AR20-21 Notes

Apcotex Industries

Leading producer of Synthetic Rubber & Synthetic Latex in India

Broadest Range of Emulsion Polymers in the market

Fasten Your Seatbelts & Enjoy the ride 🙂

Retweet for wider reach 🙏

Apcotex Industries

Leading producer of Synthetic Rubber & Synthetic Latex in India

Broadest Range of Emulsion Polymers in the market

Fasten Your Seatbelts & Enjoy the ride 🙂

Retweet for wider reach 🙏

1/

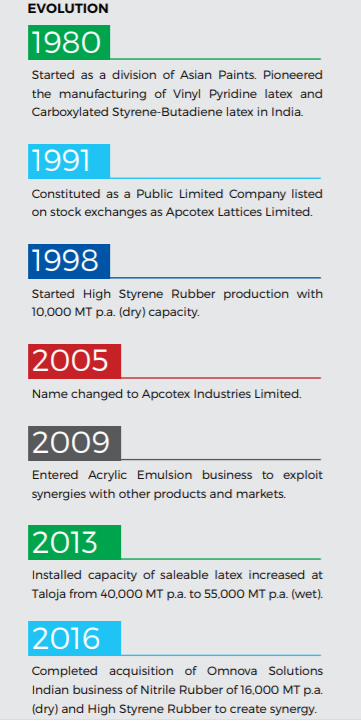

Evolution

1980: Started as a division of Asian Paints

1991: Becomes public ltd

1998: Started HSR prodn 10k MT p.a.

2005: Name changed to Apcotex

2009: Entered Acrylic Emulsion business

2013: Latex capacity increased from 40k to 55k MTp.a.

2016: Omnava Solutions Acquisition

Evolution

1980: Started as a division of Asian Paints

1991: Becomes public ltd

1998: Started HSR prodn 10k MT p.a.

2005: Name changed to Apcotex

2009: Entered Acrylic Emulsion business

2013: Latex capacity increased from 40k to 55k MTp.a.

2016: Omnava Solutions Acquisition

4/

Manufacturing Facilities

1.Taloja, Maharashtra

~Synthetic Latex: 55K MT p.a.

~HSR: 7K MT p.a.

2.Valia, Gujarat

~Nitrile Rubber & Allied 20K MT

Manufacturing Facilities

1.Taloja, Maharashtra

~Synthetic Latex: 55K MT p.a.

~HSR: 7K MT p.a.

2.Valia, Gujarat

~Nitrile Rubber & Allied 20K MT

5/

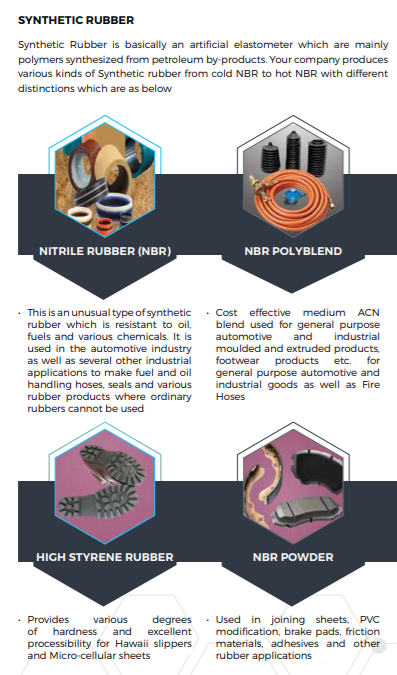

Product Mix

1.Synthetic Latex

~Paper

~Carpet

~Construction

~Tyre Cord

~Gloves

~Specialty

2.Synthetic Rubber

~NBR

~NBR Polyblend

~HSR

~NBR Powder

Product Mix

1.Synthetic Latex

~Paper

~Carpet

~Construction

~Tyre Cord

~Gloves

~Specialty

2.Synthetic Rubber

~NBR

~NBR Polyblend

~HSR

~NBR Powder

6/

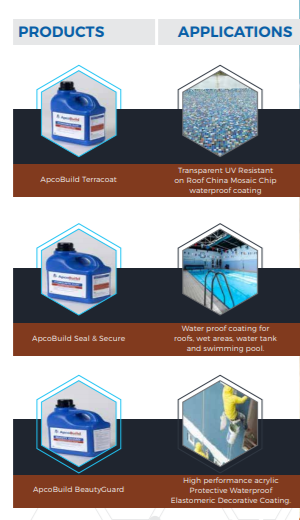

ApcoBuild

~ Construction Chemical industry 5600 Cr

~Expected to grow at a CAGR of 15%

~Green Building concept to gain more traction

~Currently in 3 states Gujarat, Maharashtra & Goa

~Focus on Waterproofing range of products

ApcoBuild

~ Construction Chemical industry 5600 Cr

~Expected to grow at a CAGR of 15%

~Green Building concept to gain more traction

~Currently in 3 states Gujarat, Maharashtra & Goa

~Focus on Waterproofing range of products

7/

Synthetic Latex Industry

~Globally a fragmented market

~Both regional & global players exist

~Customization to suit customer needs is important

~No major substitute for Synthetic latex polymers

~Nitrile latex for gloves witnessing very high demand

Synthetic Latex Industry

~Globally a fragmented market

~Both regional & global players exist

~Customization to suit customer needs is important

~No major substitute for Synthetic latex polymers

~Nitrile latex for gloves witnessing very high demand

8/

Synthetic Rubber Industry

~Asia pacific leads the global production

~Automobile sector leading the growth

~India strategically offers great opportunity for manufacturers

~India has the potential to be a leader in rubber products manufacturing

Synthetic Rubber Industry

~Asia pacific leads the global production

~Automobile sector leading the growth

~India strategically offers great opportunity for manufacturers

~India has the potential to be a leader in rubber products manufacturing

9/

FY21 Performance

~Strong growth in Rev & Profits & Strong BS

~Continued to face tough foreign competition in NBR

~Antidumping duty recently imposed by the govt

~Our interaction with the management on the NBR Anti-dumping Duty and Capex related to that

FY21 Performance

~Strong growth in Rev & Profits & Strong BS

~Continued to face tough foreign competition in NBR

~Antidumping duty recently imposed by the govt

~Our interaction with the management on the NBR Anti-dumping Duty and Capex related to that

10/

Risks

~Procurement Risk

~Environment Health & Safety Risk

~Dependence on Single Manufacturing facility

~HSR Obsolescence

~Monomer Transportation

~Investment Risk

~Business Concentration Risk

~Overseas Competition-Dumping of Products

Risks

~Procurement Risk

~Environment Health & Safety Risk

~Dependence on Single Manufacturing facility

~HSR Obsolescence

~Monomer Transportation

~Investment Risk

~Business Concentration Risk

~Overseas Competition-Dumping of Products

12/

~Last 10 concalls notes: bit.ly/35r3ZOh

~5 Min Stock Idea: bit.ly/3wyEO8l

~Infographic: bit.ly/3xqgFB4

~FY20 AR Notes: bit.ly/3q1aRLN

Detailed Analysis shared with MissioN SMILE members.

Catch a glimpse: bit.ly/35siEZu

End 🙂🙏

~Last 10 concalls notes: bit.ly/35r3ZOh

~5 Min Stock Idea: bit.ly/3wyEO8l

~Infographic: bit.ly/3xqgFB4

~FY20 AR Notes: bit.ly/3q1aRLN

Detailed Analysis shared with MissioN SMILE members.

Catch a glimpse: bit.ly/35siEZu

End 🙂🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh