• Introduction

Money loses value over time, so the goal is to protect your money against inflation, right?

Meaning - making your money grow faster than the rate of inflation.

If you don’t know what I mean, check this thread out before we start👇🏽

Money loses value over time, so the goal is to protect your money against inflation, right?

Meaning - making your money grow faster than the rate of inflation.

If you don’t know what I mean, check this thread out before we start👇🏽

https://twitter.com/talkcentss/status/1414800169934102531

• Interest rates

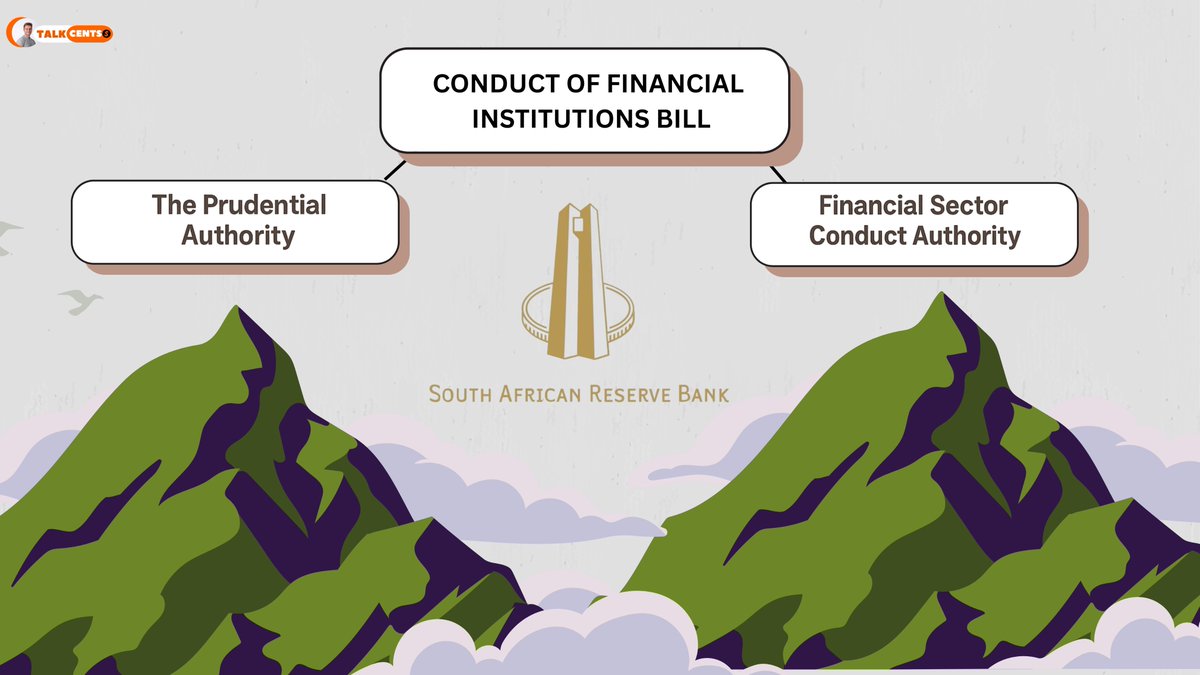

Interest rates are a monetary tool used by central banks.

It affects:

• Cost of borrowing

• Return on savings

• Returns on investment

Interest rates down = punishes savers.

Interest rates up = rewards savers.

Interest rates are a monetary tool used by central banks.

It affects:

• Cost of borrowing

• Return on savings

• Returns on investment

Interest rates down = punishes savers.

Interest rates up = rewards savers.

• Asset classes

There are many different asset classes to invest in - each with their own risk.

We always hear people saying invest in ETFs, or buy crypto without really fully understanding risk.

What if I am looking for complete safety?

Check below of some examples 👇🏽

There are many different asset classes to invest in - each with their own risk.

We always hear people saying invest in ETFs, or buy crypto without really fully understanding risk.

What if I am looking for complete safety?

Check below of some examples 👇🏽

• Fixed accounts

Fixed/ D acc are for people who really can’t handle risk, they guarantee your capital, but returns can be really low.

And at the end of the day banks restrict you from accessing your money for a set period and then they use it to invest in riskier assets.

Fixed/ D acc are for people who really can’t handle risk, they guarantee your capital, but returns can be really low.

And at the end of the day banks restrict you from accessing your money for a set period and then they use it to invest in riskier assets.

• Example:

R20 000 invested in a fixed deposit @ 7% year. (5 years)

You’ll have R28 050 (40% return) over a 5 year period.

Now it doesn’t sound impressive especially in a world of 100% return in a few week.

So why would I choose to invest in something like this?

R20 000 invested in a fixed deposit @ 7% year. (5 years)

You’ll have R28 050 (40% return) over a 5 year period.

Now it doesn’t sound impressive especially in a world of 100% return in a few week.

So why would I choose to invest in something like this?

• Pros/Cons

• Pros

- Money is guaranteed

- less risk

- No volatility

- Approaching retirement

•Cons

- Returns are lower

- No access to capital

- Penalty for early withdrawal

- Banks use your money to invest

• Pros

- Money is guaranteed

- less risk

- No volatility

- Approaching retirement

•Cons

- Returns are lower

- No access to capital

- Penalty for early withdrawal

- Banks use your money to invest

• Interest rates

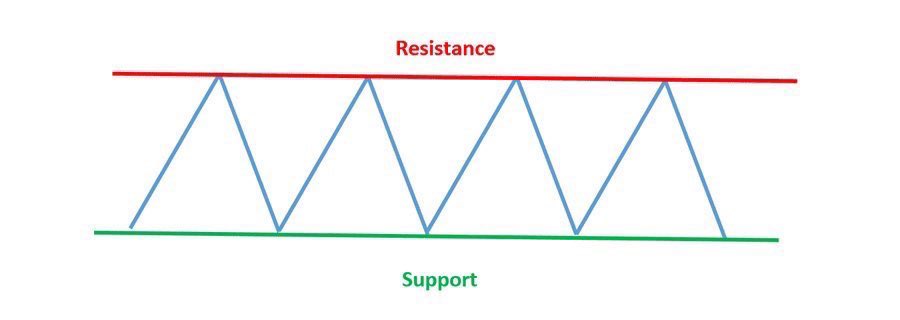

Interest Rates dictate returns, if

I/R are low then there is no real incentive to invest, but if interest rates rise then savers may opt for fixed/D. This could pull capital from other asset classes - possibly equities.

Risk premium will play a role 👇🏽

Interest Rates dictate returns, if

I/R are low then there is no real incentive to invest, but if interest rates rise then savers may opt for fixed/D. This could pull capital from other asset classes - possibly equities.

Risk premium will play a role 👇🏽

• Risk Premium

We all want to be compensated for the level of risk we take. Now, if I can earn a higher return with lower risk - then I’d take it. That’s the concept.

If rates drop it increases the risk of holding cash + vice versa.

We all want to be compensated for the level of risk we take. Now, if I can earn a higher return with lower risk - then I’d take it. That’s the concept.

If rates drop it increases the risk of holding cash + vice versa.

•How to Invest

Investing can be daunting, and knowing where to place our eggs can be challenging.

The best option is to diversify

If you are worried about fixed deposit accounts, or investing, then check this:

‘How to Invest Guide’ 👇🏽

Investing can be daunting, and knowing where to place our eggs can be challenging.

The best option is to diversify

If you are worried about fixed deposit accounts, or investing, then check this:

‘How to Invest Guide’ 👇🏽

https://twitter.com/talkcentss/status/1410099863136575490

• Local or offshore

Should I invest locally or offshore 👇🏽

Should I invest locally or offshore 👇🏽

https://twitter.com/talkcentss/status/1403260425743978496

• Tax Free Savings

Maximizing return should also be a concern.

Check out what I mean 👇🏽

Maximizing return should also be a concern.

Check out what I mean 👇🏽

https://twitter.com/talkcentss/status/1411901295716229122

• Shout out

Thanks for making it to the end.

If you want to stay up to date with more valuable information.

We make your Monday’s less blue 👇🏽

davidketh.substack.com/p/coming-soon

Thanks for making it to the end.

If you want to stay up to date with more valuable information.

We make your Monday’s less blue 👇🏽

davidketh.substack.com/p/coming-soon

• • •

Missing some Tweet in this thread? You can try to

force a refresh