A Thread on the Boss himself @Mitesh_Engr

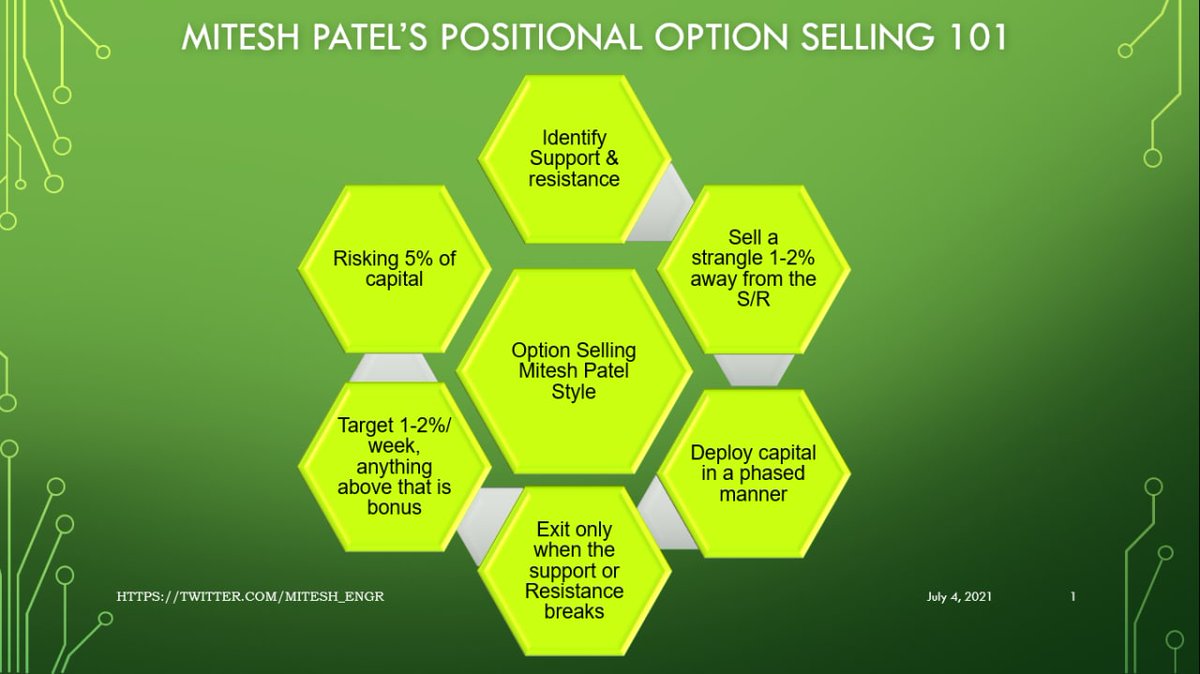

Mitesh Sir's Positional Option Selling 101:

• How to find direction

• Which options to sell

• How to deploy capital

• Exit criteria

• What ROI he targets weekly

• What % risk he takes

Done with the help of @niki_poojary

Mitesh Sir's Positional Option Selling 101:

• How to find direction

• Which options to sell

• How to deploy capital

• Exit criteria

• What ROI he targets weekly

• What % risk he takes

Done with the help of @niki_poojary

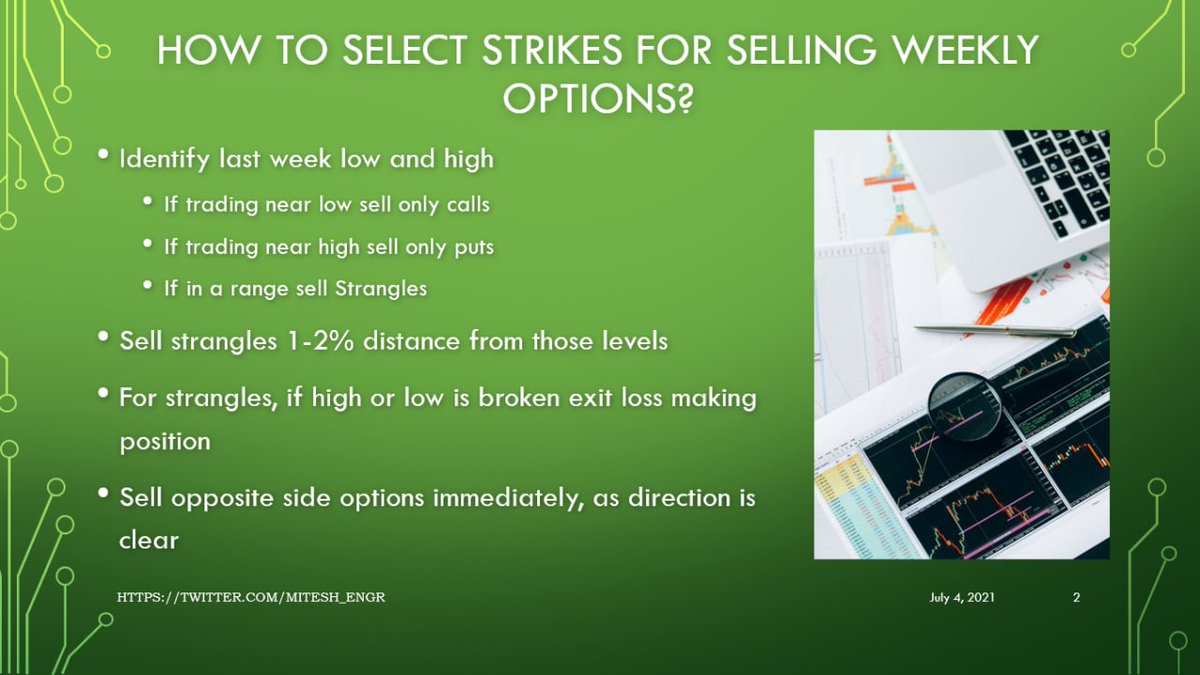

How @Mitesh_Engr Sir finds the direction?

• Daily charts S/R

• 75 min charts S/R

• Intraday trend

• Always play directional

• Never trades in strategies

• Daily charts S/R

• 75 min charts S/R

• Intraday trend

• Always play directional

• Never trades in strategies

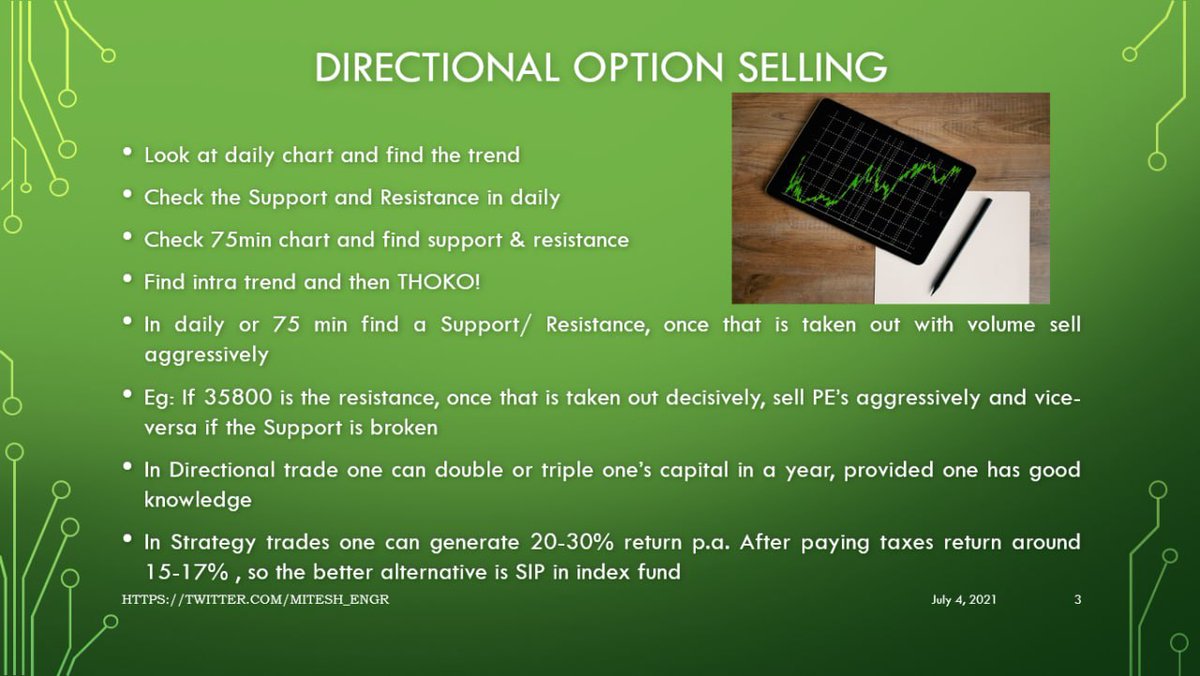

Which options to sell in weekly expiry according to @Mitesh_Engr?

