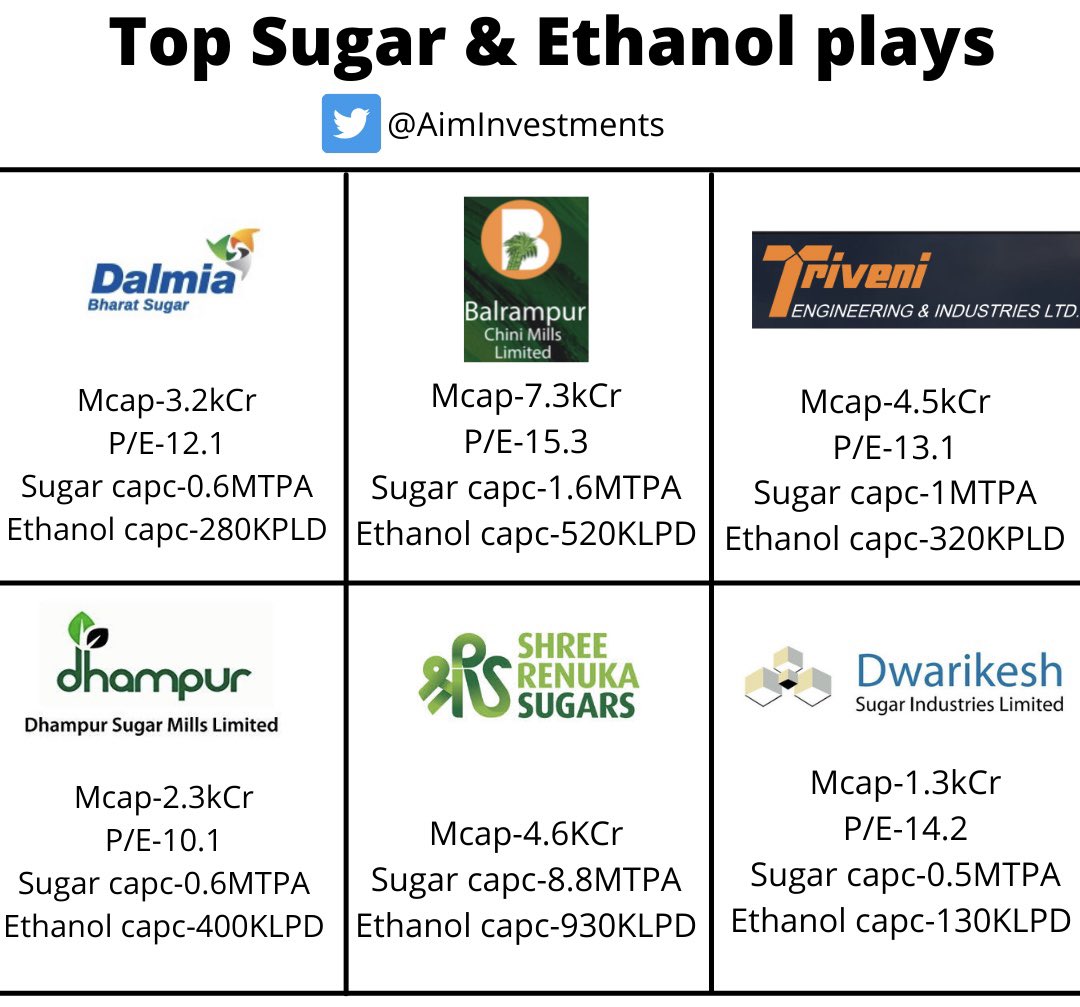

💎Top Sugar Plays💎

Current Capacity image & Expansion👇

Dalmia Sugar- 180 KLPD

Balrampur Chinni- 320 KLPD

Triveni Engineering- 200 KLPD

Dhampur Sugar- 100 KLPD

Sree Renuka Sugar- 320 KLPD

Dwarikesh Sugar-200 KLPD

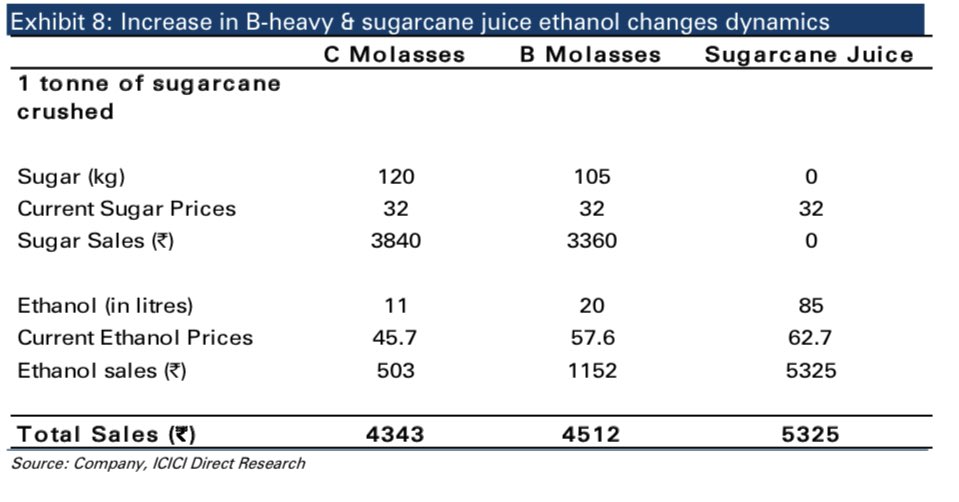

🧵on how Sugar -> Ethanol will change demand supply situation

Current Capacity image & Expansion👇

Dalmia Sugar- 180 KLPD

Balrampur Chinni- 320 KLPD

Triveni Engineering- 200 KLPD

Dhampur Sugar- 100 KLPD

Sree Renuka Sugar- 320 KLPD

Dwarikesh Sugar-200 KLPD

🧵on how Sugar -> Ethanol will change demand supply situation

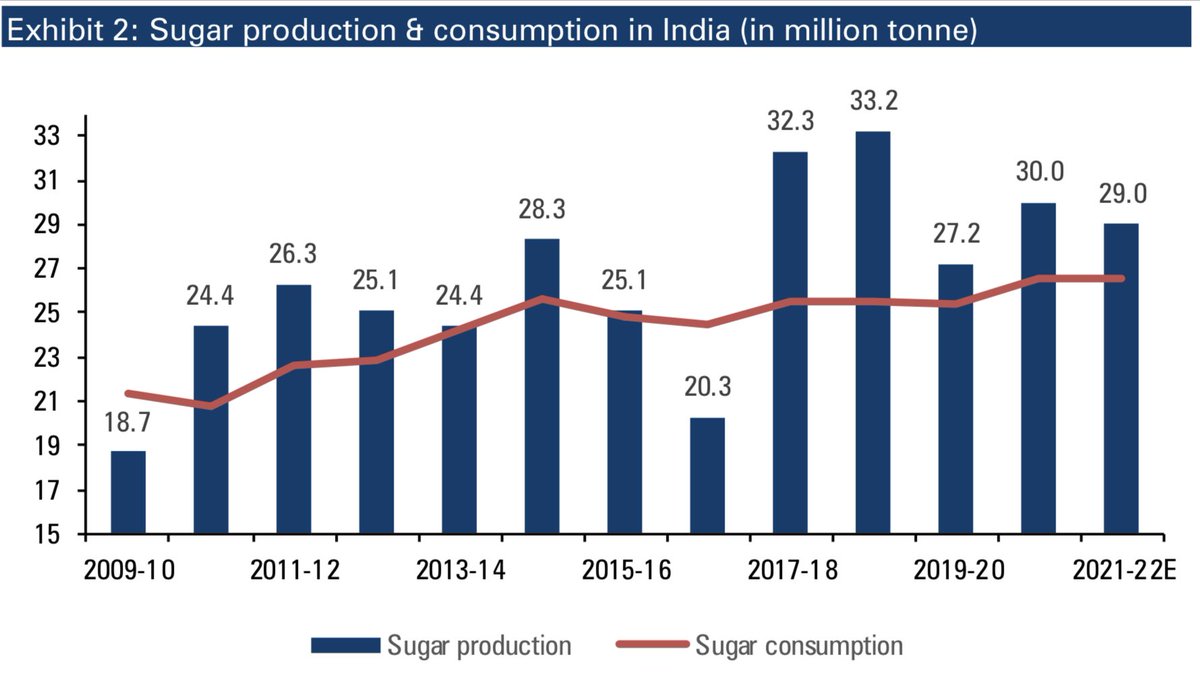

“The industry would be able to sacrifice 5-6 MT of Sugar for Ethanol production over next 2-3 years. This would help to reduce sugar production to level of sugar consumption, which would keep inventory at rational levels resulting in higher domestic sugar prices”

• • •

Missing some Tweet in this thread? You can try to

force a refresh