Premier League total income for 2019/20 down £633 million compared to previous season as Covid impact from March onwards. Gap between G6 and Other 14 average narrowed from £345m to £303m, which may 'justify' (in their own minds only) Project Big Powergrab & SuperLeague Franchise

EPL matchday income down 14% due to lockdown impact. Manchester United knocked off their perch for first time in EPL history by Spurs, who went from 4th to 1st. G6 clubs had 73% of matchday income, due to bigger stadia & more matches due to UEFA participation.

EPL broadcast income down £703m. Noticeable that Arsenal earned less than Sheffield United, a sign of a club clinging onto its 'Big Six' status?

Commercial income least affected of the three main tiers in EPL in 19/20 as increased by £175m. G6 clubs had 77% of the total.

As a result broadcast revenue fell from 59% to 51% of total income in 2019/20. Expect to bounce back in 2020/21 as more matches shown in the accounting year periods and rebates less severe.

PL wages £3.25 billion in 2019/20, compared to £3.12bn previous season. Would be higher as many contracts performance related & bonuses not paid by 30 June due to lockdown and season not finishing by that date. Mean weekly wage up 3,118% since start of EPL.

Amortisation (transfer fees spread over contract life) £1.37bn in 2019/20 up 6% on previous season. Manchester City leapfrog Chelsea and Manchester United to top the table. Spurs perhaps punching above their weight? Overall wages & amortisation 101% of total income in 19/20.

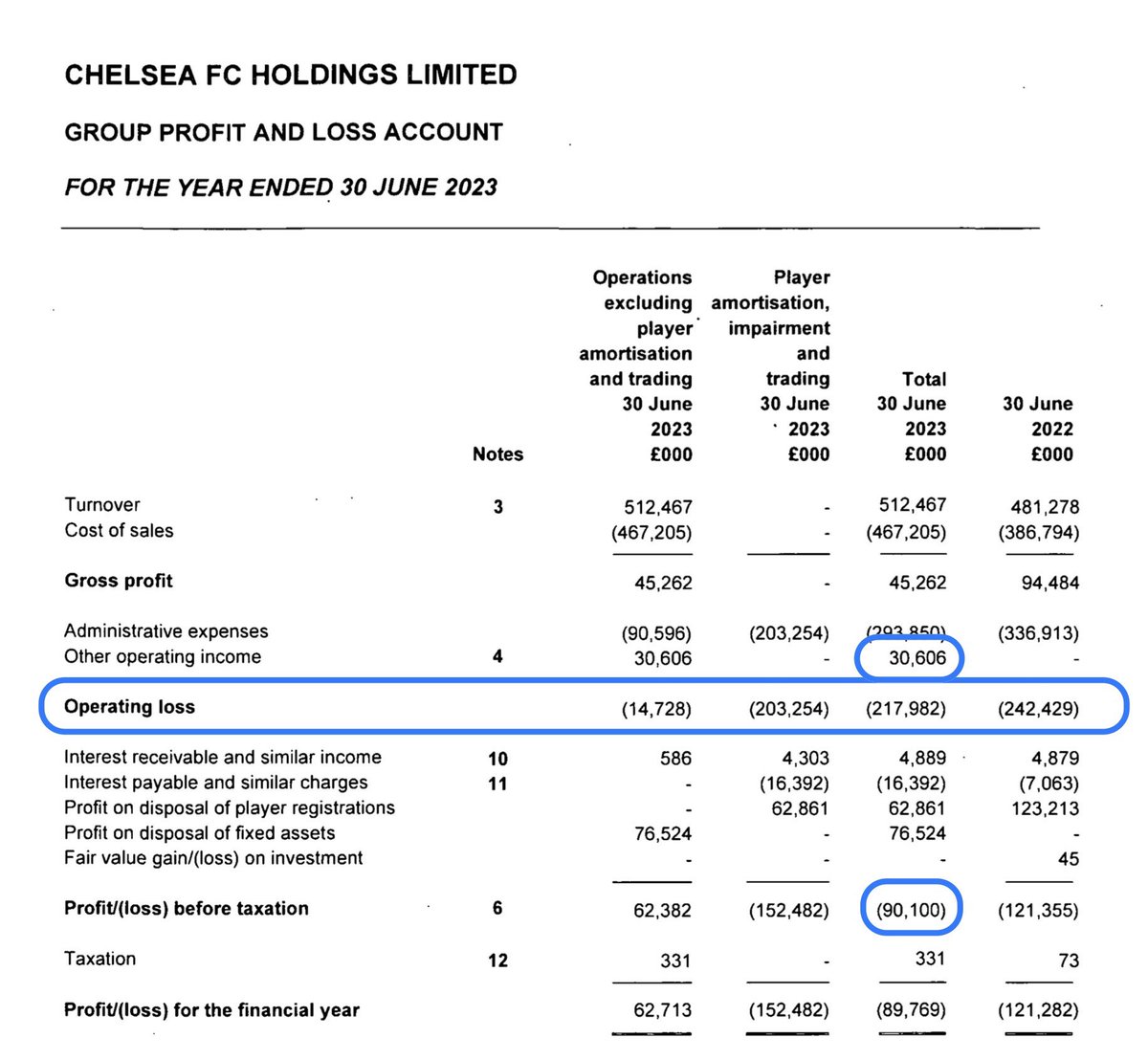

Profit can be defined in many ways by those wacky accountants. EBIT (operating profit pre-finance costs and excluding player sales and one-off items) was £1.26bn in 2019/20, up from £395m the previous season. Only two clubs made a prpfit compared to 7 in 18/19

EBITDA profit excludes player amortisation & infrastructure depreciation. Some like it as better indicator of 'cash' profit from day to day activities. Clubs went from £1.06bn profit in 18/19 to £209m in 19/20.

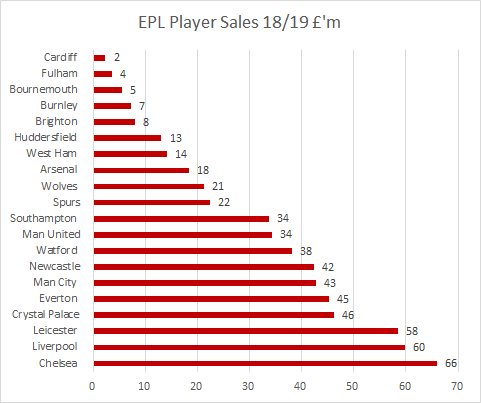

Losses can be mitigated by player sales. These totalled £542m in 19/20 compared to £434m the previous season, mainly due to Chelsea selling Hazard.

After taking into account player sales and finance costs on borrowings, EPL clubs overall made a £993m pre-tax loss in 2019/20 compared to £155m in 2018/19. Covid impact will be felt in 2020/21 too.

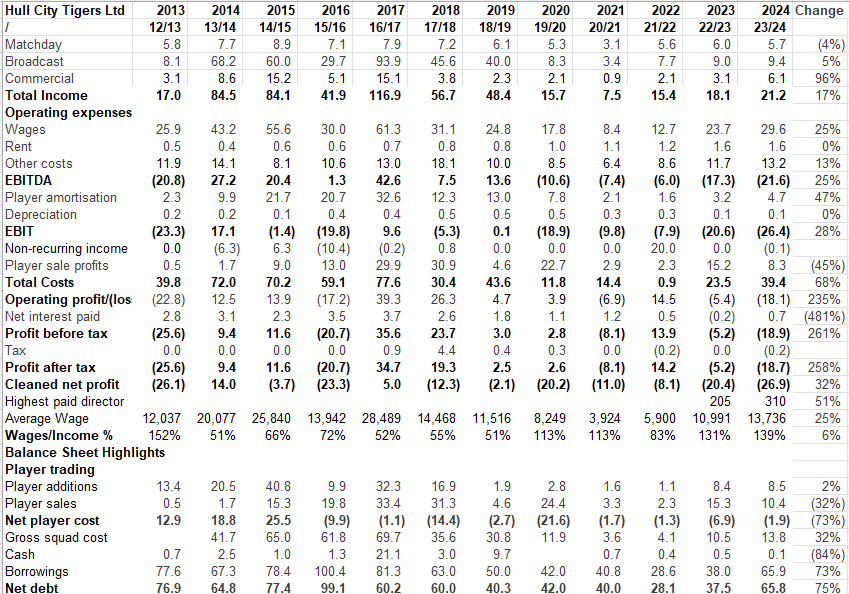

Player trading: May surprise Arsenal fans but they were the biggest spenders in 2019/20. Total player purchases £1,601bn compared to £1,867m the previous season. Chelsea top the player sales charts for fifth season in a row.

Total cost of squads at end of 19/20 was £7,428,000,000, up £691m on previous summer. Manchester City could have the first £1bn squad cost following purchase of Jack Grealish.

Football Net Debt, defined by UEFA as borrowings plus player transfer creditors less cash less football transfer debtors, was £4.17 billion at end of 19/20. Some loans are from owners and considered 'soft' with zero interest and no demand for repayment (eg Abramovich & Bloom)

• • •

Missing some Tweet in this thread? You can try to

force a refresh