💵 Stable Saving 101 💵

👉🏼 Using ‘crypto dollars’

👉🏼 AKA stable coins.

👉🏼 pegged 1:1 with the dollar

👉🏼 whose price doesn’t change.

Best 🔥 apps to get crazy good interest on these crypto dollars!

1. Watch vid

2. Read the thread 🧵

3. Earn $$$

👉🏼 Using ‘crypto dollars’

👉🏼 AKA stable coins.

👉🏼 pegged 1:1 with the dollar

👉🏼 whose price doesn’t change.

Best 🔥 apps to get crazy good interest on these crypto dollars!

1. Watch vid

2. Read the thread 🧵

3. Earn $$$

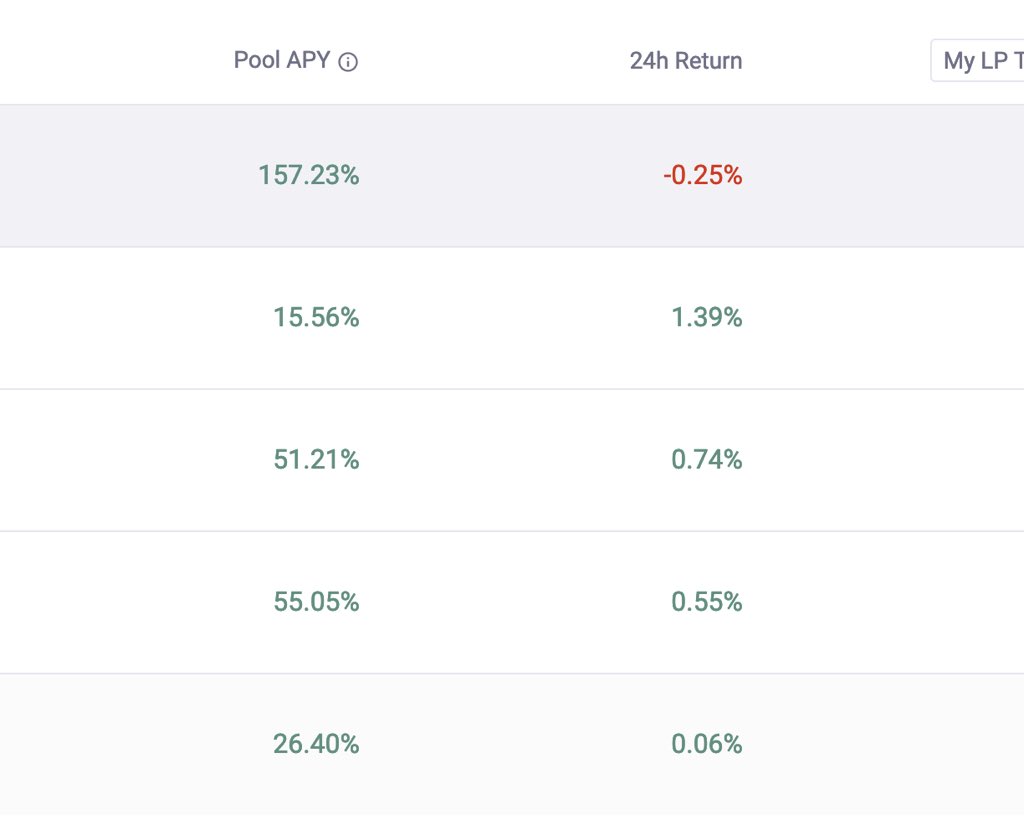

1/ @harvest_finance

👉🏼 auto compounding vaults

👉🏼 auto-sells farming rewards

👉🏼 sellers for your deposited asset

Link: harvest.finance

👉🏼 auto compounding vaults

👉🏼 auto-sells farming rewards

👉🏼 sellers for your deposited asset

Link: harvest.finance

2/ @AlchemixFi

👉🏼 solid DAI APY

👉🏼 can borrow against it

👉🏼 50% instant loan on demand

👉🏼 loan pays itself off

👉🏼 no liquidations

Link: app.alchemix.fi/vault

👉🏼 solid DAI APY

👉🏼 can borrow against it

👉🏼 50% instant loan on demand

👉🏼 loan pays itself off

👉🏼 no liquidations

Link: app.alchemix.fi/vault

3/ @CompliFi_Pro

👉🏼 double digit APY on USDC!

👉🏼 you provide liquidity to derivs

👉🏼 you get rewarded in fees

Link: app.compli.fi/pool

(Polygon network)

👉🏼 double digit APY on USDC!

👉🏼 you provide liquidity to derivs

👉🏼 you get rewarded in fees

Link: app.compli.fi/pool

(Polygon network)

4/ @PolycatFinance

👉🏼 auto compounding vaults

👉🏼 only on polygon

👉🏼 great APY for aave deposits

Link: polycat.finance

👉🏼 auto compounding vaults

👉🏼 only on polygon

👉🏼 great APY for aave deposits

Link: polycat.finance

5/ @iearnfinance

👉🏼 Mutual fund structure

👉🏼 Autopilot yield

👉🏼 USDC, DAI, USDT

Link: yearn.finance/vaults

👉🏼 Mutual fund structure

👉🏼 Autopilot yield

👉🏼 USDC, DAI, USDT

Link: yearn.finance/vaults

7/ @RariCapital (wtf 🤯)

👉🏼 low liquidity I’m assuming

👉🏼 won’t last lol don’t get hype

👉🏼 48% APY on DAI lol

Link: app.rari.capital/fuse/pool/7

👉🏼 low liquidity I’m assuming

👉🏼 won’t last lol don’t get hype

👉🏼 48% APY on DAI lol

Link: app.rari.capital/fuse/pool/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh