Let Krishna Born in your Portfolio.

Mahabharat of Mutuals.

A Thread on Mutual Fund Saga Simplified for layman warrior.

Mahabharat of Mutuals.

A Thread on Mutual Fund Saga Simplified for layman warrior.

Krishna asked Arjuna to choose either Krishna himself, unarmed with passive involvement in the war as a charioteer or his mighty Narayani Sena, the most powerful army in the world at that time.

Arjuna chose Krishna over the Narayani Sena. Duryodhana was pleased by Arjuna’s choice, and the thought of adding the mighty Narayani Sena to the Kaurava’s ranks gave him a feeling of great strength. And the rest is history.

Like Mahabharat, the stock market is a chaotic place, a battle fought between players motivated by emotions which, in another time, led to the Mahabharat. The pain of lost kingdoms and wealth, the jealousy of others gain and the anger over people breaking rules.

As a new investor when you enter this battleground, you’re mostly unaware of the emotions and intentions of different characters. But to play a long term game and win the battle, you need to find the character that suits your personality the most.

In the Mahabharat of stock market, Samay plays a major role in wealth creation through compounding. Those who understand it, earn it; those who don't, pay for it.

SEBI is like Bhishma of the stock market. He plays the supreme commander of the battle and remains one of the most powerful warriors. Bhishma vowed not to kill any of the Pandavas and prevented Kauravas to be killed in the war. He wanted a peace negotiation.

The mutual fund consists of three entities, Trustee, Sponsor and AMC. In the current ecosystem, it resembles the characters of Dhritarashtra and Gandhari. Their blind love for AUM through greedy investors like Duryodhan, only force them to go from bad to worse.

For the love of AUM, they remain silent and allow Duryodhan to be misguided by Shakuni and the huge Sena (Fund Manager and MFDs / Agents).

Shakuni remains one of the most powerful characters of Mahabharat in misguiding the Kauravas with greed and false hopes. In the current Mutual Fund industry, Fund Managers along with their MF Distributor's army strongly resemble Shakuni.

Shakuni is an extremely intelligent, crafty and devious man. He supports his nephews, especially greedy and layman investors like Duryodhana, with the promise to beat the market.

Vidur was a scholar and one of the finest advisors to Dhritarashtra. He was known for his unbiased judgment and faith in Dharma. He never feared speaking the truth even against King. In MF industry, It is difficult to find a Vidur (advisor) who guides investors on the right path.

Have you seen agents/MFDs aggressively marketing Term Insurance, Index Fund or Direct Mutual Fund? Even after knowing that most fund managers are not able to beat the market index in the long run, their self-serving interests restrict them in guiding investors to the right path.

Karna, a Chivalrous Warrior and a Powerful Archer. Generous and charitable. A man of high Value. Grateful and committed. A Tragic Hero. Karna represents a few small AMCs and good MFDs.

Karna understands the difficulty of beating the market and remain true to the stock market game without greed (accumulation of AUM). They understand the Dharma but are committed to beating the market for greedy layman investors like Duryodhan.

Duryodhana was extremely courageous warrior and he was said to be a good ruler. Duryodhana's greed and arrogance were the two qualities said to lead to his downfall in the Mahabharata. Every investor who is greedy for alpha always remains misguided.

His heavily biased views fueled by Shakuni keeps him always hopeful for more alpha. He goes blind to understand the low probability in winning the active (mutual fund) trades. He would do any gambling and trading to go to the moon…

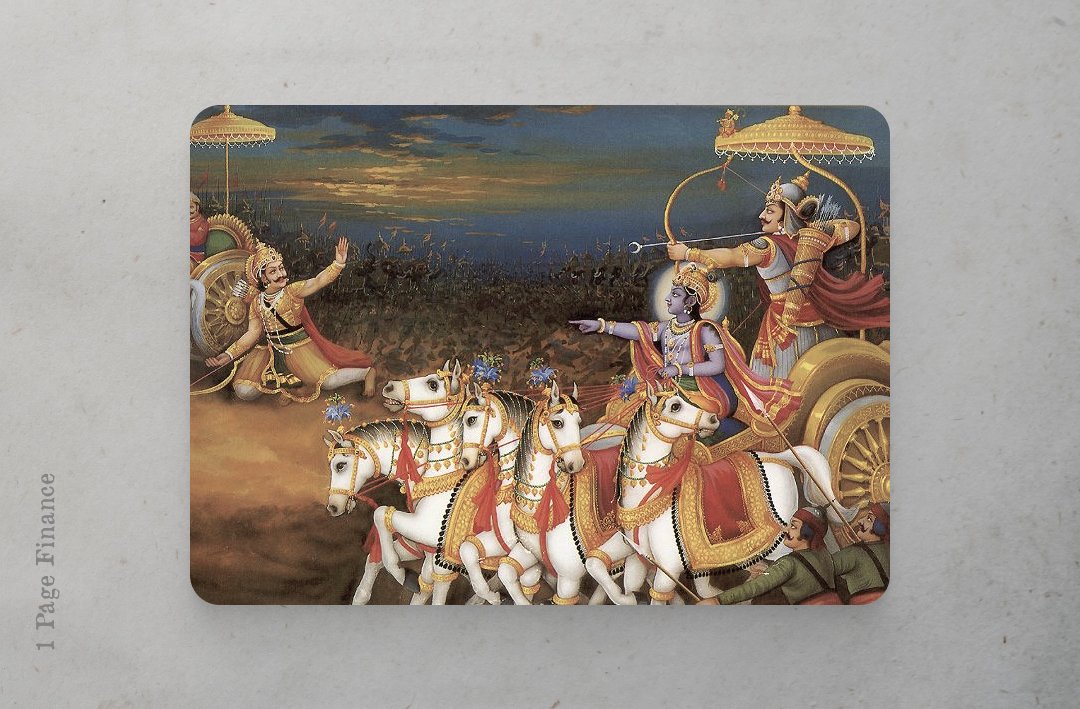

In Mahabharata, Krishna is omnipresent, making his presence at the most crucial moments. Krishna passively participated in the battle but played an instrumental role without even lifting a weapon, and helped Arjun achieve his goal through the extreme volatility of Kurukshetra.

All Arjuna had to do was to believe in Krishna & his passive tactics. Krishna made his entry into the Mahabharata at a later stage. Similarly, passive investments show its power in the later stage of the horizon, when beating the market is a distant dream for most fund managers.

Arjuna is every investor who is focused and can control emotions to fight against greed. By believing in Krishna, he chooses the path of passive investment. He knows the alpha is Maya of Krishna.

He knows real alpha can only be generated by controlling the controllable, i.e. work hard to earn more, save more and avoid the debt leverage. He believes in Krishna to fight inflation, and with his help, he will win the ultimate battle of financial independence.

Going back to the story when every new investor is given a chance to select a path. DO NOT BE the Duryodhan, who is lured by default arrangements in the financial ecosystem along with uncontrollable hunger for greed (alpha).

It is easy to choose Narayani Sena comprising 44 AMCs and thousands of distributors for instant gratification, who lure investors with Maya (alpha).

BE the Arjun, understand the human biases and bet on the ultimate truth, the Narayana (Index Fund) and it will surely help you beat the real monster, inflation.

The power of maya and greed for alpha is strong enough to lure you into expecting returns from debt instruments too. Once you get in that trap, you may encounter the Vastraharan in the form of Franklin like winding up, side pocketing and long term underperformance.

Spread the message if you liked.

Retweet the first tweet of the thread 🧵👇

Retweet the first tweet of the thread 🧵👇

https://twitter.com/1PageFinance/status/1432407702089519105

PS: On being refused training by Guru Dronacharya, Eklavya decided to learn archery skills on his own by observing him and thereafter, became a great archer. In the modern ecosystem of investing, Ekalavya represents all the DIY direct equity investors.

The so-called Dronacharyas (AMCs / MFDs) leave no chance to mock the DIY investors when they try to spread the right knowledge for layman investors.

Do not get intimidated by the financial jargon used by them. Self-learning is the best way to start investing. You just need to be disciplined and dedicated to self-learning.

The knowledge and wisdom of real Gurus like Charlie Munger, Warren Buffett and John Bogle are freely available to master the skills needed.

In this chaos of free learning from the internet, always try to identify who is on the side of Kauravas (Paid by industry to advertise). Stay away from the fake Gurus with millions of followers creating content for whoever sponsors them.

There is no free lunch, but you can trust a few who believes in Krishna (Primarily believes in Indexing).

"Main Kuchh Bhi Nahi Hun Aur Main Sab Kuchh Hun" -Krishna

"Main Kuchh Bhi Nahi Hun Aur Main Sab Kuchh Hun" -Krishna

• • •

Missing some Tweet in this thread? You can try to

force a refresh