In 1956 Warren Buffett retired at the age of 26 with a net worth of $175k (~$1.7m today).

Why did Buffet retire so early and how did he return to become the greatest investor of all time?

Time for a story👇

Why did Buffet retire so early and how did he return to become the greatest investor of all time?

Time for a story👇

Warren was born on August 30 1930, almost a year into the Great Depression, during which the market lost more than 90% of its value.

It took until 1954 for the Dow to return to its pre-crash levels.

It took until 1954 for the Dow to return to its pre-crash levels.

In 1931 his father Howard loses his stockbroker job because the bank fails.

So, what does he do? He sets up his own brokerage firm.. in the middle of the Great Depression 😅

By advising clients on hyper-conservative investments like municipal bonds, it actually ends up working.

So, what does he do? He sets up his own brokerage firm.. in the middle of the Great Depression 😅

By advising clients on hyper-conservative investments like municipal bonds, it actually ends up working.

With an affinity for numbers, it's unsurprising that Warren also had a knack for business as a kid.

To make money, he would buy things like soda in bulk, and then go around the neighborhood to sell each item at a higher price.

Always spotting new opportunities to make profits.

To make money, he would buy things like soda in bulk, and then go around the neighborhood to sell each item at a higher price.

Always spotting new opportunities to make profits.

When he’s 10 years old, Howard takes him to NYC, where Warren meets the legendary Sidney Weinberg who was the head of Goldman Sachs at the time.

Warren is blown away by the people on Wall Street and the extravagance he sees at the New York Stock Exchange.

Warren is blown away by the people on Wall Street and the extravagance he sees at the New York Stock Exchange.

That trip leaves a lasting impression on Warren, who decides that he’s going to be a millionaire by the age of 35.

For reference, $1M back then is ~$19M today.. As Warren describes it,

For reference, $1M back then is ~$19M today.. As Warren describes it,

When he’s 10 years old, he learns something else that would drive his life:

compounding.

The way he figures it out?

Paid weighing machines. He thinks about how once he buys one, the income from the machine makes it easier to buy one more, then 2, then 4, then 8... 📈

compounding.

The way he figures it out?

Paid weighing machines. He thinks about how once he buys one, the income from the machine makes it easier to buy one more, then 2, then 4, then 8... 📈

At age 11, he convinces his sister Doris to pool all their money and buy 6 shares of Cities Service for $38 each.

It quickly drops to $27. Doris freaks out and Warren feels horrible.

So when the stock returns to $40, Warren just unloads. After, the stock quickly surpasses $200!

It quickly drops to $27. Doris freaks out and Warren feels horrible.

So when the stock returns to $40, Warren just unloads. After, the stock quickly surpasses $200!

He learns 3 lessons from this.

i) don’t fixate on the price you paid.

ii) don’t rush to grab a small profit. Stay focused on the big, long-term wins.

iii) you can’t control other people’s emotions. If you manage someone's money, don't let their emotions guide your decisions.

i) don’t fixate on the price you paid.

ii) don’t rush to grab a small profit. Stay focused on the big, long-term wins.

iii) you can’t control other people’s emotions. If you manage someone's money, don't let their emotions guide your decisions.

The irony is he would violate rules 1 and 2 many times until his 40s.

Warren might have sold at $40 anyway but it surely played a role that his sister was breathing down his neck to sell.

This would later cause him to keep his stock picks quiet, even to his investors.

Warren might have sold at $40 anyway but it surely played a role that his sister was breathing down his neck to sell.

This would later cause him to keep his stock picks quiet, even to his investors.

Shortly after the NYC trip, Pearl Harbor happens and the US enters World War II. This moves Howard to run for Congress and he ends up winning the seat.

Subsequently, the Buffett family moves to DC.

Warren, though, hates it. He wants nothing to do with Washington.

Subsequently, the Buffett family moves to DC.

Warren, though, hates it. He wants nothing to do with Washington.

He loves Omaha and decides to go back to live with his grandpa Ernest.

But Ernest sends out Warren to stock the shelves with extremely low pay.

He goes as far as withholding a penny or two each day to show Warren what it's like to pay different levels of taxes.

But Ernest sends out Warren to stock the shelves with extremely low pay.

He goes as far as withholding a penny or two each day to show Warren what it's like to pay different levels of taxes.

Now this is a crazy coincidence 😲 ... there was somebody else who worked the same job for Ernest a few years earlier.

His name?

Charlie Munger.

But Warren and Charlie would never meet until their thirties... in 1959.

His name?

Charlie Munger.

But Warren and Charlie would never meet until their thirties... in 1959.

Warren has enough of his grandpa's treatment, so he returns to his family in DC where he looks for new ways to make money.

He starts delivering papers for The Washington Post, which is quite the foreshadowing as he would later become a a member of its board.

He starts delivering papers for The Washington Post, which is quite the foreshadowing as he would later become a a member of its board.

In high school, he hated his teachers, and he knew that they all had theirs pensions invested in AT&T stock.

Instead of pulling a typical prank, Warren shorts AT&T, brings the slips to school, and puts them on his teachers' desks just to show them he's betting against them.

Instead of pulling a typical prank, Warren shorts AT&T, brings the slips to school, and puts them on his teachers' desks just to show them he's betting against them.

He’s still buying stocks but he really wants to be an industrialist.

So, he buys a tenant farm in Nebraska for $1200. He’s still just 15 🤯

The deal: the tenant farms the land and the profits get split 50/50 between the tenant & Warren.

It’s his first cash flow business.

So, he buys a tenant farm in Nebraska for $1200. He’s still just 15 🤯

The deal: the tenant farms the land and the profits get split 50/50 between the tenant & Warren.

It’s his first cash flow business.

During those years, he also starts putting pinball machines in barbershops, which make him a ton of money.

He eventually exits that business for $1k (~$14k today).

Why?

Back in those days, if you got too big in the pinball biz, you started contending with the mafia 😳

He eventually exits that business for $1k (~$14k today).

Why?

Back in those days, if you got too big in the pinball biz, you started contending with the mafia 😳

With all his different businesses, he’s earning $175/mo in high school, which is more than what his teachers make, and almost as much as the average US salary.

And he’s not spending any of it.

By the time he graduates, he's amassed over $5000, which would be ~$50k today💰

And he’s not spending any of it.

By the time he graduates, he's amassed over $5000, which would be ~$50k today💰

Graduating at the age of 16, Warren went on to study at Wharton.

After two years he transfers to the University of Nebraska to graduate one year early.

His side hustle during that time? Managing the country circulation of the Lincoln Journal, with 50 paperboys reporting to him.

After two years he transfers to the University of Nebraska to graduate one year early.

His side hustle during that time? Managing the country circulation of the Lincoln Journal, with 50 paperboys reporting to him.

After getting rejected from Harvard Business School, he sees in Columbia's catalog that there is a course taught by his heroes: Ben Graham and David Dodd.

He begs them to let him in, or as Warren describes the story...

He begs them to let him in, or as Warren describes the story...

The fall of 1950, Warren arrives in NYC.

At this point, he’s compounded his net worth up to $10,000 (over $100k today).

Rather than staying in the dorms at Columbia or renting an apartment, he rents a room at the YMCA for $1 a day to save money.

At this point, he’s compounded his net worth up to $10,000 (over $100k today).

Rather than staying in the dorms at Columbia or renting an apartment, he rents a room at the YMCA for $1 a day to save money.

Warren is truly blessed (or cursed?) with having a firm grasp of compounding.

Every time he looks at spending money, he would not see the sticker price for things but rather 8x or 10x of the future value of his money.

For Warren it's simply a scoreboard game.

Every time he looks at spending money, he would not see the sticker price for things but rather 8x or 10x of the future value of his money.

For Warren it's simply a scoreboard game.

He shows up at Columbia in the fall of 1950 and he really wants to impress Graham.

So, when he sees that Graham's firm owns 55% of this little company called the Government Employees Insurance Company, Warren jumps at the opportunity to find out more.

So, when he sees that Graham's firm owns 55% of this little company called the Government Employees Insurance Company, Warren jumps at the opportunity to find out more.

The company isn't mentioned anywhere in the Intelligent Investor even though the book is full of case studies of other companies.

To investigate why, Warren decides to give them a visit on a Saturday morning.

Does Government Employees Insurance Company sound familiar?

To investigate why, Warren decides to give them a visit on a Saturday morning.

Does Government Employees Insurance Company sound familiar?

It's GEICO 😲

That was how Warren's legendary relationship with the insurance firm first started.

To this day, it's the only ad on Berkshire's website.

It is the one use of the site other than a series of links to shareholder documents.

Now, back to the story.

That was how Warren's legendary relationship with the insurance firm first started.

To this day, it's the only ad on Berkshire's website.

It is the one use of the site other than a series of links to shareholder documents.

Now, back to the story.

He just shows up at the office, knocks on the door and sees if anyone's around to talk to him.

Eventually, their head of finance, Lorimer Davidson lets the kid into his office and gives him 10 minutes of his time.

In the end, they end up talking for 4 hours...

Eventually, their head of finance, Lorimer Davidson lets the kid into his office and gives him 10 minutes of his time.

In the end, they end up talking for 4 hours...

What's the story of GEICO?

The founders started offering auto insurance cheaper by selling it D2C without agents.

They targeted government employees because the assumption was that people in gov are more conservative, less likely to drive under the influence of alcohol etc.

The founders started offering auto insurance cheaper by selling it D2C without agents.

They targeted government employees because the assumption was that people in gov are more conservative, less likely to drive under the influence of alcohol etc.

Lorimer tells him about how insurance works and explains this magical idea of float: premiums that customers pay.

Since GEICO only pays out claims later (if at all), Lorimer uses the float to make investments in the meantime.

What does Warren do with this newfound knowledge?

Since GEICO only pays out claims later (if at all), Lorimer uses the float to make investments in the meantime.

What does Warren do with this newfound knowledge?

The next Monday, Warren immediately liquidates 75% of his portfolio and puts all of it in GEICO.

He thinks he's going to show up at Graham's seminar, tell him about it and they'll become besties.

He thinks he's going to show up at Graham's seminar, tell him about it and they'll become besties.

But Graham is not that impressed and lectures him on portfolio diversity.

Hence, tragically Warren succumbs to Graham's exhortations and sells all of his GEICO stock.

He makes over a 50% IRR on it, which is great.

If he just held on though, he would have made so much more.

Hence, tragically Warren succumbs to Graham's exhortations and sells all of his GEICO stock.

He makes over a 50% IRR on it, which is great.

If he just held on though, he would have made so much more.

Graham's investing approach came to be known as cigar butt investing.

The analogy is that some small companies are like discarded cigar butts that you pick up for free have and get one final puff out of them.

He looked for companies that were “worth more dead than alive.”

The analogy is that some small companies are like discarded cigar butts that you pick up for free have and get one final puff out of them.

He looked for companies that were “worth more dead than alive.”

After getting rejected for a role at Graham's firm, Warren starts working for his dad's brokerage firm.

And he just hates it.

He's getting paid on commission, selling stocks.

It's about the most anti-Warren-Buffett thing you could imagine.

And he just hates it.

He's getting paid on commission, selling stocks.

It's about the most anti-Warren-Buffett thing you could imagine.

Two good things come out of this interlude in Omaha.

i) he meets Susie Thompson, his soon-to-be wife.

ii) he persuades his dad to set up the first of the Warren Buffett Partnerships with him, called Buffett & Buffett. It's his first taste of being a principal.

i) he meets Susie Thompson, his soon-to-be wife.

ii) he persuades his dad to set up the first of the Warren Buffett Partnerships with him, called Buffett & Buffett. It's his first taste of being a principal.

Despite the rejection from Graham-Newman, Warren continues to write letters to Ben and Jerry, constantly talking about his ideas, talking about stocks he’s looking at.

He frequently travels to New York just to go see them and drop in.

He frequently travels to New York just to go see them and drop in.

After two years of this, Jerry finally convinces Ben that they have to hire this kid. He's special.

Ben relents. He calls up Warren. He's like, all right, you really want to work here? Fine, we can make it happen.

They don't need to ask Warren twice, he accepts on the spot.

Ben relents. He calls up Warren. He's like, all right, you really want to work here? Fine, we can make it happen.

They don't need to ask Warren twice, he accepts on the spot.

Unsurprisingly, he crushes it.

And within two years, Ben and Jerry are consulting him on everything.

Warren's coming up with most of the investing ideas.

They offer to make Warren a general partner at the firm and let him take over. But Warren shocks them. He tells them no.

And within two years, Ben and Jerry are consulting him on everything.

Warren's coming up with most of the investing ideas.

They offer to make Warren a general partner at the firm and let him take over. But Warren shocks them. He tells them no.

He tells them if he's going to run a firm, he's going to run his own firm.

He's just here in NYC to work with them. He actually likes it more back home.

So, they end up winding down the firm.

Warren, Susie and their daughter move back to Omaha in 1956. This time for good.

He's just here in NYC to work with them. He actually likes it more back home.

So, they end up winding down the firm.

Warren, Susie and their daughter move back to Omaha in 1956. This time for good.

The average annual salary in the US at that time is $4800.

Warren's net worth, which has grown to $175k ($1.7m today), is 36x that.

And he's just 26...

The plan: retire early with his family, set a budget of $12k/yr, buy a house in Omaha and let the rest compound ✌️

Warren's net worth, which has grown to $175k ($1.7m today), is 36x that.

And he's just 26...

The plan: retire early with his family, set a budget of $12k/yr, buy a house in Omaha and let the rest compound ✌️

Well, the story could end here and nobody would know who Warren Buffett is.

But despite his retirement, when he's hanging out with family and friends, all he could talk about is money.

Eventually, some of these people are like, well, you want to manage my money?

But despite his retirement, when he's hanging out with family and friends, all he could talk about is money.

Eventually, some of these people are like, well, you want to manage my money?

So, Warren sets up partnerships with family & friends to manage their money alongside his own.

There's a 4% annual return hurdle and no management fee. He gets 50% carry for any returns above 4%. He also personally covers 25% of losses.

He has both risk and reward on the line!

There's a 4% annual return hurdle and no management fee. He gets 50% carry for any returns above 4%. He also personally covers 25% of losses.

He has both risk and reward on the line!

One family he gets introduced to is the Davis family in Omaha who want to invest $100k because Warren reminds them of a really bright, young man who grew up next door to them... Charlie Munger is his name.

That was in 1956. It would be another 3 years until they actually meet.

That was in 1956. It would be another 3 years until they actually meet.

In year 1, the Dow drops -8.5% and Buffett makes +10.5%🔥

With $1m, he now has enough capital to do things that Graham-Newman used to do.

They would amass big positions in cigar butts, get them to liquidate assets and distribute the cash to shareholders.. the OG Bobby Axelrod.

With $1m, he now has enough capital to do things that Graham-Newman used to do.

They would amass big positions in cigar butts, get them to liquidate assets and distribute the cash to shareholders.. the OG Bobby Axelrod.

The first company he does this to is Sanborn Map. He gets control of the company, forces it to split itself in two, and makes a 50% profit on the spin off.

By the end of 1960, total AUM are up to $2 million, and Warren's share is worth a cool $250,000 or 13% of the partnership.

By the end of 1960, total AUM are up to $2 million, and Warren's share is worth a cool $250,000 or 13% of the partnership.

Warren's performance during the next 3 years? +41%, +26% and +23%.

If you compound over the first 4 years, the results are an astounding 141% compared to the Dow's 43% (!!).

More money flows in but he's also as cautious as ever.

If you compound over the first 4 years, the results are an astounding 141% compared to the Dow's 43% (!!).

More money flows in but he's also as cautious as ever.

At this point in 1962, he finally gets an office, hires a couple of people and consolidates all these vehicles into the Buffett Partnership Limited.

With >$7M in AUM, he's now bigger than Graham-Newman ever was.

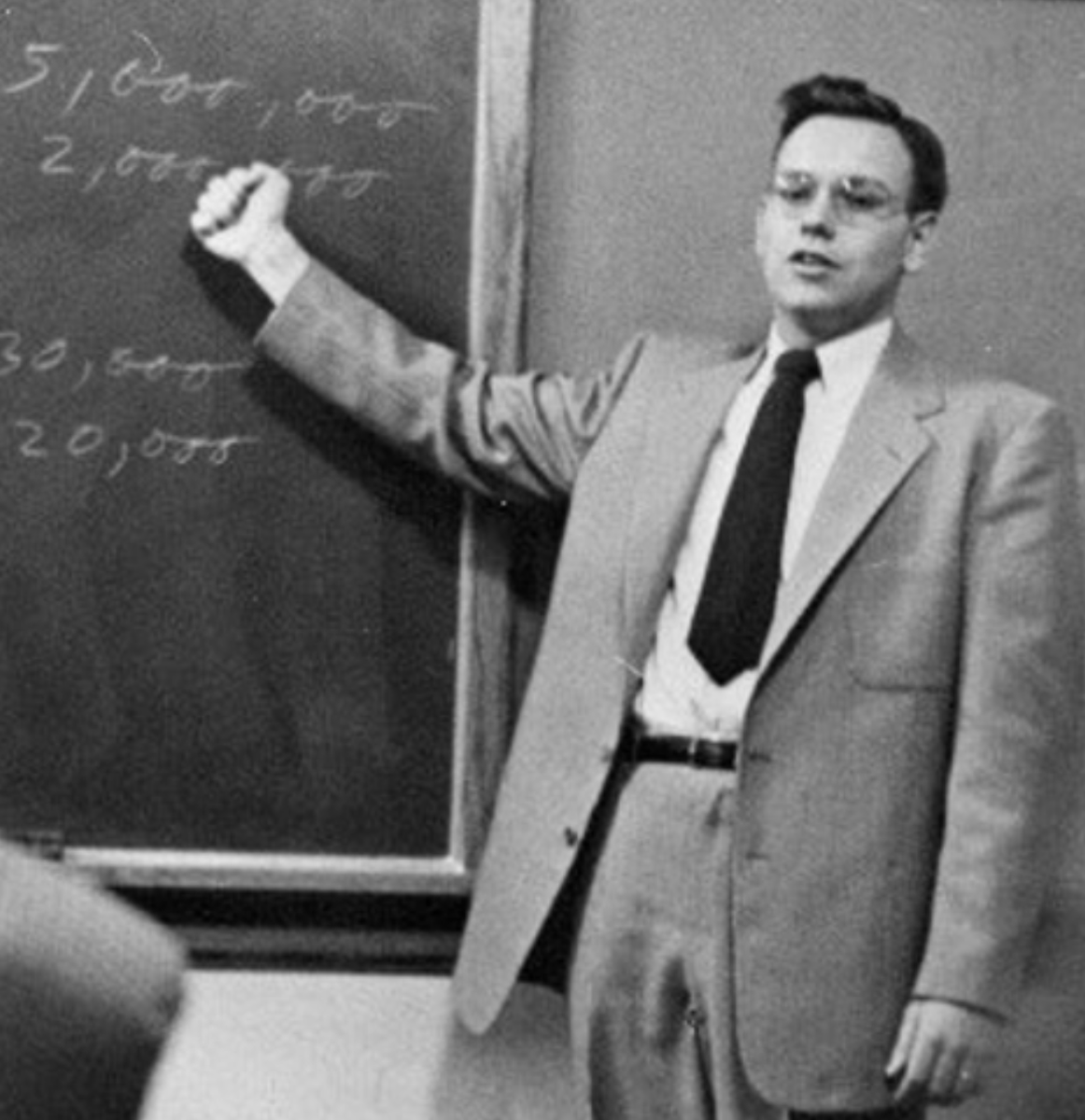

His 1st public footage is also from 1962:

With >$7M in AUM, he's now bigger than Graham-Newman ever was.

His 1st public footage is also from 1962:

Halfway through 1962, Warren achieves his dream four years early.

At the age of 31, his net worth crosses the million dollar mark 🥂

The next year, Buffett makes the 2nd great investment and 2nd great mistake of his career, the first having been GEICO.

At the age of 31, his net worth crosses the million dollar mark 🥂

The next year, Buffett makes the 2nd great investment and 2nd great mistake of his career, the first having been GEICO.

In 1963 AmEx is the most trusted financial company in the US. It has a small subsidiary that issues warehouse receipts:

AmEx inspects warehouses and issues papers that says "there are X tons of soybean here, which you could then collateralize, borrow against and trade against"

AmEx inspects warehouses and issues papers that says "there are X tons of soybean here, which you could then collateralize, borrow against and trade against"

It's a great business, until a shady commodities trader fills his tanks with seawater instead of soybean oil, defrauds the inspectors and essentially runs a Ponzi scheme.

All in, it comes to over $150 million worth of fraud.

The scandal rocks AmEx’s stock on Wall Street.

All in, it comes to over $150 million worth of fraud.

The scandal rocks AmEx’s stock on Wall Street.

The share price drops by over 50%.

Analysts think the company's not going to survive. Buffett though sees an opportunity.

He and his new employees go around Omaha and a bunch of other places. They start asking consumers if they've heard of the soybean oil scandal?

Analysts think the company's not going to survive. Buffett though sees an opportunity.

He and his new employees go around Omaha and a bunch of other places. They start asking consumers if they've heard of the soybean oil scandal?

Surprisingly, most consumers have no idea what the soybean oil scandal is and plan to keep using AmEx.

This is the first time Buffett recognizes the moat that comes from brand.

While brand doesn't show up on a balance sheet, it's still a huge asset.

This is the first time Buffett recognizes the moat that comes from brand.

While brand doesn't show up on a balance sheet, it's still a huge asset.

Buffett figures that AmEx can absorb the potential losses.

With $17 million in capital, Buffett puts $3 million into AmEx right away, a huge position.

Eventually, he puts in $13 million and owns 5% of the company.

With $17 million in capital, Buffett puts $3 million into AmEx right away, a huge position.

Eventually, he puts in $13 million and owns 5% of the company.

AmEx ends up settling the fraud case the next year for $60M. The stock goes through the roof and Warren makes 2.5x on the $13M invested.

The 2nd great investment of his career.

It's also the 2nd great investment mistake of his career: once he's up 2.5x, he sells it all.

The 2nd great investment of his career.

It's also the 2nd great investment mistake of his career: once he's up 2.5x, he sells it all.

That's it for now!

Next time we'll examine how Warren suddenly took over Berkshire Hathaway (yup, he's not the founder) and how he missed out on one of the best tech investments of all time... right under his nose.

Next time we'll examine how Warren suddenly took over Berkshire Hathaway (yup, he's not the founder) and how he missed out on one of the best tech investments of all time... right under his nose.

Thank you to @AWilkinson & @MineSafety for their help with our research and talking Berkshire with us over the years 🤝

This is a new format for us, so let us know what you thought!

If you enjoyed this, you might also like our podcast trilogy on BRK: acquired.fm/episodes/berks…

This is a new format for us, so let us know what you thought!

If you enjoyed this, you might also like our podcast trilogy on BRK: acquired.fm/episodes/berks…

• • •

Missing some Tweet in this thread? You can try to

force a refresh