q’21 topline growth +24%-30% which I thought is incredible given the tough comp of last year.

A big caveat though Prime day this time is in Q2 vs Q4 last year; will be interesting to see Etsy’s guidance next week.

A big caveat though Prime day this time is in Q2 vs Q4 last year; will be interesting to see Etsy’s guidance next week.

11/ Amazon continues to execute quarter-in-quarter-out. Probably boring by now, but boring is beautiful 😊

Here’s a thread on my favorite Bezos letter (2014):

And the latest one also is pretty close:

Here’s a thread on my favorite Bezos letter (2014):

https://twitter.com/borrowed_ideas/status/1257840748915032064

And the latest one also is pretty close:

https://twitter.com/borrowed_ideas/status/1382706207132114944

End/ Phew, Big Tech earnings is done!

You can find all my twitter threads here: mbi-deepdives.com/twitter-thread…

I will cover $ETSY, $ANSS, and $ANGI next week.

You can find all my twitter threads here: mbi-deepdives.com/twitter-thread…

I will cover $ETSY, $ANSS, and $ANGI next week.

• • •

Missing some Tweet in this thread? You can try to

force a refresh