New >> People want someone to blame for today's dumpster fire of a housing market.

It feels terrible to be priced out of the market as a new homebuyer and BlackRock is a convenient scapegoat.

But the real culprits aren't on Wall Street. (Thread)

vox.com/22524829/wall-…

It feels terrible to be priced out of the market as a new homebuyer and BlackRock is a convenient scapegoat.

But the real culprits aren't on Wall Street. (Thread)

vox.com/22524829/wall-…

Institutional investors (like BlackRock) are an absolutely tiny part of the market.

They own around 300,000 single family units as of 2019. For context, there are 15 million one-unit detached single family home rentals and 80 million detached single family homes total.

They own around 300,000 single family units as of 2019. For context, there are 15 million one-unit detached single family home rentals and 80 million detached single family homes total.

Additionally, it's not even clear that they're gaining in market share over the last year. John Burns Real Estate Consulting put out research tracking the investor purchase percentage of total home sales and it has been declining.

CoreLogic says that small investors are actually what's been driving the increase in US homebuying rates, not institutional ones like private equity. (This is pre-Covid, we don't have thorough data yet for the last couple of years)

The John Burns research is what most articles (including that very popular WSJ article) are using to claim that institutional investors are a competing with normal homebuyers and driving up home prices.

But... the research doesn't really say that.

But... the research doesn't really say that.

First, the authors are clear that they do NOT believe we are in an investor-induced home price bubble today.

Importantly, they are tracking *all investors*, not just private equity. Essentially they look to see if the zip code on the property tax records matches the home's zip code to see if it's owner-occupied.

That includes not just PE but small landlords, house flippers, and iBuyers

That includes not just PE but small landlords, house flippers, and iBuyers

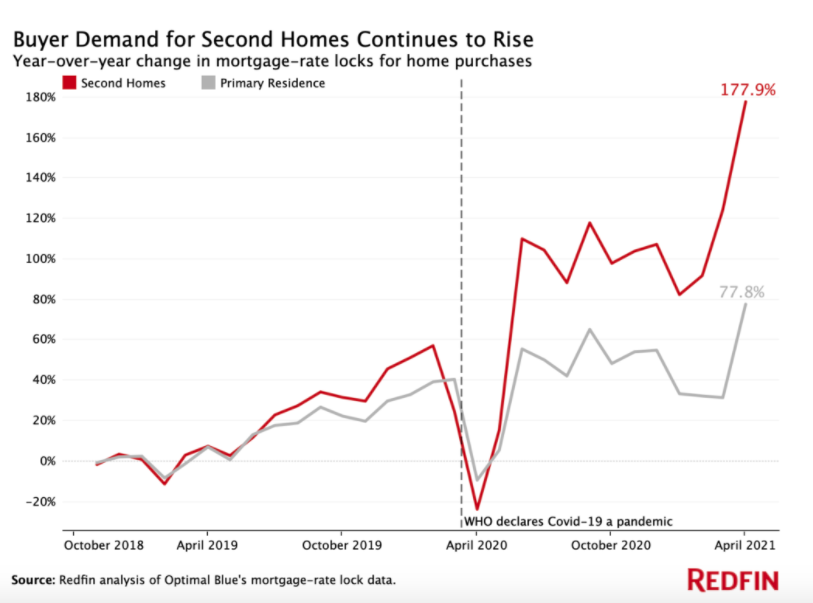

So it's hard to extrapolate from this data exactly who these people are. There is a lot of evidence that there are a ton of new second home buyers over the last year.

And many realtors have said they've observed all-cash purchases as being rich out-of-towners outbidding locals.

And many realtors have said they've observed all-cash purchases as being rich out-of-towners outbidding locals.

But we've also seen many reports that institutional investors are upping the ante. So it's certainly possible that they will increase their market share but they are still a *very* small part of the overall market.

Okay, but even if they're a small part of the market, couldn't they be outbidding regular Americans when they do try and buy homes?

Maybe, but there are reasons to be skeptical that they're directly competing with would-be normal homebuyers.

Maybe, but there are reasons to be skeptical that they're directly competing with would-be normal homebuyers.

Laurie Goodman (@MortgageLaurie) explains that institutional investors have a comparative advantage in buying homes that need tens of thousands of dollars in repairs. So they're usually competing with *other* investors like house flippers or iBuyers.

In a market this competitive it's certainly possible that some people are trying to buy homes that need $50,000 in repairs but... it's not really clear to me that it's a bad thing if they are prevented from doing so. That's a terrible investment for most people.

John Burns's research also points to specific submarkets where investor activity has been very hot. But single family rental lobbying group (@NRHCouncil) claims that they have incredibly small market shares even at the local level.

But! If we continue to block the development of new homes it's feasible that these types of investors will grow to be a larger part of the market. @_willparker_ has a great story on the built-to-rent market that is starting to bloom. wsj.com/articles/built…

There's a secondary question to all of this of whether it would be bad if institutional investors had a larger market share.

@francescamari had a great piece about the ways in which PE firms harm people and the inherent asymmetries of power and info. nytimes.com/2020/03/04/mag…

@francescamari had a great piece about the ways in which PE firms harm people and the inherent asymmetries of power and info. nytimes.com/2020/03/04/mag…

Some assume that small landlords are better and less exploitative.

While it's true they don't have the incentive to return $$ to their shareholders, they do often ignore tenant law/fair housing law. We need more research to know which is worse for tenants!

While it's true they don't have the incentive to return $$ to their shareholders, they do often ignore tenant law/fair housing law. We need more research to know which is worse for tenants!

But even if these large investors are competing directly with would-be homeowners, why should we preference homeowners over the renters that will be able to live in these homes?

There's a shortage of rental housing *AND* homes for sale!

There's a shortage of rental housing *AND* homes for sale!

The fundamental reason these large investors are gaining market share is because we have turned housing into a quickly appreciating asset. These companies are just searching for yield!

Build more homes! That gives tenants more power and it reduces the incentive for PE to invest!

Build more homes! That gives tenants more power and it reduces the incentive for PE to invest!

Blaming BlackRock is just temporary catharsis. The real culprits look much more innocuous, and they'll be much harder to root out.

NIMBY's and the local officials they elect have blocked new housing for decades. Today's market is the necessary result of those policy choices.

NIMBY's and the local officials they elect have blocked new housing for decades. Today's market is the necessary result of those policy choices.

Full piece here! vox.com/22524829/wall-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh