Word on the street is: this price graph is fucked up. What happened?

A thread about the calm, the storm, and how to tell the difference.

A thread about the calm, the storm, and how to tell the difference.

There have been a few prevailing narratives lately:

- China FUD driving prices down, U.S. maybe to follow?

- Bitcoin is bad for the environment, or at least Elon thinks so

- Maybe with this dip, some of the institutions who bought are under water and need to sell? (Saylor, etc.)

- China FUD driving prices down, U.S. maybe to follow?

- Bitcoin is bad for the environment, or at least Elon thinks so

- Maybe with this dip, some of the institutions who bought are under water and need to sell? (Saylor, etc.)

None of that is concrete, though, and people vacillate between over-stating the pieces of news they want to hear and under-stating the ones they don't. So let's break it down a little, and look at some stuff which *is* concrete.

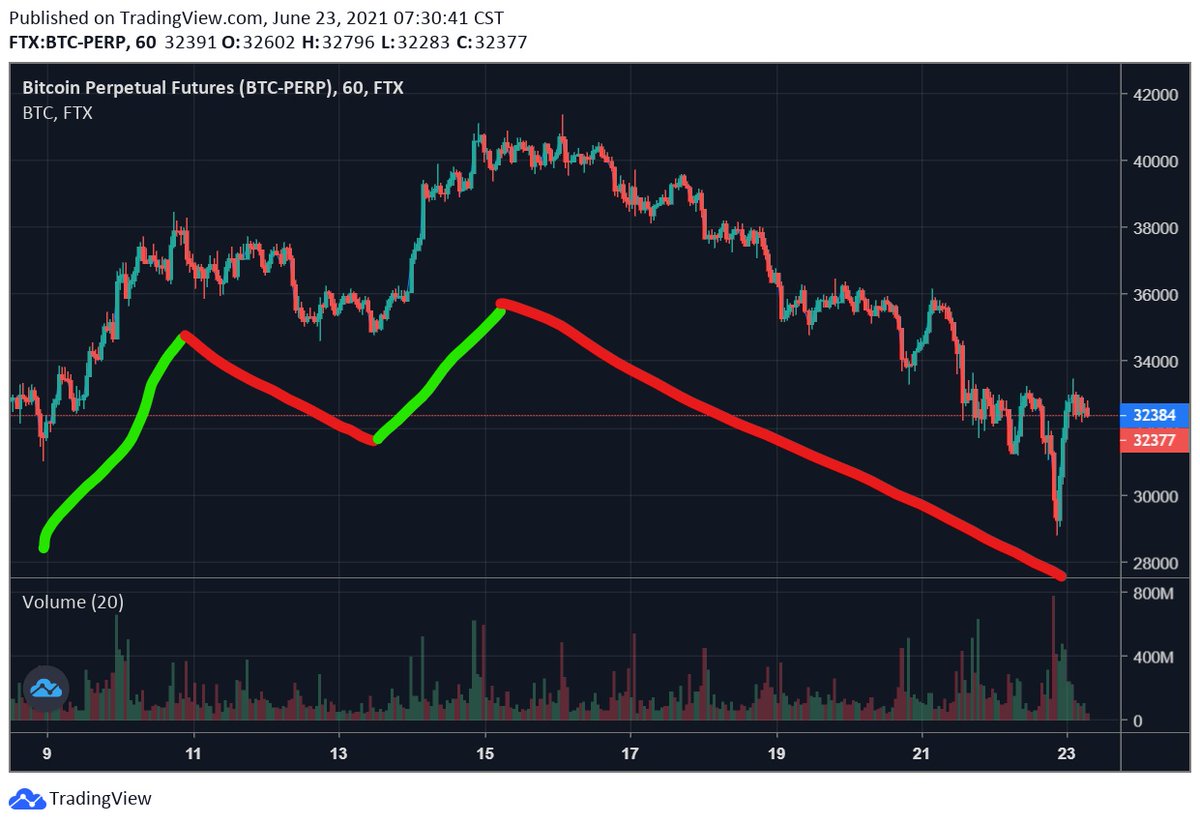

I'll start by saying something that sounds dumb (and is :P), but hear me out. The price graph I posted is from a two week-long period, but can actually be divided into four distinct sections, as follows:

Stuff like this is why I make the big bucks.

No, obviously I'm being a little tongue-in-cheek, but this *is* worth highlighting -- BTC's price has been very momentum-driven on a days-long timescale. Why?

No, obviously I'm being a little tongue-in-cheek, but this *is* worth highlighting -- BTC's price has been very momentum-driven on a days-long timescale. Why?

I think different kinds of news were dominating price action for each period.

June 9 - 11: El Salvador / reversion from Elon dump

June 11 -13: China/U.S. FUD / reversion

June 13 - 15: Saylor or something / reversion

June 15 - 23: China FUD / "Is Saylor fucked?" / reversion

June 9 - 11: El Salvador / reversion from Elon dump

June 11 -13: China/U.S. FUD / reversion

June 13 - 15: Saylor or something / reversion

June 15 - 23: China FUD / "Is Saylor fucked?" / reversion

Each of these, I think, constituted an over-reaction -- that's why I included "reversion" as an effect for all of them, because I think probably none of them *really* mattered in the first place for BTC's "value," or where people should be pricing it medium-term.

- Can you tell me where El Salvador is on a map?

- The China FUD is new-ish, but China has always had FUD and we knew China would do *something*.

- Warren is FAR from regulating crypto away.

- We *know* instos are *in*, this TWAP doesn't move that needle.

- Saylor isn't fucked.

- The China FUD is new-ish, but China has always had FUD and we knew China would do *something*.

- Warren is FAR from regulating crypto away.

- We *know* instos are *in*, this TWAP doesn't move that needle.

- Saylor isn't fucked.

That shit KEEPS happening -- remember all the times Elon would tweet, BTC would rally 10%, and then BTC would fall 9% over a few hours? I think the days of ping-ponging are just a drawn out version of that (see: right before the other graph when Elon caused a reverted dump).

Furthermore, check this graph out -- it shows the net BTC buying and selling liquidations across platforms per day. The days with inflows had $100s of millions in net buying liquidations, and vice-versa -- which creates momentum (one piece of news -> days of price movement) ...

... and, because so much of the new buying from good news and selling from bad news was from liquidations (and therefore not organic), that means there was even MORE propensity for reversion -- no one (or, not everyone who did :P) wanted to buy $41k on June 15, so people sold.

So really what's going on: people are over-reacting to news, liquidations are exacerbating that over-reaction, and then people are trading the other way when they realize that (and when another piece of news tells them to).

Tale as old as time!

Tale as old as time!

https://twitter.com/AlamedaTrabucco/status/1395211697930047489?s=20

The week-long crash we've just witnessed (culminating in the dip below $30k earlier today) is worth highlighting specifically, because it saw some weird behavior.

Specifically, let's look at some BTC perps -- here's Binance's average funding.

Specifically, let's look at some BTC perps -- here's Binance's average funding.

Binance's BTC perps often matter a ton, and as we can see, for a ton of this period funding was paying *longs* which we don't typically see -- and this was a period when OI was *shrinking*, and not *all* from liquidations.

This suggests that longs were closing one way or another -- some liquidations, yes, but also some people just ... choosing to close (also the effect is smaller than it looks cuz BTC went down, but it's still real).

FTX was similar -- more funding -> longs as OI net went way down. Bybit, OKEx, etc., all the important perps had similar patterns, and those patterns suggested the same thing -- people were closing for whatever reason, and aggressively selling to do so.

After a few days of this, it sort of just becomes predictable that it'll keep happening (until it doesn't!), and that's the kind of thing which can help us predict patterns like the skillfully drawn lines I made above.

Also, yesterday/today had the most net liquidations of any days recently -- and a spike in liquidations has tended to help fuel reversion, as we discussed, because no one WANTED to sell down to $30k, really. Buying there is a predictably great trade, just like it always is.

In fact, trading at the END of any of these periods is a predictably awesome trade -- the goal is finding it.

It seems like MAYBE today marks yet another paradigm switch? We'll have to wait and see -- Alameda's new long positions are sure hoping so.

It seems like MAYBE today marks yet another paradigm switch? We'll have to wait and see -- Alameda's new long positions are sure hoping so.

• • •

Missing some Tweet in this thread? You can try to

force a refresh