1/

Get a cup of coffee.

In this thread, I'll walk you through the benefits of turning capital quickly.

The math behind turning capital is beautiful. It leads us to the number "e", which plays a vital role in so many different fields -- from astrophysics to biology.

Get a cup of coffee.

In this thread, I'll walk you through the benefits of turning capital quickly.

The math behind turning capital is beautiful. It leads us to the number "e", which plays a vital role in so many different fields -- from astrophysics to biology.

2/

Imagine we have $1M.

Also, we know an extraordinarily generous bank where we can deposit this $1M.

This bank will pay us interest. And not a paltry 1% or 2%, but a hefty *100%* per year!

(I know, I know. But humor me, will you?)

Imagine we have $1M.

Also, we know an extraordinarily generous bank where we can deposit this $1M.

This bank will pay us interest. And not a paltry 1% or 2%, but a hefty *100%* per year!

(I know, I know. But humor me, will you?)

3/

So, if we deposit our $1M at this bank, it will earn that 100% interest and become $2M in 1 years' time.

But that's *only* if the interest is *compounded annually*.

So, if we deposit our $1M at this bank, it will earn that 100% interest and become $2M in 1 years' time.

But that's *only* if the interest is *compounded annually*.

4/

What if the interest is *not* compounded annually?

For example, suppose it's compounded half yearly?

"Compounded half yearly" means: instead of paying us 100% interest *once* a year, the bank pays us 50% interest *twice* a year (ie, once every 6 months).

What if the interest is *not* compounded annually?

For example, suppose it's compounded half yearly?

"Compounded half yearly" means: instead of paying us 100% interest *once* a year, the bank pays us 50% interest *twice* a year (ie, once every 6 months).

5/

That is, we get to "turn" our money twice -- each time earning 50% on it.

Here's a quick picture of how that looks.

The first 6 months will turn $1M into $1.5M (ie, +50%). And the second 6 months will turn this $1.5M into $2.25M (another +50%).

That is, we get to "turn" our money twice -- each time earning 50% on it.

Here's a quick picture of how that looks.

The first 6 months will turn $1M into $1.5M (ie, +50%). And the second 6 months will turn this $1.5M into $2.25M (another +50%).

6/

So, compounding half yearly works out *better* for us than compounding annually.

Half yearly means we end up with $2.25M after 1 year.

Annually means we end up with only $2M in the same 1 year.

So, compounding half yearly works out *better* for us than compounding annually.

Half yearly means we end up with $2.25M after 1 year.

Annually means we end up with only $2M in the same 1 year.

7/

This is a *fundamental* fact about turning capital.

In general, the more quickly we can turn our capital, the higher our return will be.

This is a *fundamental* fact about turning capital.

In general, the more quickly we can turn our capital, the higher our return will be.

8/

For example, the picture below shows how much we end up with if we turn our capital even faster.

As the table shows, *quarterly* is even better than *half yearly*.

*Monthly* is even better than *quarterly*.

*Daily* is even better than *monthly*.

And so on.

For example, the picture below shows how much we end up with if we turn our capital even faster.

As the table shows, *quarterly* is even better than *half yearly*.

*Monthly* is even better than *quarterly*.

*Daily* is even better than *monthly*.

And so on.

9/

But there also seems to be a "law of diminishing returns" at work.

For example, doubling our turns from annually to half yearly netted us $250K ($2M -> $2.25M).

But doubling our turns *again*, going from half yearly to quarterly, only netted us ~$191K ($2.25M -> $2.44M).

But there also seems to be a "law of diminishing returns" at work.

For example, doubling our turns from annually to half yearly netted us $250K ($2M -> $2.25M).

But doubling our turns *again*, going from half yearly to quarterly, only netted us ~$191K ($2.25M -> $2.44M).

10/

This also is a fundamental property of capital turns.

As we crank up our turns more and more, the incremental benefit we get becomes less and less.

We still get a positive benefit each time. But the benefit gets smaller as we go:

This also is a fundamental property of capital turns.

As we crank up our turns more and more, the incremental benefit we get becomes less and less.

We still get a positive benefit each time. But the benefit gets smaller as we go:

11/

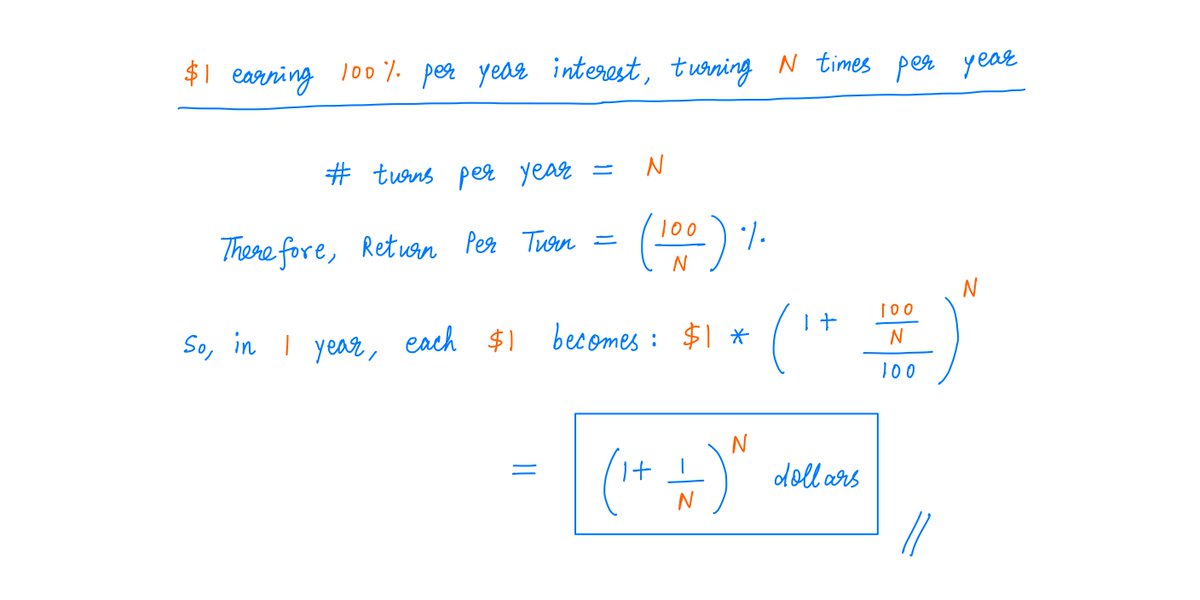

If we dig a little deeper, we can come up with a formula.

Suppose our capital turns N times per year.

Our formula then predicts how much each $1 of our money will become after 1 year -- as a function of N.

Here's the formula and its simple derivation:

If we dig a little deeper, we can come up with a formula.

Suppose our capital turns N times per year.

Our formula then predicts how much each $1 of our money will become after 1 year -- as a function of N.

Here's the formula and its simple derivation:

12/

Jacob Bernoulli was one of the first mathematicians to study this formula in the context of capital turns and compounding money.

Bernoulli's work dates all the way back to 1690!

That's when he published a paper about this formula in the journal Acta Eruditorum:

Jacob Bernoulli was one of the first mathematicians to study this formula in the context of capital turns and compounding money.

Bernoulli's work dates all the way back to 1690!

That's when he published a paper about this formula in the journal Acta Eruditorum:

13/

In the paper, Bernoulli proved that the formula *converged* to a limit.

Here's what that means:

As we keep increasing the number of turns per year N, the number (1 + 1/N)^N (which is what each dollar of our money becomes after 1 year) bumps up against a hard ceiling.

In the paper, Bernoulli proved that the formula *converged* to a limit.

Here's what that means:

As we keep increasing the number of turns per year N, the number (1 + 1/N)^N (which is what each dollar of our money becomes after 1 year) bumps up against a hard ceiling.

14/

Bernoulli proved that this ceiling had to lie somewhere between 2.5 and 3.

That is, *no matter how fast* we turn our capital (even if we turn it every nanosecond, or a billion times faster than that), we cannot grow $1 into $3 or more in 1 year. The ceiling prevents us.

Bernoulli proved that this ceiling had to lie somewhere between 2.5 and 3.

That is, *no matter how fast* we turn our capital (even if we turn it every nanosecond, or a billion times faster than that), we cannot grow $1 into $3 or more in 1 year. The ceiling prevents us.

15/

We now know that the ceiling is ~$2.718 -- between $2.5 and $3 as Bernoulli knew it had to be.

*If* we turn our capital *infinitely* often, we will grow $1 into roughly $2.718 in 1 year. Not more.

There's a strong law of diminishing returns at play.

We now know that the ceiling is ~$2.718 -- between $2.5 and $3 as Bernoulli knew it had to be.

*If* we turn our capital *infinitely* often, we will grow $1 into roughly $2.718 in 1 year. Not more.

There's a strong law of diminishing returns at play.

16/

This magic number (2.718281828...) is called "e".

e has a special place in mathematics.

It's one of the most important universal constants. And it turns up in all sorts of surprising places -- from probability distributions to the shapes of galaxies!

This magic number (2.718281828...) is called "e".

e has a special place in mathematics.

It's one of the most important universal constants. And it turns up in all sorts of surprising places -- from probability distributions to the shapes of galaxies!

17/

For those who'd like to nerd out even more, here's a sketch of Bernoulli's proof that the limit e has to exist and that it has to lie between 2.5 and 3.

(Don't worry if you don't get this math. I promise that you won't need it to make sense of the rest of this thread!)

For those who'd like to nerd out even more, here's a sketch of Bernoulli's proof that the limit e has to exist and that it has to lie between 2.5 and 3.

(Don't worry if you don't get this math. I promise that you won't need it to make sense of the rest of this thread!)

18/

As I said, e plays such a vital role in so many areas beyond capital turns and compounding.

For example, the formula for the Gaussian probability distribution (known more commonly as the "bell curve") depends strongly on e:

As I said, e plays such a vital role in so many areas beyond capital turns and compounding.

For example, the formula for the Gaussian probability distribution (known more commonly as the "bell curve") depends strongly on e:

19/

Another fun "curve" whose formula involves e in a big way: the famous Gateway Arch in St. Louis!

Another fun "curve" whose formula involves e in a big way: the famous Gateway Arch in St. Louis!

20/

Oh, and what if our bank paid us a more realistic interest rate -- say, R% per year?

Well, *if* we can turn our capital infinitely often, each $1 of ours becomes e^(R/100) dollars in 1 year.

I set R=100 just so the answer simplified to e dollars. But other Rs work too.

Oh, and what if our bank paid us a more realistic interest rate -- say, R% per year?

Well, *if* we can turn our capital infinitely often, each $1 of ours becomes e^(R/100) dollars in 1 year.

I set R=100 just so the answer simplified to e dollars. But other Rs work too.

21/

I can't resist pointing out one more place where e showed up unexpectedly: in Google's IPO filing!

sec.gov/Archives/edgar…

That's e billion dollars, folks!

I can't resist pointing out one more place where e showed up unexpectedly: in Google's IPO filing!

sec.gov/Archives/edgar…

That's e billion dollars, folks!

22/

If you want to learn more about the rich history behind e, and some of the math surrounding it, I recommend the book "e: The Story of A Number" by Eli Maor. It's a great read!

Amazon link: amazon.com/Story-Number-P…

If you want to learn more about the rich history behind e, and some of the math surrounding it, I recommend the book "e: The Story of A Number" by Eli Maor. It's a great read!

Amazon link: amazon.com/Story-Number-P…

23/

For more on the investing principles behind capital turns, inventory turns, and working capital management:

For more on the investing principles behind capital turns, inventory turns, and working capital management:

https://twitter.com/10kdiver/status/1304814783045099520

24/

I also very much enjoyed this Focused Compounding episode, where Andrew and Geoff discuss some of these concepts in their usual illuminating way (h/t @FocusedCompound).

~45 minute video:

I also very much enjoyed this Focused Compounding episode, where Andrew and Geoff discuss some of these concepts in their usual illuminating way (h/t @FocusedCompound).

~45 minute video:

25/

If you're still with me, thank you very much!

Capital turns are a key concept in compounding.

In addition to investing insights, I hope this thread also gave you an appreciation for the rich history and the beautiful math behind this topic.

Enjoy your weekend!

/End

If you're still with me, thank you very much!

Capital turns are a key concept in compounding.

In addition to investing insights, I hope this thread also gave you an appreciation for the rich history and the beautiful math behind this topic.

Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh