In honor of Ether hitting an all-time-high above $3,000, I am sharing some bullish stats and charts about the second-largest cryptocurrency from The Block's data dashboard.

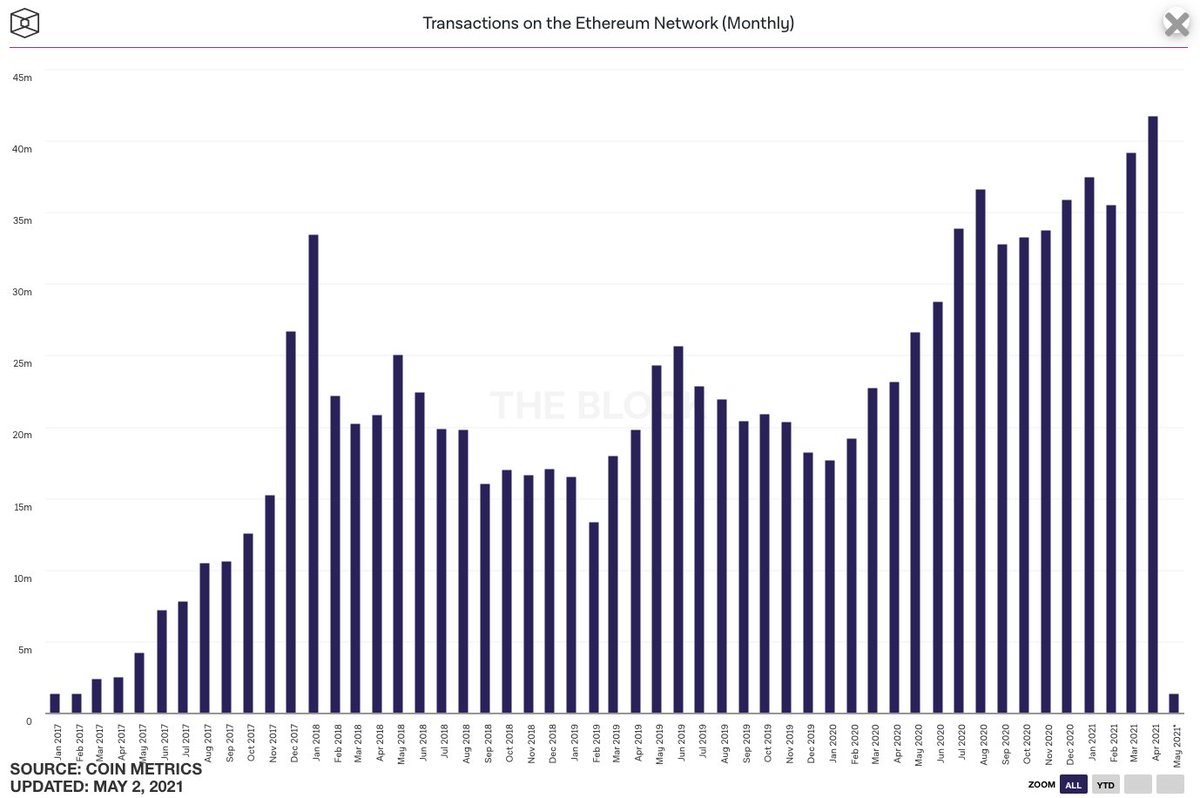

First off: Transactions on the Ethereum Network hit an all-time-high last month of 41.7 million.

First off: Transactions on the Ethereum Network hit an all-time-high last month of 41.7 million.

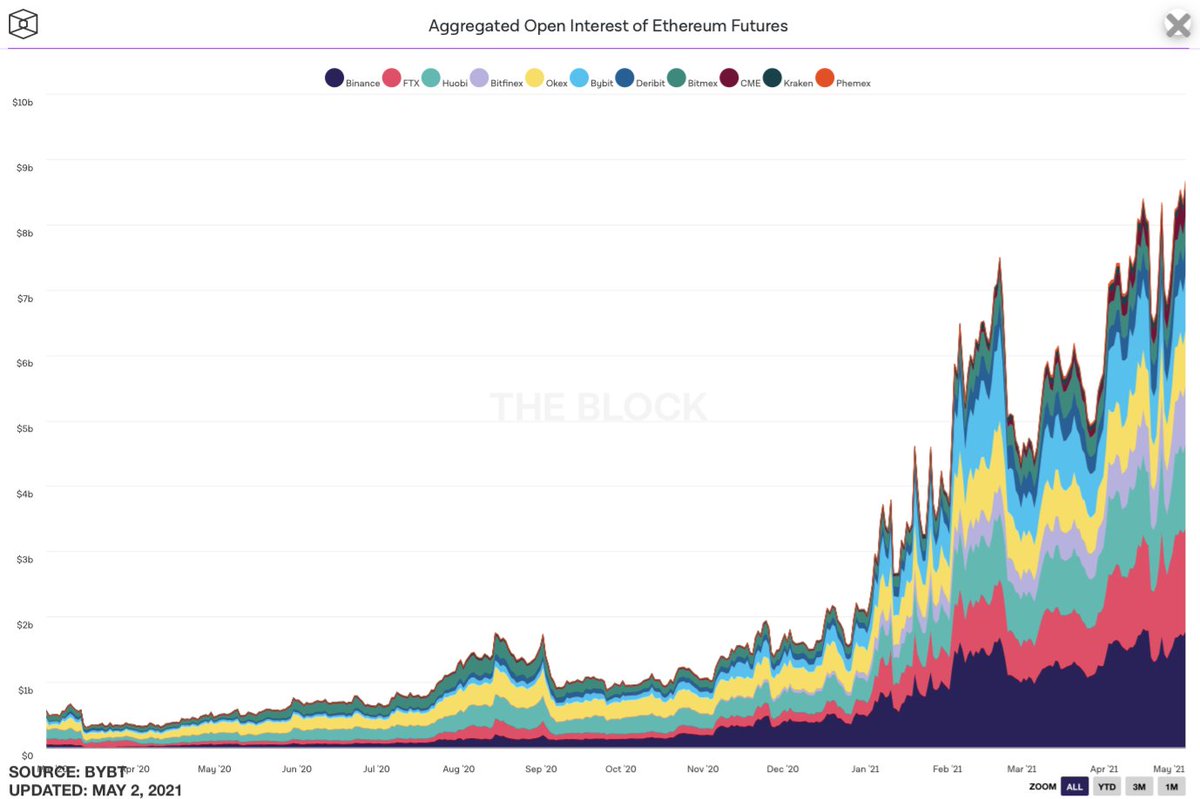

Looking to the derivatives world, open interest across ether options markets has soared this year.

At last check OI stood at $4.1 billion — up from under $800 million at the beginning of 2020.

At last check OI stood at $4.1 billion — up from under $800 million at the beginning of 2020.

Looking at futures, CME's ether futures market - which kicked off in February - grew from $68m in open interest on March 1 to $373 million in OI on May 1

Aggregate open interest across Ethereum futures recently hit an all-time high of $8.6bn

Aggregate open interest across Ethereum futures recently hit an all-time high of $8.6bn

On the DeFi front, DEXes are seeing their trading volumes as a percentage of centralized exchanges surge once again.

At last check, DEXes were seeing more than 15% of total centralized exchange spot trading volumes

In April, DEXes facilitated $14.5bn in traded volumes.

At last check, DEXes were seeing more than 15% of total centralized exchange spot trading volumes

In April, DEXes facilitated $14.5bn in traded volumes.

This is one of the coolest charts in my opinion:

Gross value locked across Ethereum-based DeFi now stands at nearly $78 billion

Just one year ago (May 2 2020) that number sat around $700 million.

100x increase.

Gross value locked across Ethereum-based DeFi now stands at nearly $78 billion

Just one year ago (May 2 2020) that number sat around $700 million.

100x increase.

• • •

Missing some Tweet in this thread? You can try to

force a refresh