📚TraderLion’s Recommending Reading List 📚 (Thread)

⬇️

⬇️

1. How To Make Money in Stocks - William O’Neil

William J. O'Neil is the founder @IBDinvestors. His #CANSLIM methodology and studies have influenced us at TraderLion & many authors including those in this thread.

amzn.to/3tfMp9u

William J. O'Neil is the founder @IBDinvestors. His #CANSLIM methodology and studies have influenced us at TraderLion & many authors including those in this thread.

amzn.to/3tfMp9u

2. Reminiscences of a Stock Operator - Livermore

Reminiscences is the biography of Jesse Livermore, one of the greatest speculators who ever lived. More than 80 years later, it is still one of the most highly recommended investment books ever written.

amzn.to/2Rtkt4R

Reminiscences is the biography of Jesse Livermore, one of the greatest speculators who ever lived. More than 80 years later, it is still one of the most highly recommended investment books ever written.

amzn.to/2Rtkt4R

3. Jesse Livermore’s Methods of Trading in Stocks

Livermore started trading in securities when he was fourteen years old. This book is derived from a series of interviews between Richard Wyckoff and Jesse Livermore from the 1920s.

amzn.to/33fnsAo

Livermore started trading in securities when he was fourteen years old. This book is derived from a series of interviews between Richard Wyckoff and Jesse Livermore from the 1920s.

amzn.to/33fnsAo

4. How to Trade in Stocks - Livermore

This book sheds even more light on Livermore's philosophy & methodology with a ton of insights into his trading formula.

amzn.to/33iFge0

This book sheds even more light on Livermore's philosophy & methodology with a ton of insights into his trading formula.

amzn.to/33iFge0

5. Trading in the Zone - Mark Douglas

Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the mental habits that cost them money. This is a MUST-READ for all traders/investors.

amzn.to/3tnn8KD

Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the mental habits that cost them money. This is a MUST-READ for all traders/investors.

amzn.to/3tnn8KD

6. The Disciplined Trader - Mark Douglas

The Disciplined Trader focuses on how traders can take control of their trading behavior by developing a systematic, step-by-step approach to winning week after week, month after month.

amzn.to/3umdadR

The Disciplined Trader focuses on how traders can take control of their trading behavior by developing a systematic, step-by-step approach to winning week after week, month after month.

amzn.to/3umdadR

7. How I Trade and Invest in Stocks - Richard Wyckoff

Wyckoff leverages over 33 years of experience in the markets in this book. His primary reason for writing this was to help new investors who find the markets too complex.

amzn.to/3hb0iTM

Wyckoff leverages over 33 years of experience in the markets in this book. His primary reason for writing this was to help new investors who find the markets too complex.

amzn.to/3hb0iTM

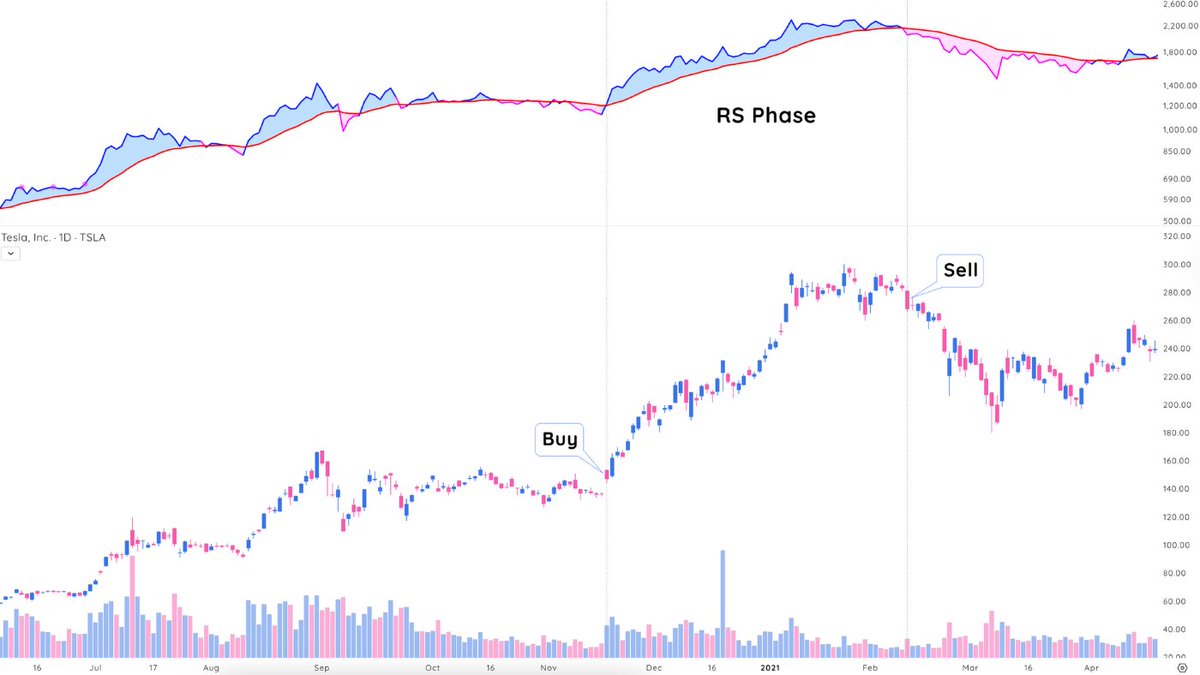

8. Secrets for Profiting in Bull and Bear Markets - Stan Weinstein

All traders/investors should read this book as it offers the skeleton of which phases stocks go through again and again over many years. Timeless principles.

amzn.to/2QTXcc8

All traders/investors should read this book as it offers the skeleton of which phases stocks go through again and again over many years. Timeless principles.

amzn.to/2QTXcc8

9. The LifeCycle Trade: How to Win at Trading IPOs - @EBoboch @KGD_Investor & team.

This book presents the conclusions of an extensive study of Super Growth stocks and IPOs. Another must-read.

amzn.to/3b5DGQR

This book presents the conclusions of an extensive study of Super Growth stocks and IPOs. Another must-read.

amzn.to/3b5DGQR

10. Monster Stocks: How They Set Up, Run Up, Top and Make You Money - @monsterstocks1

Monster Stocks gives you the tools you need to land super-performing stocks and handle them for maximum profit, market cycle after market cycle.

amzn.to/3vANj1U

Monster Stocks gives you the tools you need to land super-performing stocks and handle them for maximum profit, market cycle after market cycle.

amzn.to/3vANj1U

11. Lessons from the Greatest Stock Traders of All Time - @monsterstocks1

This book follows Livermore, Bernard Baruch, Gerald Loeb, Darvas, and WON and emphasizes their processes and common characteristics even as they traded in different time periods.

amzn.to/3ulniDq

This book follows Livermore, Bernard Baruch, Gerald Loeb, Darvas, and WON and emphasizes their processes and common characteristics even as they traded in different time periods.

amzn.to/3ulniDq

12. Market Wizards: Interviews with Top Traders - @jackschwager

Schwager interviewed dozens of top traders and while the details differed, they can all be boiled down to the same formula: solid methodology + proper mental attitude = trading success.

amzn.to/3b2bVZm

Schwager interviewed dozens of top traders and while the details differed, they can all be boiled down to the same formula: solid methodology + proper mental attitude = trading success.

amzn.to/3b2bVZm

13. Unknown Market Wizards: The Best Traders You’ve Never Heard of - @jackschwager

This book continues on the popular Market Wizards series, interviewing exceptionally successful traders to learn how they achieved their performance results.

amzn.to/3h8lc67

This book continues on the popular Market Wizards series, interviewing exceptionally successful traders to learn how they achieved their performance results.

amzn.to/3h8lc67

14. Trade Like a Stock Market Wizard - @markminervini

Minervini unveils his trademarked stock market method SEPA, which combines careful risk management, self-analysis, and perseverance. He explains his process for achieving triple-digit returns.

amzn.to/2PTF3ec

Minervini unveils his trademarked stock market method SEPA, which combines careful risk management, self-analysis, and perseverance. He explains his process for achieving triple-digit returns.

amzn.to/2PTF3ec

15. Think & Trade Like a Champion - @markminervini

A sequel to Trader Like a Stock Market Wizard. This is another gem by Mark which expands upon his first book.

amzn.to/2QW1hN5

A sequel to Trader Like a Stock Market Wizard. This is another gem by Mark which expands upon his first book.

amzn.to/2QW1hN5

16. Technical Analysis Using Multiple Timeframes - @alphatrends

This book is an excellent introduction to technical analysis and reading price action. It goes through how to read trends, market structure, and the psychology of price movement.

amzn.to/3vWAG1t

This book is an excellent introduction to technical analysis and reading price action. It goes through how to read trends, market structure, and the psychology of price movement.

amzn.to/3vWAG1t

17. The Hour Between Dog and Wolf - John Coates

This book covers a series of experiments that identifies a feedback loop between testosterone & success that is responsible for how we feel after a winning or losing streak. Very fun read.

amzn.to/2Sw1jvB

This book covers a series of experiments that identifies a feedback loop between testosterone & success that is responsible for how we feel after a winning or losing streak. Very fun read.

amzn.to/2Sw1jvB

18. 24 Essential Lessons for Investment Success - William O’Neil

We had to end with another book from WON! This one breaks down his 40 years of experience studying the markets into a handful of easy-to-digest lessons.

amzn.to/3b4V2gC

We had to end with another book from WON! This one breaks down his 40 years of experience studying the markets into a handful of easy-to-digest lessons.

amzn.to/3b4V2gC

19. How I Made $2,000,000 in the Stock Market - Darvas

Let's not forget Darvas! In this book, he documents his techniques including his unique Box system. This is a classic even to this day and we highly recommend reading it.

amzn.to/3thoZRb

Let's not forget Darvas! In this book, he documents his techniques including his unique Box system. This is a classic even to this day and we highly recommend reading it.

amzn.to/3thoZRb

• • •

Missing some Tweet in this thread? You can try to

force a refresh