AR20-21 Notes begins🗒️

First on the list is

BKT

Boring Business Steady Compounder

Fasten your seatbelt

Here we go!

Hit L&R if you find value.🙂🙏

First on the list is

BKT

Boring Business Steady Compounder

Fasten your seatbelt

Here we go!

Hit L&R if you find value.🙂🙏

2/

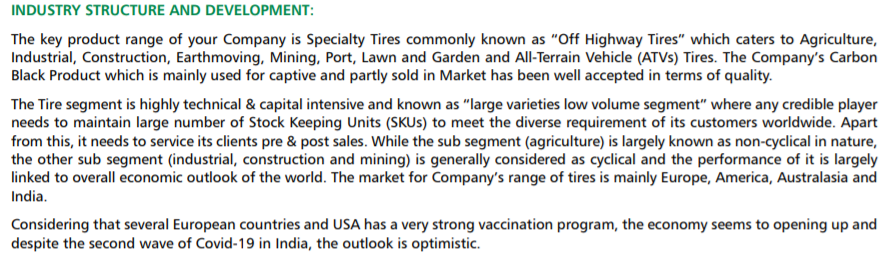

~Off-Highway Tires

~Large Variety Low Volume (BKT has 2700+SKUs)

~Requires pre & post-sales servicing

~Two subsegments Agricultural & Industrial

~Large Market in USA, Europe, Australasia & India

~Off-Highway Tires

~Large Variety Low Volume (BKT has 2700+SKUs)

~Requires pre & post-sales servicing

~Two subsegments Agricultural & Industrial

~Large Market in USA, Europe, Australasia & India

3/

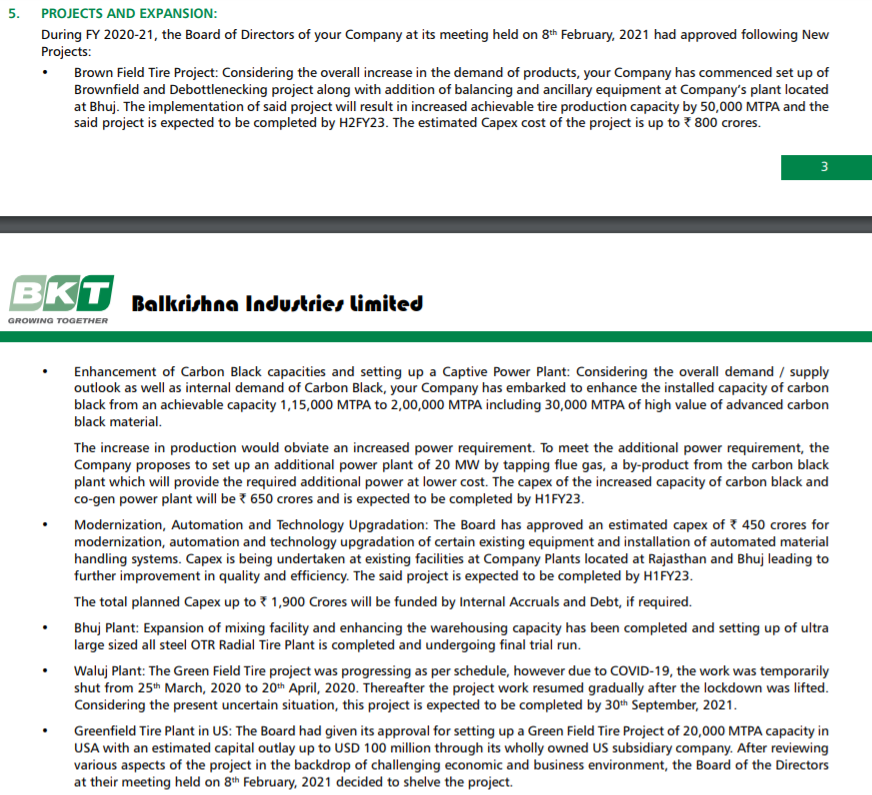

Projects/Expansion

~Brown Field: INR 800 Cr Capex, 50k MTPA

~Carbon Black: INR 650 Cr Capex, 1.15 lac-2lac MTPA

~Upgradation: INR 450 Cr

~ Capex done through Internal Accruals + Debt

Projects/Expansion

~Brown Field: INR 800 Cr Capex, 50k MTPA

~Carbon Black: INR 650 Cr Capex, 1.15 lac-2lac MTPA

~Upgradation: INR 450 Cr

~ Capex done through Internal Accruals + Debt

4/

~Capital Intensive

~Labour Intensive

~Low technological obsolescence risk

~Low demand fluctuation risk due to large replacement market

~Ultra Large Tires

~Capital Intensive

~Labour Intensive

~Low technological obsolescence risk

~Low demand fluctuation risk due to large replacement market

~Ultra Large Tires

5/

Risks

~Operational Risks

~Fluctuation in RM prices

~Market Risk

~Labour Relations

~Retention of Skilled Manpower

~Currency Fluctuation

Risks

~Operational Risks

~Fluctuation in RM prices

~Market Risk

~Labour Relations

~Retention of Skilled Manpower

~Currency Fluctuation

7/

~Last 10 concalls notes: bit.ly/3vnfQYn

~5 Min Stock Idea: bit.ly/2TZoT4t

~Stock Infographic: bit.ly/3cHIrAX

~ FY20 AR Notes: bit.ly/3ziJEs6

~Blog Post: bit.ly/3xiMZWd

~Detailed Analysis: bit.ly/3gu2WlP

L&R🙂🙏

~Last 10 concalls notes: bit.ly/3vnfQYn

~5 Min Stock Idea: bit.ly/2TZoT4t

~Stock Infographic: bit.ly/3cHIrAX

~ FY20 AR Notes: bit.ly/3ziJEs6

~Blog Post: bit.ly/3xiMZWd

~Detailed Analysis: bit.ly/3gu2WlP

L&R🙂🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh