AI/ML are in their very early stages! 🤖

As the technology progresses, it will prove to be extremely disruptive to a number of industries. The choice could become: adopt or perish.

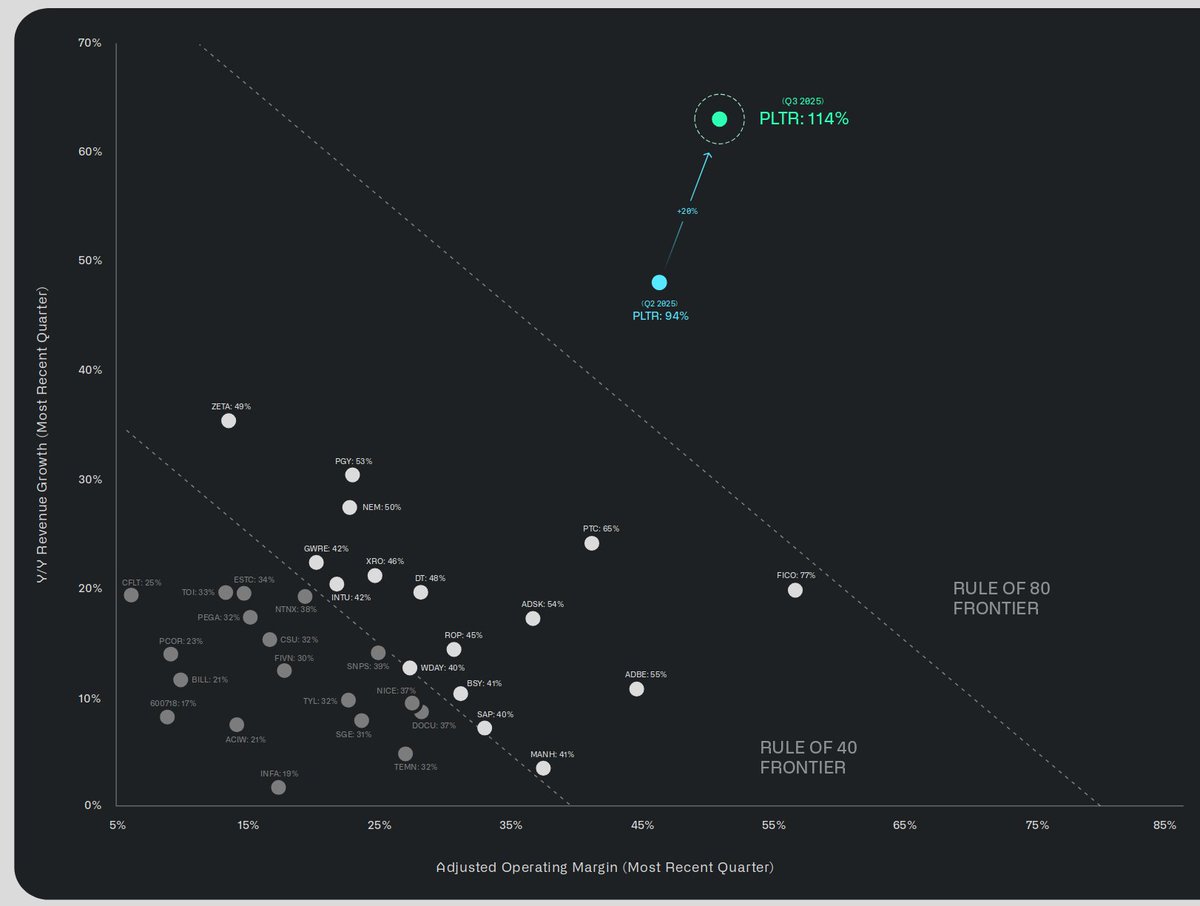

Why does this matter? Because players like $PLTR and $AI, they stand to massively benefit.

1/X

As the technology progresses, it will prove to be extremely disruptive to a number of industries. The choice could become: adopt or perish.

Why does this matter? Because players like $PLTR and $AI, they stand to massively benefit.

1/X

AI/ML are fundamentally misunderstood and as a result massively underestimated.

By 2027 AI is expected to have a TAM worth at least $733B with a CAGR of approximately 42% from 2021 on.

That's one of the fastest growing parts of tech, or any industry for that matter!

2/X

By 2027 AI is expected to have a TAM worth at least $733B with a CAGR of approximately 42% from 2021 on.

That's one of the fastest growing parts of tech, or any industry for that matter!

2/X

Why are AI/ML so pivotal to unlocking the value of data for businesses large and small?

Because AI/ML both provide a fundamental competitive advantage by combining streamlining of costs, with automation, and therefore greater efficiency of capital deployed for better RoI.

3/X

Because AI/ML both provide a fundamental competitive advantage by combining streamlining of costs, with automation, and therefore greater efficiency of capital deployed for better RoI.

3/X

As AI/ML is a frontier technology within the fourth industrial revolution, it is exceedingly difficult for many to grasp its full potential if they themselves are not technologists with experience within this field.

That's often true with the latest innovation, though!

4/X

That's often true with the latest innovation, though!

4/X

Imagine the analysts that looked at what was the Internet in 1995.

It was a dinosaur compared to what it has become since!

We can say the same of just about every technology that's progressed in that timespan: operating systems, computers, mobile devices, and broadband!

5/X

It was a dinosaur compared to what it has become since!

We can say the same of just about every technology that's progressed in that timespan: operating systems, computers, mobile devices, and broadband!

5/X

So let's recap. AI/ML are early stage technology w/enormous potential that is only beginning to be realized. Most don't understand it, and won't begin to care about investing in it until it's already proven itself. That's why it is a fascinating time to assess opportunities.

6/6

6/6

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh