1/22

Did you know that you could get paid for participating in the Maker forum? We talked about governance, now it's time to talk about what governance can do. In this thread, let's learn about the SourceCred program in the Maker forum. Get paid to post! 💸

Did you know that you could get paid for participating in the Maker forum? We talked about governance, now it's time to talk about what governance can do. In this thread, let's learn about the SourceCred program in the Maker forum. Get paid to post! 💸

2/22

First of all, what is @sourcecred? ➡️ SourceCred is a technology for making rewardable the labor of individuals in a project or community. Specifically, SourceCred's technology determines how much value a contributor added to a project or community overall ✊

First of all, what is @sourcecred? ➡️ SourceCred is a technology for making rewardable the labor of individuals in a project or community. Specifically, SourceCred's technology determines how much value a contributor added to a project or community overall ✊

3/22

When a contributor make a contribution in a project, SourceCred's algorithm pick up that contribution and assign it an amount of "Cred" based on how much value this contribution added to the project.

When a contributor make a contribution in a project, SourceCred's algorithm pick up that contribution and assign it an amount of "Cred" based on how much value this contribution added to the project.

4/22

How the SourceCred program was implemented on the Maker forum? ➡️ A 3-month trial was proposed by LongForWisdom and Seth Benton (@zen_bacon) in June 2020 for using SourceCred as a data responsible to quantify the value of each contributor in the Maker forum 📊

How the SourceCred program was implemented on the Maker forum? ➡️ A 3-month trial was proposed by LongForWisdom and Seth Benton (@zen_bacon) in June 2020 for using SourceCred as a data responsible to quantify the value of each contributor in the Maker forum 📊

5/22

🤓 Here you can read the "SourceCred Trial Kickoff" post on Maker forum: forum.makerdao.com/t/sourcecred-t…

🤓 Here you can read the "SourceCred Trial Kickoff" post on Maker forum: forum.makerdao.com/t/sourcecred-t…

6/22

After approval, the Maker Foundation grants program allocated $25k in DAI for the next three months and distributed it to the Maker forum contributors according to Cred scores 💰

After approval, the Maker Foundation grants program allocated $25k in DAI for the next three months and distributed it to the Maker forum contributors according to Cred scores 💰

7/22

Trial was successful! 🥳 After the trial report, the working group decided to extend the trial, and after another successful outcome, MIP13c3-SP6 went into action on the Maker Governance. Here you can read the MIP post: forum.makerdao.com/t/mip13c3-sp6-…

Trial was successful! 🥳 After the trial report, the working group decided to extend the trial, and after another successful outcome, MIP13c3-SP6 went into action on the Maker Governance. Here you can read the MIP post: forum.makerdao.com/t/mip13c3-sp6-…

8/22

Remember that Maker Improvement Proposals (MIPs) are how changes and additions to the Maker Protocol and the DAO are suggested to the governance community. 🗳️ So, the MIP for SourceCred program called MIP13c3-SP6, was approved by Maker Governance in november 2020.

Remember that Maker Improvement Proposals (MIPs) are how changes and additions to the Maker Protocol and the DAO are suggested to the governance community. 🗳️ So, the MIP for SourceCred program called MIP13c3-SP6, was approved by Maker Governance in november 2020.

10/22

How it works in the Maker forum? ➡️ At the moment, SourceCred program in the Maker Forum allocates $5.000 in DAI per week destined to pay contributors and, in the same way, pay their contributions based on the value they add to the Maker community.

How it works in the Maker forum? ➡️ At the moment, SourceCred program in the Maker Forum allocates $5.000 in DAI per week destined to pay contributors and, in the same way, pay their contributions based on the value they add to the Maker community.

11/22

In other words, as a forum member, you can be PAID IN DAI for posting contributions that are valuable to the Maker community. Pretty cool, right? 🤑📣 Image source: criptomonedasweb.com/que-es-makerda…

In other words, as a forum member, you can be PAID IN DAI for posting contributions that are valuable to the Maker community. Pretty cool, right? 🤑📣 Image source: criptomonedasweb.com/que-es-makerda…

12/22

This is achieved via SourceCred's algorithm to determine what contribution is valued by the community and through the power of DAI, payments arrive on-chain to each contributor 📈📊 Here you can read the distribution for week ending June 27th: forum.makerdao.com/t/sourcecred-d…

This is achieved via SourceCred's algorithm to determine what contribution is valued by the community and through the power of DAI, payments arrive on-chain to each contributor 📈📊 Here you can read the distribution for week ending June 27th: forum.makerdao.com/t/sourcecred-d…

13/22

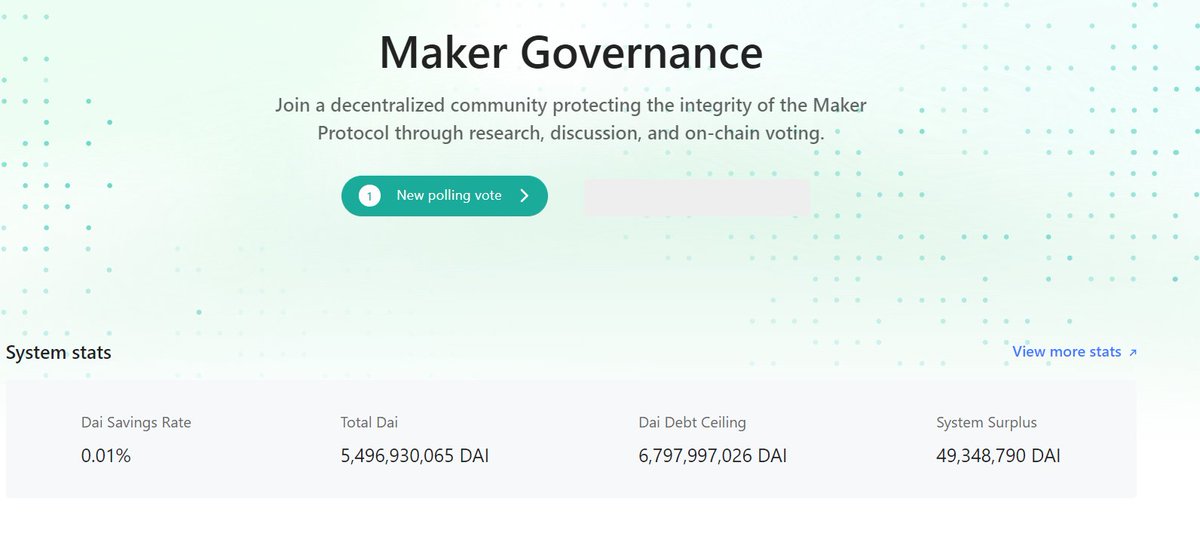

The funding comes from the Maker Protocol using funds from the surplus buffer or generated through MKR minting. Surplus buffer is the place where all DAI from Stability Fee revenue are collected 💰

The funding comes from the Maker Protocol using funds from the surplus buffer or generated through MKR minting. Surplus buffer is the place where all DAI from Stability Fee revenue are collected 💰

14/22

At the end of each month, contributors that have at least 20 DAI assigned can claim their DAI on-chain ⛓️ Scores are updated weekly and payments are made on the first week of each month 💯

At the end of each month, contributors that have at least 20 DAI assigned can claim their DAI on-chain ⛓️ Scores are updated weekly and payments are made on the first week of each month 💯

15/22

How to opt-in? ➡️ If you want to be part of this program, you just need to fill out this form: docs.google.com/forms/d/e/1FAI….

How to opt-in? ➡️ If you want to be part of this program, you just need to fill out this form: docs.google.com/forms/d/e/1FAI….

16/22

Also, you'll need to provide an Ethereum address to receive payments. This address may be tied to your identity at Maker forum. After submitting the info, the SourceCred admin at Maker forum will send you a DM to validate the submission✅

Also, you'll need to provide an Ethereum address to receive payments. This address may be tied to your identity at Maker forum. After submitting the info, the SourceCred admin at Maker forum will send you a DM to validate the submission✅

17/22

Why it is important to Maker community? 🤔➡️ According to the MIP proposal for SourceCred program, the importance of rewarding contributors in the Maker forum is based on:

Why it is important to Maker community? 🤔➡️ According to the MIP proposal for SourceCred program, the importance of rewarding contributors in the Maker forum is based on:

18/22

1️⃣ Encourage involvement in governance. The more humans you have paying attention to governance, the more chance that current issues will be discussed and understood thoroughly.

1️⃣ Encourage involvement in governance. The more humans you have paying attention to governance, the more chance that current issues will be discussed and understood thoroughly.

19/22

2️⃣ Help to align incentives between members of the Governance forum who do not hold MKR and MKR Holders.

2️⃣ Help to align incentives between members of the Governance forum who do not hold MKR and MKR Holders.

20/22

3️⃣ Larger MKR Holders have thus far been unable or unwilling to participate openly in governance, SourceCred represents a way for them to fund governance and the community contributionsthrough the protocol equally.

3️⃣ Larger MKR Holders have thus far been unable or unwilling to participate openly in governance, SourceCred represents a way for them to fund governance and the community contributionsthrough the protocol equally.

21/22

4️⃣ People spend a lot of time on the forums, making proposals and discussing the Maker protocol deeply they deserve to be compensated for their time.

4️⃣ People spend a lot of time on the forums, making proposals and discussing the Maker protocol deeply they deserve to be compensated for their time.

So, are you ready to be paid for posting? 📯

• • •

Missing some Tweet in this thread? You can try to

force a refresh