SoFi & Galileo are building an impenetrable moat within Fintech.

After spending the past month studying Fintech trends and SoFi's recent Q1 results, here are my findings.

10 reasons why both companies are well positioned to capture a major share amongst giants like $SQ & $PYPL

After spending the past month studying Fintech trends and SoFi's recent Q1 results, here are my findings.

10 reasons why both companies are well positioned to capture a major share amongst giants like $SQ & $PYPL

1/Product & Market:

The Fintech Industry can be broken down into the following types of companies:

• Lending

• Payments & Transfers

• Pers. Finance

• Consumer Banking

• Insurtech

• Investing

• Blockchain

SoFi has product offerings positioned across most of the industry.

The Fintech Industry can be broken down into the following types of companies:

• Lending

• Payments & Transfers

• Pers. Finance

• Consumer Banking

• Insurtech

• Investing

• Blockchain

SoFi has product offerings positioned across most of the industry.

2/ All-In-One Platform:

Offers a comprehensive suite of products across Fintech with competitive rates:

• Lending: Loans for Home, Autos, Students

• Financial Services

• Credit Card

• Investing: Crypto & Equities

This all-In-one platform is a key advantage amongst peers.

Offers a comprehensive suite of products across Fintech with competitive rates:

• Lending: Loans for Home, Autos, Students

• Financial Services

• Credit Card

• Investing: Crypto & Equities

This all-In-one platform is a key advantage amongst peers.

3/Bank Charter:

A follow-up to #2, legitimacy of becoming a full bank increases the product stickiness. The GPG acquisition increases their odds.

+ They can lend at better rates;

+ Get lower cost of capital

+ Better interest margin on loans

#3 could really strengthen the moat.

A follow-up to #2, legitimacy of becoming a full bank increases the product stickiness. The GPG acquisition increases their odds.

+ They can lend at better rates;

+ Get lower cost of capital

+ Better interest margin on loans

#3 could really strengthen the moat.

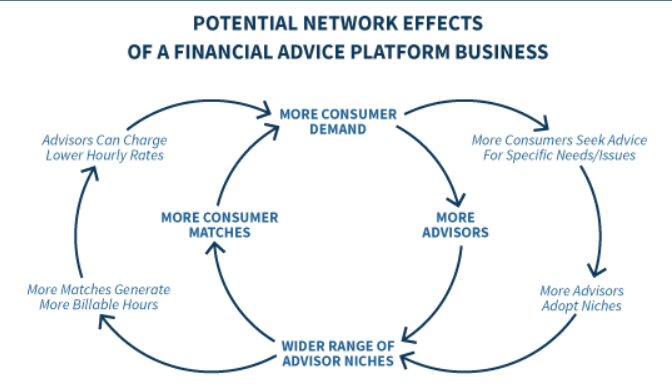

4/ Low CAC:LTV drives long-term value

Building on #2 & #3; Due to $IPOE product mix, they have the ability to cross-sell products at low unit economics which lowers their CAC for every new client.

The platform's product mix helps drive LTV.

Below are examples & Q1 growth:

Building on #2 & #3; Due to $IPOE product mix, they have the ability to cross-sell products at low unit economics which lowers their CAC for every new client.

The platform's product mix helps drive LTV.

Below are examples & Q1 growth:

5/ Galileo Infrastructure:

All the points above are for B2C, Let's talk B2B

Galileo is one of the leading enterprise banking infrastructure in the world.

It powers 90% of the leading neo-banks & fintech companies in the US & UK.

Below are similar players (More on this later)

All the points above are for B2C, Let's talk B2B

Galileo is one of the leading enterprise banking infrastructure in the world.

It powers 90% of the leading neo-banks & fintech companies in the US & UK.

Below are similar players (More on this later)

5i/.. Spent time understanding Galileo.

This platform provides the infrastructure that powers these emerging Fintech players in a sector called BaaS as its API significantly reduces costs and banking requirements.

They power 70M+ Accounts and growing rapidly at +130% YoY in Q1

This platform provides the infrastructure that powers these emerging Fintech players in a sector called BaaS as its API significantly reduces costs and banking requirements.

They power 70M+ Accounts and growing rapidly at +130% YoY in Q1

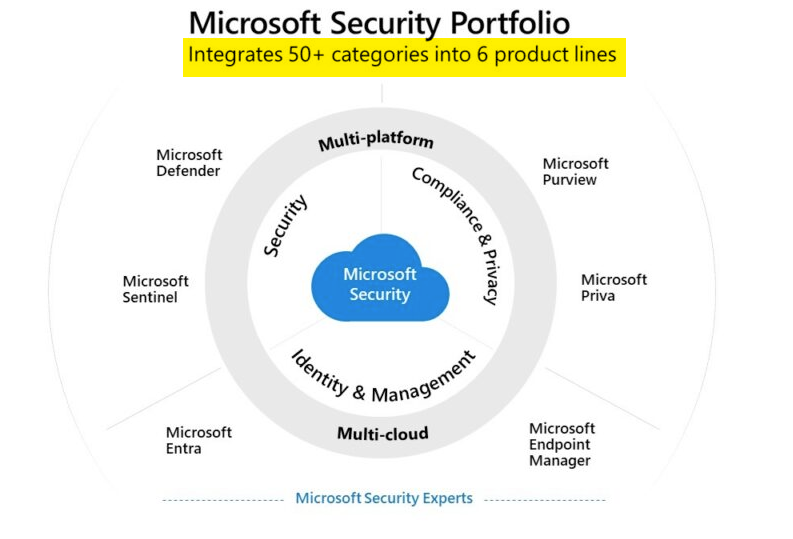

6/ Data Network Effects

The inherent value of adding a new user across SoFi and Galileo's platforms in their B2B & B2C areas further increases the data loop.

And as AI & Data Analytics builds momentum in banking, this data moat gets stronger.

This effect can drive point #7.

The inherent value of adding a new user across SoFi and Galileo's platforms in their B2B & B2C areas further increases the data loop.

And as AI & Data Analytics builds momentum in banking, this data moat gets stronger.

This effect can drive point #7.

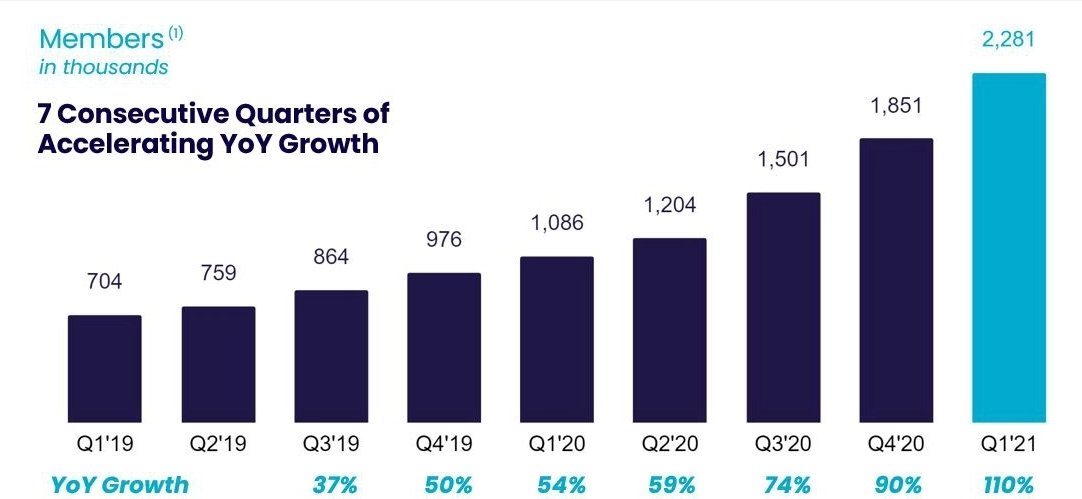

7/ Brand Recognition:

Strengthened by the stadium deal & Social media WOM.

As many people know, SoFi is really popular among millennials & students.

If millennial wealth is the future, there is a good chance the brand continues grow with them.

See the rapid growth as at Q1:

Strengthened by the stadium deal & Social media WOM.

As many people know, SoFi is really popular among millennials & students.

If millennial wealth is the future, there is a good chance the brand continues grow with them.

See the rapid growth as at Q1:

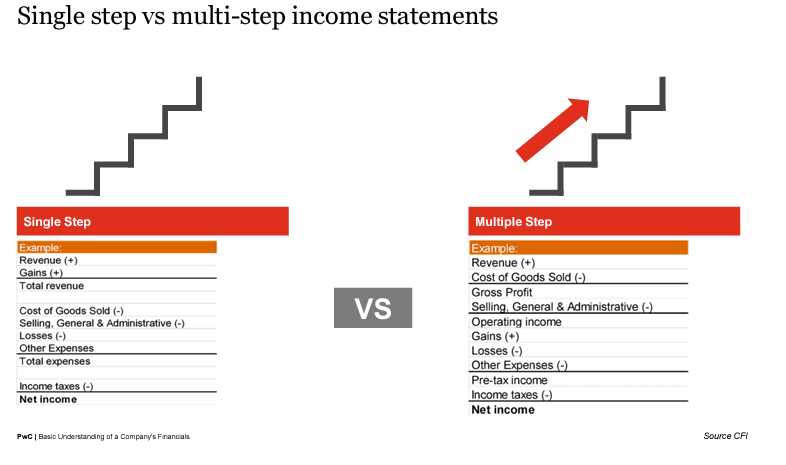

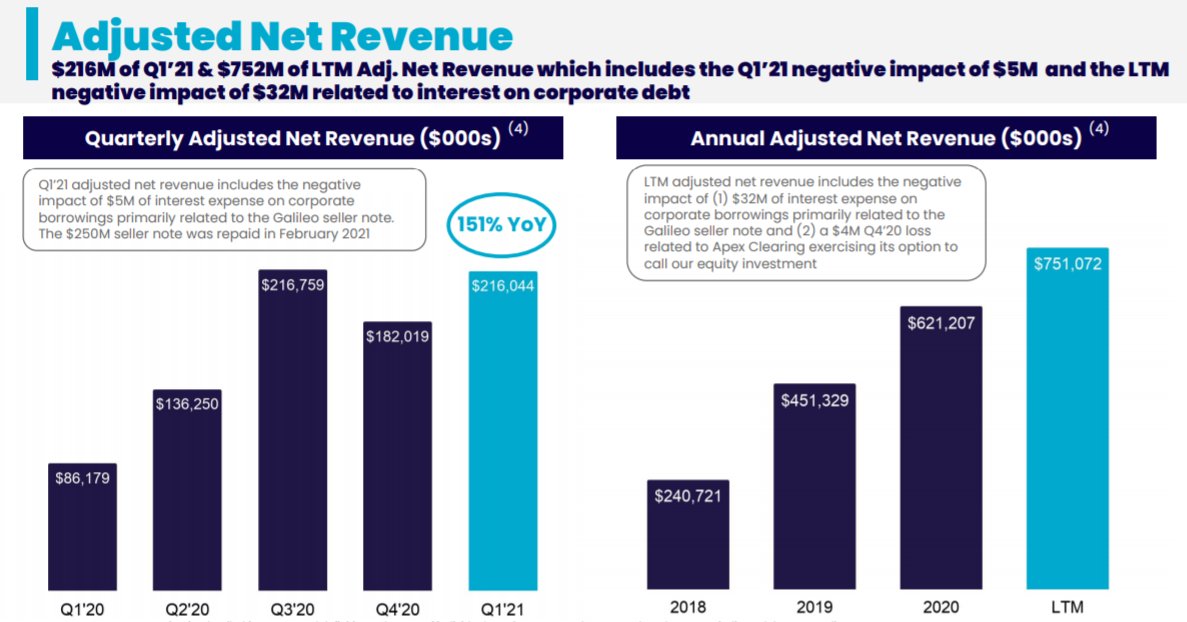

8/ Financials:

The financials and rapid revenue growth of $IPOE supports the entire thesis.

@kingtutspacs has a great summary here:

They've consistently recorded accelerating top-line (14% beat) despite a bump in 2020 and some revenue losses incurred.

The financials and rapid revenue growth of $IPOE supports the entire thesis.

@kingtutspacs has a great summary here:

https://twitter.com/kingtutspacs/status/1395338089606885381

They've consistently recorded accelerating top-line (14% beat) despite a bump in 2020 and some revenue losses incurred.

8ii/ Financials - Bottom-line:

+ Financial services Revs grew 212%

+ FY 2021 Revenue expected to grow 58% YoY to $980M

+ Valuation @ $15B is reasonable relative to growth

+ EBITDA Margins are low but keeps improving

+ Contribution margins of 27%

+ Profitability keeps improving

+ Financial services Revs grew 212%

+ FY 2021 Revenue expected to grow 58% YoY to $980M

+ Valuation @ $15B is reasonable relative to growth

+ EBITDA Margins are low but keeps improving

+ Contribution margins of 27%

+ Profitability keeps improving

9/ Management Team:

I listened to a podcast of @anthonynoto's story. He has one of the most unique CEO stories I know on Wall Street. First, His credentials:

+ CFO @ Twitter

+ CFO @ NFL

+ Co-head TMT @ Goldman + Awarded No. 1 ranked Internet analyst for 4-years

+ Wharton MBA

I listened to a podcast of @anthonynoto's story. He has one of the most unique CEO stories I know on Wall Street. First, His credentials:

+ CFO @ Twitter

+ CFO @ NFL

+ Co-head TMT @ Goldman + Awarded No. 1 ranked Internet analyst for 4-years

+ Wharton MBA

9ii/ Untold Stories:

+ Raised by a single mom,lived on food stamps and grew up tough

+ Trained at West Point & Ranger Academy

+ US Army Telecommunications officer & Captain

His values: Leadership; Work hard & treat others right

Listen and get motivated:

open.spotify.com/episode/53ZqZw…

+ Raised by a single mom,lived on food stamps and grew up tough

+ Trained at West Point & Ranger Academy

+ US Army Telecommunications officer & Captain

His values: Leadership; Work hard & treat others right

Listen and get motivated:

open.spotify.com/episode/53ZqZw…

10/ Finally, It's clear Fintech's TAM is rapidly growing by 15% CAGR

$SoFi is positioned across the B2B and B2C sectors to capture a major share of this unpenetrated market and capitalize on legacy banks.

Most people know that Fintech represent the future. See some data below:

$SoFi is positioned across the B2B and B2C sectors to capture a major share of this unpenetrated market and capitalize on legacy banks.

Most people know that Fintech represent the future. See some data below:

a/ PS - Risks:

I'll balance my bull case to say the risk is the competitive landscape especially from $PYPL Venmo, $SQ CashApp and smaller players

The 10 advantages outlined still positions them as an integral player in a large TAM. Also, at $15B MC, there's likely more upside.

I'll balance my bull case to say the risk is the competitive landscape especially from $PYPL Venmo, $SQ CashApp and smaller players

The 10 advantages outlined still positions them as an integral player in a large TAM. Also, at $15B MC, there's likely more upside.

b/ To go deeper on most of the integral elements of SoFi and especially Galileo in detail, feel free to read this long-form article where I explore the intricacies:

i)Link: seekingalpha.com/article/442709…

ii) I also wrote more about the platform on my newsletter

investianalystnewsletter.substack.com/welcome

i)Link: seekingalpha.com/article/442709…

ii) I also wrote more about the platform on my newsletter

investianalystnewsletter.substack.com/welcome

i/ To Summarize: SoFi/ $IPOE Competitive Advantage:

1. Fintech ecosystem positioning

2. All-In-One Comprehensive Platform

3. Becoming a Full Chartered Bank

4. Low CAC: LTV business value

5. Galileo’s B2B infrastructure

6. Data Network Effects

7. Millennial Brand Recognition

1. Fintech ecosystem positioning

2. All-In-One Comprehensive Platform

3. Becoming a Full Chartered Bank

4. Low CAC: LTV business value

5. Galileo’s B2B infrastructure

6. Data Network Effects

7. Millennial Brand Recognition

ii/..

8. Financials – Top-line & bottom-line growth

9. Unique CEO & Mgmt Team

10.Large unpenetrated Fintech TAM

In my opinion, the unique intersection of SoFi x Galileo's B2C-B2B business model positions them well in the Fintech ecosystem.

Thanks for reading, @InvestiAnalyst

8. Financials – Top-line & bottom-line growth

9. Unique CEO & Mgmt Team

10.Large unpenetrated Fintech TAM

In my opinion, the unique intersection of SoFi x Galileo's B2C-B2B business model positions them well in the Fintech ecosystem.

Thanks for reading, @InvestiAnalyst

• • •

Missing some Tweet in this thread? You can try to

force a refresh