0/ In today’s Delphi Daily, we took a brief look at market structure.

We examined the impact of leverage in the market, implied volatility of $BTC, CME’s open interest, and Ethereum DEX volume.

To dive deeper into this analysis 🧵👇

We examined the impact of leverage in the market, implied volatility of $BTC, CME’s open interest, and Ethereum DEX volume.

To dive deeper into this analysis 🧵👇

1/ Market Update-

🔹The markets are red again, with BTC and ETH both nuking into the Asia session and consolidating near the lows.

🔹AVAX is down 18% over the last 2 days, and Avalanche ecosystem coins took a hit too.

🔹SAFEMOON and SOL are unfazed by the downturn.

🔹The markets are red again, with BTC and ETH both nuking into the Asia session and consolidating near the lows.

🔹AVAX is down 18% over the last 2 days, and Avalanche ecosystem coins took a hit too.

🔹SAFEMOON and SOL are unfazed by the downturn.

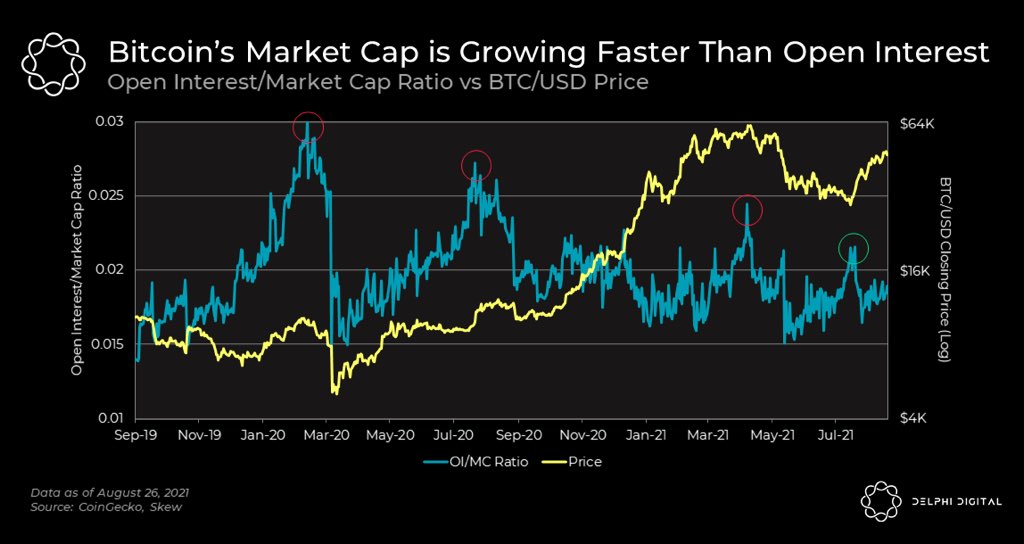

2/ A useful metric to gauge leverage is the ratio between BTC’s OI across futures and perps, and its total market cap.

On its own, this probably isn’t a very useful data point. But with the context of price and trend structure, we can actually pull away some useful insights.

On its own, this probably isn’t a very useful data point. But with the context of price and trend structure, we can actually pull away some useful insights.

3/ Implied volatility for near-term BTC options have been trending down for a couple of weeks now.

Realized volatility, or actual volatility, has been a lot lower for the same time horizon.

Realized volatility, or actual volatility, has been a lot lower for the same time horizon.

4/ CME’s open interest increased over the last few days, while OI on crypto-native exchanges took a tiny hit.

With price moving down on shorter time frames and OI on CME ticking up, this is a sign that institutional players on CME might be positioning for further downside.

With price moving down on shorter time frames and OI on CME ticking up, this is a sign that institutional players on CME might be positioning for further downside.

5/ Ethereum DEX volume has fallen significantly relative to spot volumes on the big three centralized exchanges.

The highest readings are from DeFi summer, where the mania was more or less contained to on-chain primitives.

The highest readings are from DeFi summer, where the mania was more or less contained to on-chain primitives.

10/ Crypto moves fast. Delphi has you covered. Sign up here to get Delphi's free daily newsletter delivered right to your inbox every weekday

delphidigital.io/daily/

delphidigital.io/daily/

• • •

Missing some Tweet in this thread? You can try to

force a refresh