For my next thread, I'd like to talk a boring business, you know the ones which quietly grow and are profitable types... follow along for a thread here 👇

This company is a great executor in the boring industry of on-site document destruction and downstream recycling industry.

Redishred Capital Corp @KUTRedishred (#TSXV : $KUT)

Ticker: $KUT

Price: ~C$.8

Shares outstanding: ~ 78.8 million

Market cap: ~ C$66 million

Investment style: Speculative Growth

h/t @EightTrack180 @MaldenDriveCap

Ticker: $KUT

Price: ~C$.8

Shares outstanding: ~ 78.8 million

Market cap: ~ C$66 million

Investment style: Speculative Growth

h/t @EightTrack180 @MaldenDriveCap

1/22 Redishred Capital Corp. is a publicly-traded investment company focused on the on-site information destruction and downstream recycling industry.

2/22 @KUTRedishred's mandate is to build shareholder value through a market-development and consolidation strategy, delivering highly profitable operations by means of franchising, joint venture partnerships and corporate acquisitions.

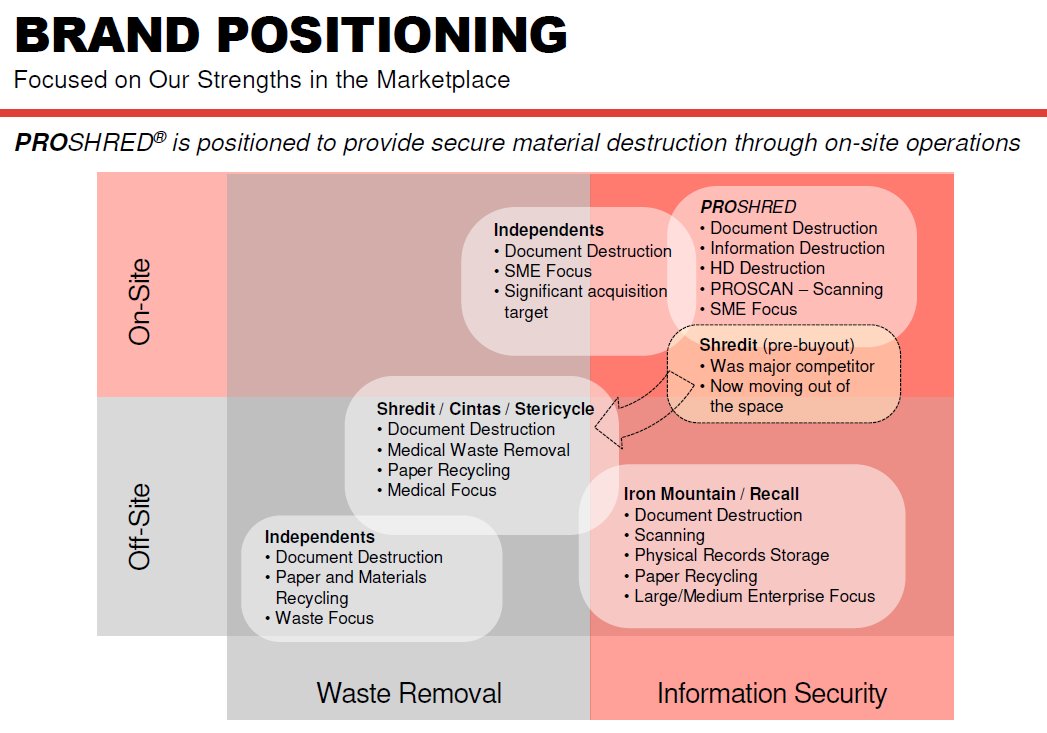

3/22 @KUTRedishred owns and operates the PROSHRED® Security brand and business platform in the United States and internationally.

4/22 $KUT.V operates the PROSHRED® system under two business models, franchising in the United States, via direct ownership of shredding trucks and facilities in nine locations in the United States.

5/22 Industry: Document destruction is a US $3.6 billion industry and the market is highly fragmented with many independents and only a handful of large providers.

6/22 Market driving factors include: concern about identity theft and corporate espionage, concern about liability protection and transference, tighter regulatory requirements, legislation and enforcement & massive push towards “green” business practices.

7/22 $KUT.V is the third largest information destruction company in the United States and has over 30 locations respectively across the US – Blend of Corporate and Franchised serving 40 markets

8/22 $KUT.V has 3 long term drivers of growth: 1) Drive Same location revenue and EBITDA growth, focusing on recurring revenue streams, directed at the Small Medium Enterprise market

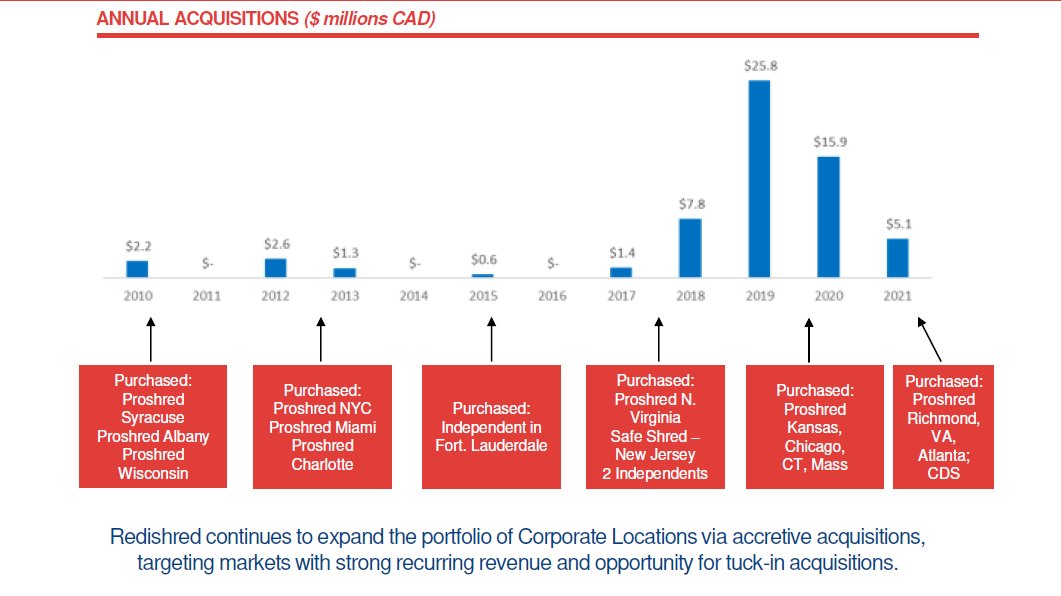

9/22 2) Conduct accretive acquisitions, purchasing franchisees as they retire/wish to exit; independents in existing and new markets

10/22 3) Support franchisees to help them grow durable and sustainable revenue and EBITDA streams

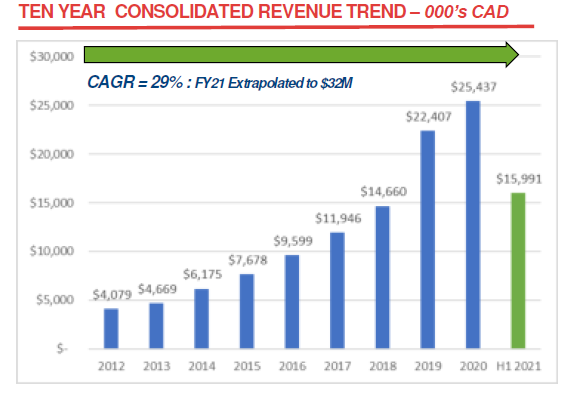

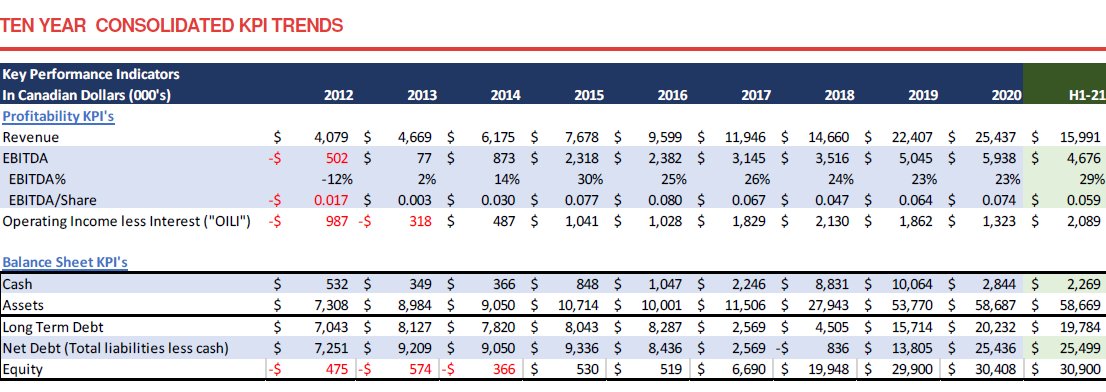

11/22 $KUT.V has revenue growth CAGR of 29% over last 10 years! the strategy behind this growth relies on: Investing in Sales, Marketing and New Trucks, Targeting of SMEs Recurring Monthly Service & Acquisitions

13/22 EBITDA: $KUT.V has been steadily improving its EBITDA over last 10 years, focusing on Driver Retention, Route Density and Routing Science and acquisitions

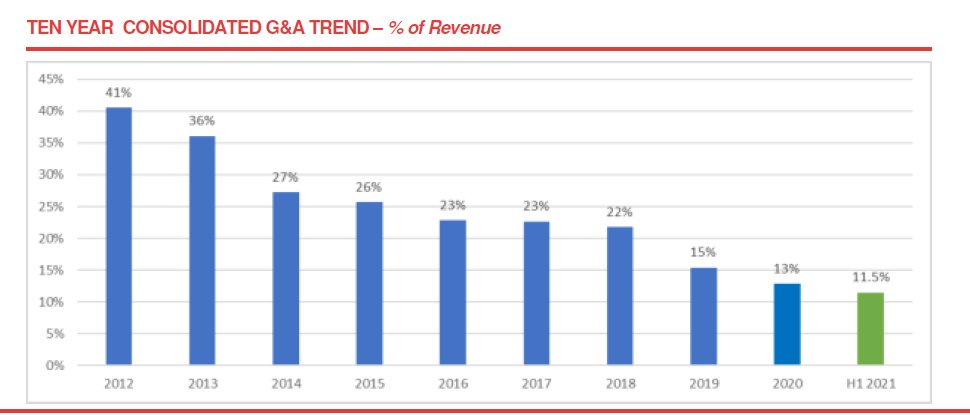

14/22 $KUT.V has also been steadily reducing its G&A expense share by using Centralization of Key Back

Office Functions, Use of Enabling Technology and Continued Centralization of Tasks

Office Functions, Use of Enabling Technology and Continued Centralization of Tasks

15/22 KPI's: Overall $KUT.V has been improving all its operational and financial KPI’s over past 10 years

16/22 Acquisition strategy: $KUT.V has been focusing on buying out its franchisee’s and smaller independent players in key markets

17/22 Management: $KUT.V has experienced management who have been with the company long term and have been key part of its operational excellence with great track record

19/22 Growth Strategy: $KUT.V plans to drive its growth via operational excellence, acquisitions and increasing its corporate store footprint to increase its cash flow.

20/22 In summary. $KUT.V has all the ingredients of an early #compounder and a future #multibagger.

With its focus on driving cash flow and focusing on EBITDA growth, it is poised for profitable growth!

With its focus on driving cash flow and focusing on EBITDA growth, it is poised for profitable growth!

21/22 $KUT.V maybe a boring company in a boring sector but its focus on profitable growth and successful history of execution makes it an exciting opportunity!

Long $KUT.V

Long $KUT.V

22/22 If you liked this thread then please quote-retweet it and consider signing up for my free newsletter to be the first to receive future research about innovative small cap companies which have a good chance of becoming future #multibagger.

getrevue.co/profile/adluna…

getrevue.co/profile/adluna…

• • •

Missing some Tweet in this thread? You can try to

force a refresh