$PLTR's newly launched Apollo for Edge AI just expanded their TAM & is going to be a huge.

The first thing @ssankar spoke about on the Q1 ER call was their delight on Apollo going Live.

After studying $NET & $FSLY, I've connected the dots.

Here are the reasons this is big news:

The first thing @ssankar spoke about on the Q1 ER call was their delight on Apollo going Live.

After studying $NET & $FSLY, I've connected the dots.

Here are the reasons this is big news:

1/ First, what is $PLTR Apollo?

This is the software that is the backbone for $PLTR's Gotham and Foundry software.

They launched Apollo a couple years ago to allow for scale, to deploy software update solutions faster & grow customers rapidly.

Read more ⬇️h/t @CapitalWiseman

This is the software that is the backbone for $PLTR's Gotham and Foundry software.

They launched Apollo a couple years ago to allow for scale, to deploy software update solutions faster & grow customers rapidly.

Read more ⬇️h/t @CapitalWiseman

2/ I'll let you read the actual words from the COO:

Page 1) Customers now have flexibility to train, manage & deploy multiple independent models to the Edge with ease which means faster times.

P 2) He gives examples of how they are seeing "huge interest from commercial clients.

Page 1) Customers now have flexibility to train, manage & deploy multiple independent models to the Edge with ease which means faster times.

P 2) He gives examples of how they are seeing "huge interest from commercial clients.

3/ Now $PLTR have built and launched their own Apollo for Edge AI on top of Apollo.

Note: This is a proprietary technology that $PLTR has been working on for a while and launched in April.

Read some use-cases below⬇️

Note: This is a proprietary technology that $PLTR has been working on for a while and launched in April.

Read some use-cases below⬇️

4/ Edge networks are powering many high-speed internet application industries that need intense computations with the rise of 5G. This is key for managing multiple IoT devices across countries. etc

As noted in my article, $PLTR is highly involved with these heavy industries....

As noted in my article, $PLTR is highly involved with these heavy industries....

5/

In this article, I talked extensively about how the rise of 5G, Edge Compute & IoT devices are going to drive the next generation of smart factories and how $PLTR is playing a dominant role..

Within the industrial demo section, I discussed this: seekingalpha.com/article/442062…

In this article, I talked extensively about how the rise of 5G, Edge Compute & IoT devices are going to drive the next generation of smart factories and how $PLTR is playing a dominant role..

Within the industrial demo section, I discussed this: seekingalpha.com/article/442062…

6/ $PLTR's vertical integration has just gotten stronger by developing their own edge AI platform. It means they likely will not need platforms like $NET & $FSLY to help them.

This further builds on how $PLTR enhances their moat across key spectrums of the Analytics landscape.

This further builds on how $PLTR enhances their moat across key spectrums of the Analytics landscape.

7/ Edge Networks TAM is roughly an $18-30B industry by 2025 growing at a CAGR of 34%.

Key factors driving this adoption are the rise of the adoption of IoT across multiple industries from High-tech to VR/AR.

Read Muji piece for more on edge networks: hhhypergrowth.com/what-are-edge-…

Key factors driving this adoption are the rise of the adoption of IoT across multiple industries from High-tech to VR/AR.

Read Muji piece for more on edge networks: hhhypergrowth.com/what-are-edge-…

8/ I've spent the past week studying $NET, $FSLY & Edge networks. These are the best platforms positioned to capture the opportunities on the Edge.

This is how I connected the dots.. I'm sure we'll learn about this in the coming months.

It'll be interesting to see it plays out.

This is how I connected the dots.. I'm sure we'll learn about this in the coming months.

It'll be interesting to see it plays out.

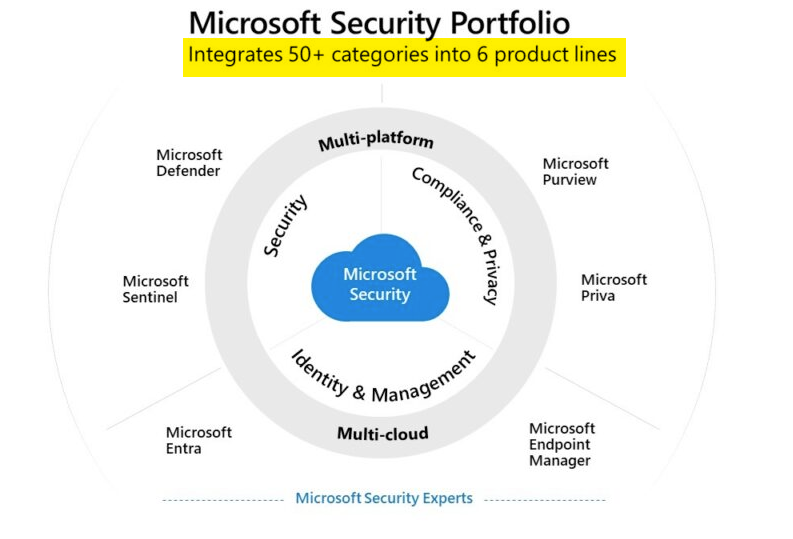

9/ $PLTR's Moat across the analytics landscape is essentially one integrated platform that has the following:

1) Data Visualization

2) Core Predictive analytics/AI

3) Data Integration & management piece

4) Elements for Edge Networks to power advanced AI

1) Data Visualization

2) Core Predictive analytics/AI

3) Data Integration & management piece

4) Elements for Edge Networks to power advanced AI

https://twitter.com/CapitalWiseman/status/1380969276073373699

10/ Bottom-line: $PLTR's Apollo for Edge AI

✅Means more $$

✅Expands their TAM

✅Increases stickiness

✅Expands offerings for clients

✅Clients can deploy rapid & advanced AI, saving costs

✅This therefore, increases their moat within the AI industry and landscape.

✅Means more $$

✅Expands their TAM

✅Increases stickiness

✅Expands offerings for clients

✅Clients can deploy rapid & advanced AI, saving costs

✅This therefore, increases their moat within the AI industry and landscape.

• • •

Missing some Tweet in this thread? You can try to

force a refresh