Sansera Engineering IPO - Everything you need to know!

A Thread 🧵👇

Do hit the retweet and help us educate more investors :)

#IPOwithJST

A Thread 🧵👇

Do hit the retweet and help us educate more investors :)

#IPOwithJST

1/n

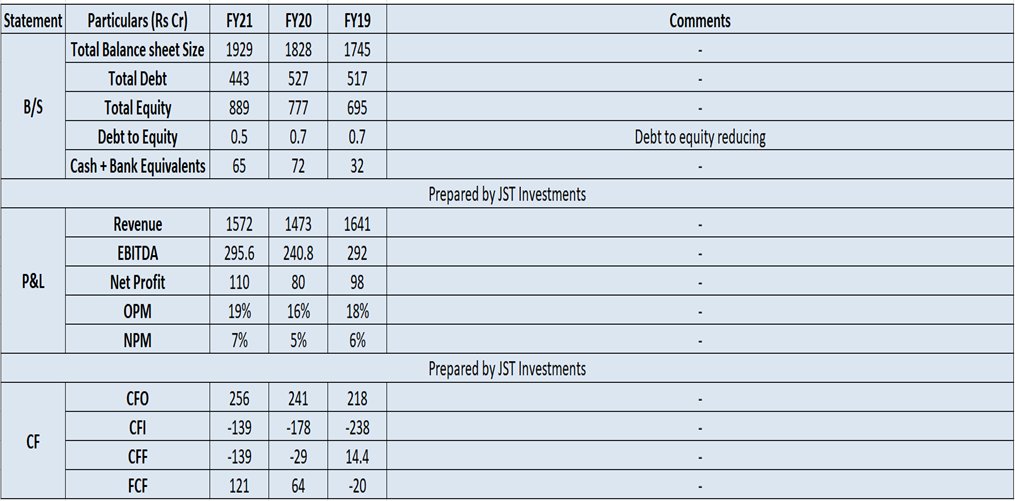

About the Company -

- Manufactures complex and critical precision engineered components

2 Segments -

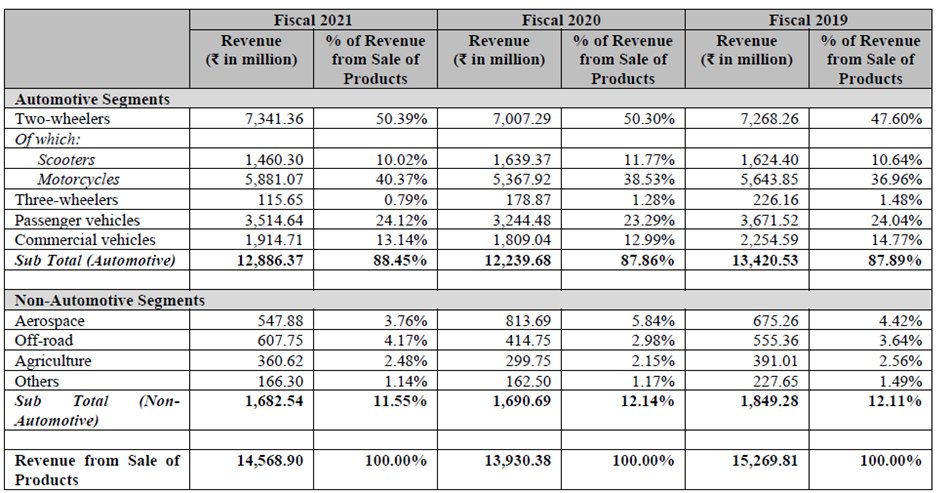

- Automotive - 2W, PV, and CVs (88.5% of total revenue)

- Non-Automotive - aerospace, off-road, agriculture, engineering, and capital goods (11.5% of total revenue)

About the Company -

- Manufactures complex and critical precision engineered components

2 Segments -

- Automotive - 2W, PV, and CVs (88.5% of total revenue)

- Non-Automotive - aerospace, off-road, agriculture, engineering, and capital goods (11.5% of total revenue)

2/n

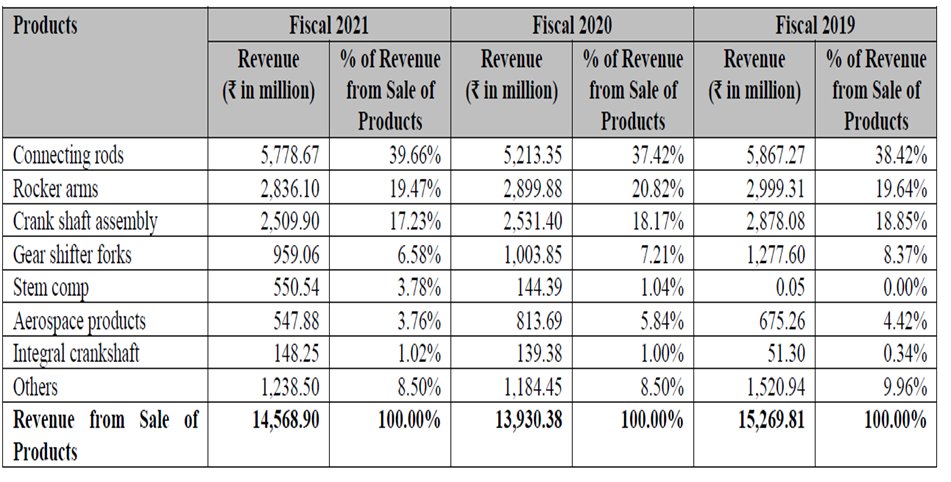

Products -

Automotive - Connecting rods, rocker arm, crankshaft, gear shifter fork, etc that are critical for engine, transmission, suspension etc

Non-Automotive - range of precision components, supplying directly to OEMs in finished (forged and machined) condition

Products -

Automotive - Connecting rods, rocker arm, crankshaft, gear shifter fork, etc that are critical for engine, transmission, suspension etc

Non-Automotive - range of precision components, supplying directly to OEMs in finished (forged and machined) condition

3/n

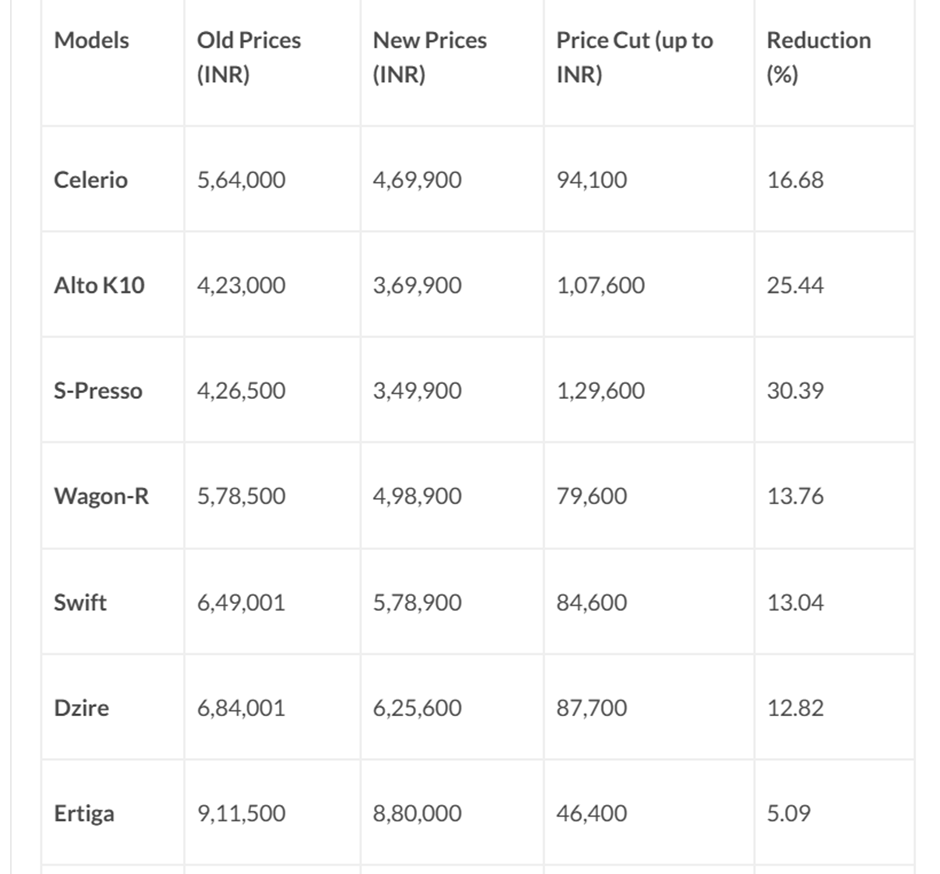

Note - 83% of revenue (Top 4 products in the table) comes from components are used in an Internal combustion engine (ICE)

EV is a headwind for them (Mgmt said they will shift focus to EVs on a BQ interview. So this is a key monitorable)

Image 2 shows a connecting rod

Note - 83% of revenue (Top 4 products in the table) comes from components are used in an Internal combustion engine (ICE)

EV is a headwind for them (Mgmt said they will shift focus to EVs on a BQ interview. So this is a key monitorable)

Image 2 shows a connecting rod

4/n

Geographic Revenue break up - (Img 1)

65% from India, 35% from abroad (Europe, US, etc)

Manufacturing - (Img 2)

15 plants in India and 1 in Sweden

Capacity Utilization - (Img 3)

Geographic Revenue break up - (Img 1)

65% from India, 35% from abroad (Europe, US, etc)

Manufacturing - (Img 2)

15 plants in India and 1 in Sweden

Capacity Utilization - (Img 3)

5/n

About the Issue -

Dates – 14 to 16 September

Price – Rs 734 to Rs 744

Issue Size – Rs 1283 Cr

Pure OFS, no fresh money being raised

MCap post listing – Rs 3773 Cr (34% of the company being sold)

About the Issue -

Dates – 14 to 16 September

Price – Rs 734 to Rs 744

Issue Size – Rs 1283 Cr

Pure OFS, no fresh money being raised

MCap post listing – Rs 3773 Cr (34% of the company being sold)

6/n

Quick Facts on Sansera (Img 1)

New products (Img 2) -

Some of their new products included components for both ICE and E-2Ws.

They sold components across 69 product families in FY21 v/s 51 in FY19.

Quick Facts on Sansera (Img 1)

New products (Img 2) -

Some of their new products included components for both ICE and E-2Ws.

They sold components across 69 product families in FY21 v/s 51 in FY19.

7/n

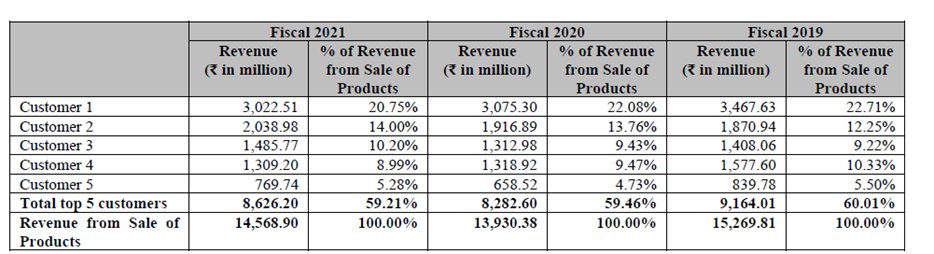

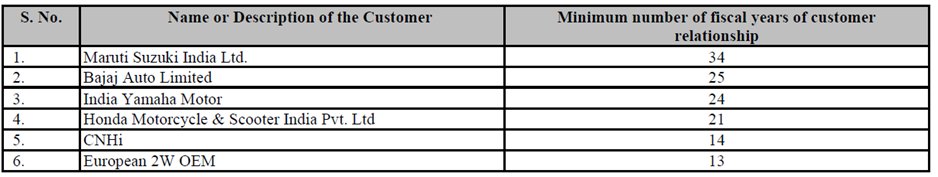

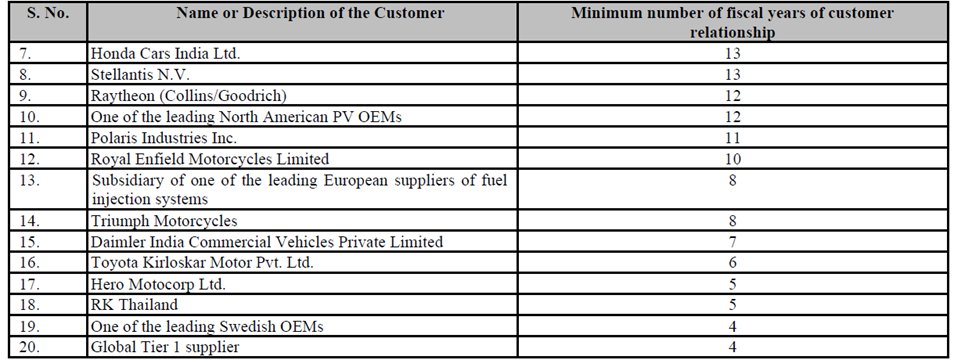

Customers -

In India – 9 of the top 10 2W OEMs + the leading PV OEM

Globally – 6 of the top 10 Light Vehicle OEMs + 3 of the top 10 global MHCV OEMs

Suppliers to 71 customers in FY21 v/s 64 in FY19

Bajaj is the biggest customer | Long-standing relationships (Img 2 & 3)

Customers -

In India – 9 of the top 10 2W OEMs + the leading PV OEM

Globally – 6 of the top 10 Light Vehicle OEMs + 3 of the top 10 global MHCV OEMs

Suppliers to 71 customers in FY21 v/s 64 in FY19

Bajaj is the biggest customer | Long-standing relationships (Img 2 & 3)

9/n

Conclusion -

The company derives major revenue from components related to the Internal combustion engine of a car.

As more and more EVs start to come, engines will be replaced by an electric motor and components will change drastically.

Conclusion -

The company derives major revenue from components related to the Internal combustion engine of a car.

As more and more EVs start to come, engines will be replaced by an electric motor and components will change drastically.

10/n

This is a classic example of a company that will undergo major disruption - Let's see how they adapt to the change!

Valuations seem priced in with 2.4x P/S as many ancillaries are available at 1x price to sales or below it even!

Thanks for reading! Happy weekend :)

This is a classic example of a company that will undergo major disruption - Let's see how they adapt to the change!

Valuations seem priced in with 2.4x P/S as many ancillaries are available at 1x price to sales or below it even!

Thanks for reading! Happy weekend :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh