Continuing with our Q4 and FY21 results coverage.

𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐞𝐱𝐭𝐫𝐚𝐜𝐭𝐬: In this thread, we will highlight select extracts from company presentations that we found interesting.

PS: None of it is an investment advice.

#Q4withMultipie

1/n

𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫 𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧 𝐞𝐱𝐭𝐫𝐚𝐜𝐭𝐬: In this thread, we will highlight select extracts from company presentations that we found interesting.

PS: None of it is an investment advice.

#Q4withMultipie

1/n

1. L&T Infotech: Between 2019 and 2021, LTI has deepened its' capabilities and offerings into top tier of partners across key platforms such as AWS, Google Cloud, IBM, Services Now and Snowflake.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/LTI_…

2/n

#Q4withMultipie

Link:

archives.nseindia.com/corporate/LTI_…

2/n

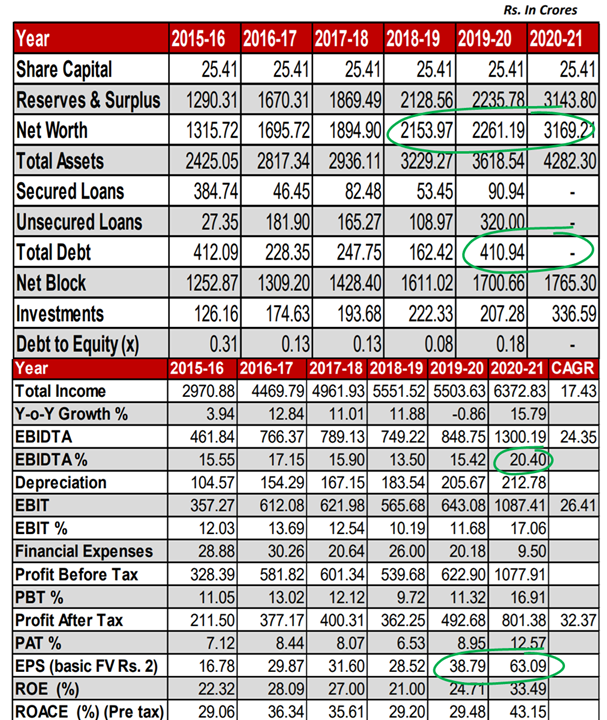

2. Supreme Industries: Supreme has market leadership (or among Top 3) in each of its segments - Plastic piping, furniture, packaging and industrial products.

Both P&L and Balance sheet look stronger at FY21 end as highlighted.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/SUPR…

3/n

Both P&L and Balance sheet look stronger at FY21 end as highlighted.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/SUPR…

3/n

3. Matrimony.com: Overview of the Indian matchmaking opportunity size.

👫1.1-1.3 crore weddings per year

👫6% online matchmaking = 6.6-7.8 lks per year

👫Matrimony saw 20% jump in paid subscriptions in FY21 to 8.4 lks

#Q4withMultipie

Link:

archives.nseindia.com/corporate/MATR…

4/n

👫1.1-1.3 crore weddings per year

👫6% online matchmaking = 6.6-7.8 lks per year

👫Matrimony saw 20% jump in paid subscriptions in FY21 to 8.4 lks

#Q4withMultipie

Link:

archives.nseindia.com/corporate/MATR…

4/n

4. Saregama: Apart from improvement in financials (highlighted), we find the growth in licensing revenue interesting.

#Q4withMultipie

Good thread on music streaming:

Link:

archives.nseindia.com/corporate/SARE…

5/n

#Q4withMultipie

Good thread on music streaming:

https://twitter.com/mehrotra_saket/status/1393088709734453249?s=20

Link:

archives.nseindia.com/corporate/SARE…

5/n

5. Lodha/ Macrotech Developers:

The presentation makes a case for start of a real estate upcycle, along with consolidation towards Tier I players due to inability of Tier II players to sell.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/LODH…

6/n

The presentation makes a case for start of a real estate upcycle, along with consolidation towards Tier I players due to inability of Tier II players to sell.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/LODH…

6/n

6. HDFC Limited:

Interesting slide that argues that while nominal mortgage rates are pretty low at 6.75%, effective interest rate on a Home Loan is as low as 3.1% after factoring current tax incentives.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/HDFC…

7/n

Interesting slide that argues that while nominal mortgage rates are pretty low at 6.75%, effective interest rate on a Home Loan is as low as 3.1% after factoring current tax incentives.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/HDFC…

7/n

7. Apollo Tyres:

Significant expansion in rural outlets (including sub-dealers) in FY21 - over 4x from 1,350 to 5,800.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/APOL…

8/n

Significant expansion in rural outlets (including sub-dealers) in FY21 - over 4x from 1,350 to 5,800.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/APOL…

8/n

8. Jindal Steel and Power:

Planned expansion of steel capacity by 66% and pellet capacity by 133% over next 4 years (by FY25E).

#Q4withMultipie

Link:

archives.nseindia.com/corporate/JIND…

9/n

Planned expansion of steel capacity by 66% and pellet capacity by 133% over next 4 years (by FY25E).

#Q4withMultipie

Link:

archives.nseindia.com/corporate/JIND…

9/n

9. Avadh Sugar:

Details of structural changes in Ethanol that is expected to drive profitability for sugar players. Government target of 20% Ethanol blending by 2025 to resolve problem of excess sugar production.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/AVAD…

10/n

Details of structural changes in Ethanol that is expected to drive profitability for sugar players. Government target of 20% Ethanol blending by 2025 to resolve problem of excess sugar production.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/AVAD…

10/n

10. Sonata Software:

🧑💻Proprietary Platformation approach at Sonata.

🧑💻Details on long time partnership with Microsoft (over 25 years), which contributes over 45% of its IT services revenues.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/SONA…

11/n

🧑💻Proprietary Platformation approach at Sonata.

🧑💻Details on long time partnership with Microsoft (over 25 years), which contributes over 45% of its IT services revenues.

#Q4withMultipie

Link:

archives.nseindia.com/corporate/SONA…

11/n

11. UPL:

🌱Demonstrated track record of profitable growth in last 5 years (Revenue CAGR: 21%, EBITDA CAGR: 26%) along with deleveraging of B/S in last 2 years.

🌱UPL's capabilities and pipeline/ outlook on OpenAg innovation

#Q4withMultipie

Link:

archives.nseindia.com/corporate/UPL_…

12/n

🌱Demonstrated track record of profitable growth in last 5 years (Revenue CAGR: 21%, EBITDA CAGR: 26%) along with deleveraging of B/S in last 2 years.

🌱UPL's capabilities and pipeline/ outlook on OpenAg innovation

#Q4withMultipie

Link:

archives.nseindia.com/corporate/UPL_…

12/n

12. Prince Pipes:

🧑🏭Good financial traction with steady revenue growth (Q4FY21/ FY21: 77%/27% yoy) along expansion of EBITDA margins by ~6%

🧑🏭Improvement in WC days from 58 to 36 days, mainly due to lower inventory

#Q4withMultipie

Link:

archives.nseindia.com/corporate/PRIN…

13/n

🧑🏭Good financial traction with steady revenue growth (Q4FY21/ FY21: 77%/27% yoy) along expansion of EBITDA margins by ~6%

🧑🏭Improvement in WC days from 58 to 36 days, mainly due to lower inventory

#Q4withMultipie

Link:

archives.nseindia.com/corporate/PRIN…

13/n

13. Aarti Drugs:

💊 Recommended presentation to learn pharma basics

💊 Details of Pharma PLI scheme with INR 15,000 crore of incentives over next 6 years

💊 Aarti 2.0: INR 600 cr Capex, ~INR 4,200-4500 cr revenue potential

#Q4withMultipie

Link:

archives.nseindia.com/corporate/AART…

14/n

💊 Recommended presentation to learn pharma basics

💊 Details of Pharma PLI scheme with INR 15,000 crore of incentives over next 6 years

💊 Aarti 2.0: INR 600 cr Capex, ~INR 4,200-4500 cr revenue potential

#Q4withMultipie

Link:

archives.nseindia.com/corporate/AART…

14/n

14. Butterfly Gandhimathi - Liked this presentation

🦋Into kitchen appliances, cooker/ware, misc home appliances

🦋Shift towards branded sales; no B2G business since last 4 years

🦋Prominent improvement in WC+ Debt reduction

🦋New launches

Link: archives.nseindia.com/corporate/BUTT…

15/n

🦋Into kitchen appliances, cooker/ware, misc home appliances

🦋Shift towards branded sales; no B2G business since last 4 years

🦋Prominent improvement in WC+ Debt reduction

🦋New launches

Link: archives.nseindia.com/corporate/BUTT…

15/n

15. Firstsource Solutions

💻ROCE 🔼 by 5.3%, but stagnant ROE

💻ROCE 🔼= Good op. results + debt 🔽in FY21

💻ROE flat = One time P&L charge of 110 cr

💻Op. metrics: Traction in Banking & FS; higher offshoring

💻Revenue/ employee is flattish

Link: mk0firstsourcecw8t7d.kinstacdn.com/wp-content/upl…

16/n

💻ROCE 🔼 by 5.3%, but stagnant ROE

💻ROCE 🔼= Good op. results + debt 🔽in FY21

💻ROE flat = One time P&L charge of 110 cr

💻Op. metrics: Traction in Banking & FS; higher offshoring

💻Revenue/ employee is flattish

Link: mk0firstsourcecw8t7d.kinstacdn.com/wp-content/upl…

16/n

16. IIFL Wealth: 👍

💰Focus on advisory/ ARR model (fees) over distributor (transactional). Higher repeat rev. & sticky

💰Good🔼in ARR AUM (up 63% vs 32% overall)

💰ARR share: FY16/20/21 = 33%/40%/49%

💰Strong guidance on ROE (12% to 19%) & PAT

Link

archives.nseindia.com/corporate/IIFL…

17/n

💰Focus on advisory/ ARR model (fees) over distributor (transactional). Higher repeat rev. & sticky

💰Good🔼in ARR AUM (up 63% vs 32% overall)

💰ARR share: FY16/20/21 = 33%/40%/49%

💰Strong guidance on ROE (12% to 19%) & PAT

Link

archives.nseindia.com/corporate/IIFL…

17/n

17. Heritage Foods: Promising

🐄Strengthening Bal. Sheet (comments in Image 1)

🐄Improving OCF & WC; financial metrics (Image 2)

🐄Due to focus on high margin Value Added prod.

🐄Focus on technology (Heritage TUCH) & omni-channel supply chain

Link

archives.nseindia.com/corporate/HERI…

18/n

🐄Strengthening Bal. Sheet (comments in Image 1)

🐄Improving OCF & WC; financial metrics (Image 2)

🐄Due to focus on high margin Value Added prod.

🐄Focus on technology (Heritage TUCH) & omni-channel supply chain

Link

archives.nseindia.com/corporate/HERI…

18/n

18. Cosmo Films: On fast pedal

📦Strong guidance by mgmt.

📦Details on India & Global BOPP industry. Indian BOPP industry growth 2x of GDP.

📦Focus on increasing specialized business to 80%

📦De-commoditized model -->Higher return metrics

Link:

archives.nseindia.com/corporate/COSM…

19/n

📦Strong guidance by mgmt.

📦Details on India & Global BOPP industry. Indian BOPP industry growth 2x of GDP.

