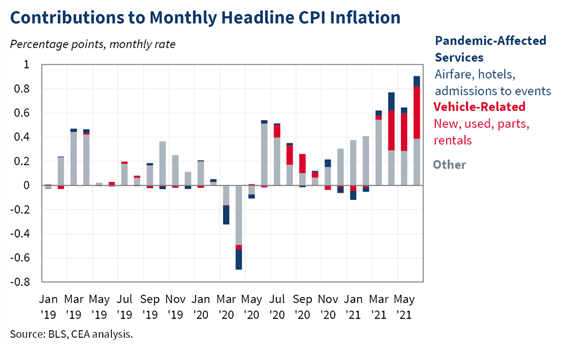

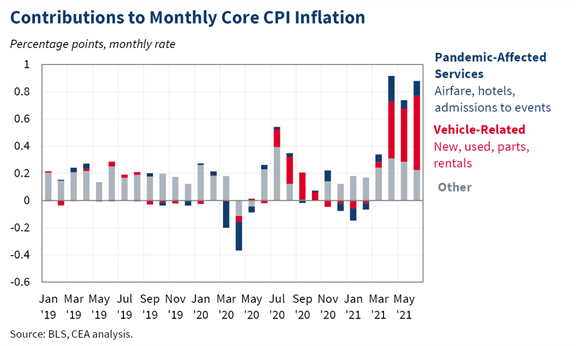

Inflation as measured by CPI increased at a 5.4% rate year-over-year last month and 0.9% month-over-month. Core inflation—without food/energy—rose 4.5% year-over-year and 0.9% month-over-month. A large part of the increase is due to cars and pandemic-affected services. 1/

Cars once again accounted for a large share of the increase. Used cars, new cars, auto parts, and car rentals together made up about 60 percent of core month-over-month inflation 2/

Prices of pandemic-affected services rose again this month and contributed 11 basis points to the core inflation increase in June. 3/

Without cars and pandemic-affected services, core inflation rose 0.22 percent month-over-month, relative to 0.28 percent in May and 0.31 percent in April 4/

The year-over-year numbers were impacted by base effects from last year, although the impact of base effects is starting to move out of the data. Starting in July, year-over-year changes in CPI will be calculated off of a price level that is above the pre-pandemic level. 5/

Controlling for base effects by smoothing across the 16 months since February 2020, the rate of CPI inflation was 3.5%. 6/

We know that the recovery from the pandemic will not be linear. The Council of Economic Advisers will continue to monitor the data as they come in. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh