In a continuation with my correlation with credit series .. 🧑💼

$HYB (junk bonds) vs $QQQ (NASDAQ 100) 🤔

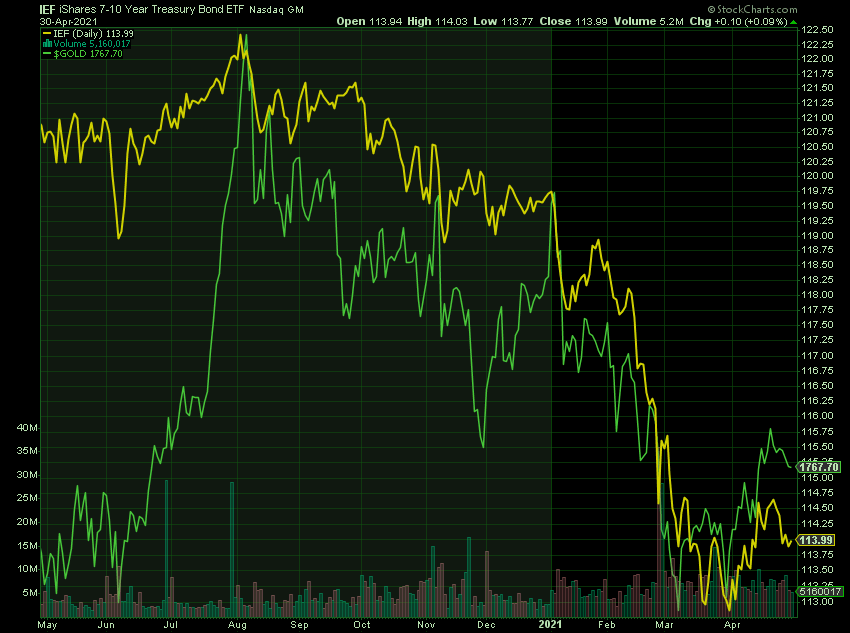

Interesting to note that risk appetite remained relatively strong for both $HYG and $QQQ, while it was noticeably diminished for $LQD, $TLT, $IWO, and many growth stocks. 🧐

$HYB (junk bonds) vs $QQQ (NASDAQ 100) 🤔

Interesting to note that risk appetite remained relatively strong for both $HYG and $QQQ, while it was noticeably diminished for $LQD, $TLT, $IWO, and many growth stocks. 🧐

• • •

Missing some Tweet in this thread? You can try to

force a refresh