Revolution, Digital Gold, Ponzi, Scam..

“Bitcoin” – almost everyone has an opinion on it! Bitcoin, along with other coins in Crypto Land, have seen a steep correction in last few days.

Let's use this fall to simplify and de-jargonize the complicated world of Bitcoin.

Thread 🧵

“Bitcoin” – almost everyone has an opinion on it! Bitcoin, along with other coins in Crypto Land, have seen a steep correction in last few days.

Let's use this fall to simplify and de-jargonize the complicated world of Bitcoin.

Thread 🧵

𝐎𝐫𝐢𝐠𝐢𝐧𝐬: Bitcoin was born in chaos, in the aftermath of 2008 financial crisis – banks collapsing, counter parties abetting on contracts and declining trust in Central banks. It was designed as a peer to peer decentralized monetary system devoid of intermediaries.

1/n

1/n

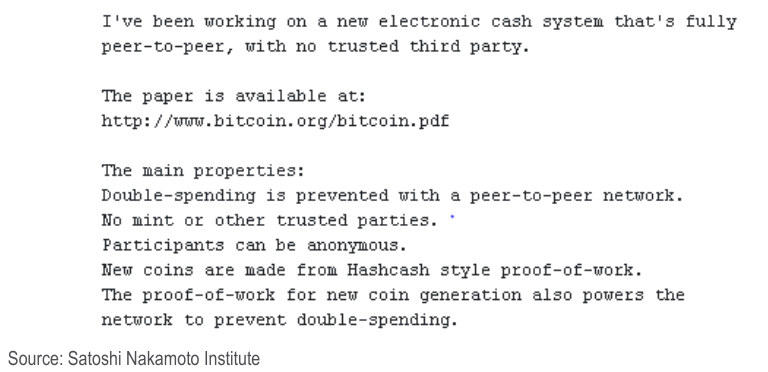

The domain Bitcoin.org was registered in Aug 2008 and the Bitcoin paper (bitcoin.org/bitcoin.pdf) was published on Oct 31, 2008. This started the journey of Cryptocurrency.

Bookmark this visual comic form explanation of the whitepaper: whitepaper.coinspice.io

2/n

Bookmark this visual comic form explanation of the whitepaper: whitepaper.coinspice.io

2/n

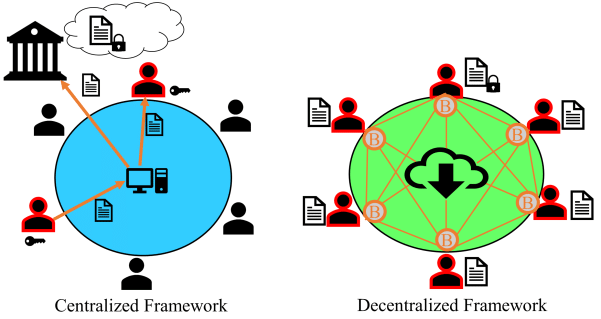

What is the debate on decentralization all about?

For both storing your money and for every transaction involving transfer of value, a financial intermediary or an administrator has been necessary before this. Such as Central Bank for Banking, SEC for securities, etc.

3/n

For both storing your money and for every transaction involving transfer of value, a financial intermediary or an administrator has been necessary before this. Such as Central Bank for Banking, SEC for securities, etc.

3/n

This was until a guy called Satoshi Nakamoto decided - No more middlemen!

That isn’t how Satoshi Nakamoto looks :)

Nobody knows how he looks. Nobody knows if such a person even exists. In words, no one knows who owns Bitcoin. This has been fodder for conspiracy theories.

4/n

That isn’t how Satoshi Nakamoto looks :)

Nobody knows how he looks. Nobody knows if such a person even exists. In words, no one knows who owns Bitcoin. This has been fodder for conspiracy theories.

4/n

But what is fairly certain is that the origin of Bitcoin (and Cryptocurrency) can be attributed to 𝐉𝐚𝐩𝐚𝐧, purely by looking at the history of crypto volumes. Also the pseudonym adds up here. The Japanese were the first to start mining and using Bitcoin on the Darknet.

5/n

5/n

Cut to today - a lot of water has flown under bridge.

Before today's carnage, the total market capitalization of Crypto stood at ~$ 2 Trillion, with Bitcoin contributing c. half of it, although its weight in overall Crypto has been declining.

Check: coinmarketcap.com

6/n

Before today's carnage, the total market capitalization of Crypto stood at ~$ 2 Trillion, with Bitcoin contributing c. half of it, although its weight in overall Crypto has been declining.

Check: coinmarketcap.com

6/n

Bitcoin is too big to ignore now.

As Dalio puts it - "Bitcoin is one hell of an invention. To have invented a new type of money via a system programmed into a computer & being able to scale like that in 10 years!"

This chart via JPM shows the ascent of BTC. Fascinating.

7/n

As Dalio puts it - "Bitcoin is one hell of an invention. To have invented a new type of money via a system programmed into a computer & being able to scale like that in 10 years!"

This chart via JPM shows the ascent of BTC. Fascinating.

7/n

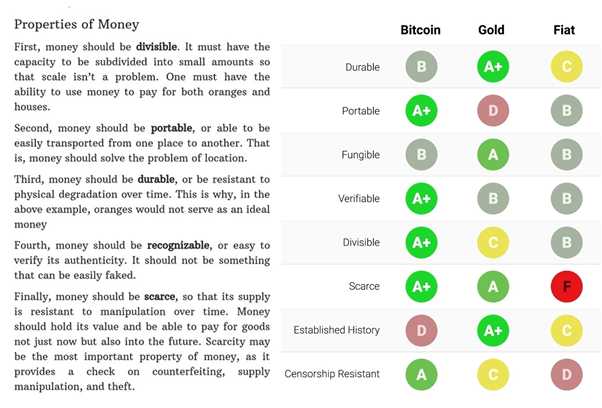

To understand the success of Bitcoin, we first need to understand what is money?

As per traditional finance, money has 3 purposes. It serves as:

✍️A medium of exchange

✍️A store of value

✍️A unit of account

The utility of BTC & Cryptos has been debated on all 2 parameters.

8/n

As per traditional finance, money has 3 purposes. It serves as:

✍️A medium of exchange

✍️A store of value

✍️A unit of account

The utility of BTC & Cryptos has been debated on all 2 parameters.

8/n

9/n

While the many critics of Bitcoin have challenged the idea that it can never serve as money, experts now agree on on it's utility as a store of value. The current debate is around medium of exchange due to the volatility.

To its many critics, Bitcoin has always asked back:

While the many critics of Bitcoin have challenged the idea that it can never serve as money, experts now agree on on it's utility as a store of value. The current debate is around medium of exchange due to the volatility.

To its many critics, Bitcoin has always asked back:

10/n

Where are we today?

To quote Twitter: "Bitcoin is inevitable":

✅Increasing use cases, leading to DeFi

✅A strong cult (seen the laser eyes?)

✅Early institutional adoption (Mastercard, Visa, PayPal, Tesla, Blackrock etc)

✅Stronger payment ecosystem

But there is a catch:

Where are we today?

To quote Twitter: "Bitcoin is inevitable":

✅Increasing use cases, leading to DeFi

✅A strong cult (seen the laser eyes?)

✅Early institutional adoption (Mastercard, Visa, PayPal, Tesla, Blackrock etc)

✅Stronger payment ecosystem

But there is a catch:

11/n

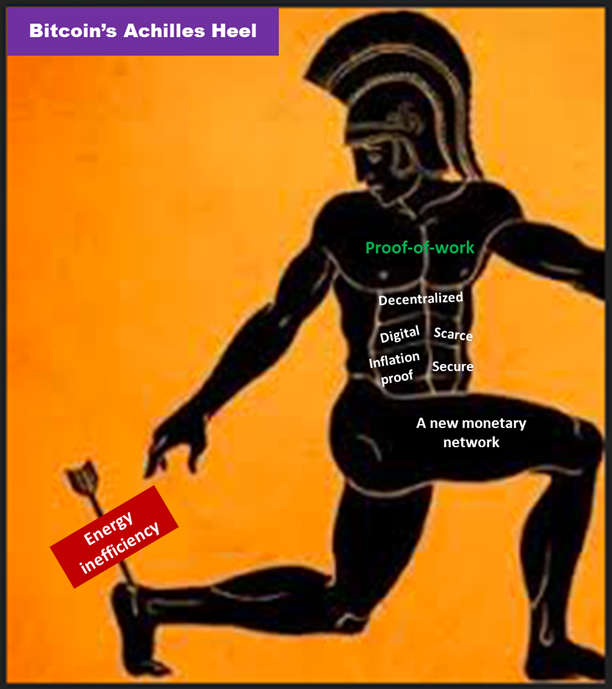

Of the many debated aspects, the one that is proving to be Bitcoin (and Crypto's) nemesis is energy inefficiency.

"Bitcoin consumes more electricity than Argentina". This headline caught the world's fancy in Feb '21 & it's been a topsy turvy terrain since, leading to this:

Of the many debated aspects, the one that is proving to be Bitcoin (and Crypto's) nemesis is energy inefficiency.

"Bitcoin consumes more electricity than Argentina". This headline caught the world's fancy in Feb '21 & it's been a topsy turvy terrain since, leading to this:

12/n

As we speak, BTC is down from its peak of ~$64,870 to $40,010 (recovered from intra day low of $30,202). But if one zooms out, it's still a phenomenal rally.

And this not the first correction.

It fell from its peak of $19K in Dec'17

to ~$10K in Feb '18, to ~$3K early 2019.

As we speak, BTC is down from its peak of ~$64,870 to $40,010 (recovered from intra day low of $30,202). But if one zooms out, it's still a phenomenal rally.

And this not the first correction.

It fell from its peak of $19K in Dec'17

to ~$10K in Feb '18, to ~$3K early 2019.

13/n

Let's discuss some lesser talked aspects:

A. Increased retail participation:

Rapid growth in new a/c openings on crypto exchanges. Chart shows unique crypto wallet accounts on blockchain.com. Sharp upticks during FOMO rallies in end 17, mid-2019 & since Nov '20.

Let's discuss some lesser talked aspects:

A. Increased retail participation:

Rapid growth in new a/c openings on crypto exchanges. Chart shows unique crypto wallet accounts on blockchain.com. Sharp upticks during FOMO rallies in end 17, mid-2019 & since Nov '20.

14/n

B. Increase in balances held in accounts between 1,000 and 10,000 BTCs, likely to be institutionally driven.

Interestingly, balances held in accounts with more

than 10,000 BTCs have declined significantly,

suggesting potential cashing out by early investors and miners.

B. Increase in balances held in accounts between 1,000 and 10,000 BTCs, likely to be institutionally driven.

Interestingly, balances held in accounts with more

than 10,000 BTCs have declined significantly,

suggesting potential cashing out by early investors and miners.

15/n

C. Debate on volatility:

Despite the raging debate, data shows that Bitcoin's volatility has not trended lower over the

past several years. Tt remains about 4 times more volatile than Equities or Gold.

This has been a big impediment in its utility as a medium of exchange.

C. Debate on volatility:

Despite the raging debate, data shows that Bitcoin's volatility has not trended lower over the

past several years. Tt remains about 4 times more volatile than Equities or Gold.

This has been a big impediment in its utility as a medium of exchange.

16/n

D. Constraints on liquidity

Lack of legal tender status will constrain

cryptocurrency liquidity compared to traditional portfolio hedges such as Commodities (Gold), Currency, Bonds or real estate.

D. Constraints on liquidity

Lack of legal tender status will constrain

cryptocurrency liquidity compared to traditional portfolio hedges such as Commodities (Gold), Currency, Bonds or real estate.

17/n

JPM observes that a "large majority of this liquidity provision comes from high frequency-style traders who often end up fleeing when volatility picks up."

This explains the steep swings (such as now) and are tail risks that should be understood by more crypto enthusiasts.

JPM observes that a "large majority of this liquidity provision comes from high frequency-style traders who often end up fleeing when volatility picks up."

This explains the steep swings (such as now) and are tail risks that should be understood by more crypto enthusiasts.

18/n

E. Regulatory risks:

Citi in a report "BITCOIN - At the Tipping Point" opines:

"Despite most ardent wishes, it might prove almost impossible for a government to shut access to BTC or prevent its ownership or usage w/out effectively causing shutdown of the global Internet."

E. Regulatory risks:

Citi in a report "BITCOIN - At the Tipping Point" opines:

"Despite most ardent wishes, it might prove almost impossible for a government to shut access to BTC or prevent its ownership or usage w/out effectively causing shutdown of the global Internet."

19/n

F. Way forward:

There are increasing cues that the way forward would be a middle path between a centralized monetary network and a decentralized network such as Bitcoin - something what experts are calling "Stablecoins". Or Central bank backed digital currencies.

F. Way forward:

There are increasing cues that the way forward would be a middle path between a centralized monetary network and a decentralized network such as Bitcoin - something what experts are calling "Stablecoins". Or Central bank backed digital currencies.

20/20

Conclusion: It is difficult to have one particular conclusion of a globally debated topic such as Bitcoin and Cryptocurrency, but we close with these articulate and poetic closure by Citi in their note.

Let us know questions or thoughts and we would love to discuss.

/End

Conclusion: It is difficult to have one particular conclusion of a globally debated topic such as Bitcoin and Cryptocurrency, but we close with these articulate and poetic closure by Citi in their note.

Let us know questions or thoughts and we would love to discuss.

/End

If you liked this, please subscribe on multipie.co to get our reads and updates in your inbox. No spam assured :)

@threadreaderapp: Unroll please.

@threadreaderapp: Unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh