As businesses start to reopen and the country gets back to normal, over 1.3 million people came off furlough in March and April - showing our #PlanforJobs is working.

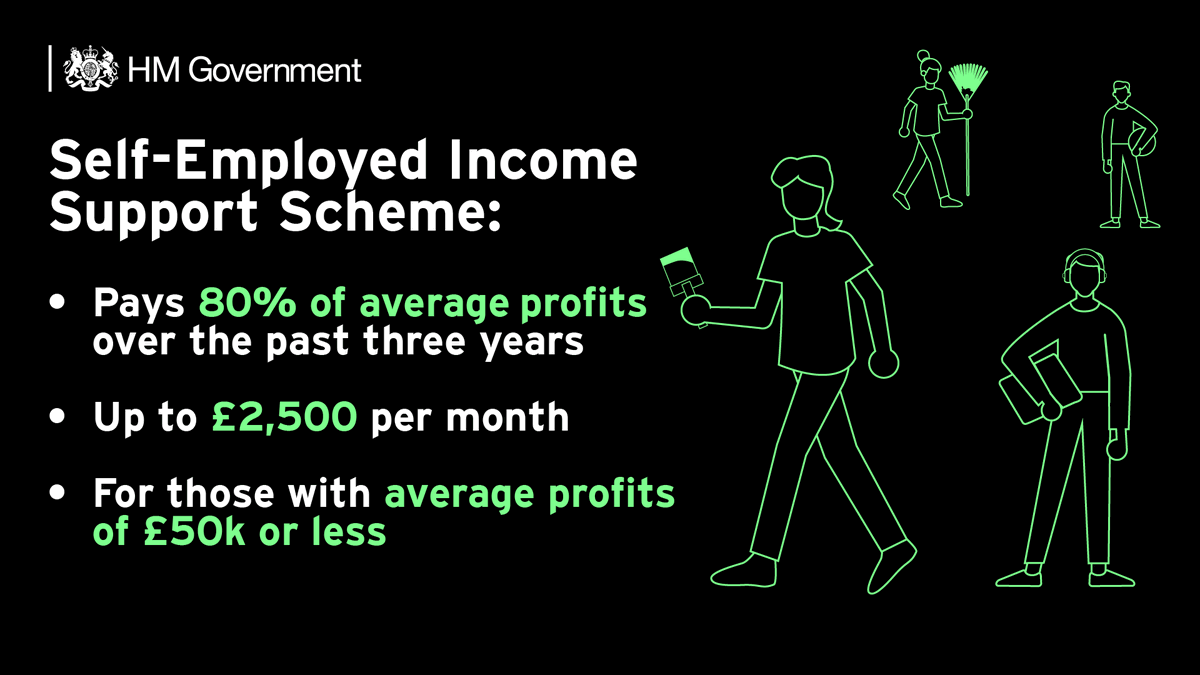

New data also shows that 2.8 million people benefitted from the Self-Employment Income Support Scheme - which has provided over £24 billion in support.

The retail and hospitality sectors saw the highest numbers of people come off furlough in April, with 234,500 retail workers and 181,600 hospitality staff taken off the scheme.

The number of people on furlough decreased across every age bracket in the month of April – and the largest reductions in take up rate were for the under 18s and 18-24 year olds.

The number of people on furlough fell in all four UK nations in April, with 714,700 people removed from furlough in England, 63,600 in Scotland, 31,500 in Wales and 12,200 in Northern Ireland.

• • •

Missing some Tweet in this thread? You can try to

force a refresh