• Weekly candle High/Low

• Sell 1% away options from those

• Exit when levels breached

• Weekly candle High/Low

• Sell 1% away options from those

• Exit when levels breached

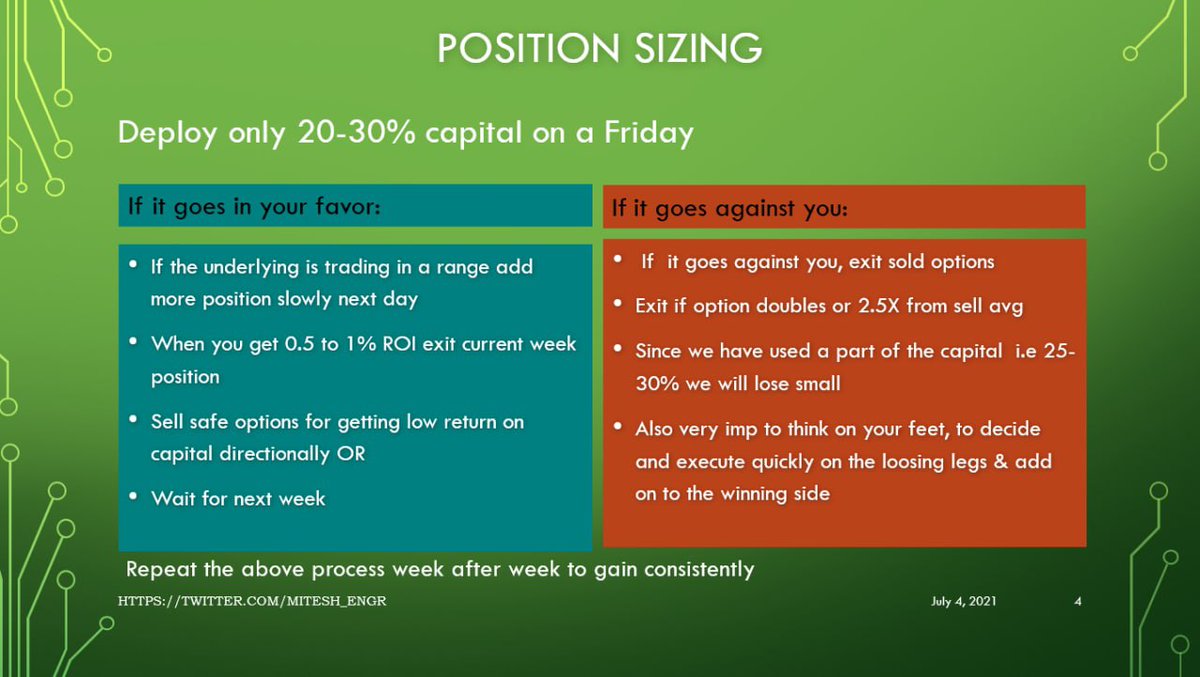

Position Sizing by @Mitesh_Engr Sir.

How to deploy your capital?

• First sell 20%

• Pyramid the next day

• When to exit

• What to do when view goes wrong

• What to do with idle capital

How to deploy your capital?

• First sell 20%

• Pyramid the next day

• When to exit

• What to do when view goes wrong

• What to do with idle capital

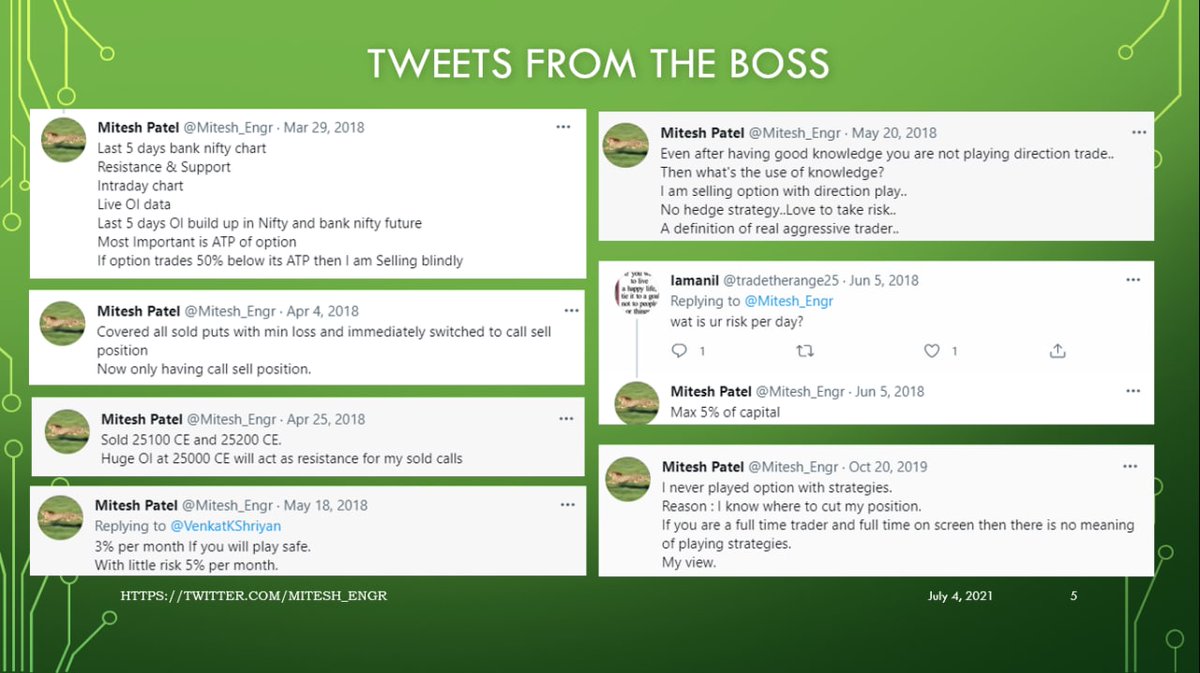

Some important tweets of @Mitesh_Engr Sir

• What Data to look at

• ROI for safe players per month

• Max risk per day

• Gather knowledge and play directional

• Never play strategies

• What Data to look at

• ROI for safe players per month

• Max risk per day

• Gather knowledge and play directional

• Never play strategies

What kind of returns should traders expect according to @Mitesh_Engr

• Monthly 2% easily via index options

• With little risk 4-5%

• Beginners weekly target - 0.5%

• Consistency

• Trade fearlessly later

• Monthly 2% easily via index options

• With little risk 4-5%

• Beginners weekly target - 0.5%

• Consistency

• Trade fearlessly later

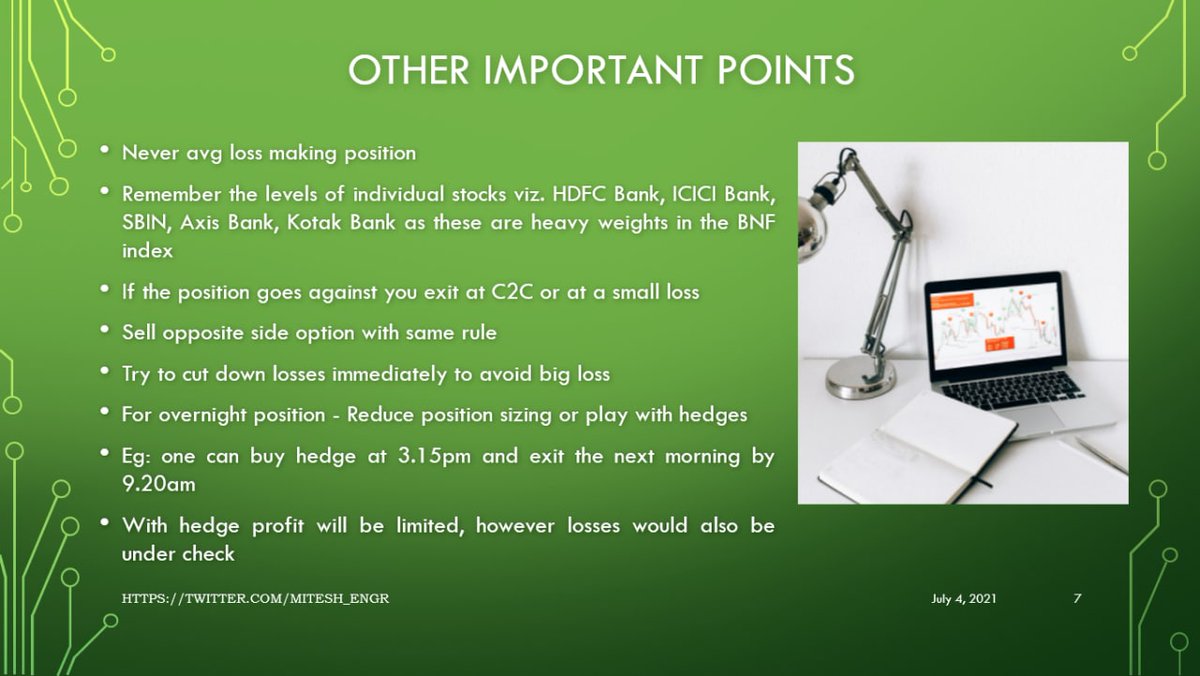

Important points by @Mitesh_Engr Sir

• Never average losers

• Remember levels of stocks

• Cut losses immediately

• Overnight positions - Control position sizing/ hedge

• Never average losers

• Remember levels of stocks

• Cut losses immediately

• Overnight positions - Control position sizing/ hedge

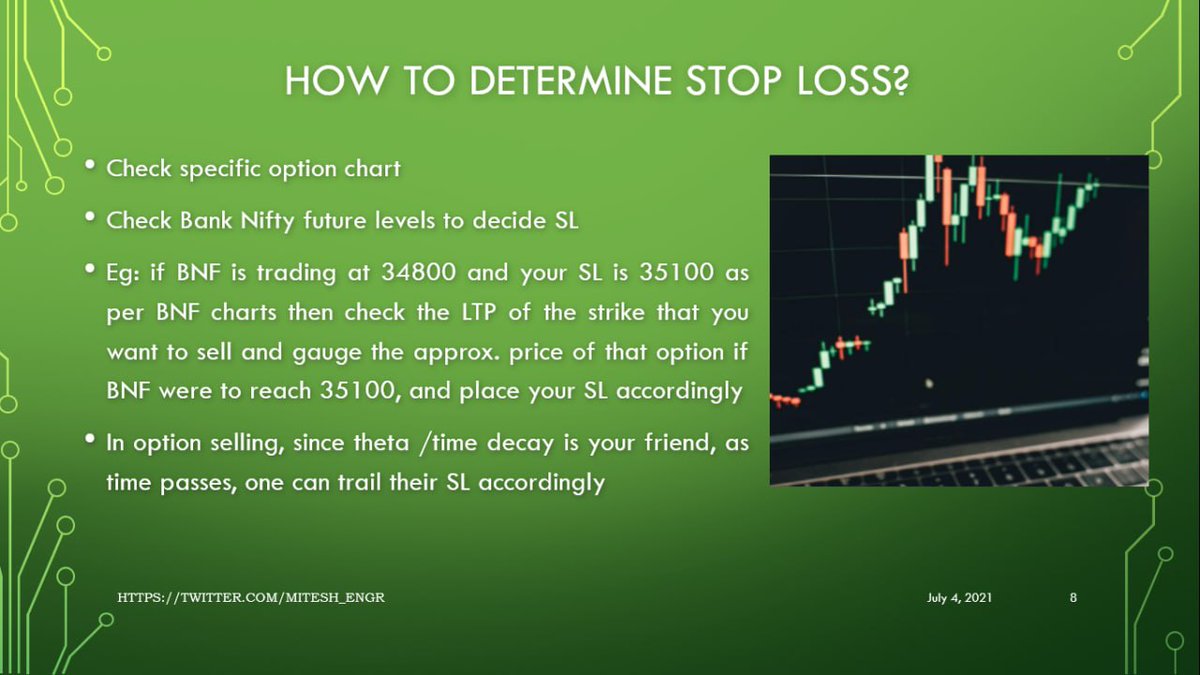

How @Mitesh_Engr Sir determines stop loss?

• Options levels

• Bank Nifty future levels

• At that level check option price and keep that as an SL

• Rely on theta decay to help you

• This will lower your SL further

• Options levels

• Bank Nifty future levels

• At that level check option price and keep that as an SL

• Rely on theta decay to help you

• This will lower your SL further

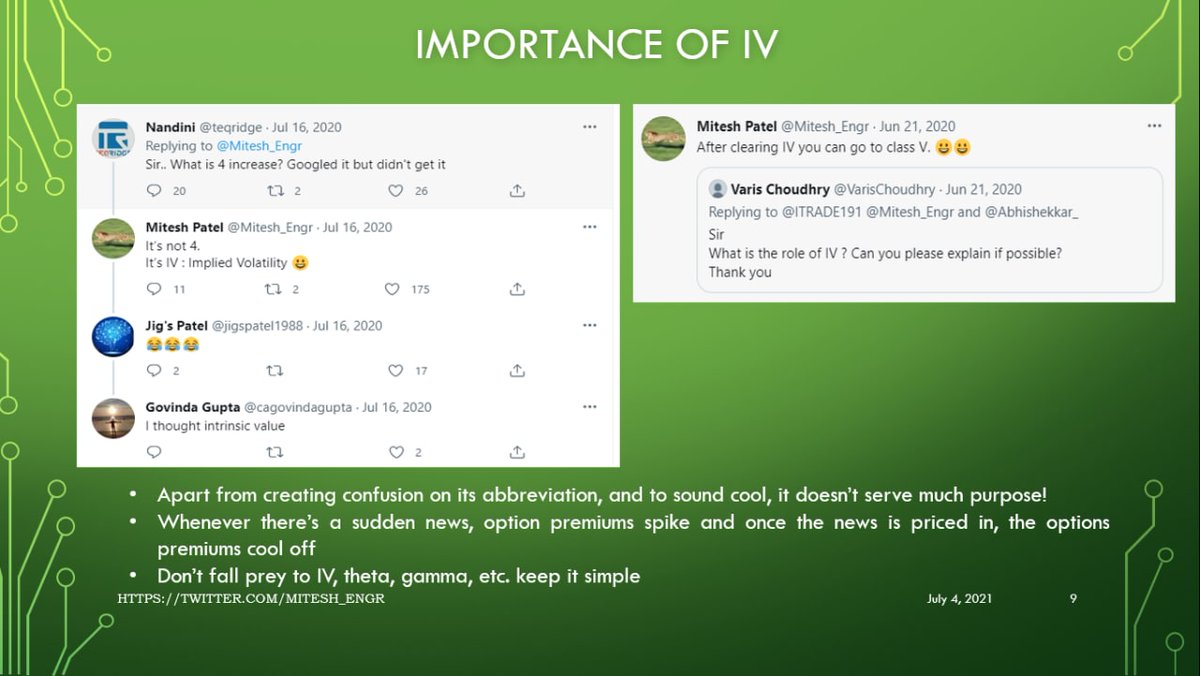

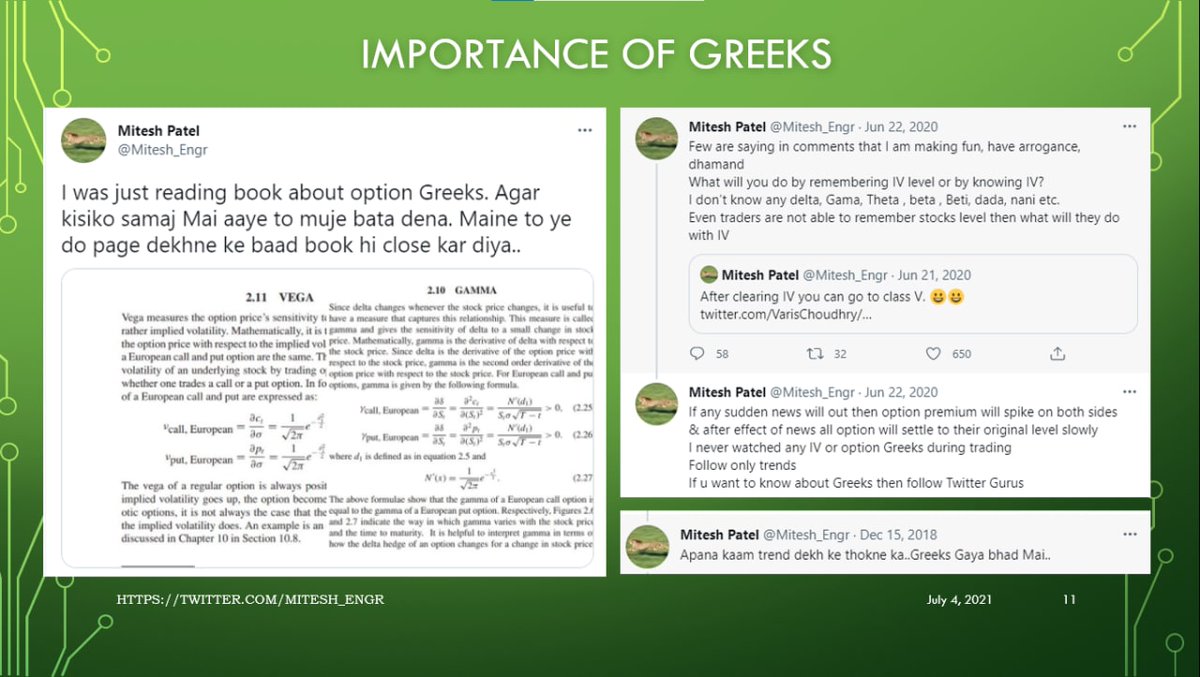

Importance of IV according to @Mitesh_Engr Sir

• Doesn't serve much purpose

• When news is priced in option premium cools

• Don't be fooled by twitter gurus

• Doesn't serve much purpose

• When news is priced in option premium cools

• Don't be fooled by twitter gurus

Importance of Greeks according to @Mitesh_Engr Sir 😂🔥

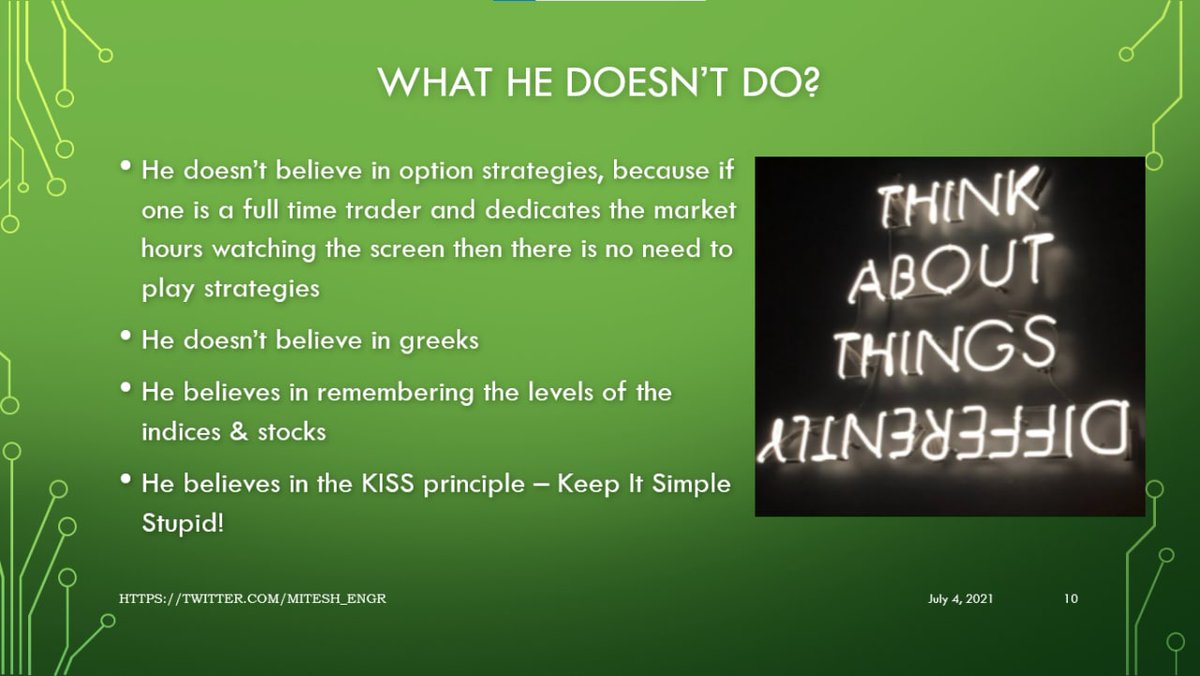

What @Mitesh_Engr Sir doesn't do

• Play strategies

• Doesn't believe in Greeks

What @Mitesh_Engr Sir does do

• Remember levels of stock/index

• Simple trading

• Play strategies

• Doesn't believe in Greeks

What @Mitesh_Engr Sir does do

• Remember levels of stock/index

• Simple trading

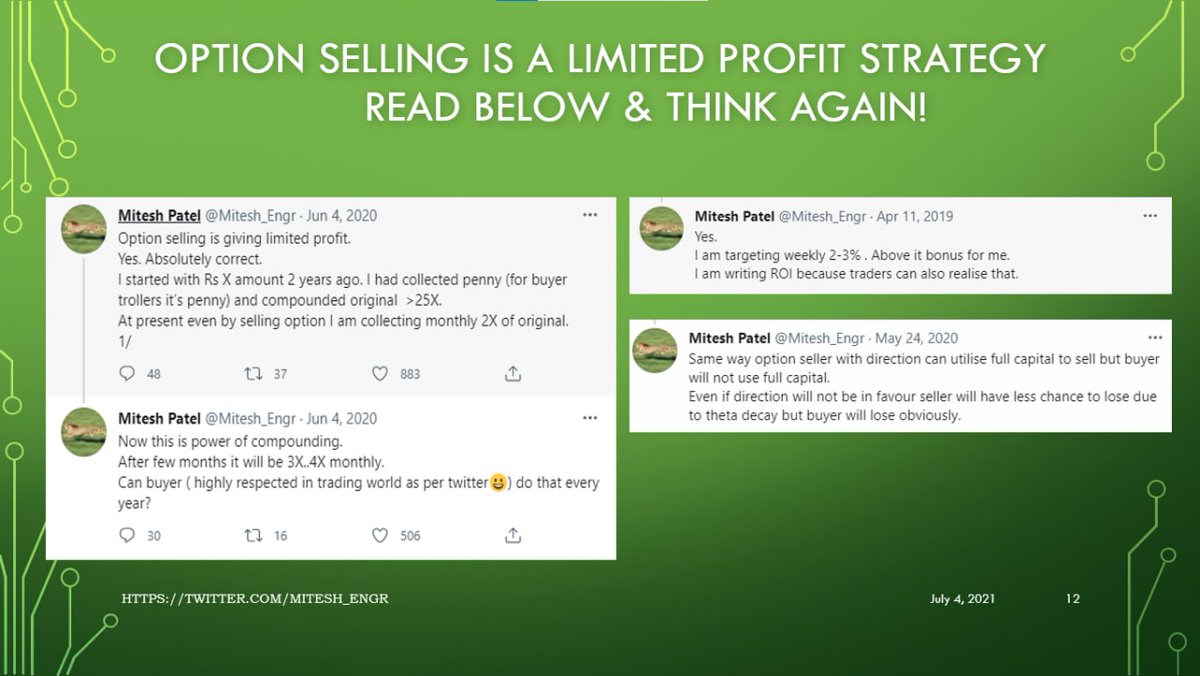

Is Option selling limited profit? Look at @Mitesh_Engr Sir's explanation and think again.

Making 2X of his original capital per month now.

Making 2X of his original capital per month now.

This was an introductory thread on how @Mitesh_Engr Sir trades positionally.

@niki_poojary and @AdityaTodmal will be making more threads on how Mitesh Sir trades

• Futures

• Expiry Trading etc etc

Keep an eye out for those threads.

Happy learning to everyone!

__________

@niki_poojary and @AdityaTodmal will be making more threads on how Mitesh Sir trades

• Futures

• Expiry Trading etc etc

Keep an eye out for those threads.

Happy learning to everyone!

__________

• • •

Missing some Tweet in this thread? You can try to

force a refresh