We are starting our Q4 and FY21 results coverage starting today. Updates will be added in this thread.

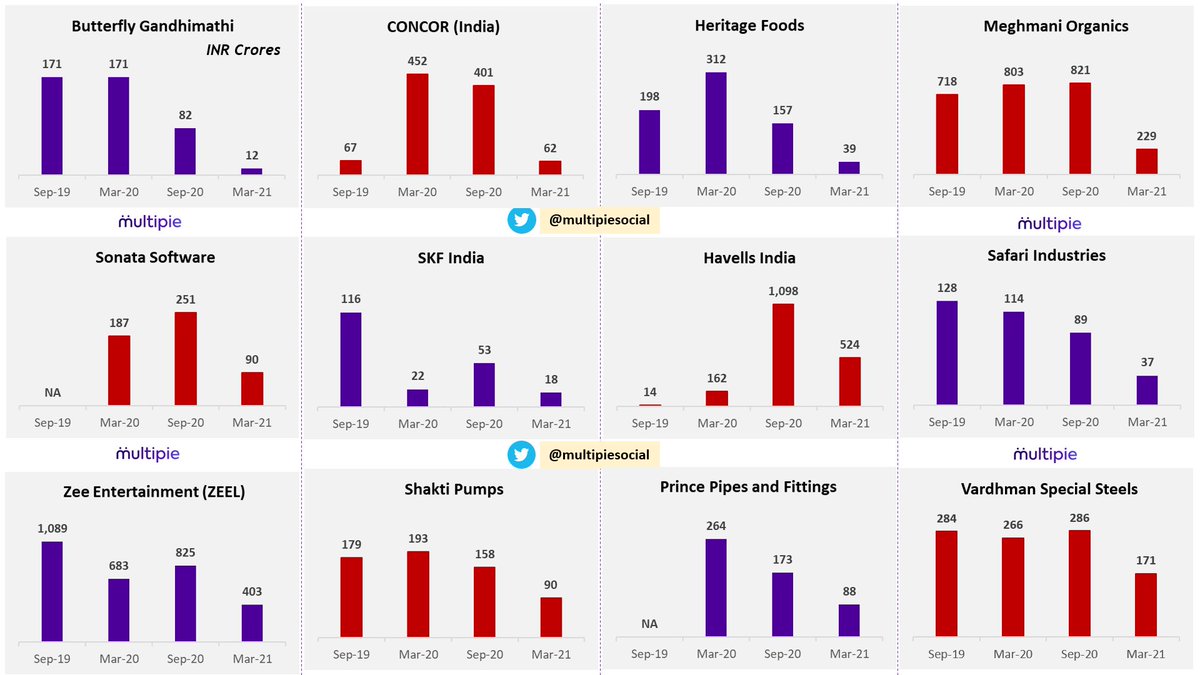

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 1-12)

#Q4withMultipie

1/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 1-12)

#Q4withMultipie

1/n

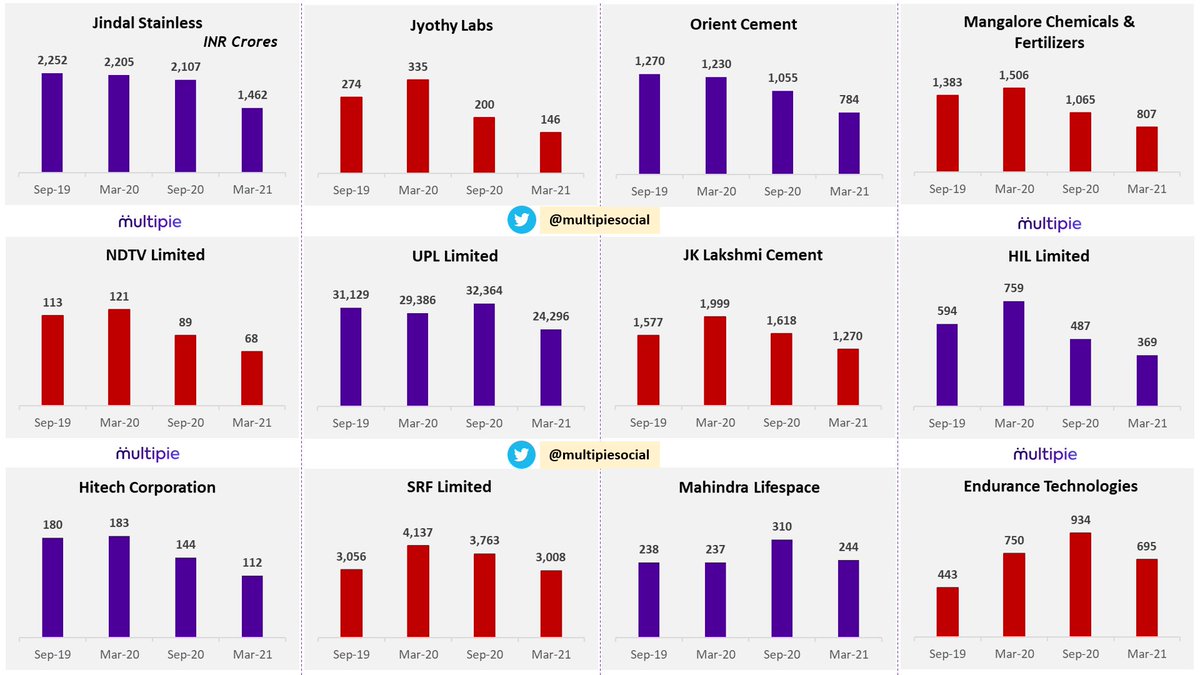

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 13-24)

#Q4withMultipie

2/n

#Q4withMultipie

2/n

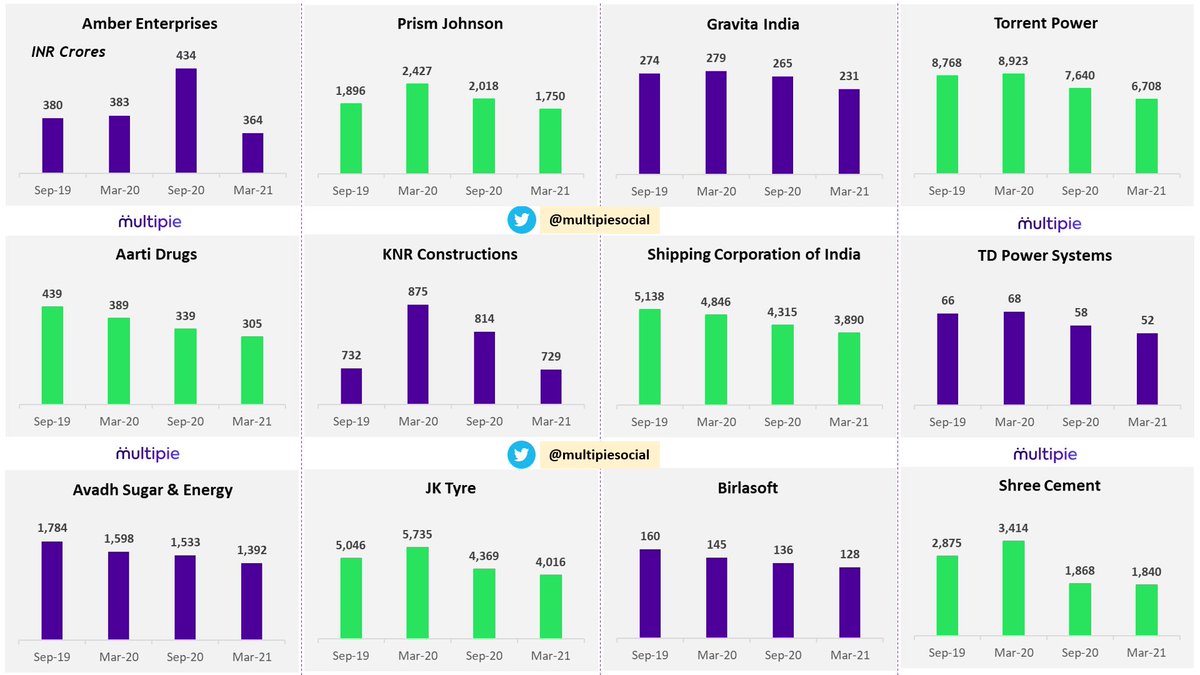

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 25-36)

#Q4withMultipie

3/n

#Q4withMultipie

3/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 37-48)

#Q4withMultipie

4/n

#Q4withMultipie

4/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have seen minimum 10% debt reduction in H2 FY21 till now.

#Q4withMultipie

Please RT if this helps.

5/n

#Q4withMultipie

Please RT if this helps.

5/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 49-60)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

5/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

5/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 61-72)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

6/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

6/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 73-84)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

7/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

7/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 85-96)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

8/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

8/n

Published third batch of 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭:

60 names are being added based on a study of results declared in last week.

S. No. 97-108 👇

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

9/n

60 names are being added based on a study of results declared in last week.

S. No. 97-108 👇

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

9/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 109-120)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

10/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

10/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 121-132)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

11/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

11/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 133-144)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

12/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

12/n

𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐫𝐞𝐝𝐮𝐜𝐢𝐧𝐠 𝐃𝐞𝐛𝐭: List of companies that have been reducing total debt between Sep' 19 & Mar' 21 (S. No. 145-156)

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

13/n

Note: Figures represent outstanding debt (INR crores)

#Q4withMultipie

13/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh