Company Overview

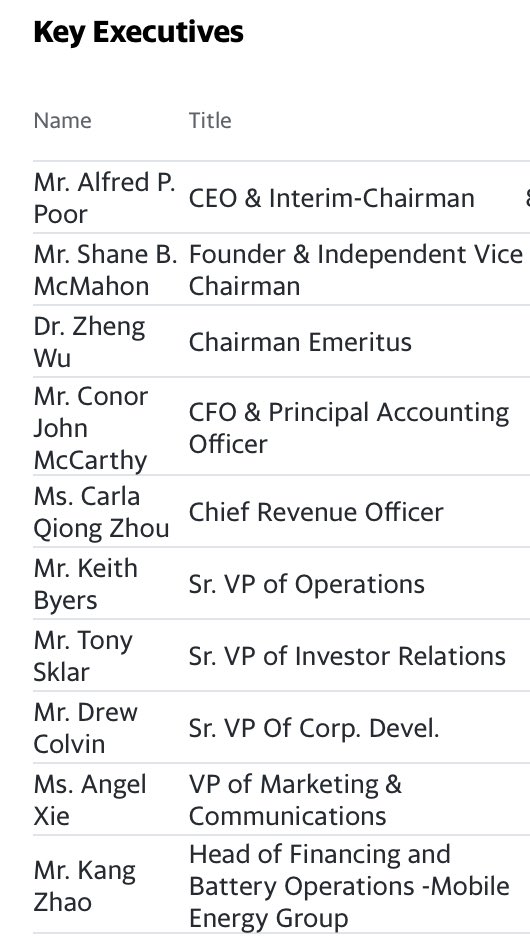

• Ideanomics is a financial technology company and EV company that was founded in 2004 by Shane McMahon

• The Headquarters is located in New York City

• And have offices in Beijing, Guangzhou, and Qingdao, China

• The current CEO is Alf Poor

Page 1

• Ideanomics is a financial technology company and EV company that was founded in 2004 by Shane McMahon

• The Headquarters is located in New York City

• And have offices in Beijing, Guangzhou, and Qingdao, China

• The current CEO is Alf Poor

Page 1

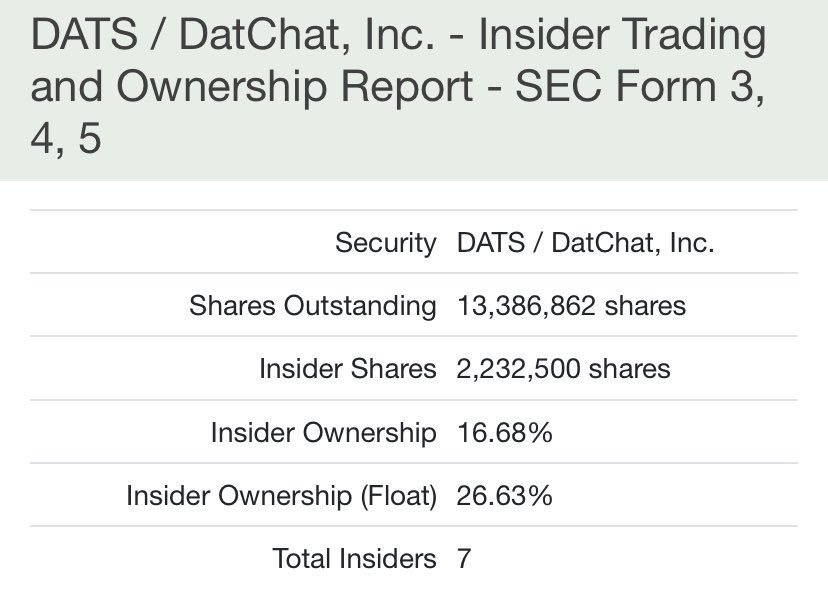

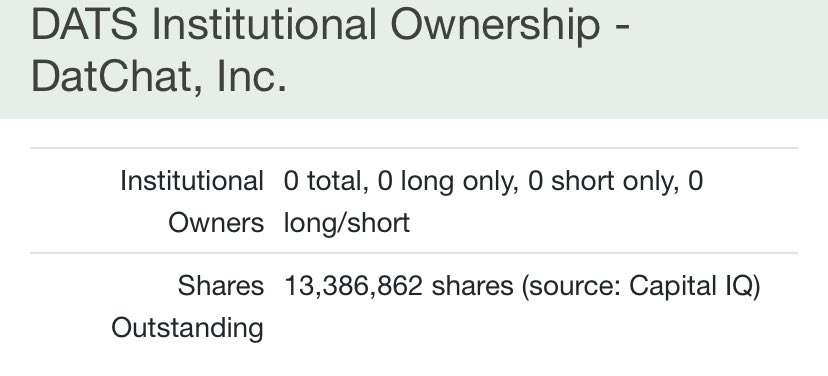

Institutional Owners

• 103 total

• Many major companies are invested such as Morgan Stanley, Goldman, Wells Fargo, JP Morgan and many more!

• Shares Outstanding-425,900,124

• Institutional Shares-21,154,278 4.97%

• Institutional Value - $91,090

fintel.io/so/us/idex

Page 2

• 103 total

• Many major companies are invested such as Morgan Stanley, Goldman, Wells Fargo, JP Morgan and many more!

• Shares Outstanding-425,900,124

• Institutional Shares-21,154,278 4.97%

• Institutional Value - $91,090

fintel.io/so/us/idex

Page 2

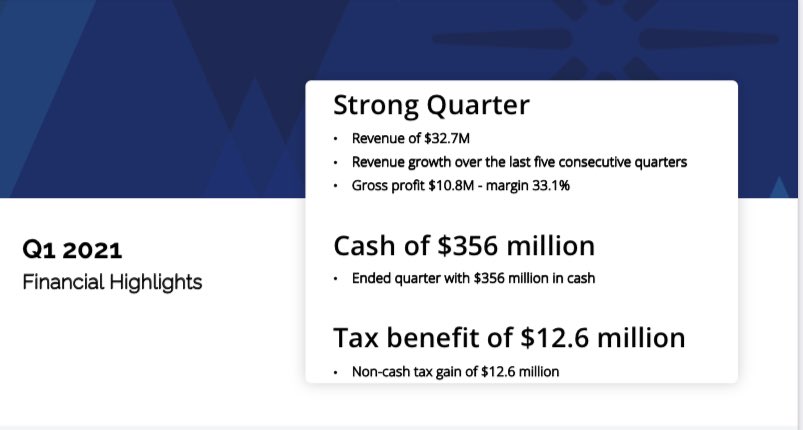

Financial Highlights

• In Q1 2021 Ideanomics made $32.7M

• And they had a GROSS profit of $10.8M which is a margin of 33.1%

• They also ended the quarter with $356M in Cash

• Ideanomics also has a constant growth over the past 5 quarters

Page 3

• In Q1 2021 Ideanomics made $32.7M

• And they had a GROSS profit of $10.8M which is a margin of 33.1%

• They also ended the quarter with $356M in Cash

• Ideanomics also has a constant growth over the past 5 quarters

Page 3

Ideanomics Company Portfolio

DBOT - 98.4%

Intelligenta - 100%

Liquefy - 10%

Logistorm - 10%

Hoobe - 20%

Solectrac - 100%

Timios - 100%

Wave - 100%

US Hybrid - 100%

Tree Manufacturing- 11.2%

TM2 - 10%

MEG - 80%

EnergicaMotors - 20%

Silk EV - $15M

marketwatch.com/press-release/…

Page 4

DBOT - 98.4%

Intelligenta - 100%

Liquefy - 10%

Logistorm - 10%

Hoobe - 20%

Solectrac - 100%

Timios - 100%

Wave - 100%

US Hybrid - 100%

Tree Manufacturing- 11.2%

TM2 - 10%

MEG - 80%

EnergicaMotors - 20%

Silk EV - $15M

marketwatch.com/press-release/…

Page 4

Merger with Soletrac

• On June 11 2021 Ideanomics announced a plan that they will merge with Soletrac

• Soletrac makes zero-emission electric tractors

• Soletrac states they are trying to become the “Tesla of Tractors”

sec.report/Document/00011…

Page 5

• On June 11 2021 Ideanomics announced a plan that they will merge with Soletrac

• Soletrac makes zero-emission electric tractors

• Soletrac states they are trying to become the “Tesla of Tractors”

sec.report/Document/00011…

Page 5

Ideanomics is shaping the future of e-mobility

• Ideanomics is an ecosystem of synergistic businesses.

• They Target 3 key pillars of EV: Vehicles, Charging and, Energy.

Price Targets

• Roth Capital Gives Ideanomics a Buy Rating, PT of $7

besthotstocks.com/roth-capital-i…

Page 6

• Ideanomics is an ecosystem of synergistic businesses.

• They Target 3 key pillars of EV: Vehicles, Charging and, Energy.

Price Targets

• Roth Capital Gives Ideanomics a Buy Rating, PT of $7

besthotstocks.com/roth-capital-i…

Page 6

Ideanomics 2 Business Segments

• Ideanomics Mobility- A turnkey solution that provides economic and operational confidence for electrification.

• The global EV market opportunity is expected to grow to $132.73 billion at a CAGR of 39.9% through 2022

Page 7

• Ideanomics Mobility- A turnkey solution that provides economic and operational confidence for electrification.

• The global EV market opportunity is expected to grow to $132.73 billion at a CAGR of 39.9% through 2022

Page 7

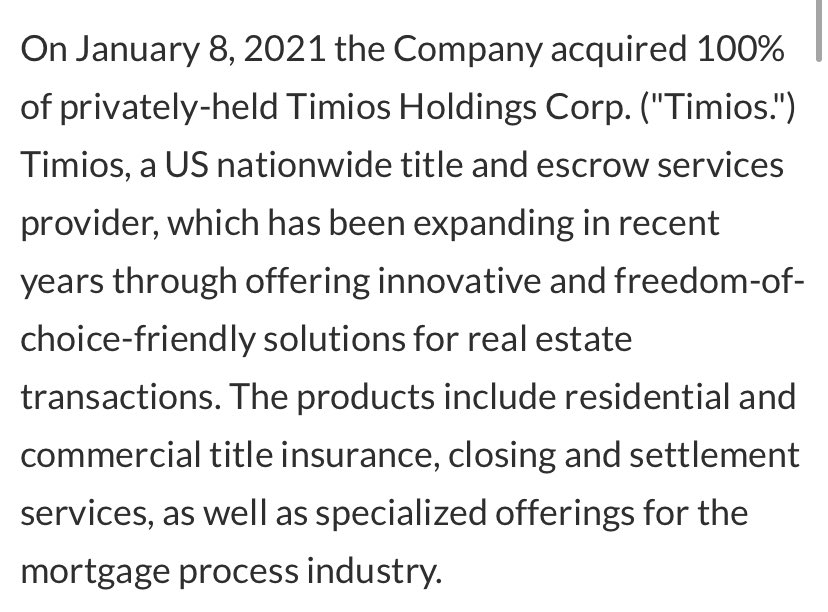

• Ideanomics Capital - Focused on fintech and its disruptive impact across financial services, from financial markets to mortgages where home sales are forecasted to grow 21.9% in 2021 6.9M homes

• Ideanomics Mobility includes Timios, DBOT, TM2, and Liquefy

Page 7 continued

• Ideanomics Mobility includes Timios, DBOT, TM2, and Liquefy

Page 7 continued

Companies in Ideanomics pipeline brief overview

• US Hybrid - Hydrogen Fuel Cells

• Solectrac - Electric Tractors

• Medici - Heavy Duty Trucks & Buses

• WAVE - EV Charging

• Engergica- Electric Motorcycles

• SilkEV- Electric luxury vehicles

• Timios- real estate

Page 8

• US Hybrid - Hydrogen Fuel Cells

• Solectrac - Electric Tractors

• Medici - Heavy Duty Trucks & Buses

• WAVE - EV Charging

• Engergica- Electric Motorcycles

• SilkEV- Electric luxury vehicles

• Timios- real estate

Page 8

I would like to now conclude this DD Thread on Ideanomics

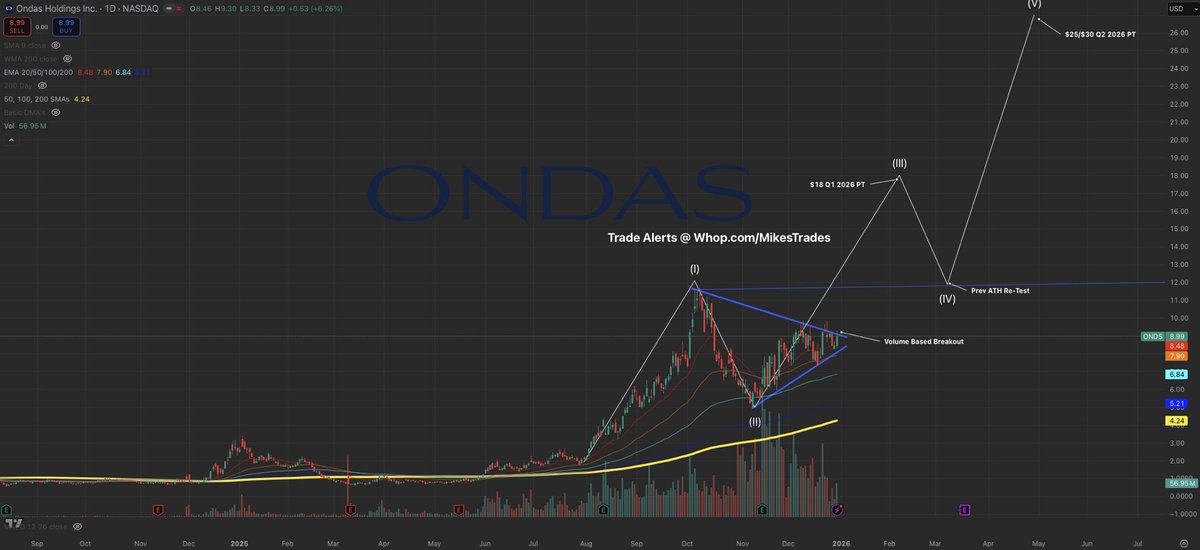

Price Targets 🎯

Short Term ($6-$13)

Long Term ($17-$30)

@PJ_Matlock

@yatesinvesting

@Mitch___Picks

Page 9

Price Targets 🎯

Short Term ($6-$13)

Long Term ($17-$30)

@PJ_Matlock

@yatesinvesting

@Mitch___Picks

Page 9

• • •

Missing some Tweet in this thread? You can try to

force a refresh