We live in a multichain world.

Today there are 10 blockchains storing more than $10 billion in assets, as well as several ecosystems with meaningful development and activity.

THORChain is vying to sit at the center of this world as infrastructure for cross-chain finance.

1/

Today there are 10 blockchains storing more than $10 billion in assets, as well as several ecosystems with meaningful development and activity.

THORChain is vying to sit at the center of this world as infrastructure for cross-chain finance.

1/

For nearly a decade people have speculated about the potential for decentralized exchange between blockchains with some conceptualizing it as the “holy grail”.

Today it’s still largely an unsolved problem at scale.

Today it’s still largely an unsolved problem at scale.

THORChain is an attempt at fulfilling this vision.

It is a cross-chain liquidity protocol built using the Cosmos SDK that aims to provide a variety of cross-chain financial services including exchange, lending and borrowing, and synthetic assets.

messari.io/article/thorch…

It is a cross-chain liquidity protocol built using the Cosmos SDK that aims to provide a variety of cross-chain financial services including exchange, lending and borrowing, and synthetic assets.

messari.io/article/thorch…

At a high level THORChain is a network of nodes and liquidity providers.

It recently launched Mainnet in April with caps on liquidity pools.

The community progressively raises these caps as the network proves out its security and works through bugs. medium.com/electric-capit…

It recently launched Mainnet in April with caps on liquidity pools.

The community progressively raises these caps as the network proves out its security and works through bugs. medium.com/electric-capit…

THORChain currently supports 5 blockchains including:

- Bitcoin

- Ethereum

- Litecoin

- Bitcoin Cash

- Binance Chain

Traction though limited by its self-imposed caps has been promising, with liquidity pools quickly hitting their new limits each time they are raised.

- Bitcoin

- Ethereum

- Litecoin

- Bitcoin Cash

- Binance Chain

Traction though limited by its self-imposed caps has been promising, with liquidity pools quickly hitting their new limits each time they are raised.

At the core of THORChain is its native token RUNE which plays an essential role in both liquidity provisioning and network security.

1. All assets in THORChain’s liquidity pools are paired with RUNE, which is the settlement asset of the network.

This allows THORChain to aggregate liquidity more efficiently and prevent liquidity from fragmenting across pools.

This allows THORChain to aggregate liquidity more efficiently and prevent liquidity from fragmenting across pools.

2. THORChain nodes must bond RUNE in order to become active.

These nodes process transactions and guarantee security for all assets stored in its liquidity pools.

THORChain is secure so long as the RUNE bonded by nodes is >2x the value of external assets in liquidity pools.

These nodes process transactions and guarantee security for all assets stored in its liquidity pools.

THORChain is secure so long as the RUNE bonded by nodes is >2x the value of external assets in liquidity pools.

With each liquidity pool also being half RUNE the network is designed to incentivize a balance of $3 of RUNE for every $1 of external assets in the network.

It ensures this ratio through the use of a mechanism called the incentive pendulum.

It ensures this ratio through the use of a mechanism called the incentive pendulum.

The incentive pendulum is a mechanism that dynamically allocates system income (trading fees and RUNE rewards) between nodes and liquidity providers.

It aims to ensure nodes always are bonding two times more than the value of external assets (non-RUNE) in its liquidity pools.

It aims to ensure nodes always are bonding two times more than the value of external assets (non-RUNE) in its liquidity pools.

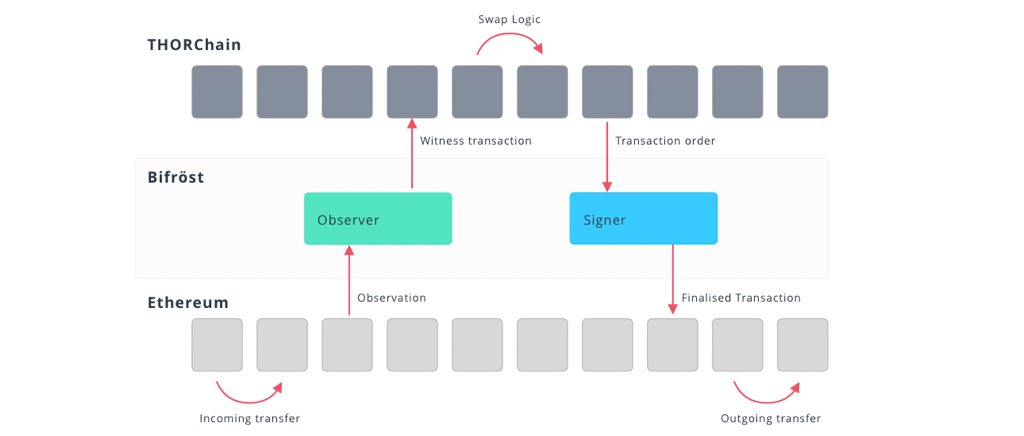

At its core THORChain is a vault manager.

It observes incoming user deposits to vaults, executes business logic (swap, add/remove liquidity), and processes outbound transactions.

The second graphic attached here is an example of a BTC to ETH swap.

It observes incoming user deposits to vaults, executes business logic (swap, add/remove liquidity), and processes outbound transactions.

The second graphic attached here is an example of a BTC to ETH swap.

These THORChain vaults provide the foundation for what it calls “THOFi” - the aforementioned suite of financial services enabled by THORChain’s liquidity pools.

In our latest Enterprise research piece we provide a detailed dive into THORChain that includes:

- THORChain Overview

- THORFi Overview

- Competitive Analysis

- Risk Analysis

...and more 🤔 messari.io/article/thorch…

- THORChain Overview

- THORFi Overview

- Competitive Analysis

- Risk Analysis

...and more 🤔 messari.io/article/thorch…

• • •

Missing some Tweet in this thread? You can try to

force a refresh