📦Focus on increasing specialized business to 80%

📦De-commoditized model -->Higher return metrics

Link:

archives.nseindia.com/corporate/COSM…

19/n

19. Acrysil:

🏠Good FY21: Revenue 🔼13%, but RM cost ↔️ = Margin expansion

🏠~57% Gross Margins - among Top tier

🏠Export focused (~80%); domestic traction in Carysil

🏠IKEA (Switz) partnership - dispatches start in Mar 21; Capacity expansion

Link: archives.nseindia.com/corporate/ACRY…

20/n

🏠Good FY21: Revenue 🔼13%, but RM cost ↔️ = Margin expansion

🏠~57% Gross Margins - among Top tier

🏠Export focused (~80%); domestic traction in Carysil

🏠IKEA (Switz) partnership - dispatches start in Mar 21; Capacity expansion

Link: archives.nseindia.com/corporate/ACRY…

20/n

20. Dr. Lal Pathlabs:

💉Q4FY21: Revenue growth of 27% in non-Covid biz is impressive (patient volume gr. of 33% to 59 lakhs)

💉FY21 EPS of 35.3; trades at 80X FY21

💉Genevolve: Genomics division focused on Genetic testing - interesting

Link: archives.nseindia.com/corporate/LALP…

21/n

💉Q4FY21: Revenue growth of 27% in non-Covid biz is impressive (patient volume gr. of 33% to 59 lakhs)

💉FY21 EPS of 35.3; trades at 80X FY21

💉Genevolve: Genomics division focused on Genetic testing - interesting

Link: archives.nseindia.com/corporate/LALP…

21/n

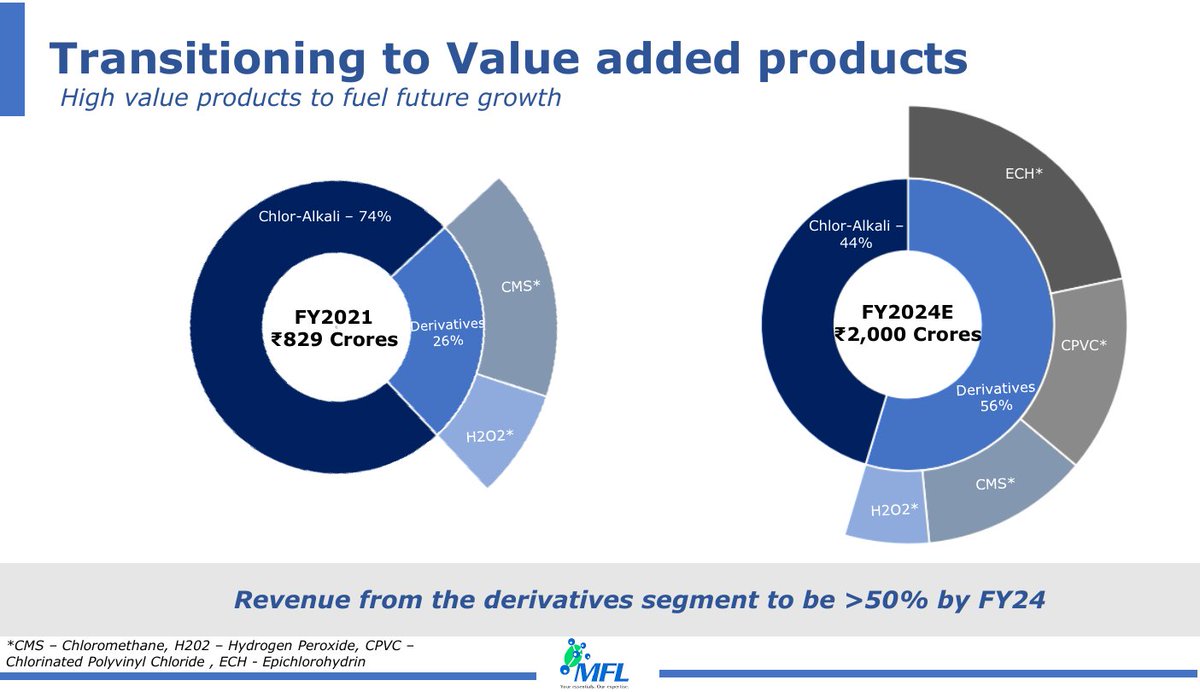

21. Meghmani: Demerger play

🧪Guidance of 34% revenue growth over FY21-24 vs 21% in last 5 yrs

🧪Focus on higher margin derivatives (H2O2, CMS, ECM, CPVC). Rev. share 26 --> 56%

🧪Capacity expansion

🧪Demerger focus to unlock Derivatives business

Link: archives.nseindia.com/corporate/LALP…

🧪Guidance of 34% revenue growth over FY21-24 vs 21% in last 5 yrs

🧪Focus on higher margin derivatives (H2O2, CMS, ECM, CPVC). Rev. share 26 --> 56%

🧪Capacity expansion

🧪Demerger focus to unlock Derivatives business

Link: archives.nseindia.com/corporate/LALP…

Correct link for Meghmani:

archives.nseindia.com/corporate/MEGH…

archives.nseindia.com/corporate/MEGH…

22. SBI: The worst is behind

🏦NPA: Incremental slippages low at 1.18%; 88% PCR provides cushion against shocks

🏦Key indicators - Stable + improving

🏦Digital & YONO (Slide 38 to 42): This is SBI's edge! 40K home loan leads; 1 Mn A/L products

Link: sbi.co.in/documents/1783…

23/n

🏦NPA: Incremental slippages low at 1.18%; 88% PCR provides cushion against shocks

🏦Key indicators - Stable + improving

🏦Digital & YONO (Slide 38 to 42): This is SBI's edge! 40K home loan leads; 1 Mn A/L products

Link: sbi.co.in/documents/1783…

23/n

23. Grasim - "In the works" (Capex 🔼, Debt🔽)

🧥 Viscose - "Green" fibre for textiles looks promising

🧥 Balance sheet - Visible improvement; standlone/ consol debt repayment of INR 2084/12050 cr in FY21

🧥Planned capex of ~2600 cr in FY22

Link: archives.nseindia.com/corporate/GRAS…

24/n

🧥 Viscose - "Green" fibre for textiles looks promising

🧥 Balance sheet - Visible improvement; standlone/ consol debt repayment of INR 2084/12050 cr in FY21

🧥Planned capex of ~2600 cr in FY22

Link: archives.nseindia.com/corporate/GRAS…

24/n

24. Tata Power - Green Future

⚡️ESG & green energy is top focus (Slides 5-11); exited non-ESG biz such as Defense

⚡️Largest Solar EPC company; Good offtake in Solar EPC in FY21

⚡️Solar pumps: Big opportunity with GoI (Kusum)

⚡️Distribution 4x

Link: tatapower.com/pdf/investor-r…

25/n

⚡️ESG & green energy is top focus (Slides 5-11); exited non-ESG biz such as Defense

⚡️Largest Solar EPC company; Good offtake in Solar EPC in FY21

⚡️Solar pumps: Big opportunity with GoI (Kusum)

⚡️Distribution 4x

Link: tatapower.com/pdf/investor-r…

25/n

25. Polymed - Leading player in Medical devices 🌞

🔬Overview of industry and outlay under PLI scheme

🔬Vision 2025: Transform from devices maker to solution provider

🔬INR 400 cr QIP in 2021 from prominent investors - to aid capex plan

Link: archives.nseindia.com/corporate/POLY…

26/n

🔬Overview of industry and outlay under PLI scheme

🔬Vision 2025: Transform from devices maker to solution provider

🔬INR 400 cr QIP in 2021 from prominent investors - to aid capex plan

Link: archives.nseindia.com/corporate/POLY…

26/n

26. Newgen Software - Transitioning into a SAAS player

✍️Focus on low code/ no code automation

✍️Annuity (repeat) revenue now 57% of mix

✍️83% yoy growth in EBITDA (FY21 vs FY20)

✍️Q4 - Received patent for "Image Processing System"

Link: archives.nseindia.com/corporate/NEWG…

27/n

✍️Focus on low code/ no code automation

✍️Annuity (repeat) revenue now 57% of mix

✍️83% yoy growth in EBITDA (FY21 vs FY20)

✍️Q4 - Received patent for "Image Processing System"

Link: archives.nseindia.com/corporate/NEWG…

27/n

27. Polyplex - Leader in plastic packaging

📦#1 BOPET film producer in SEA

📦22% EBITDA margins in Q4 vs 26% for FY21

📦Export freight rate pressure to remain in 2021

📦High capacity utilization leading to expansion

📦Talks of promoter exit

Link: archives.nseindia.com/corporate/POLY…

28/n

📦#1 BOPET film producer in SEA

📦22% EBITDA margins in Q4 vs 26% for FY21

📦Export freight rate pressure to remain in 2021

📦High capacity utilization leading to expansion

📦Talks of promoter exit

Link: archives.nseindia.com/corporate/POLY…

28/n

28. Goldiam - Another Vaibhav Global?

💎Transitioning from Brick & mortar to e-com omni-channel = Working capital optimisation

💎Debt free; Cash of 310 Cr

💎Focus on Lab grown diamonds market (expected to be 10% of market by 2030 vs 3% now)

Link: archives.nseindia.com/corporate/GOLD…

29/n

💎Transitioning from Brick & mortar to e-com omni-channel = Working capital optimisation

💎Debt free; Cash of 310 Cr

💎Focus on Lab grown diamonds market (expected to be 10% of market by 2030 vs 3% now)

Link: archives.nseindia.com/corporate/GOLD…

29/n

29. Godavari Power & Ispat - FY21 best year ever

💡Bumper year - strong operating & financial metrics, cash flows & debt reduction

💡Green focus: Replacing thermal with 250 MW captive Solar PV power plant

💡Captive mining gives strategic edge

Link: archives.nseindia.com/corporate/GPIL…

30/n

💡Bumper year - strong operating & financial metrics, cash flows & debt reduction

💡Green focus: Replacing thermal with 250 MW captive Solar PV power plant

💡Captive mining gives strategic edge

Link: archives.nseindia.com/corporate/GPIL…

30/n

30. Burger King - Not healthy

🍔QSR industry to grow at 23% CAGR (FY21-25)

🍔Aggressive expansion plans (265 to 700 stores by 2026)

🍔Store economics not in place; restaurant EBITDA of -2.1%

🍔Weak SSSG across FY21 - negative in Q4 as well

Link: archives.nseindia.com/corporate/BURG…

31/n

🍔QSR industry to grow at 23% CAGR (FY21-25)

🍔Aggressive expansion plans (265 to 700 stores by 2026)

🍔Store economics not in place; restaurant EBITDA of -2.1%

🍔Weak SSSG across FY21 - negative in Q4 as well

Link: archives.nseindia.com/corporate/BURG…

31/n

31. J. Kumar Infraprojects

🏗️Slide on Mumbai metro line project depicts the state of Mumbai - underground construction has been slow, but elevated construction in works

🏗️Good traction in flyover work

🏗️Turned Net debt -ive in FY21; WC issues

Link: archives.nseindia.com/corporate/JKIL…

32/n

🏗️Slide on Mumbai metro line project depicts the state of Mumbai - underground construction has been slow, but elevated construction in works

🏗️Good traction in flyover work

🏗️Turned Net debt -ive in FY21; WC issues

Link: archives.nseindia.com/corporate/JKIL…

32/n

32. Precision Camshaft - Interesting

🚚Acquired MFT and EMOSS in 2018 - fully integrated now

🚚EMOSS (e-mobility) business - Loss making currently, but outlook is promising - integrated electric powertrains for trucks, buses, etc

Link:

archives.nseindia.com/corporate/PREC…

33/n

🚚Acquired MFT and EMOSS in 2018 - fully integrated now

🚚EMOSS (e-mobility) business - Loss making currently, but outlook is promising - integrated electric powertrains for trucks, buses, etc

Link:

archives.nseindia.com/corporate/PREC…

33/n

33. Solar Industries - Explosive

💣Significant increase in rate of explosives (25% yoy)

💣Increase in last 2 quarters has aided sales & margin expansion

💣Rate increase due to increasing share of EXPORTS in revenue mix (high margin)

Link:

archives.nseindia.com/corporate/SOLA…

34/n

💣Significant increase in rate of explosives (25% yoy)

💣Increase in last 2 quarters has aided sales & margin expansion

💣Rate increase due to increasing share of EXPORTS in revenue mix (high margin)

Link:

archives.nseindia.com/corporate/SOLA…

34/n

34. Jamna Auto - "Spring" effect in Q4

♨️4 point financial & op. strategy - 33% target; on path; expect ROE 🔼

♨️11 plants (3 new) at strategic locations close to CV OEMs; new plants for Tata M, Ashok, Force

♨️Strong Q4 with margin expansion

Link:

archives.nseindia.com/corporate/JAMN…

35/n

♨️4 point financial & op. strategy - 33% target; on path; expect ROE 🔼

♨️11 plants (3 new) at strategic locations close to CV OEMs; new plants for Tata M, Ashok, Force

♨️Strong Q4 with margin expansion

Link:

archives.nseindia.com/corporate/JAMN…

35/n

35. Marksans Pharma - Underrated

💊Good detailed presentation

💊Key therapy focus: Pain mgmt (growth driver), anti-diabetic, CVS (OTC & prescription)

💊Strong FY21 with consistent improvement

💊Focus on regulated markets (US, UK, Aus, etc)

Link:

archives.nseindia.com/corporate/MARK…

36/n

💊Good detailed presentation

💊Key therapy focus: Pain mgmt (growth driver), anti-diabetic, CVS (OTC & prescription)

💊Strong FY21 with consistent improvement

💊Focus on regulated markets (US, UK, Aus, etc)

Link:

archives.nseindia.com/corporate/MARK…

36/n

36. Affle -

📲 Mobile spend in India expected to grow 3x faster than global (32.4% vs 11.3%)

📲 Cash flow 35% CAGR amongst best in India Tech; 99% OCF/ PAT

📲 Strong user conversion (5.5/10.5 cr in FY19/ FY21); key revenue driver (+ive)

Link:

archives.nseindia.com/corporate/AFFL…

37/n

📲 Mobile spend in India expected to grow 3x faster than global (32.4% vs 11.3%)

📲 Cash flow 35% CAGR amongst best in India Tech; 99% OCF/ PAT

📲 Strong user conversion (5.5/10.5 cr in FY19/ FY21); key revenue driver (+ive)

Link:

archives.nseindia.com/corporate/AFFL…

37/n

37. Dilip Buildcon - B2G Infra play

🛣️Highest ever orderbook

🛣️Diversified in last 3 yrs - Roads (87-->52%); Irrigation & Mining (32%)

🛣️Improving WC (104 to 82 days in Q4); D/E🔽

🛣️Timely completion of projects

🛣️To divest HAM proj. (2000 cr)

Link:

archives.nseindia.com/corporate/DBL_…

38/n

🛣️Highest ever orderbook

🛣️Diversified in last 3 yrs - Roads (87-->52%); Irrigation & Mining (32%)

🛣️Improving WC (104 to 82 days in Q4); D/E🔽

🛣️Timely completion of projects

🛣️To divest HAM proj. (2000 cr)

Link:

archives.nseindia.com/corporate/DBL_…

38/n

38. Camlin Fine Sciences: Watch out

🧪Fwd integration of business model from food ingredients to high value food additives

🧪Dahej plant utilisation to🔼from 65% to 90% by Sep-21. Expected to🔼margins by 3-4%

🧪PL expects 70% PAT CAGR till FY23

Link

bseindia.com/xml-data/corpf…

39/n

🧪Fwd integration of business model from food ingredients to high value food additives

🧪Dahej plant utilisation to🔼from 65% to 90% by Sep-21. Expected to🔼margins by 3-4%

🧪PL expects 70% PAT CAGR till FY23

Link

bseindia.com/xml-data/corpf…

39/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh