Choosing between bitcoin and gold to protect your long-term purchasing power should be an unemotional decision, grounded in logic, with the interests of your future self in mind (a single-player game).

🟠>🟡

Thread.

🟠>🟡

Thread.

2/ Both gold and bitcoin cannot be artificially synthesized.

But bitcoin is more easily authenticated.

But bitcoin is more easily authenticated.

3/ The physical nature of gold comes with security, storage and insurance costs that scale linearly with value.

Compare this with securing a 256-bit number.

Compare this with securing a 256-bit number.

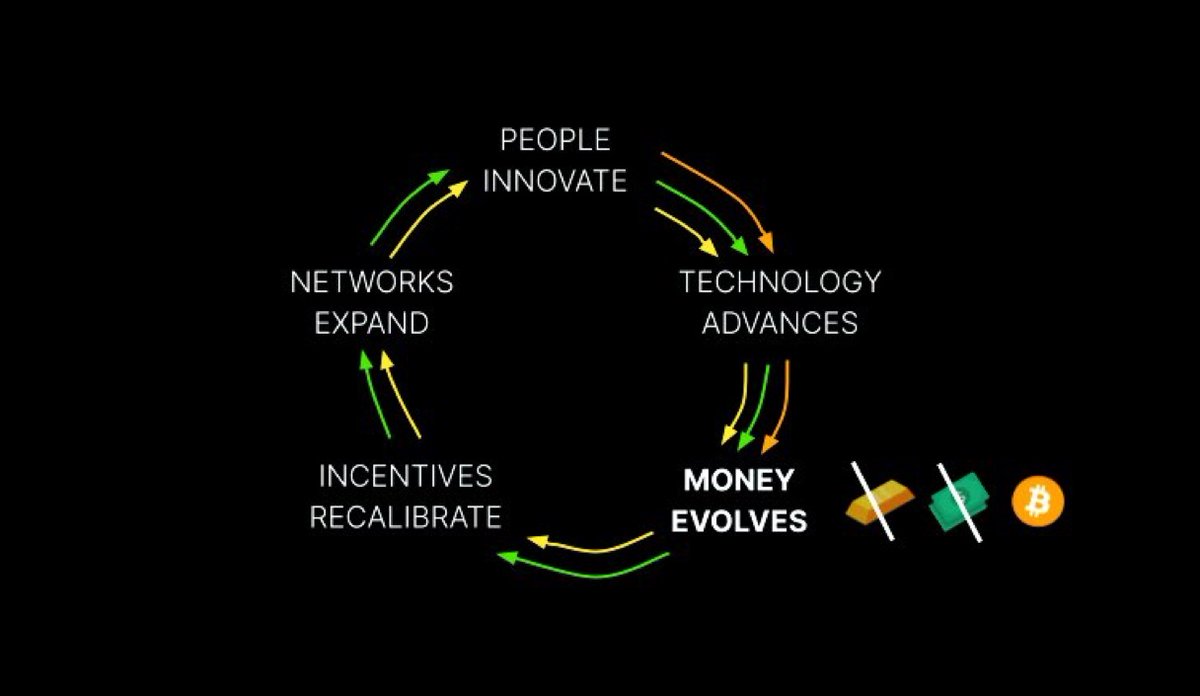

4/ It should also be noted that what we deem 'money' is not static.

Money is technology that changes over time.

Money is technology that changes over time.

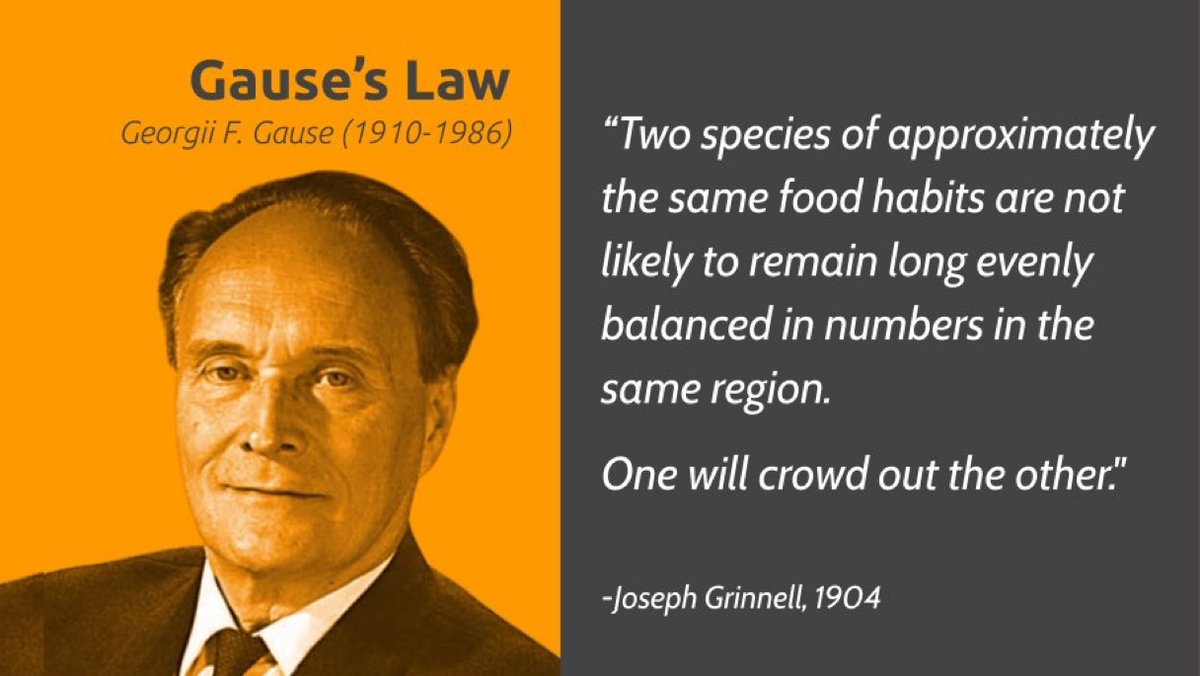

5/ Creative destruction is the process of entrepreneurs out-innovating incumbents, rendering them obsolete, under a free-market.

The dominant tech forces of today were once new entrants that dematerialized a previously physical good or service

The dominant tech forces of today were once new entrants that dematerialized a previously physical good or service

6/ Money is not immune from this process, it evolves over time as new forms offer stronger incentives.

7/ As store of value assets compete in the same environment, even a slight advantage will result in a disproportionate share of the spoils.

9/ Technology gets obsoleted, money gets demonetized. We've witnessed this throughout history.

Case Study:

India’s adoption of a silver standard from 1835-1893 while the trading partners upgraded to gold

Case Study:

India’s adoption of a silver standard from 1835-1893 while the trading partners upgraded to gold

10/ We now have over a decade of data from which to identify a trend and draw a conclusion.

You be judge, after all- it’s your purchasing power.

You be judge, after all- it’s your purchasing power.

• • •

Missing some Tweet in this thread? You can try to

force a refresh