1⃣ stock should do good accumulation near all time high or 52 weeks high.

Ex - #routemobile & #crest

Ex - #routemobile & #crest

https://twitter.com/Trading0secrets/status/1410972197930209281

3⃣ stock should face least resistance after breakout. ( Or not face major hurdle after BO)

Ex- #uttamsugar

Ex- #uttamsugar

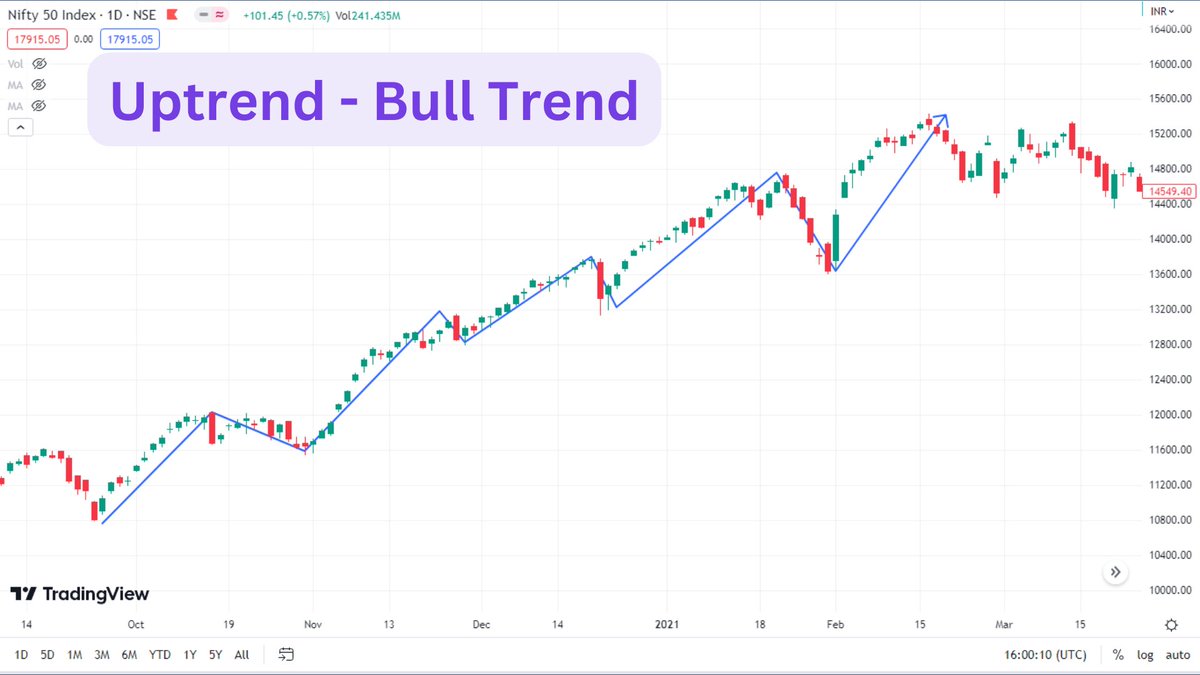

4⃣ it's sector should come out with big breakout or in good uptrend.

And, that time market should not take big correction.

Ex- #niftypharma & #indoco

And, that time market should not take big correction.

Ex- #niftypharma & #indoco

5⃣ it should be given good profit growth in last 1/2 quater & come out with more then 5+ years breakout.

Ex - #indiaglycols

Ex - #indiaglycols

There is no such technical scanner which give you all that filters

You have to use this manual by yourself & it is not 100% effective.

But ,chances of finding good stock 💗must increases 🙏

Price Action Masters💞 is my thread 🧵 helpful?

@RajarshitaS

@AmitabhJha3

@chartmojo

You have to use this manual by yourself & it is not 100% effective.

But ,chances of finding good stock 💗must increases 🙏

Price Action Masters💞 is my thread 🧵 helpful?

@RajarshitaS

@AmitabhJha3

@chartmojo

• • •

Missing some Tweet in this thread? You can try to

force a refresh