Well. Crypto's crashed quite a bit in the past few days, leading up to a GIANT crash (BTC touched sub-$30k!) a few hours ago. It's ticked back up somewhat since, and started bouncing around a bit. What happened?

A thread about lemons and lemonade.

A thread about lemons and lemonade.

The narrative in the winter was clear: institutions were getting into crypto and that's why crypto rallied so much. This mostly happened in BTC, but the other coins mostly had a beta to BTC so they all rallied some, too.

Simple enough.

Simple enough.

More recently, the rumors turned to ETH. Now, institutions were getting into ETH, too! And some other coins, but at least for the past couple weeks, the ETH rally was The Big Thing happening (ignoring DOGE). Look at that ETH/BTC over-performance! BTC dominance was at a local min.

Many alts reached all-time highs -- some for these more fundamental reasons, and some from Elon-related hysteria.

Which coins are rallying isn't all that matters, though, and understanding reasons for the buying isn't enough, either. We need to go deeper.

Which coins are rallying isn't all that matters, though, and understanding reasons for the buying isn't enough, either. We need to go deeper.

I saw a TON of speculation that the rallies (especially the ETH rallies) were low-leverage and spot-driven, and therefore "more organic" somehow. An important implication of that is that, in the event of a downturn, there'd be relatively few liquidations.

This narrative was super wrong, though -- and it was possible to know that. How? Well, this narrative has basically been true zero times in the past 3ish years -- you can tell from the fact that all the volume is in derivatives or spot where the exchange allows leverage.

More specifically, though, this rally looked identical to all the others I've discussed on here. Open interest (on Binance, but also on all the other platforms) was shooting up basically the entire time, premia were high for those products, etc. Tale as old as time.

BTC perp funding was consistently between low + and really quite high + as new contracts got opened -- looking just at Binance (the most important for liquidations), you can see this was literally never untrue during the past 3 months (BTC > $40k the whole time).

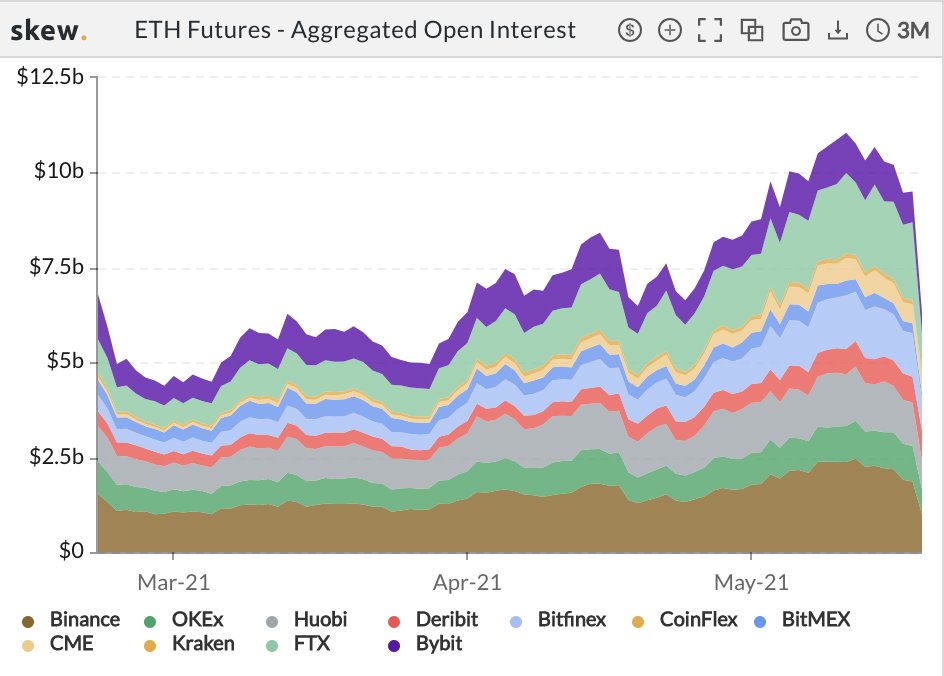

That people thought ETH in particular was just all institutions buying on Coinbase or something was particularly baffling to me. Look at these GIANT OIs/premia as ETH skyrocketed to its ATH! This was all on leverage, just waiting for a day like today to come along ...

And come along it did. I won't repeat myself here -- when there's a big 1-directional move with lots of aggro positions getting opened and then there's a small reversion, liquidations create momentum and make it a BIG reversion. See: Thanksgiving 2020.

https://twitter.com/AlamedaTrabucco/status/1332036791151390720?s=20

Whatever caused the initial market-wide crash -- probably a lot of Elon with some China and other vague regulatory news thrown in, or maybe it's a "natural correction" -- it happened, and liquidations did a lot of work to make the downturn more intense.

https://twitter.com/SBF_Alameda/status/1395008187435143173?s=20

This started happening *before* BTC hit $40k. When it managed to dip below $40k -- a level it's not seen since February, meaning a LOT of new buyers have gotten long since -- there were a LOT of long positions which had their first chance to get liquidated. And, well ...

If you were paying attention to the last times moves like this have happened, this was a PERFECT chance to get mega-short into the recent lows. ETH was even more extreme -- less time since this level, but a TON of new open interest, much of which got rekt in a trademark cascade.

Another thing we've seen time and again -- when these natural moves get exacerbated by liquidations, the fundamental thing to understand is: NO ONE wanted to sell them as low as they got. That means, whenever the market can gather its collateral, the market *should* rebound.

The timescale for this trade tends to be pretty quick -- minutes to hours, depending on magnitude. It's one of the nicer trades because of how much *sense* it makes -- no one wanted to sell here ... so ... people will buy.

And so Alameda did just that -- we bought a LOT.

And so Alameda did just that -- we bought a LOT.

The actual probability/timescale of reversion is unclear -- maybe it's done, maybe this whole few days of crashing is partially inorganic. We've seen moves like this revert super predictably, though, when they're partially liquidation-driven -- and this all was, so we're LONG.

And there were non-delta trades that were amazing today, too! Markets got SUPER out of line as they tend to when they move a lot, and %s of arbs were possible -- if you had free capital. Which you might have, if you were considering opportunity cost ;)

https://twitter.com/AlamedaTrabucco/status/1391988315100893184?s=20

Now, that's not exactly to say it was correct to have lots of capital sitting around -- lots of profitable yield farms, spreads, normal types of trades, etc., and who *actually* knows the probability of a day like today a priori.

Empirically, though, I think it's been frequent enough to justify at least having *some* easily-accessed capital laying around. You could easily make multiples on $ you had if you, e.g., knew when to buy the bottom -- disregarding lower risk %s-wide spreads.

Even something like selling into this Bitfinex bid wall and simultaneously buying elsewhere was AWESOME. These walls tend to be super price-insensitive, so as the other markets move, an awesome spread develops as this person doesn't move their bid.

https://twitter.com/paoloardoino/status/1394977425717661697?s=20

There were TONS of trades like this all across the market -- if you knew were to look and had the money to do them, today was more important than any in the past 3 months, easily.

So, even though many of you were probably long and lost a lot to positions today (Alameda too!), there were still lots of great trades to make. These days are rough and can be tough to swallow as they're happening -- but buckling down during them is necessary to make the most $.

The most bitter lemons can make the best lemonade -- you just need a good recipe (I think this is just sugar, which makes sense). Make sure you're ready for next time if you weren't this time!

Because lemme tell you: lemonade is good.

Because lemme tell you: lemonade is good.

• • •

Missing some Tweet in this thread? You can try to

force a refresh