My review and highlights from $ETSY's Earnings Call:

Thread Outline:

1) Top-line figures

2) Buyer & seller growth

3) Marketplace acceleration

4) FY 2021 Outlook

5) Key management discussion

My Theme: Cautious guidance sets them up to over-deliver.

Phenomenal results 🧵

Thread Outline:

1) Top-line figures

2) Buyer & seller growth

3) Marketplace acceleration

4) FY 2021 Outlook

5) Key management discussion

My Theme: Cautious guidance sets them up to over-deliver.

Phenomenal results 🧵

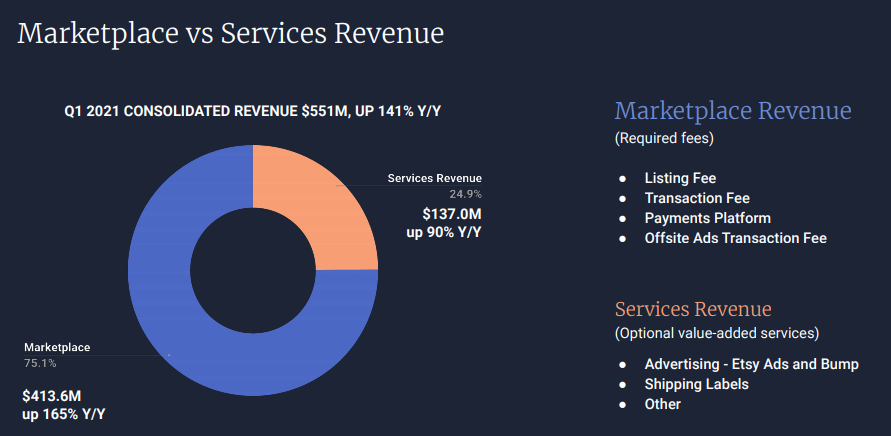

2/ Top-line figures:

Revenue of $550M+141% YoY

• GMS Revenue - 132% YoY

• Services Revenue - 90% YoY

• Gross Profit - 180% YoY

• Reverb's marketplace acquisition contributed to growth

• Stimulus checks helped

-/+ deceleration in revenue QoQ

Category breakdown ->

Revenue of $550M+141% YoY

• GMS Revenue - 132% YoY

• Services Revenue - 90% YoY

• Gross Profit - 180% YoY

• Reverb's marketplace acquisition contributed to growth

• Stimulus checks helped

-/+ deceleration in revenue QoQ

Category breakdown ->

3/ $ETSY Marketplace growth:

• Marketplace Revenue- 141% YoY

+ Marketplace- 165%

+Services - 90% YoY

- Marketplace = combination of visits+conversion+AoV)

• Home improvement is still one of highest spend

CFO indicated that April is already momentum. Essential part.

• Marketplace Revenue- 141% YoY

+ Marketplace- 165%

+Services - 90% YoY

- Marketplace = combination of visits+conversion+AoV)

• Home improvement is still one of highest spend

CFO indicated that April is already momentum. Essential part.

4/ $ETSY Buyers:

Acceleration in the buyer growth!

•Active Buyers -90% YoY

•GMS per Active Buyer also grew 20% YoY

• The repeat and habitual buyer is phenomenal

• Mgmt is now focused on getting more new buyers from their new cohort to become habitual buyers

Look at that!📈

Acceleration in the buyer growth!

•Active Buyers -90% YoY

•GMS per Active Buyer also grew 20% YoY

• The repeat and habitual buyer is phenomenal

• Mgmt is now focused on getting more new buyers from their new cohort to become habitual buyers

Look at that!📈

5/ $ETSY Sellers growth acceleration!

•Active Sellers - 4.5M

•Active Sellers - 67%

• $ETSY Ads & off-site Ads is helping momentum for sellers

Personally, the acceleration btw buyers x sellers is one of the most powerful aspects of $ETSY long-term viability, moat and success!

•Active Sellers - 4.5M

•Active Sellers - 67%

• $ETSY Ads & off-site Ads is helping momentum for sellers

Personally, the acceleration btw buyers x sellers is one of the most powerful aspects of $ETSY long-term viability, moat and success!

6/ On Take rate:

This was one of their best take rates in a while and continues to show continuous improvement.

Although mgmt. warned it may decline slightly, overall this is so important to how the company generates revenue and key.

I'm interested to see how it evolves!

This was one of their best take rates in a while and continues to show continuous improvement.

Although mgmt. warned it may decline slightly, overall this is so important to how the company generates revenue and key.

I'm interested to see how it evolves!

7/ Bottom-line results:

• Net Income - 10x YoY

• ~33% Adj. EBITDA Margin

• FCF growth 📈+Cash Balance of +$1.7B (I believe acquisition is soon)

• They expect to increase spending on marketing, ads and more hiring of technical employees more to further improve the products.

• Net Income - 10x YoY

• ~33% Adj. EBITDA Margin

• FCF growth 📈+Cash Balance of +$1.7B (I believe acquisition is soon)

• They expect to increase spending on marketing, ads and more hiring of technical employees more to further improve the products.

8/ Outlook: Only Q2 Guidance:

Rev: $493-$536M(in-line), growth of 25%

GMS Growth:15%

Adj. EBITDA Margin: 25%

Love how EBITDA is accelerating despite the company's increased spend.

They were conservative and cautious on guidance which is why stock is down. I think they'll beat!

Rev: $493-$536M(in-line), growth of 25%

GMS Growth:15%

Adj. EBITDA Margin: 25%

Love how EBITDA is accelerating despite the company's increased spend.

They were conservative and cautious on guidance which is why stock is down. I think they'll beat!

10/ Notables during the call:

- Expect more advertising spend

- Lots of discussion about growth in April.

- Reverb's marketplace acquisition is complete and is showing momentum.

- I really like how management is very cautious about Q2 and the future.

Future is bright!

- Expect more advertising spend

- Lots of discussion about growth in April.

- Reverb's marketplace acquisition is complete and is showing momentum.

- I really like how management is very cautious about Q2 and the future.

Future is bright!

10/ I love to zoom out and think big picture on quarterly earnings :)

My conviction just got higher after this report. My full thread on why I am big believer in $ETSY long-term and my full thesis below 👇

My conviction just got higher after this report. My full thread on why I am big believer in $ETSY long-term and my full thesis below 👇

https://twitter.com/InvestiAnalyst/status/1383881457614004225

END/

Join Ryan, MBI and myself to fully discuss these results on Saturday at 12PM PST and how we see marketplaces like $ETSY Post-Covid!

Thank you!

Join Ryan, MBI and myself to fully discuss these results on Saturday at 12PM PST and how we see marketplaces like $ETSY Post-Covid!

Thank you!

https://twitter.com/InvestiAnalyst/status/1390049776419295235

Hi @StockNovice, curious to hear what stood out the most for you from the report? or key takeaways?

• • •

Missing some Tweet in this thread? You can try to

force a refresh