The US is in big trouble with twin deficits & high debt.

But few realize that a Fed-issued digital USD token can change the fate of America.

How?

Grab a coffee ☕️ & read on 👇

But few realize that a Fed-issued digital USD token can change the fate of America.

How?

Grab a coffee ☕️ & read on 👇

Contrary to common beliefs, America’s biggest export is not tech, not Hollywood…

It’s the USD.

USD is the biggest money network in the world—used for 40-50% of global trade settlement and int’l credits.

It’s the USD.

USD is the biggest money network in the world—used for 40-50% of global trade settlement and int’l credits.

With reserve currency status, USD allows America to get away with murder w/ its monetary policy, and run up debt to levels disastrous for other countries.

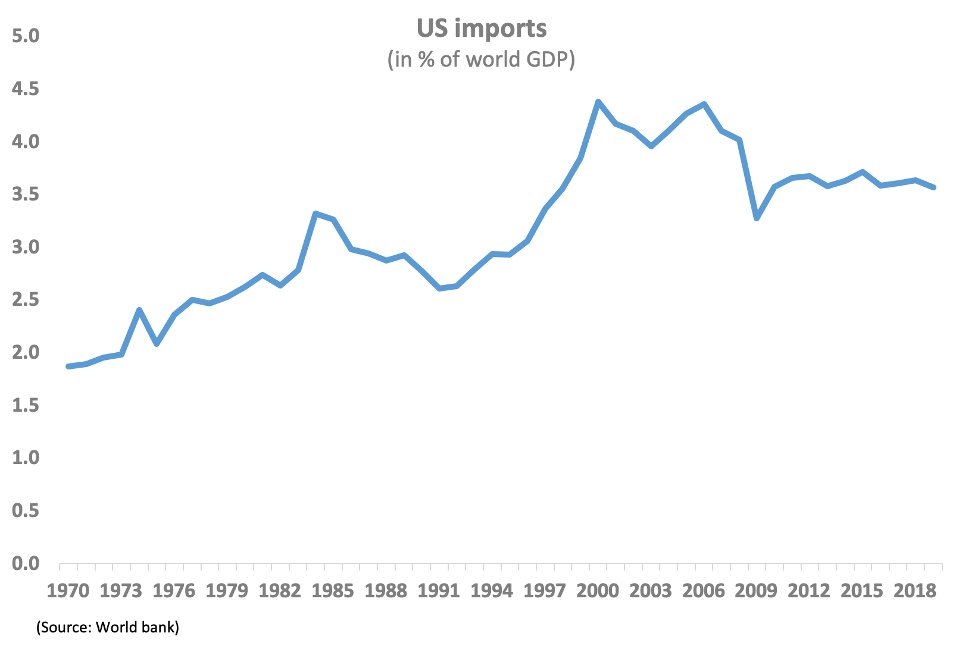

Since the end of Bretton Woods, US has run a trade deficit every year. But that’s only counting the trade balance other than the “export” of USD.

Providing a medium of exchange and store of value for the world is a lucrative monopoly business. World trade expands every year. So does its demand for dollar. Everyone needs it to buy oil and stuff, and issue their own debt in.

Let’s call the USD export “dollar-as-a-service”. Except, obviously, it’s not counted in int’l trade stats. The benefits America gets from USD is an intangible seigniorage income.

Since this is not counted in trade balance, what you see in stats is US running a large current account deficit (i.e. imports more than exports, roughly speaking).

That means the US is accumulating debt against other countries— China says, “Take our exports and pay us later. We’ll take US treasuries as IOUs.”

So what you see is:

US trade deficits, accumulated over time ≈ US external debt

But since dollar-as-a-service doesn’t show up on the books, the reality should be:

US trade deficits - “dollar as a service” exports, accumulated over time ≈ US external debt

US trade deficits, accumulated over time ≈ US external debt

But since dollar-as-a-service doesn’t show up on the books, the reality should be:

US trade deficits - “dollar as a service” exports, accumulated over time ≈ US external debt

First implication: the actual worth of US external debt should be less than whatever number showing on the books.

That means foreign creditors earning low or negative real interest rates on their US treasuries is justified. It should be the norm, not the exception.

That means foreign creditors earning low or negative real interest rates on their US treasuries is justified. It should be the norm, not the exception.

Look at this relationship one more time:

US trade deficits - “dollar as a service” exports, accumulated over time ≈ US external debt,

you’ll see a 2nd implication:

US trade deficits - “dollar as a service” exports, accumulated over time ≈ US external debt,

you’ll see a 2nd implication:

Other things equal, if the US wants to lower its debt, it needs to increase the value of its dollar-as-a-service exports.

But how?

By making the USD money network bigger and easier to use.

But how?

By making the USD money network bigger and easier to use.

It’s the classic Metcalfe’s law. The value of a network grows exponentially with the number of users. That’s why big networks like Facebook and Uber are so valuable. Folks like @RaoulGMI explain this beautifully.

Unfortunately in reality the value of the USD network has been declining, not increasing. This is because—

It’s been harder and harder to get USD.

Other countries get their hands on USD by exporting to the US. That’s the main way for USD to flow out of America. (There’re other ways, e.g. US can make investments overseas or give grants. More on that in a sec.)

Other countries get their hands on USD by exporting to the US. That’s the main way for USD to flow out of America. (There’re other ways, e.g. US can make investments overseas or give grants. More on that in a sec.)

That means USD is becoming less available outside the US, relative to the growing needs of global commerce. The growth of USD network value is limited on the supply side.

Fortunately, internet + digital currency makes it possible to grow a money network at low cost. This can be a big leverage for the Fed. The world already wants USD. Demand will be enormous if the tech is unleashed.

So if you were the Fed, how should you play this?

Here’s a 6-step playbook for you.

Here’s a 6-step playbook for you.

Step 1. Issue a digitalUSD token available to the whole world.

And like what @CryptoHayes said, make your APIs available for anyone to build on, and make your network interoperable w/ major public blockchains.

And like what @CryptoHayes said, make your APIs available for anyone to build on, and make your network interoperable w/ major public blockchains.

You’ll need to handle astronomical numbers of transactions. Building out this infrastructure is no small feat and a big investment. But compared to the ungodly amount you wasted in Iraq and Afghanistan, this is smart spending.

Step 2. Call on your big tech companies to build distribution.

Even the hottest hooker can use a good pimp. Your big tech like Facebook and Google always have world-wide userbase. Leverage that.

Even the hottest hooker can use a good pimp. Your big tech like Facebook and Google always have world-wide userbase. Leverage that.

Let the FAANG offer their users digital wallets that interact with your APIs. They can build layer 2, layer 3 products on top of your network. Let your banks do the same.

You can even airdrop to those wallets to supercharge adoption. If you give everyone in the world $5 for opening a digitalUSD wallet, it would only cost you $40 billion to cover entire world population. That’s peanuts compared to the network effect it’ll create.

Don’t fight with your FAANG. Collaborate. Or they will start their own tokens and eat your lunch.

Step 3. Let the stablecoins live.

The USD stablecoins increase your network reach without you lifting a finger. As long as you strictly regulate the types of assets they can use to “back” the stablecoin and make sure it doesn’t distort the demand of USD assets, let them operate.

The USD stablecoins increase your network reach without you lifting a finger. As long as you strictly regulate the types of assets they can use to “back” the stablecoin and make sure it doesn’t distort the demand of USD assets, let them operate.

They won’t get too big once you start your own digitalUSD.

Step 4. Nip the dollar appreciation in the bud.

At some point you need to start charging fees for activities on the digitalUSD network, but not for the reason you may think.

The world wants dollar. When you make USD easy to access, it will bid up the price.

At some point you need to start charging fees for activities on the digitalUSD network, but not for the reason you may think.

The world wants dollar. When you make USD easy to access, it will bid up the price.

Tether, the stablecoin with a large user base in emerging markets, has traded above $1 in much of its existence. This gives you a glimpse of what will happen when the developing world can get the “real” USD.

https://twitter.com/RealNatashaChe/status/1414238085424898052?s=20

On top of that, the value of digitalUSD network will increase as its size grows. That puts additional upward pressure on the dollar. You can’t let that happen, since the USD is already the source of severe Dutch Disease for America.

“Dutch Disease” is the term for a phenomenon where high demand for a single commodity export pushes up the exporting country’s exchange rate so much, and leads to things like

•overvalued currency

•ballooning imports

•death of manufacturing b/c they’re no longer price competitive

•soaring prices in non-tradable services like healthcare

•large inequality as people in manufacturing lose jobs

•ballooning imports

•death of manufacturing b/c they’re no longer price competitive

•soaring prices in non-tradable services like healthcare

•large inequality as people in manufacturing lose jobs

Usually the problematic commodity is a natural resource like oil. But in the case of the US, it’s the USD.

As @bhgreeley brilliantly puts it, America has become the Saudi Arabia of money.

As @bhgreeley brilliantly puts it, America has become the Saudi Arabia of money.

(BTW, quit blaming China for undervaluing the yuan already. You’re the bigger problem. Not them.)

This USD Dutch Disease is the root cause of so many social economic problems in the US today. A worldwide digitalUSD network will only make them worse.

That’s why you need to add fees, i.e. taxes, to transactions on the network. The seigniorage that used to be implicit, you can make it explicit now thanks to technology.

It gives you a powerful “monetary policy” tool to moderate the demand for USD and its exchange rate, plus allowing you to legitimately make money from your dollar exports.

BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 natashache.com/newsletter/

Step 5. Get more digitalUSD token deployed abroad by investing overseas.

If you can curb the dollar appreciation, then the growth of digitalUSD network should not lead to higher imports or bigger trade deficits.

If you can curb the dollar appreciation, then the growth of digitalUSD network should not lead to higher imports or bigger trade deficits.

But as mentioned earlier, the main way for USD to flow out of America has been through US importing from the world. Now you don’t want to import more, but still need to get adequate amount of USD circulating outside the States, to grow your network. How?

Free airdrops are pocket changes. They only get you so far. What you really need is to ramp up investments overseas, big time.

So instead of importing foreign stuff, you buy foreign land, invest in foreign infrastructure, take stakes in foreign companies. Also, make it no-brainer for your citizens to invest overseas (e.g. lower capital gain tax on foreign incomes? 🤔)

That’s how you get USD into foreign hands.

The Chinese have been doing this for years and now owns half of Africa and much of everywhere else. Swallow your pride and copy trade.

Investing abroad, rather than using the money you make from digitalUSD to feed your budget deficit, also helps control your Dutch Disease.

And let’s not kid ourselves. If you’re allowed to spend that income from digitalUSD domestically, you’ll blow it on more entitlements and overpriced healthcare. Better stack that money elsewhere out of sight.

Step 6. Enjoy reserve currency status for another 20 years.

The bigger the digitalUSD network gets, the more money you can make from dollar-as-a-service exports. You’ll have unprecedented room to print money out of thin air and pay little for the debt you owe.

The bigger the digitalUSD network gets, the more money you can make from dollar-as-a-service exports. You’ll have unprecedented room to print money out of thin air and pay little for the debt you owe.

But none of this will help if you keep squandering money on healthcare and entitlements or your stupid wars.

Because all that digitalUSD does is to buy you time, to get your affairs in order before your reserve currency status is lost to competition, along with your biggest export.

In a world where anybody can issue and distribute a digital token at minimum cost, money will be dragged off its pedestal. The USD will have to cede its monopoly to a great many competitions eventually.

But there is a 15-20 year time window before that happens. For now the USD can leverage digitization to maximize its gain from monopoly, but it needs to do it quickly.

If the US can treat this as a one-off windfall opportunity and manage it wisely, it can pave the road to a new era of American prosperity. And the eventual loss of dollar exports would not be painful.

Like this? I write about ideas to help you become smarter, richer, freer. Follow me on Twitter for updates 👉 @RealNatashaChe .

• • •

Missing some Tweet in this thread? You can try to

force a refresh