0 for 14.

That is the track record the "Inflationistas" have amassed in predicting Inflation, Deflation, Disinflation - really ANY "Flation - so far in the 21st century.

0 for 14

My advice: Pour yourself a tall glass of STFU + go find another expertise to pretend to have...

That is the track record the "Inflationistas" have amassed in predicting Inflation, Deflation, Disinflation - really ANY "Flation - so far in the 21st century.

0 for 14

My advice: Pour yourself a tall glass of STFU + go find another expertise to pretend to have...

How can any economist have missed 3 decades of deflation?

Automation, global labor arbitrage, digitalization + outsourcing/offshoring all have worked to drive global prices lower.

Missing this and/or ignoring it explains that awful inflation-predicting track record

Automation, global labor arbitrage, digitalization + outsourcing/offshoring all have worked to drive global prices lower.

Missing this and/or ignoring it explains that awful inflation-predicting track record

Hence, why my preferred framework is:

"Deflation, punctuated with spasms of inflation"

"Deflation, punctuated with spasms of inflation"

https://twitter.com/ritholtz/status/1360200786899255297

The concern that "Spiking Commodity prices" are running away from buyers has been thoroughly debunked.

Commodity traders know that "The cure for high prices is high prices..."

Commodity traders know that "The cure for high prices is high prices..."

Example: Lumber prices

They dropped almost 40% from the record high reached on May 10.

Sawmills are catching up with rampant homebuilding demand in N.America that fueled rally beset by supply shortages.

Buyers balked at historically elevated prices + supplies increased.

They dropped almost 40% from the record high reached on May 10.

Sawmills are catching up with rampant homebuilding demand in N.America that fueled rally beset by supply shortages.

Buyers balked at historically elevated prices + supplies increased.

"Costs soared partly because of do-it-yourselfers’ spending stimulus checks, but a month of declines show that consumers aren’t about to trigger runaway [inflation]."

nytimes.com/2021/06/21/bus…

nytimes.com/2021/06/21/bus…

This timeline nicely explains what occurred over the past 16 months:

https://twitter.com/Sams_Antics/status/1391068809075830784

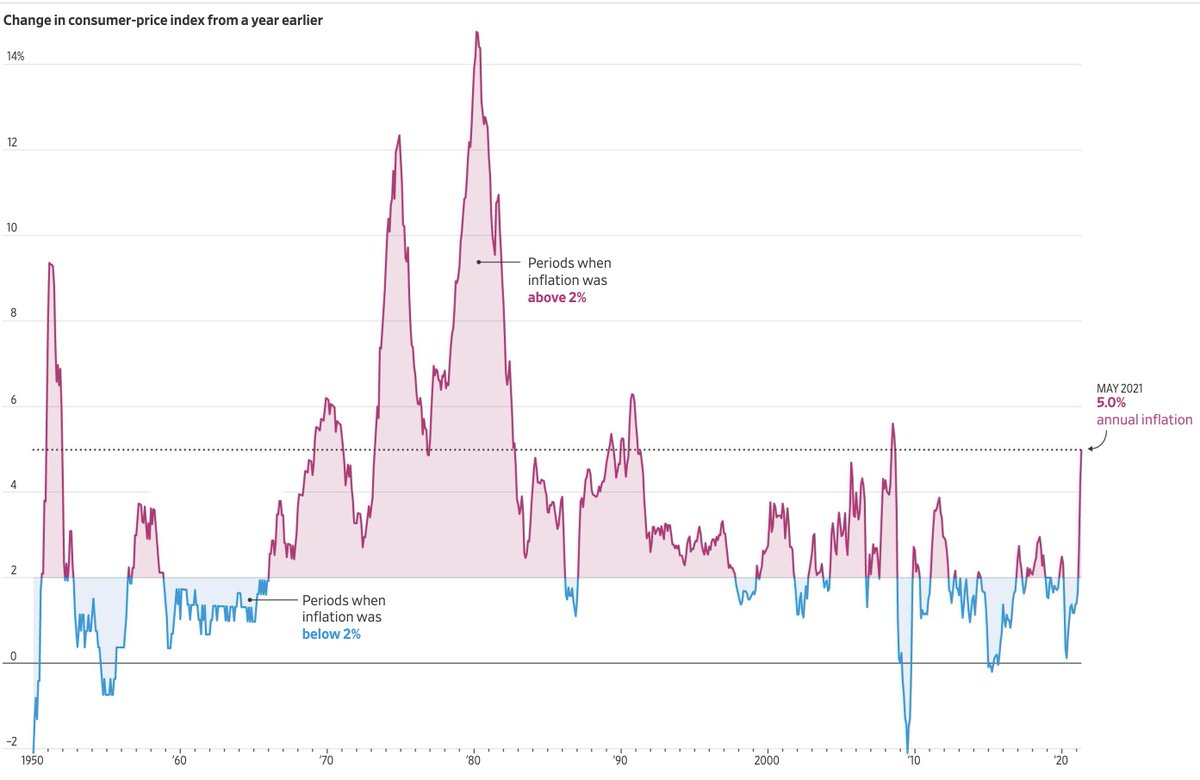

Ask yourself how similar or different today is versus the 1970s. Your answer likely determines how concerned you are about whether rising prices are transitory or longer-lasting

WSJ: What Investors Can Learn From the History of Inflation

wsj.com/articles/what-…

WSJ: What Investors Can Learn From the History of Inflation

wsj.com/articles/what-…

What surprises me is why anyone -- the media, investors, policymakers -- ever gives these "neverrights" any oxygen.

If you were this bad a stock-picking, who would ever listen to you?

If you were this bad a stock-picking, who would ever listen to you?

Things that are cheaper today than 1 year ago:

TVs

Toys

Food

Clothes

Software

Broadband

Mobile service

Entertainment

Mortgage Rates

Apartment rents in big cities

TVs

Toys

Food

Clothes

Software

Broadband

Mobile service

Entertainment

Mortgage Rates

Apartment rents in big cities

My colleague @boes_ reminds us that New York Fed President John Williams is also looking at "Downside inflation risks"

https://twitter.com/boes_/status/1407081106466299912

I like the idea of looking at inflation over a 2-year period

https://twitter.com/David_Charts/status/1407072082370912262

Paulie the K knows what I am talking about

https://twitter.com/paulkrugman/status/1407061356449304577

The word of the day is #TRANSITORY

Lumber, among the world’s best-performing commodities as the pandemic sent construction demand soaring + stoked fears of inflation, has officially wiped out all of its staggering gains for the year.

Lumber = Flat YTD

bloomberg.com/news/articles/…

Lumber, among the world’s best-performing commodities as the pandemic sent construction demand soaring + stoked fears of inflation, has officially wiped out all of its staggering gains for the year.

Lumber = Flat YTD

bloomberg.com/news/articles/…

Transitory Inflation, work truck edition:

Semiconductor shortage hurting biz: Companies are paying more for work vehicles when they can find them in stock. Instead of discounts of 8%+ from MSRP; Now, commercial customers are paying over sticker price.

wsj.com/articles/chip-…

Semiconductor shortage hurting biz: Companies are paying more for work vehicles when they can find them in stock. Instead of discounts of 8%+ from MSRP; Now, commercial customers are paying over sticker price.

wsj.com/articles/chip-…

I am in the same camp as @DanielAlpert that most of the CPI surge is associated with re-opening:

https://twitter.com/DanielAlpert/status/1414930936349741079

What we are seeing are the effects of the vaccines, massive fiscal stimulus + ZIRP via @jasonfurman

https://twitter.com/jasonfurman/status/1414930092254498818

Here is the official CEA take on inflation:

https://twitter.com/WhiteHouseCEA/status/1414940727088402438

I hate to cherrypick data, but for Lumber, I will make this one time only exception:

https://twitter.com/TheStalwart/status/1415357557196181506

CPI inflation is still about reopening + motor vehicle supply issues.

"Outside of a few categories that are experiencing significant idiosyncratic supply constraints or healthy price normalization, prices rose as much as could reasonably be expected."

theovershoot.co/p/us-cpi-infla…

"Outside of a few categories that are experiencing significant idiosyncratic supply constraints or healthy price normalization, prices rose as much as could reasonably be expected."

theovershoot.co/p/us-cpi-infla…

One of the reasons I started The Big Picture was to counter the many MSM economic reporting fails I saw.

Economic reporting has improved a lot, but there are still occasional backslides: Like this one, which conflates budgeting, credit + inflation.

wsj.com/articles/how-m…

Economic reporting has improved a lot, but there are still occasional backslides: Like this one, which conflates budgeting, credit + inflation.

wsj.com/articles/how-m…

Inflation worries focused on the 1970s are misguided: Oil Embargo, Energy Prices, Cartel driven shortages are so very different than the current environment: Economic boom/Reopening, Pandemic shortages, monetary stimulus.

The 2020s are not the 1970s

marketwatch.com/story/worried-…

The 2020s are not the 1970s

marketwatch.com/story/worried-…

Today in Transitory Inflation:

Supply chain shortages of new cars sent Used Car prices skyward. In July they were flat. The Inflationistas managed to scare everyone with their usual nonsense.

#Beyondwrong

fredblog.stlouisfed.org/2021/05/the-ju…

Supply chain shortages of new cars sent Used Car prices skyward. In July they were flat. The Inflationistas managed to scare everyone with their usual nonsense.

#Beyondwrong

fredblog.stlouisfed.org/2021/05/the-ju…

Adjusted for Inflation, the 2022 Ford Maverick is Less Expensive Than the 1908 Model T

The original Model T cost $850 -- adjusted for inflation, that is ~$25,000. All in, the 2022 Maverick's price is $21,490.

via @mrlevine

newsweek.com/adjusted-infla…

The original Model T cost $850 -- adjusted for inflation, that is ~$25,000. All in, the 2022 Maverick's price is $21,490.

via @mrlevine

newsweek.com/adjusted-infla…

The never-ending LOL Inflation saga continues...

https://twitter.com/charliebilello/status/1427985533414805512

Iron Ore, which is used to make steel, plummets in price:

https://twitter.com/elerianm/status/1429756589041463297

What do you do for an encore after you were wrong about, inflation, deficit spending, stimulus, and well, pretty much everything?

washingtonpost.com/opinions/2021/…

washingtonpost.com/opinions/2021/…

If your name is Lawrence H. Summers, you keep penning nonsensical editorials, fail to acknowledge your terrible track record, then accuse everyone who mentions your terrible track record as going ad hominem (even as you make ad hominem attacks yourself).

noahpinion.substack.com/p/interview-la…

noahpinion.substack.com/p/interview-la…

Automobiles = largest component of inflation in 2021; Prices went ballistic earlier this year due to chip shortages caused by woes in restarting semiconductor production.

As Supply/Demand imbalance normalizes, prices soften.

Understand this, understand "transitory inflation."

As Supply/Demand imbalance normalizes, prices soften.

Understand this, understand "transitory inflation."

Nobody Really Knows How the Economy Works: Many experts are rethinking longstanding core ideas, including the importance of inflation expectations.

“It requires more humility and acceptance that not everything fits into one model yet.”

nytimes.com/2021/10/01/ups…

“It requires more humility and acceptance that not everything fits into one model yet.”

nytimes.com/2021/10/01/ups…

"The problems that have been crimping recovery from the pandemic recession seem, by and large, to be global rather than local."

nytimes.com/2021/10/29/opi…

nytimes.com/2021/10/29/opi…

The temporary shift in consumption from services to goods is behind broken supply chains, component shortages + increased prices.

It is a great visualization of the impact of WFH/lockdowns.

It also suggests these increases are likely to be temporary.

It is a great visualization of the impact of WFH/lockdowns.

It also suggests these increases are likely to be temporary.

https://twitter.com/TBPInvictus/status/1456683999657615364

“Burning rubber to rejoin highway traffic is not the same thing as overheating the engine.”

@delong explains why the current uptick in US inflation is highly likely to be simply rubber on the road, resulting from the post-pandemic recovery.

project-syndicate.org/commentary/us-…

@delong explains why the current uptick in US inflation is highly likely to be simply rubber on the road, resulting from the post-pandemic recovery.

project-syndicate.org/commentary/us-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh