Top projects with the best fundamentals and lowest recognition..

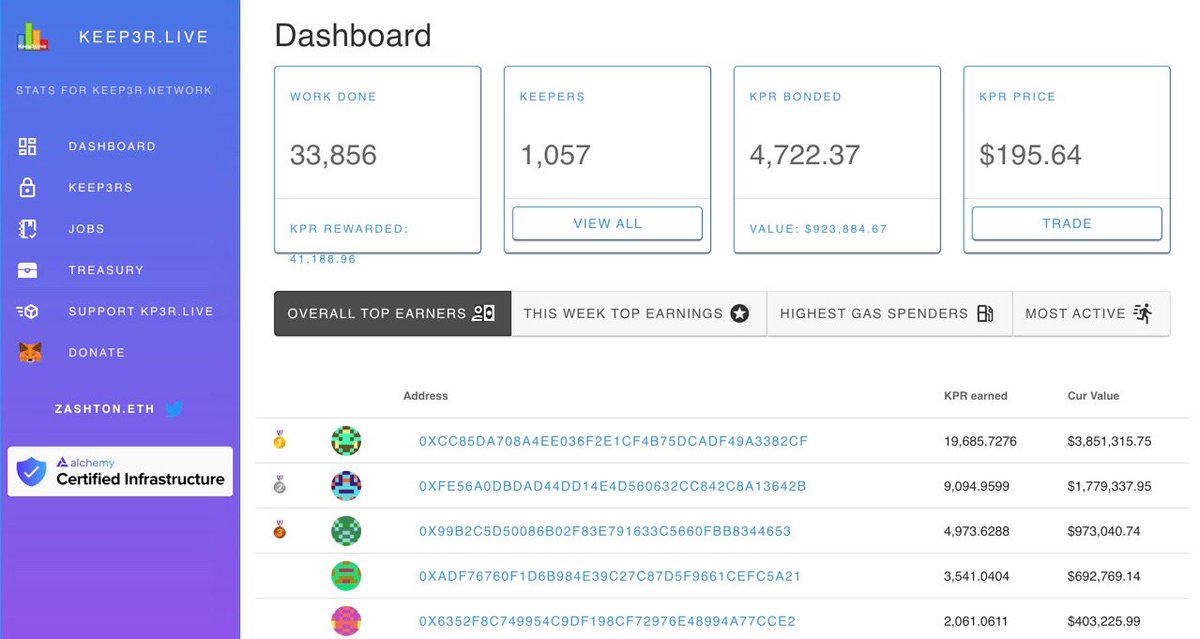

1. KP3R Network

KP3R can be described as a network for automating smart contacts on $ETH.

Users submit “jobs” (liquidations, harvesting, batch executions) to the KP3R network, where a Keeper can then perform the task & get rewarded in the form of KP3R tokens.

KP3R can be described as a network for automating smart contacts on $ETH.

Users submit “jobs” (liquidations, harvesting, batch executions) to the KP3R network, where a Keeper can then perform the task & get rewarded in the form of KP3R tokens.

2. Unlock Protocol

$UDT is an open source protocol designed to help creators monetize their content without a middleman

Creators deploy “locks” in the form of NFT’s with specific parameters allowing for tickets, customizable memberships & even paywalls for online content

$UDT is an open source protocol designed to help creators monetize their content without a middleman

Creators deploy “locks” in the form of NFT’s with specific parameters allowing for tickets, customizable memberships & even paywalls for online content

3. Reflexer

Reflexer allows users to use their collateral to issue non-pegged stable assets.

An iteration of Maker’s $DAI, Reflexer’s $RAI is an $ETH backed asset that dampens volatility of its underlying collateral thus shielding users from major movements in the crypto market

Reflexer allows users to use their collateral to issue non-pegged stable assets.

An iteration of Maker’s $DAI, Reflexer’s $RAI is an $ETH backed asset that dampens volatility of its underlying collateral thus shielding users from major movements in the crypto market

4. Sushi

What first started up as a DEX in DeFi summer, is now a massive liquidity engine powering a multi chain AMM, isolated lending markets, a token launchpad, & even an NFT marketplace.

The protocol has amassed billions in TVL, & distributes millions in revenue to its users

What first started up as a DEX in DeFi summer, is now a massive liquidity engine powering a multi chain AMM, isolated lending markets, a token launchpad, & even an NFT marketplace.

The protocol has amassed billions in TVL, & distributes millions in revenue to its users

5. Centrifuge

Centrifuge is a protocol for tokenizing assets like invoices, mortgages, or goods being delivered & brings them onto the blockchain via NFT’s.

These assets can then financed on the platforms marketplace, Tinlake, without the need of a bank or other intermediary

Centrifuge is a protocol for tokenizing assets like invoices, mortgages, or goods being delivered & brings them onto the blockchain via NFT’s.

These assets can then financed on the platforms marketplace, Tinlake, without the need of a bank or other intermediary

6. HXRO

$HXRO is platform that offers a simple, game-like manner of interacting with perp markets & time based derivatives.

“MoonRekt”, the platforms game, allows players to bet on particular movements of a currency within predefined lengths of 5 mins, 15 mins, 1 Hr, 1 day, etc

$HXRO is platform that offers a simple, game-like manner of interacting with perp markets & time based derivatives.

“MoonRekt”, the platforms game, allows players to bet on particular movements of a currency within predefined lengths of 5 mins, 15 mins, 1 Hr, 1 day, etc

7. Convex Finance

Convex is a platform designed to boost $CRV rewards for both stakers & LP’s without the need of locking $CRV tokens.

Liquidity providers can deposit their $CRV LP tokens into convex to earn $CRV trading fees, boosted $CRV & $CVX tokens.

Convex is a platform designed to boost $CRV rewards for both stakers & LP’s without the need of locking $CRV tokens.

Liquidity providers can deposit their $CRV LP tokens into convex to earn $CRV trading fees, boosted $CRV & $CVX tokens.

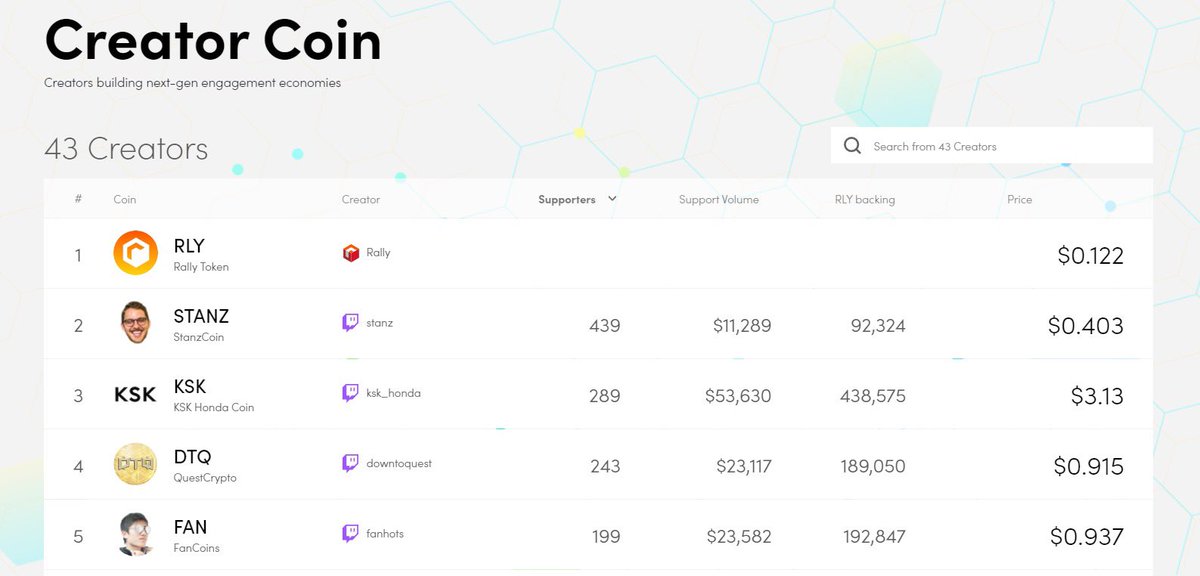

8.Rally

Rally.io allows content creators to build a marketplace around their brand & community

It provides a blockchain toolkit for users to make “Creator Coins”, which are personalized cryptocurrencies that unlock better engagement & monetization from their fans

Rally.io allows content creators to build a marketplace around their brand & community

It provides a blockchain toolkit for users to make “Creator Coins”, which are personalized cryptocurrencies that unlock better engagement & monetization from their fans

9.EDEN

$EDEN is combating one of the most criticized aspects of $ETH: frontrunning & MEV

$EDEN introduces the term “Trader Extractable Value”

When a trade is made on $EDEN, the tx is sent to a private relayer & profitable arbitrage opportunities are distributed back to traders

$EDEN is combating one of the most criticized aspects of $ETH: frontrunning & MEV

$EDEN introduces the term “Trader Extractable Value”

When a trade is made on $EDEN, the tx is sent to a private relayer & profitable arbitrage opportunities are distributed back to traders

10.Robonomics $XRT

First a robotics team, their devs found home on $ETH for their plan to build out a network of IOT devices

$XRT has worked with Microsoft in an aim to make smart cities a reality in the 4th industrial revolution

They offer “robot as a service” technology

First a robotics team, their devs found home on $ETH for their plan to build out a network of IOT devices

$XRT has worked with Microsoft in an aim to make smart cities a reality in the 4th industrial revolution

They offer “robot as a service” technology

11. Lido

Lido sets out to solve two problems for potential $ETH 2.0 stakers

1. Min 32 $ETH req

2. Locked up funds

Lido allows users to deposit funds in an $ETH 2.0 staking pool, where they can then earn rewards & issues $stETH that can be freely traded across markets

Lido sets out to solve two problems for potential $ETH 2.0 stakers

1. Min 32 $ETH req

2. Locked up funds

Lido allows users to deposit funds in an $ETH 2.0 staking pool, where they can then earn rewards & issues $stETH that can be freely traded across markets

12. Veracity

$VRA is designed to fulfill the needs of the video entertainment industry & increase revenue for content creators & video publishers

$VRA introduces a concept known as Proof of View, where both publishers & viewers are rewarded in $VRA Tokens for each organic view

$VRA is designed to fulfill the needs of the video entertainment industry & increase revenue for content creators & video publishers

$VRA introduces a concept known as Proof of View, where both publishers & viewers are rewarded in $VRA Tokens for each organic view

13. ZK-Sync

ZK-Sync is a trustless scaling & privacy solution for $ETH with zero security compromises.

Utilizing a ZK-Rollup architecture, ZK-Sync is designed to bring VISA-scale throughput to $ETH by batching up tx’s & processing them off the root chain.

ZK-Sync is a trustless scaling & privacy solution for $ETH with zero security compromises.

Utilizing a ZK-Rollup architecture, ZK-Sync is designed to bring VISA-scale throughput to $ETH by batching up tx’s & processing them off the root chain.

14. Tornado Cash

$TORN is a decentralized, non-custodial privacy solution for $ETH that breaks the on-chain link between recipient & destination addresses,

Using $TORN, tx’s are mixed using ZK-Proofs, which completely obfuscates tx information & ensures privacy for the user.

$TORN is a decentralized, non-custodial privacy solution for $ETH that breaks the on-chain link between recipient & destination addresses,

Using $TORN, tx’s are mixed using ZK-Proofs, which completely obfuscates tx information & ensures privacy for the user.

• • •

Missing some Tweet in this thread? You can try to

force a refresh