Why ERCOT had a close call June 14-16:

1. Demand high for June (70 GW; T in 90s), but not for summer peak (expected ~77 GW, or 80+GW in heat wave)

2. Winds very slow

3. Thermal power plant outages higher than expected (~15% of 64 GW fleet) throughout month

4. Solar kept lights on

1. Demand high for June (70 GW; T in 90s), but not for summer peak (expected ~77 GW, or 80+GW in heat wave)

2. Winds very slow

3. Thermal power plant outages higher than expected (~15% of 64 GW fleet) throughout month

4. Solar kept lights on

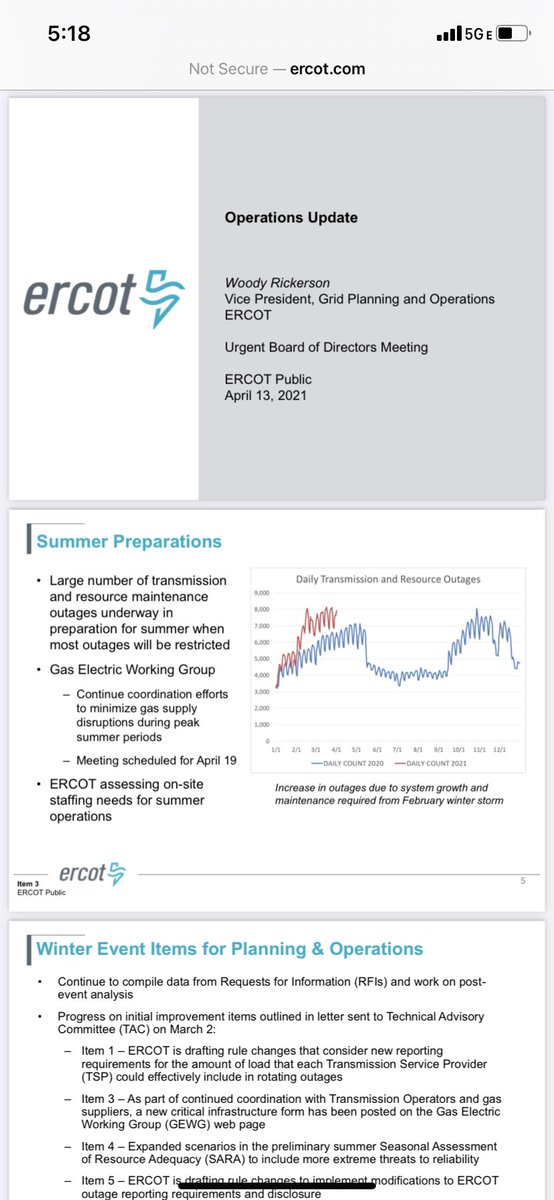

ERCOT's summer assessment of resource adequacy unrealistically expects to get 95% output from its 64 GW thermal fleet during summer peak demand. But outages have stayed ~10-15+%, and output is often below 90% even at plants that don't report outages.

As I noted here, 20 GW of ERCOT's 64 GW thermal + hydro fleet is >40 years old, and 30 GW is >30 years old. Expecting 95% output from it when we need it most seems like wishful thinking, especially given recent levels of outages.

https://twitter.com/cohan_ds/status/1406995557663580161?s=20

With ERCOT's thermal fleet aging, almost all growth has been solar & wind. Solar topping 6 GW kept the lights on while winds were so stagnant that DFW had its worst ozone smog day in 15 years. Expected unprecedented growth in solar will ease strain in future summer afternoons.

ERCOT's outage data shows outages in June at many of the same plants that struggled in February -- Parish gas and coal, Limestone coal, Barnie Davis gas, Sandy Creek coal, etc. ERCOT's "firm" power plants haven't been so firm, even without extreme summer T or drought yet.

Key caveat: I see some oddities in ERCOT outage data. E.g., Martin Lake reported "fuel problems / repairs" at its 3 huge coal units, but claimed zero reduction in capacity. So, its 2400 MW doesn't appear as outage in my plots, but may have been important.

Reporting treated the June 14-18 outages as an anomaly due to a heat wave. But it wasn’t that hot, and outages were high all month. It’s the expectations of “firm” performance that are overly optimistic.

forbes.com/sites/nicholas…

forbes.com/sites/nicholas…

Given all of the above, hard to see how ERCOT would keep the lights on if we get record heat with slow winds. No need for PTSD from February; any trouble would likely be less widespread and pass as temperatures cool and winds pick up, but rolling blackouts are certainly possible.

During tightest conditions & slowest winds (June 15 afternoon), over half of outages were from Comanche Peak nuclear, Limestone coal, Barney Davis gas, Parish coal & gas, Kiamichi gas, & Antelope Elk gas. Limestone, Davis, & Parish failed in February too.

mis.ercot.com/public/data-pr…

mis.ercot.com/public/data-pr…

ERCOT's summer SARA plan (ercot.com/gridinfo/resou…) vs. June 2021 actual outages (mis.ercot.com/public/data-pr…), which were persistently 2-3x expectations.

• • •

Missing some Tweet in this thread? You can try to

force a refresh