1/16 Dai token bridge on @optimismPBC was launched! 🌉🚀 MakerDAO's Engineering Team and Optimism have been working very hard to bring scalability to Dai without losing Ethereum's essence! Here you can read a recap about the implications of this milestone:

2/16 Optimism Protocol, also known as Optimistic Ethereum (OE), is scaling protocol for Ethereum applications based on Layer 2 architecture 🌩️. OE is meant to look, feel and behave like Ethereum but cheaper and faster. Really cheaper and faster. 🧘

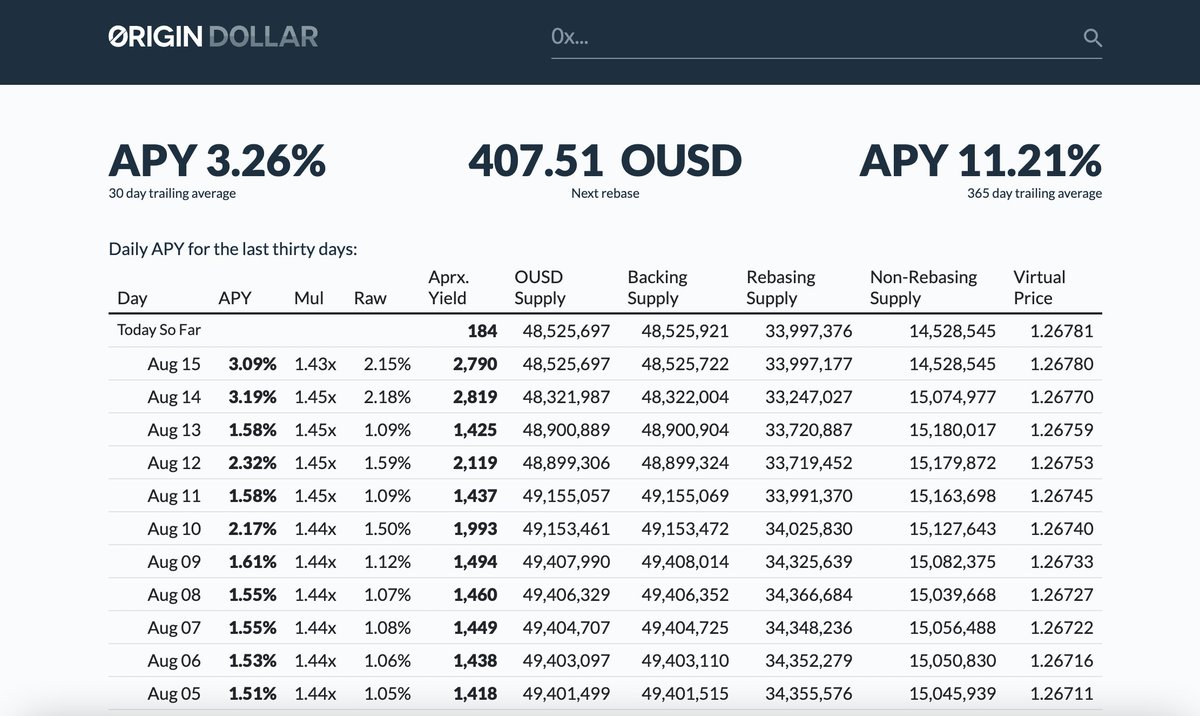

3/16 In fact, according to the Optimism Gas Comparison calculator, a MakerDAO poolet ETH conversion might be 14.5x cheaper in OE. About execution time, it's as fast as an instant. 🔦

4/16 Developers can BUIDL on Optimism just like they would on Ethereum with imperceptible differences. Existing Solidity smart contracts can run on Optimism L2 exactly how they run on L1 with very few exceptions. ✊

5/16 This is thanks to the Optimistic Virtual Machine (OVM), the backbone of the implementation that is perfectly compatible with the EVM. 🤝

6/16 OVM makes all this possible by aggregating many transactions in a rollup block for publishing them on L1 later. This is how scaling is achieved. 💨

7/16 One of the main facts of Optimistic Rollups is that they scale without sacrificing high levels of security. This is because Optimistic Rollups prevent invalid state transitions by using fraud proofs. 🔒

8/16 For example, if Jack's balance was maliciously modified in L2 they would try to replay that exact transaction on Ethereum to demonstrate the correct result there. 🙅

9/16 On the other hand, Sequencers are responsible for storing and executing user-submitted transactions locally. They need to provide a guarantee deposit in L1 to be able to do his job, with the condition that they will lose that deposit if a fraud is successfully proven. 💀

10/16📣 @ben_chain from Optimism explained it with a very cool storytelling:

You basically take some ETH and lock it up and you say "Hey, I promise to tell the truth"... If I don't tell the truth and fraud is proven, this money will be slashed ...

You basically take some ETH and lock it up and you say "Hey, I promise to tell the truth"... If I don't tell the truth and fraud is proven, this money will be slashed ...

11/16 ... Not only does some of this money get slashed but some of it will pay for the gas that people spent doing the fraud proof".

It's all about incentives guys. 💸

It's all about incentives guys. 💸

12/16 The Ethereum♻️Optimism Dai token bridge brings a fast, trustless, decentralized and modernized version of Dai that exists to facilitate cheaper transactions. Deposits are almost instant but withdrawals are subject to a 1 week wait period. 📅

13/16⚡ L2 Dai is now integrated with the Optimism Gateway UI gateway.optimism.io/welcome and is supported through Uniswap on Optimism. Anyone can now verify that they are interacting with the official Dai by the token address: 0xda10009cbd5d07dd0cecc66161fc93d7c9000da1. 📡

14/16💻 OVM state is present on L1 and can be independently verified by anyone from the Canonical Transaction Chain (CTC). It's necessary to wait one week to ensure that the computation of the corresponding state is correct.

15/16🚫 Protocol Engineering Team does not hold any upgrade keys. Changes to Dai can only be made via Governance votes on L1. 🗳️ It is worth noting that Optimism related contracts can however be upgraded by the Optimism team.

16/16 Thanks to the sources of this thread:

✅ Maker forum post: forum.makerdao.com/t/official-dai…

✅ Paradigm research: research.paradigm.xyz/rollups

✅ Optimism docs: community.optimism.io/docs/protocol/…

✅ Images from Optimism blog: medium.com/ethereum-optim…

✅ Maker forum post: forum.makerdao.com/t/official-dai…

✅ Paradigm research: research.paradigm.xyz/rollups

✅ Optimism docs: community.optimism.io/docs/protocol/…

✅ Images from Optimism blog: medium.com/ethereum-optim…

• • •

Missing some Tweet in this thread? You can try to

force a refresh