Centum is hosting an Analysts Call at 3pm following FY 2020/2021 results.

Keep it here for highlights.

#CentumFY21

Keep it here for highlights.

#CentumFY21

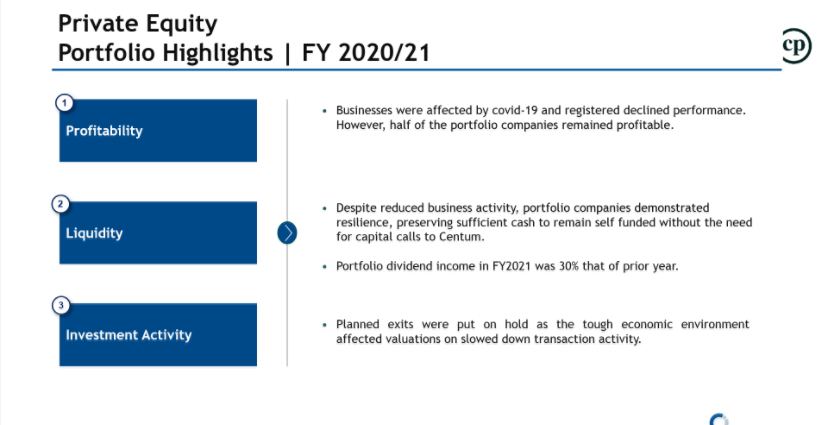

- No exits this year

- 30% expenses target by end of the strategy period

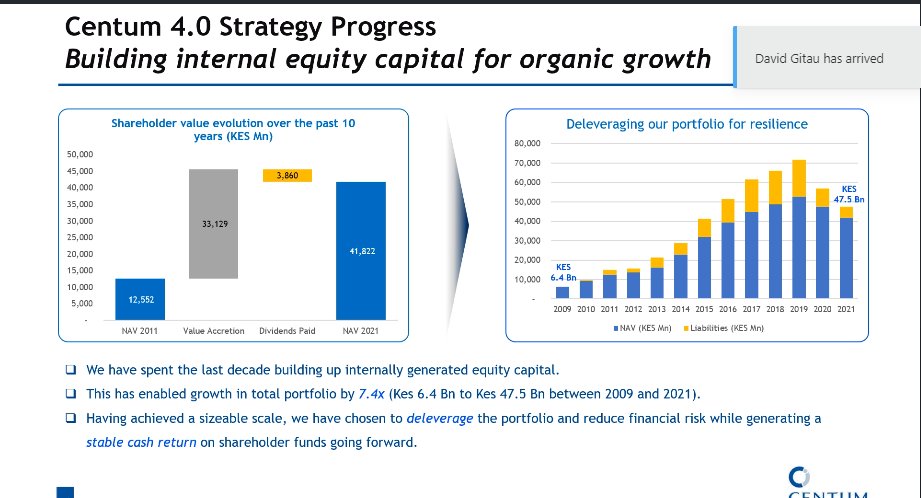

- Kshs 4.2B unrealized losses were driven by business multiples down, the performance of its businesses going down, and deferred tax being passed at 30% from the previous 5%

- 30% expenses target by end of the strategy period

- Kshs 4.2B unrealized losses were driven by business multiples down, the performance of its businesses going down, and deferred tax being passed at 30% from the previous 5%

Company Income Statement:

-Loss of Ksh 607M for the year

-Revaluations driven by low business performance

-Finance costs down following 6.6B bond redemption

-Loss of Ksh 607M for the year

-Revaluations driven by low business performance

-Finance costs down following 6.6B bond redemption

Here's an overview of @CentumPLC's portfolio.

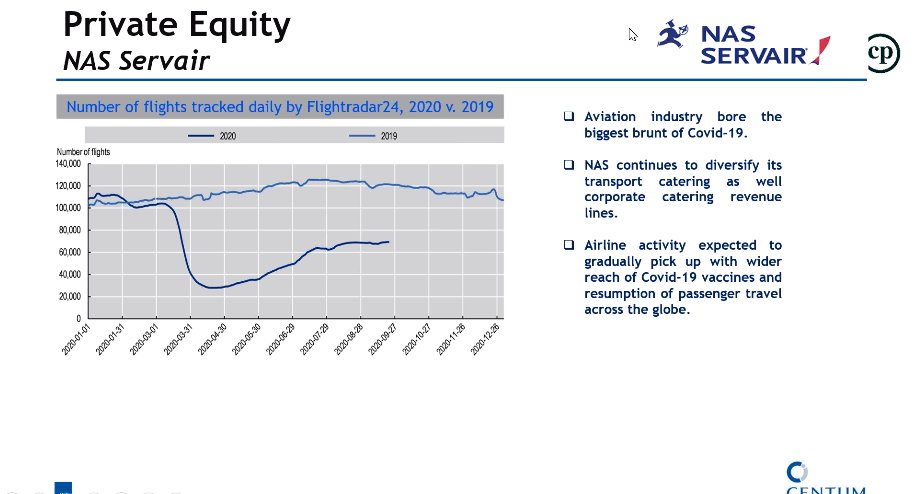

In their Private Equity segment:

Sidian Bank: Kshs 102m profit in Q1

Longhorn Publishers: 24.5% market share in Kenya

Isuzu: 20% market share gained from 2011

Sidian Bank: Kshs 102m profit in Q1

Longhorn Publishers: 24.5% market share in Kenya

Isuzu: 20% market share gained from 2011

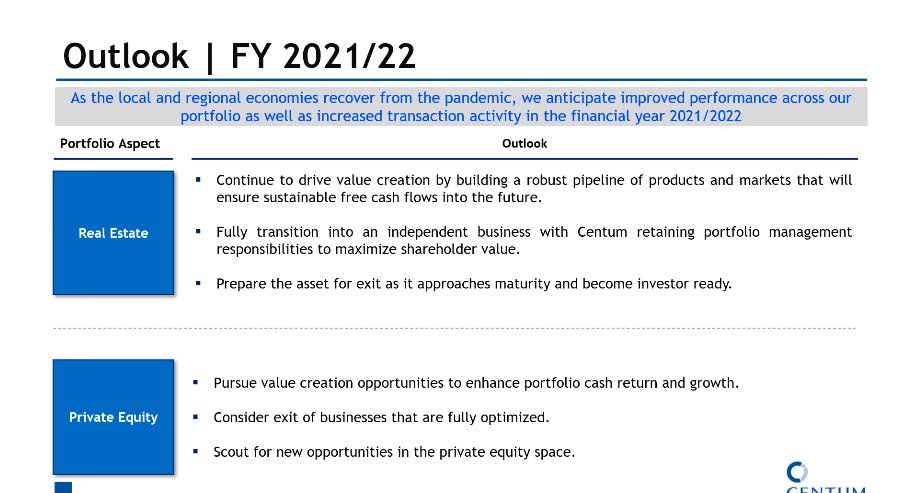

Considerations for reducing the dividend paid:

- Company profit of Kshs 245m

- Current economic uncertainties

Company looking forward to going back to its dividend policy.

- Company profit of Kshs 245m

- Current economic uncertainties

Company looking forward to going back to its dividend policy.

- On the TRDL capital restructuring, @CentumPLC intends to bring in an equity investor to reduce the debt burden

• • •

Missing some Tweet in this thread? You can try to

force a refresh