MOI Global @manualofideas fosters a community of intelligent investors united by a passion for lifelong learning. They recently did an in-depth interview with me which I enjoyed. Thank you for the same.

https://twitter.com/manualofideas/status/1421385200894976004?s=20

If I have one good idea and you have another and if we share both of us land up with two good ideas. So Let me share some key highlights to get the ideas exchange going.

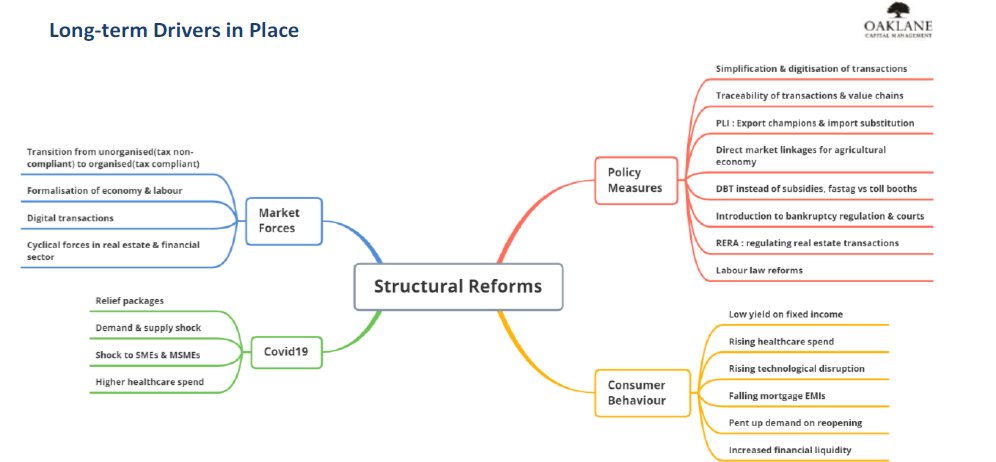

Change is the only constant! The true art of evolving as an Investor is being able to improvise & adapt.

Change is the only constant! The true art of evolving as an Investor is being able to improvise & adapt.

India is a land of opportunity, with a long runway of growth remaining due to under-penetration and demographical advantages. GDP per capita expansion and privatisation will bring about a re-rating of the Indian economy.

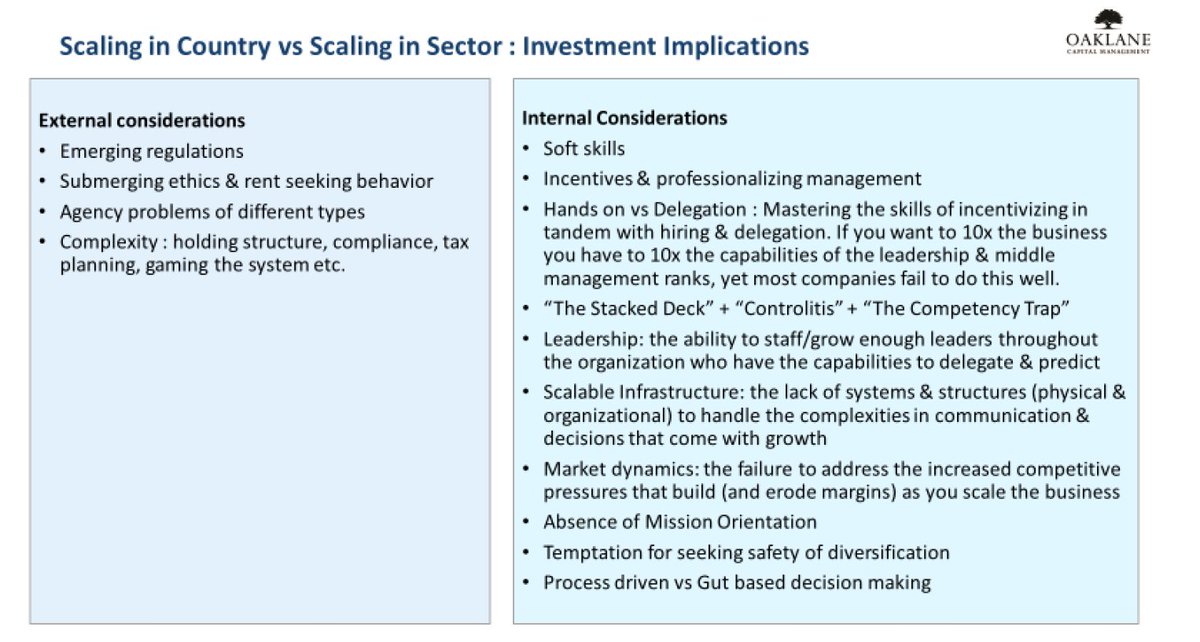

In the platform business, the stickiness of customers matters. In a technology business with a high rate of change, the holding period and the terminal value should reflect the probability of those changes.

Growing, sticky customer base and falling unit economic costs- A deadly combination. Only a paradigm shift in consumption can dislodge such a company.

Investing and business are not still photographs but an unfolding movie with many twists and turns. Watch out for capital allocation, agility, and culture.

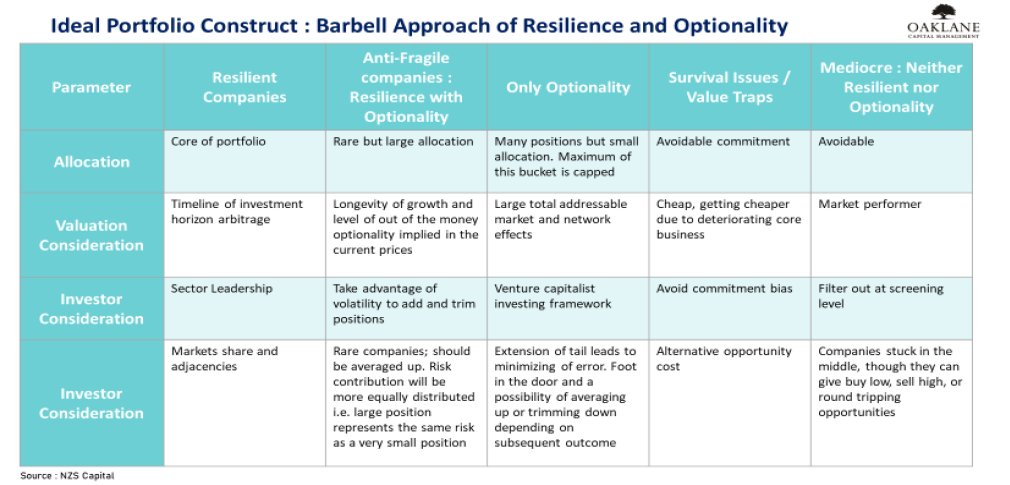

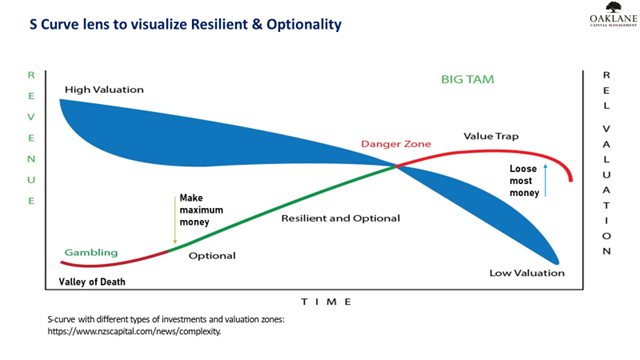

The rarest breed of Companies large addressable market and growing market share, Agile and minority friendly management capable of creating optionality, resilience & anti-fragility, deliver the most fructuous gains.

Good businesses have a narrow window of a buy zone, the long window of a holding zone, and a narrow window again of a sell zone. Evaluate companies from the perspective of maturity and reinvention ability.

Your conviction and depth of research and insights into an idea determine the size of the investment. Ideas are meant to be stress-tested not cherished so do seek disconfirming evidence.

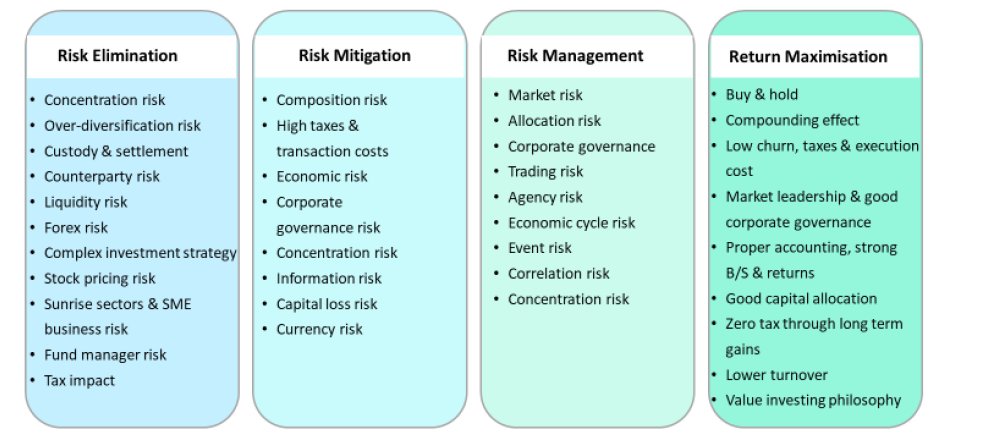

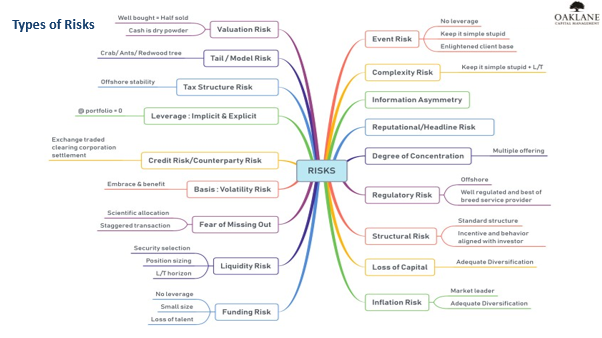

"Risk" is a four-letter word and "This time is different" is a four-word sentence defining Investing. Risk warrants additional due diligence and legitimate weighing pre-investment and reactions post-investing.

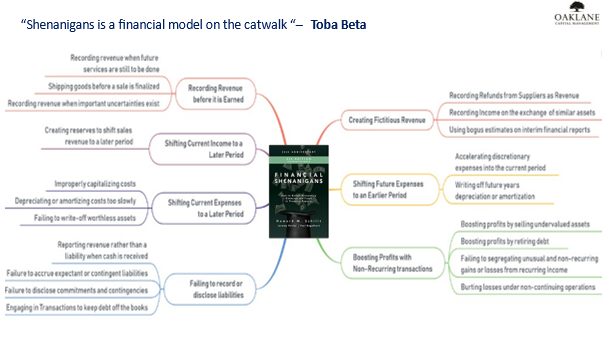

Every accounting fraud had an audited Balance sheet. Don't outsource your due diligence. Trust but verify as caveat emptor is the norm.

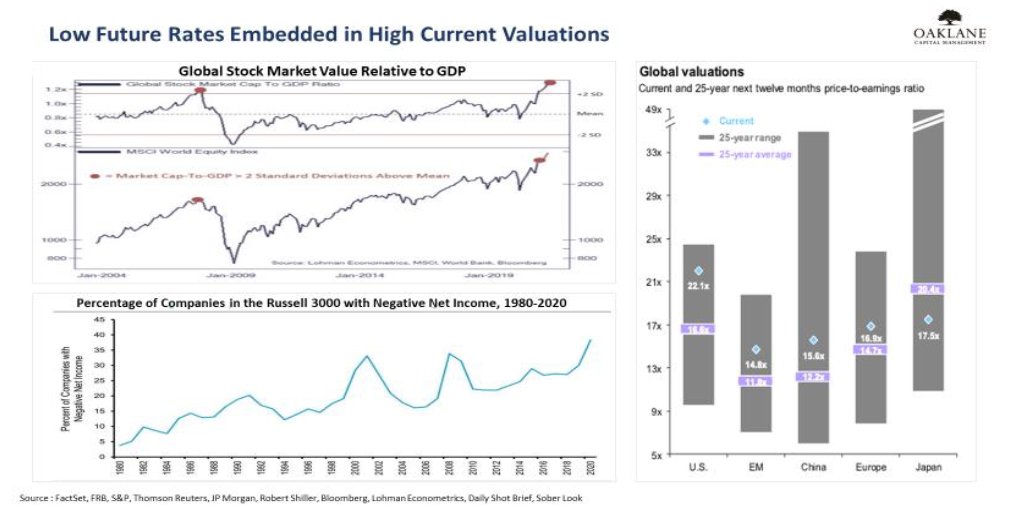

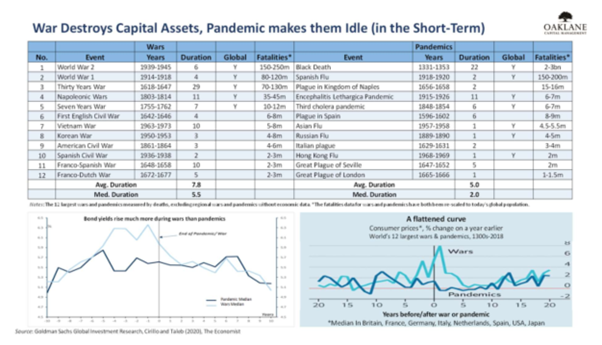

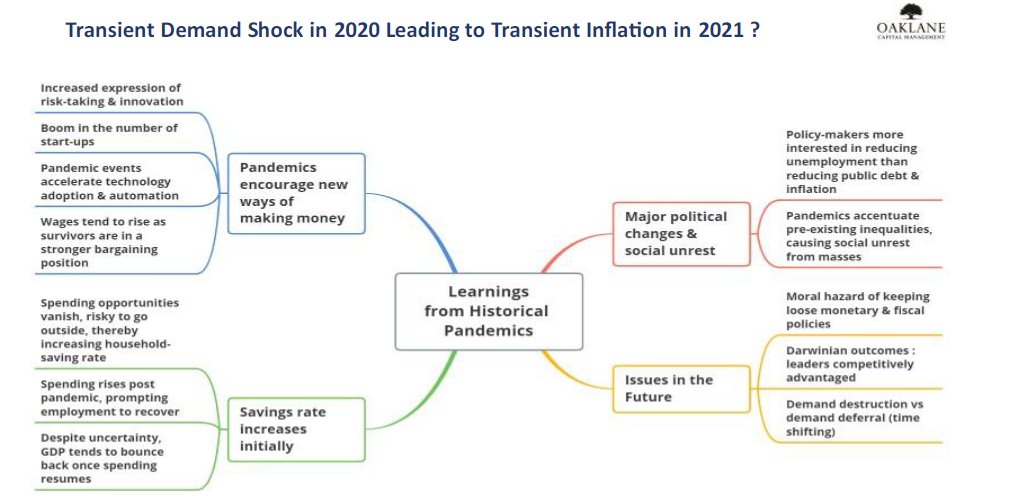

The history of the capital market has been a study of cycles and human behavior associated with them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh