The #loancharge was designed to be penal in order to force people into voluntary settlement. But HMRC got carried away with their settlement terms adding IHT & penal interest. They could only do so because the #loancharge was so penal. So challenge this “fair share” claim by HMRC

This was the purpose of the #loancharge. It was meant to make the option of ‘voluntary’ settlement seem so much more attractive in comparison. Nobody was actually meant to suffer the #loancharge. But then the IHT department of HMRC decided that they too wanted their bit of flesh.

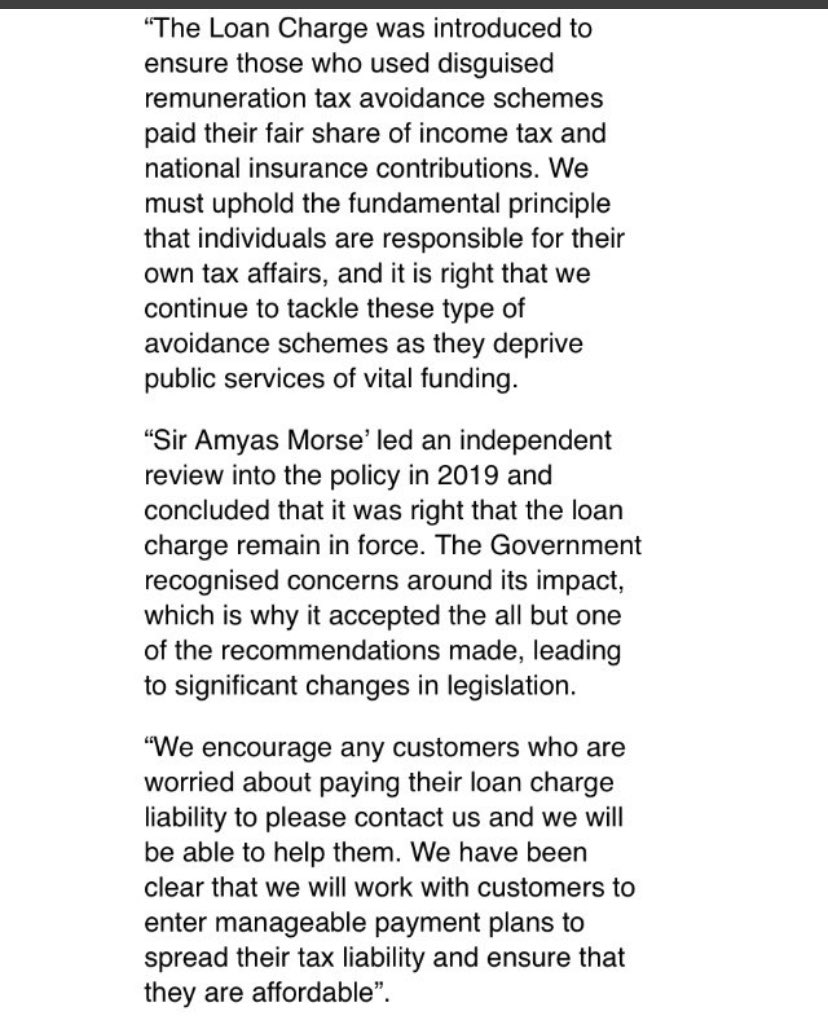

The #loancharge was never meant to be “fair” & neither now are the settlement terms. The irony of asking for IHT is that it’s due precisely because HMRC argue that it’s a write-off of a legitimate loan to the trust. (The attached was written by HMRC)

• • •

Missing some Tweet in this thread? You can try to

force a refresh