A thread on how you can use @unusual_whales to find opportunistic day-trades

Example: $SDC

*Disclaimer: This will not always work, but if you find an edge and capitalize, you'll win more often than not*

@snorlax_support

Example: $SDC

*Disclaimer: This will not always work, but if you find an edge and capitalize, you'll win more often than not*

@snorlax_support

1. Options Alerts

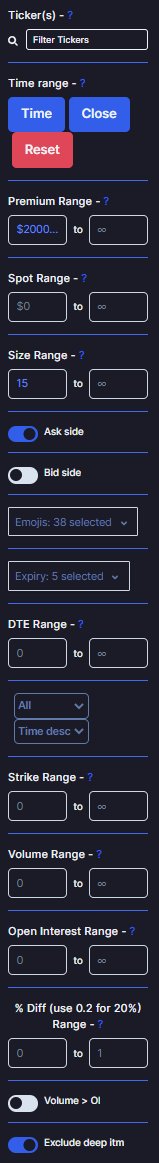

I start by going over the options alert page and looking for things that catch my eye. Some specifics I like personally would be:

- OTM strikes

- Volume > OI

- 1-2 week Expiry

- IV normally under 100 (This example is an exception)

Take a look at this $SDC alert

I start by going over the options alert page and looking for things that catch my eye. Some specifics I like personally would be:

- OTM strikes

- Volume > OI

- 1-2 week Expiry

- IV normally under 100 (This example is an exception)

Take a look at this $SDC alert

2. Historical Flow - $SDC

I head over to the historical flow of the ticker and analyze the table. Here I primarily look for 2 things (my preference you can disagree)

- Call v Put volume / Call Vol %

- Call Premium %

As you can see, this table was heavily bullish

I head over to the historical flow of the ticker and analyze the table. Here I primarily look for 2 things (my preference you can disagree)

- Call v Put volume / Call Vol %

- Call Premium %

As you can see, this table was heavily bullish

3. Next I check the Flow Levels

Here I'm primarily looking for Big spikes in Strike Prices and Expiry's that are somewhat unusual.

For the 5k and 15k, nothing stands out as too crazy, but we do have bullish sentiment for:

Expiry - 09/03 (Good for Scalping)

Strike - $5, $5.5

Here I'm primarily looking for Big spikes in Strike Prices and Expiry's that are somewhat unusual.

For the 5k and 15k, nothing stands out as too crazy, but we do have bullish sentiment for:

Expiry - 09/03 (Good for Scalping)

Strike - $5, $5.5

After all of this, the unusual whales tools have now done their job. Next up would be charting the ticker and doing our technical analysis. For $SDC this is what that would have looked like from my point of view (Not showing today's session yet).

It would take a lot to explain my key level's and why I set them so that you'll have to learn on you're own. Just know that I use multiple times frames (D, 4H, 3H, 2H, 1H, 90M, 45M, 30M, 15M) to identify levels of interest that either pivot or act as S/R multiple times.

Using these key levels I would create a plan for entries / exits / scaling in / take profits. In this case:

Break over orange = my entry

First purple - Either Scaling in or Take profit (dependent on volume)

Second purple - Either Scaling in or Take profit (dependent on volume)

Break over orange = my entry

First purple - Either Scaling in or Take profit (dependent on volume)

Second purple - Either Scaling in or Take profit (dependent on volume)

Now let's look at today's action and how I would have played it.

Open strong break through resistance - I would enter (first green oval)

Push through first Key with strength - I scale due to high volume

Second Key - already in with decent size, Keeping R/R safe so holding

Open strong break through resistance - I would enter (first green oval)

Push through first Key with strength - I scale due to high volume

Second Key - already in with decent size, Keeping R/R safe so holding

Today's action pt.2

Break over 3rd Key into gap - Taking some profit, don't get greedy (Orange arrow)

Break down back out of gap zone, stop out (Red Arrow)

There were more opportunities to scalp this following the initial move, but that's how I would play the OPEN on $SDC

Break over 3rd Key into gap - Taking some profit, don't get greedy (Orange arrow)

Break down back out of gap zone, stop out (Red Arrow)

There were more opportunities to scalp this following the initial move, but that's how I would play the OPEN on $SDC

If you had played the $SDC $6 09/17 Calls off of our key levels you would have entered at around .32 and sold (if you didn't take profit into gap zone) for .58.

.32 --> .58 = 81.25% Increase

Pretty good start to the week if you ask me.

.32 --> .58 = 81.25% Increase

Pretty good start to the week if you ask me.

Just goes to show you how powerful @unusual_whales can be at spotting strong moves before they happen, and preparing you to take advantage of them.

Hope this helped some of you!

S/O @Prophitcy for the play

Hope this helped some of you!

S/O @Prophitcy for the play

• • •

Missing some Tweet in this thread? You can try to

force a refresh