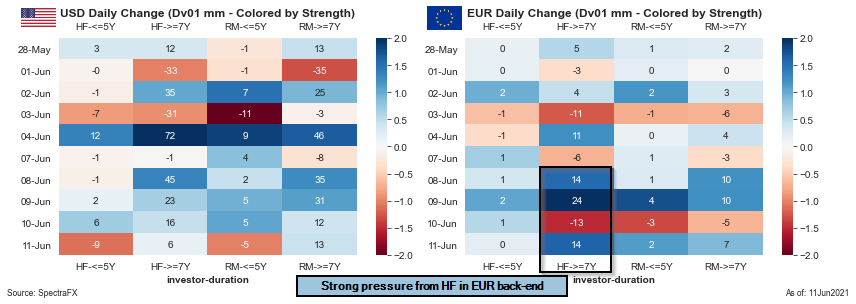

As rates continue to rally I'm starting to worry we might get some more pressure in EUR rates.

There's been decent unwind of shorts in USD and some decent reduction in EUR this week.

1/x

There's been decent unwind of shorts in USD and some decent reduction in EUR this week.

1/x

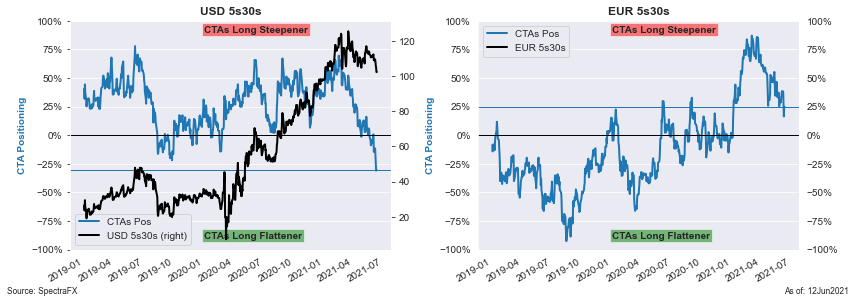

Trend Followers have had similar momentum with decent buying of govies (and selling of commodities).

2/x

2/x

What's even more striking at the moment is that they have now moved into USD 5s30s flatteners.

And they have reduced their EUR steepener extensively.

3/x

And they have reduced their EUR steepener extensively.

3/x

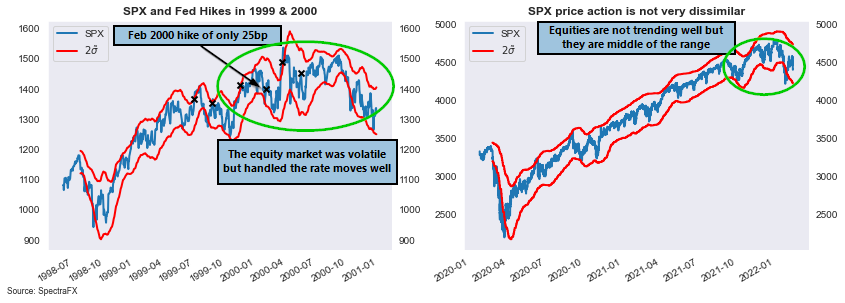

Also when I look at what was priced in vol at the March FOMC, we have just moved within the 25 delta cone. And as such a 25bp rally in EUR 30s over the next few months could be just as likely.

4/x

4/x

And the current vol surface has not moved really]. Vols are just lower, while the USD smirk has been removed and is now a nice smile.

5/x

5/x

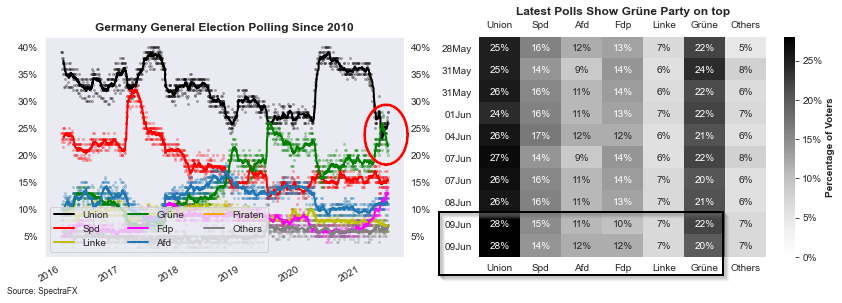

So as much as I was a proponent of seeing Schwarze Null for Bunds I'm starting to reconsider. Especially if the Fed is not threatened by inflation.

Now let's go enjoy the sun.

7/7

Now let's go enjoy the sun.

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh