My Investment Thesis on the Rise of The Gig and Freelance Work Economy.

The contrarian reason I chose $UPWK over $FVRR.

Full Thread Below:

The contrarian reason I chose $UPWK over $FVRR.

Full Thread Below:

1/The Market Opportunity:

+ 80% of gig transactions are still happening offline

+ The share of full-time freelancers and job market grew from 17% to 28% from 2014 to 2019.

+ 59Million Freelanced in 2020

+ 10+ Million Freelancers last year.

+ Over 50% are Gen Z and Millennials.

+ 80% of gig transactions are still happening offline

+ The share of full-time freelancers and job market grew from 17% to 28% from 2014 to 2019.

+ 59Million Freelanced in 2020

+ 10+ Million Freelancers last year.

+ Over 50% are Gen Z and Millennials.

2/ Key Drivers for Work Marketplaces:

1/ Trust: Ability to trust the ratings and reviews

2/ Access to Buyers

3/ Product Offering

4/ Transaction Fees

5/ Network Effects (especially cross-border)

6/ Commoditized vs Differentiated Supply

7/ Economic Value

8/ Aggregating Demand

1/ Trust: Ability to trust the ratings and reviews

2/ Access to Buyers

3/ Product Offering

4/ Transaction Fees

5/ Network Effects (especially cross-border)

6/ Commoditized vs Differentiated Supply

7/ Economic Value

8/ Aggregating Demand

3/ Key Dominant players are:

1. Upwork

2. Fiverr

Then,

a Freelancer

b. Toptal

c. Axiom in Legal.

d. Reruits (owns Glassdoor)

e. Adeco

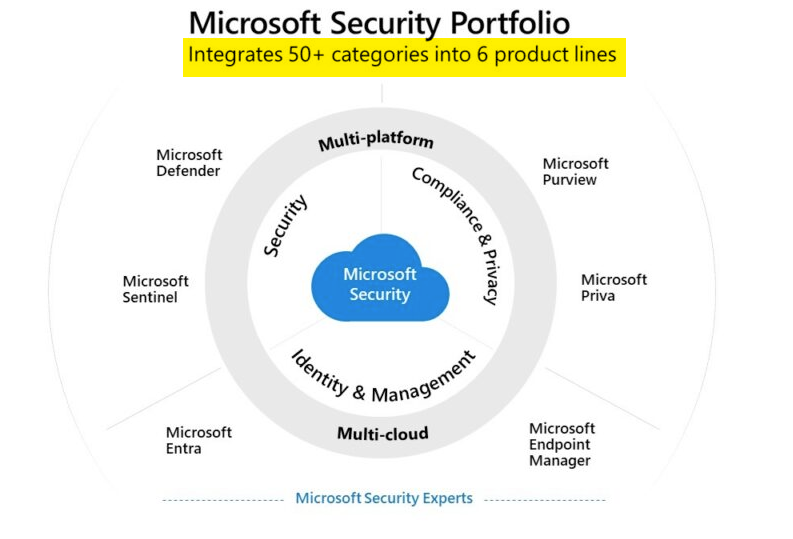

f. Microsoft (LinkedIn)

1. Upwork

2. Fiverr

Then,

a Freelancer

b. Toptal

c. Axiom in Legal.

d. Reruits (owns Glassdoor)

e. Adeco

f. Microsoft (LinkedIn)

4/ Why pick $UPWK? -Reason I

The most dominant player.

They were pioneers.

They have the largest work marketplace and da biggest transaction value

Lots of Data network effects emerge!

They have the most comprehensive product offering for all areas of the freelance economy.

The most dominant player.

They were pioneers.

They have the largest work marketplace and da biggest transaction value

Lots of Data network effects emerge!

They have the most comprehensive product offering for all areas of the freelance economy.

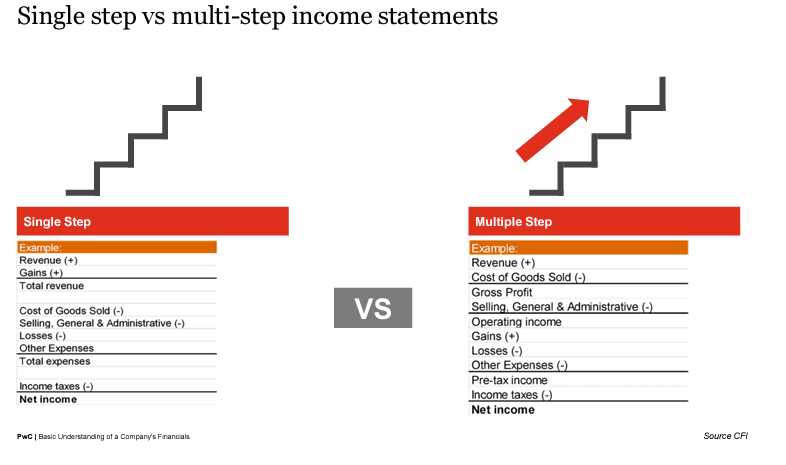

5/ R-II - Business Model:

$UPWK has a hybrid model that combines the normal freelance platform + Staffing Services.

As a result, their model is more resilient and diversified with more revenue sources.

This market positioning allows them to capture more opportunities.

$UPWK has a hybrid model that combines the normal freelance platform + Staffing Services.

As a result, their model is more resilient and diversified with more revenue sources.

This market positioning allows them to capture more opportunities.

6/ R-III: Enterprise & B2B Model:

$UPWK has a strong enterprise focus.

+ 50%+ of Fortune 500 use $UPWK, eg $MSFT & more

+ Freelancers in 180 countries

Enterprise bring more stability to freelancers and vice-versa. *Over 50% of spending within the industry is within Enterprise.

$UPWK has a strong enterprise focus.

+ 50%+ of Fortune 500 use $UPWK, eg $MSFT & more

+ Freelancers in 180 countries

Enterprise bring more stability to freelancers and vice-versa. *Over 50% of spending within the industry is within Enterprise.

7/ R-IV: Product Stickiness:

Below are some enterprise metrics:

+ Builds on RII & RIII, That spend retention 115%+ is impressive for a marketplace

+ They added 30-new major clients recently

+ Recently, the GSV per client is $4K+

The retention metrics shows how $UPWK is sticky.

Below are some enterprise metrics:

+ Builds on RII & RIII, That spend retention 115%+ is impressive for a marketplace

+ They added 30-new major clients recently

+ Recently, the GSV per client is $4K+

The retention metrics shows how $UPWK is sticky.

8/ CAC to LTV of Client Enterprise strength:

Observe d. growth, continuity and recent high spend of their client cohort acquired. I put $FVRR cohort too. The key is $UPWK's client spend more.

Retention of cohort is key due to platform leakage that freelance platforms suffer.

Observe d. growth, continuity and recent high spend of their client cohort acquired. I put $FVRR cohort too. The key is $UPWK's client spend more.

Retention of cohort is key due to platform leakage that freelance platforms suffer.

9/ R-V- Staffing Marketplace Leader & Optionality:

$UPWK was recently announced, A Leader within Digital Staffing Marketplaces.

$UPWK had the most breadth, most advanced tech offering + robust talent network 10M.

$UPWK is a leader in another industry + a bonus for enterprise

$UPWK was recently announced, A Leader within Digital Staffing Marketplaces.

$UPWK had the most breadth, most advanced tech offering + robust talent network 10M.

$UPWK is a leader in another industry + a bonus for enterprise

10/ R-V Cont'd: $UPWK's Enterprise & Staffing Competitive Advantage:

This 3rd-party report from Ardent outlines strengths of $UPWK's platform. Pls read:

Major part of their success is their $UPWK Enterprise Solution. I've read expert transcripts that confirm these strengths.

This 3rd-party report from Ardent outlines strengths of $UPWK's platform. Pls read:

Major part of their success is their $UPWK Enterprise Solution. I've read expert transcripts that confirm these strengths.

11/ Ct'd:

Due to $FVRR's model of short gigs, it needs to constantly acquire new customers and make take-rate high bcos most transactions are short-term (keeps S&M high)

Compared to UPWK's B2B enterprise model which is more long-term, sustainable & large $ contracts due to B2B

Due to $FVRR's model of short gigs, it needs to constantly acquire new customers and make take-rate high bcos most transactions are short-term (keeps S&M high)

Compared to UPWK's B2B enterprise model which is more long-term, sustainable & large $ contracts due to B2B

12/R-VI: $UPWK's Project Catalogue

This is the area where $UPWK plays against $FVRR on short-gigs. $UPWK has a strong SMB presence w. this eCommerce product. 10% of $UPWK growth is now due to it

Vice-versa, $FVRR just launched their B2B recently while $UPWK is so mature here.

This is the area where $UPWK plays against $FVRR on short-gigs. $UPWK has a strong SMB presence w. this eCommerce product. 10% of $UPWK growth is now due to it

Vice-versa, $FVRR just launched their B2B recently while $UPWK is so mature here.

13/R-VII: Optionality:

There is so much optionality embedded from the nature of the gig work to different services.

This piece from @AznWeng shows $UPWK might be building an Ad platform to help employers/freelancers (Hiring a PM of Monetization).

There is so much optionality embedded from the nature of the gig work to different services.

This piece from @AznWeng shows $UPWK might be building an Ad platform to help employers/freelancers (Hiring a PM of Monetization).

https://twitter.com/AznWeng/status/1420743806375272448?s=20

14/R-VIII: Stronger in Tech & Software:

I accessed Freelance transcripts (Thanks @investing_city)

I learned $FVRR has bigger strengths in marketing & design Gigs while $UPWK is stronger at Tech & Talent.

IMO, Tech is 'more crucial' for enterprises and start-ups than Design.

I accessed Freelance transcripts (Thanks @investing_city)

I learned $FVRR has bigger strengths in marketing & design Gigs while $UPWK is stronger at Tech & Talent.

IMO, Tech is 'more crucial' for enterprises and start-ups than Design.

15/R-IX: Financials:

Begin w. Revs(This type of growth is not typical for me, but.)

Since @hydnbrwn took over, Observe sequential Growth QoQ & YoY. Analysis shows most of this was organic based on less S&M

They increased guidance in 2021 (despite tough comps) compared to $FVRR

Begin w. Revs(This type of growth is not typical for me, but.)

Since @hydnbrwn took over, Observe sequential Growth QoQ & YoY. Analysis shows most of this was organic based on less S&M

They increased guidance in 2021 (despite tough comps) compared to $FVRR

16/ It's interesting bcos one of the reason many investors love $FVRR is due to growth

But If we look closely by Q4 2021, $UPWK would have similar growth rates (roughly 26% at $500M+) <organically> compared to $FVRR 30% YoY on $285M+ which will still be half the size of $UPWK .

But If we look closely by Q4 2021, $UPWK would have similar growth rates (roughly 26% at $500M+) <organically> compared to $FVRR 30% YoY on $285M+ which will still be half the size of $UPWK .

17/ Sustainability of Revs:

Freelance can be unstable, but $UPWK b-model strength shows. They guided to $1B+ by 2025. Estimating a conservative 20%+ 5-Yr CAGR

It shows the strength of their ARR Revs. meanwhile this will be hard for $FVRR due to fluctuations of short-term gigs.

Freelance can be unstable, but $UPWK b-model strength shows. They guided to $1B+ by 2025. Estimating a conservative 20%+ 5-Yr CAGR

It shows the strength of their ARR Revs. meanwhile this will be hard for $FVRR due to fluctuations of short-term gigs.

18/ R-X: Fresh Superstar Mgmt Team:

This is the *BIG* part of the thesis.

@hydnbrwn, CEO is Ex Princeton, Mckinsey & Microsoft Strategy Executive. The unique thing about her is she understands product and strategy which is key

The rest of new Mgmt are $FB, HBS Grads etc

This is the *BIG* part of the thesis.

@hydnbrwn, CEO is Ex Princeton, Mckinsey & Microsoft Strategy Executive. The unique thing about her is she understands product and strategy which is key

The rest of new Mgmt are $FB, HBS Grads etc

19/ Cont'd:

E.g. Lets look at their new CTO who played a big role in Data Science for $AMZN's Alexa.

Investors need to know that all of Mgmt were appointed <1-year ago.

@hydnbrwn has been re-building a new team to transform $UPWK. The results are already showing as seen above.

E.g. Lets look at their new CTO who played a big role in Data Science for $AMZN's Alexa.

Investors need to know that all of Mgmt were appointed <1-year ago.

@hydnbrwn has been re-building a new team to transform $UPWK. The results are already showing as seen above.

20/ R-XI-Institutional Fund Ownership:

Importantly, let's talk about top money managers.

I'm happy that here I'm not in the minority.

$UPWK has 2x the No. of Funds Invested than $FVRR.

Through my time of knowing Funds, they do more due diligence

than retail due to their size

Importantly, let's talk about top money managers.

I'm happy that here I'm not in the minority.

$UPWK has 2x the No. of Funds Invested than $FVRR.

Through my time of knowing Funds, they do more due diligence

than retail due to their size

21/ Thesis Risks: How could I go wrong?

$FVRR Strengths

+ Stronger SEO Performance Marketing for SMB's

+ $FVRR has a stronger brand amongst retail & has millennial-branding

+ More buyers (4M)= more brand awareness

+ Strong design/marketing talent

+ Leader in Frictionless Gigs

$FVRR Strengths

+ Stronger SEO Performance Marketing for SMB's

+ $FVRR has a stronger brand amongst retail & has millennial-branding

+ More buyers (4M)= more brand awareness

+ Strong design/marketing talent

+ Leader in Frictionless Gigs

22/ II: Cont'd

+ Growth does not accelerate by 2022

+ Other Competitive Platforms catch-up

+ Platform leakage (when a buyer/client build relationships outside the platform. $FVRR faces this churn more due to its B2C focus than $UPWK, but it's still a big issue!

+ Execution risk

+ Growth does not accelerate by 2022

+ Other Competitive Platforms catch-up

+ Platform leakage (when a buyer/client build relationships outside the platform. $FVRR faces this churn more due to its B2C focus than $UPWK, but it's still a big issue!

+ Execution risk

23/ Concluding words:

The bet for $FVRR Investors is that FVRR becomes a future leader based on those strengths I outlined.

I've provided evidence why I picked $UPWK

However, I truly believe both platforms will continue to lead the industry with so much room for future growth!

The bet for $FVRR Investors is that FVRR becomes a future leader based on those strengths I outlined.

I've provided evidence why I picked $UPWK

However, I truly believe both platforms will continue to lead the industry with so much room for future growth!

24/ My thesis in Summary:

1. The Pioneers, the Market leader, and largest

2. Most comprehensive marketplace offerings

3. Enterprise & B2B Strength

4. Product stickiness & retention

5. Network effects & LTV of their enterprise strengths

6. Leader in Digital Staffing Marketplace

1. The Pioneers, the Market leader, and largest

2. Most comprehensive marketplace offerings

3. Enterprise & B2B Strength

4. Product stickiness & retention

5. Network effects & LTV of their enterprise strengths

6. Leader in Digital Staffing Marketplace

Thesis Summary (2):

7. Platform Optionality

8. Strength in Tech & Software

9. Accelerating Revenue + New Mgmt Team

10. 2x Institutional Ownership backs my thesis

I'm happy betting on the current transformation w. Top-class New-Mgmt onboard. Thesis will take time to materialize.

7. Platform Optionality

8. Strength in Tech & Software

9. Accelerating Revenue + New Mgmt Team

10. 2x Institutional Ownership backs my thesis

I'm happy betting on the current transformation w. Top-class New-Mgmt onboard. Thesis will take time to materialize.

26/ In Jan, I used to be a $FVRR bull, up until I started reading more about the industry and $UPWK. Ultimately both will succeed.

The future of work will see educated & highly skilled folks desire flexibility with work. These platforms make it happen.

The future of work will see educated & highly skilled folks desire flexibility with work. These platforms make it happen.

https://twitter.com/InvestiAnalyst/status/1364325852440236037?s=20

27/ An aspect of my process is that I believe that if you want to significantly outperform markets, you need to hold few names that are contrarian/non-consensus.

You need to be comfortable looking wrong in the short-term (sometimes years) for any future reward, which is tough.

You need to be comfortable looking wrong in the short-term (sometimes years) for any future reward, which is tough.

28/28 Thanks for reading if you went thru everything!

I'll put together a SA write-up. Apologies, this thread was posted much later. Below is a newsletter I write on.

Let me know what you think about the future of the Gig & freelance economy?

Thanks!

investianalystnewsletter.substack.com/welcome

I'll put together a SA write-up. Apologies, this thread was posted much later. Below is a newsletter I write on.

Let me know what you think about the future of the Gig & freelance economy?

Thanks!

investianalystnewsletter.substack.com/welcome

Please

@threadreaderapp - unroll

@threadreaderapp - unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh